Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.29% lower at 18,252.50, signalling that Dalal Street was headed for a negative start on Wednesday.

Japanese shares were trading lower after Wall Street ended down as Tesla and Apple shares slumped amid investors awaiting minutes from the Federal Reserve’s most recent meeting. The Nikkei 225 index fell 1.42% and the Topix was down 1.02%. Meanwhile, the CSI 300 index was up 0.27% and the Hang Seng index jumped 1.735.

Indian rupee fell 14 paise to 82.88 against the US dollar on Wednesday.

Radiant Cash Management will make its stock market debut on Wednesday. The grey market premium price indicates that the stock could list at a marginal premium to the issue price of Rs 99.

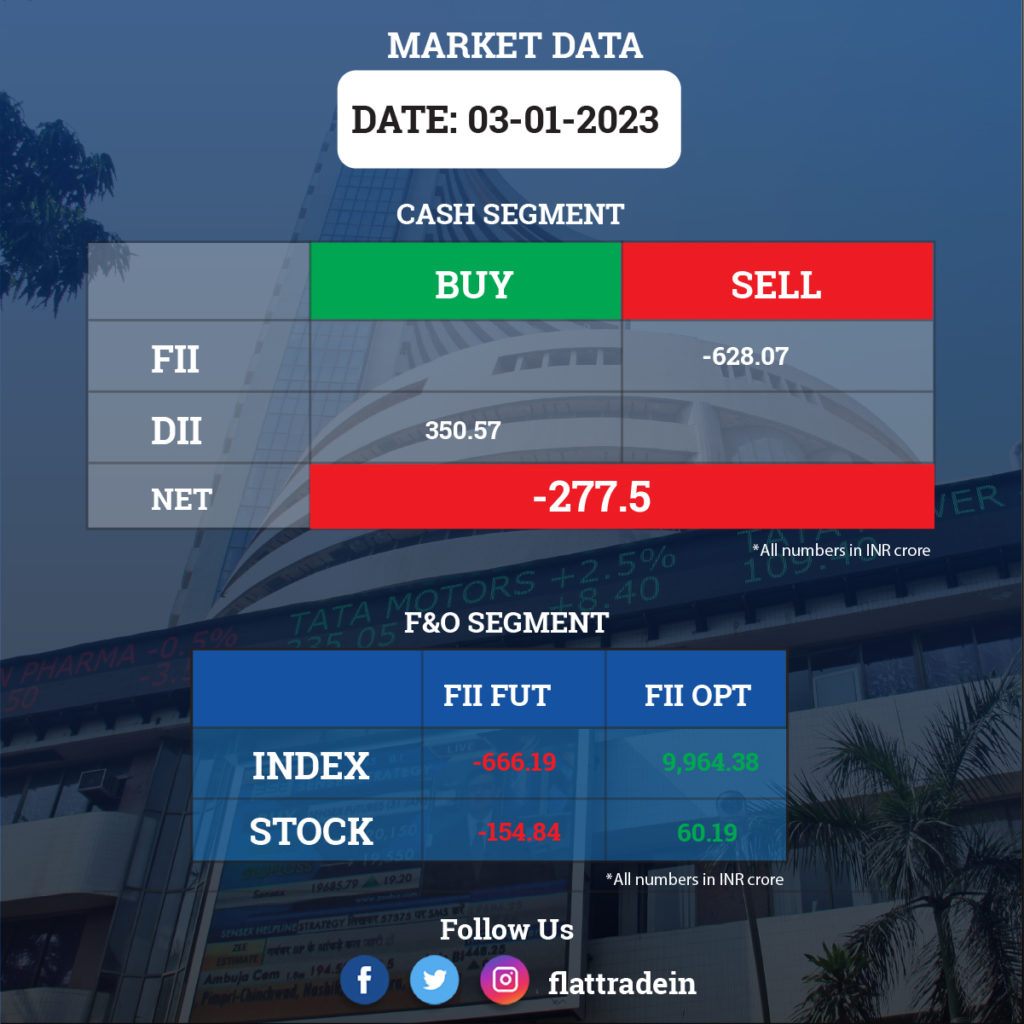

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): Reliance Consumer Products, the FMCG arm of Reliance Retail Ventures, will acquire 50% stake in Gujarat-headquartered Sosyo Hajoori Beverages Private Limited (SHBPL), which owns and operates beverage business under the flagship brand ‘Sosyo’.

