Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.2% lower at 18,869.5, signalling that Dalal Street was headed for negative start on Thursday.

Asian shares were mixed as investors gauged Jerome Powell’s comments on the need for higher interest rates to tame inflation. The Nikkei 225 index was flat, while the Topix rose 0.63%. The CSI 300 index was down 1.53% and the Hang Seng tanked 1.98%.

Indian rupee rose 11 paise to 82.04 against the US dollar on Wednesday.