Housing Development Finance Corp (HDFC): The company assigned loans amounting to Rs 8,892 crore to HDFC Bank in the Q3FY23, compared to Rs 7,468 crore in the corresponding quarter of the previous year. The gross income from dividend for the quarter ended December 2022 was Rs 482 crore compared to Rs 195 crore a year ago.

State Bank of India: The country’s largest lender will raise another Rs 10,000 crore through infrastructure bonds this quarter to fund credit growth. The executive committee of the bank’s central board at a meeting approved the fundraising through a public issue or private placement during this financial year.

Avenue Supermarts (DMart): The hypermarket chain operator reported standalone revenue from operations at Rs 11,304.58 crore for quarter ended December FY23, a rise of 25% from Rs 9,065 crore in same period last year. The total number of stores as of December 2022 stood at 306.

NTPC: The country’s largest power generator has commissioned India’s first green hydrogen blending project. The green hydrogen blending has been started in the piped natural gas (PNG) network of NTPC Kawas township, Surat. The project is a joint effort of NTPC and Gujarat Gas.

Vedanta: Alumina production at Lanjigarh refinery for quarter ended December 2022 fell by 6% YoY to 443kt due to maintenance activities in calciners, while zinc international production increased by 32% YoY to 70kt with continued ramp-up at Gamsberg. Meanwhile, total saleable steel production stood at 306kt which was lower by 13% YoY due to maintenance activities in blast furnace in Q3FY23. Its overall power sales increased by 5% YoY to 3,616 million units.

Airline Companies: The domestic air passenger traffic for the airline sector touched 1.29 crore to cross the pre-COVID level in December. Civil Aviation Minister Jyotiraditya Scindia termed it as a healthy trend and a good sign for the industry. In December 2019, the domestic air passenger traffic stood at 1.26 crore.

Reliance Capital: The insolvency process of the debt-ridden company hit a roadblock on Tuesday, as the NCLT Mumbai bench has stayed the resolution process due to a plea from Torrent Group. The stay order was issued by the tribunal as Ahmedabad-based Torrent Group challenged the revised bid from Hinduja Group.

IIFL Finance: The company will raise up to Rs 1,000 crore through public issue of secured non-convertible debentures (NCDs). The funds raised through the issue will be used for business growth, IIFL Finance said in a statement. The public issue opens on January 6 and closes on January 18, 2023, with an option of early closure.

Punjab National Bank: The lender has increased the interest rate of fixed deposits across various tenures by 50 basis points in a bid to attract deposits. Interest rates on term deposits below Rs 2 crore between 1 year and 3 years have been raised by 50 basis points to 6.75%.

GM Polyplast: Shares of the company will trade ex-bonus in the ratio of 6:1, implying eligible shareholders will be getting 6 shares for every 1 share held. Ahead of the ex-bonus date, shares of the company ended lower by over 2% at Rs 1210.

RailTel Corporation of India: The state-run telecom infrastructure provider has received the work order from South Eastern Coalfields for providing MPLS VPN services at 529 locations under SECL command area for 5 years. The total value of the work is Rs 186.19 crore.

PNC Infratech: The company’s subsidiary Akkalkot Highways received appointed date, from National Highways Authority of India, for construction of 6 lane with access controlled greenfield highway on hybrid annuity mode under Bharatmala Pariyojna. The construction period of the road project is 912 days from appointed date.

Advanced Enzyme Technologies: The company has completed acquisition of 50% stake in Saiganesh Enzytech Solutions by subscribing its 1.99 crore shares on private placement or preferential issue basis, for over Rs 5.99 crore. It also completed acquisition of additional stake of 4.83% in JC Biotech.

Themis Medicare: The pharma firm has launched a novel transdermal estradiol spray Lenzetto in the Indian market, for treatment of menopausal symptoms. Lenzetto, which is approved by USFDA and EMA is manufactured in Europe by Gedeon Richter.

Can Fin Homes: The housing finance company said the board of directors has appointed Apurav Agarwal, ACA, as the Chief Financial Officer and key managerial personnel of the company. He becomes CFO with effect from January 4, 2023.

LTIMindtree: Venugopal Lambu, a whole-time director and Markets President has resigned from LTIMindtree, the company said on Tuesday. His last working day will be January 10, 2023.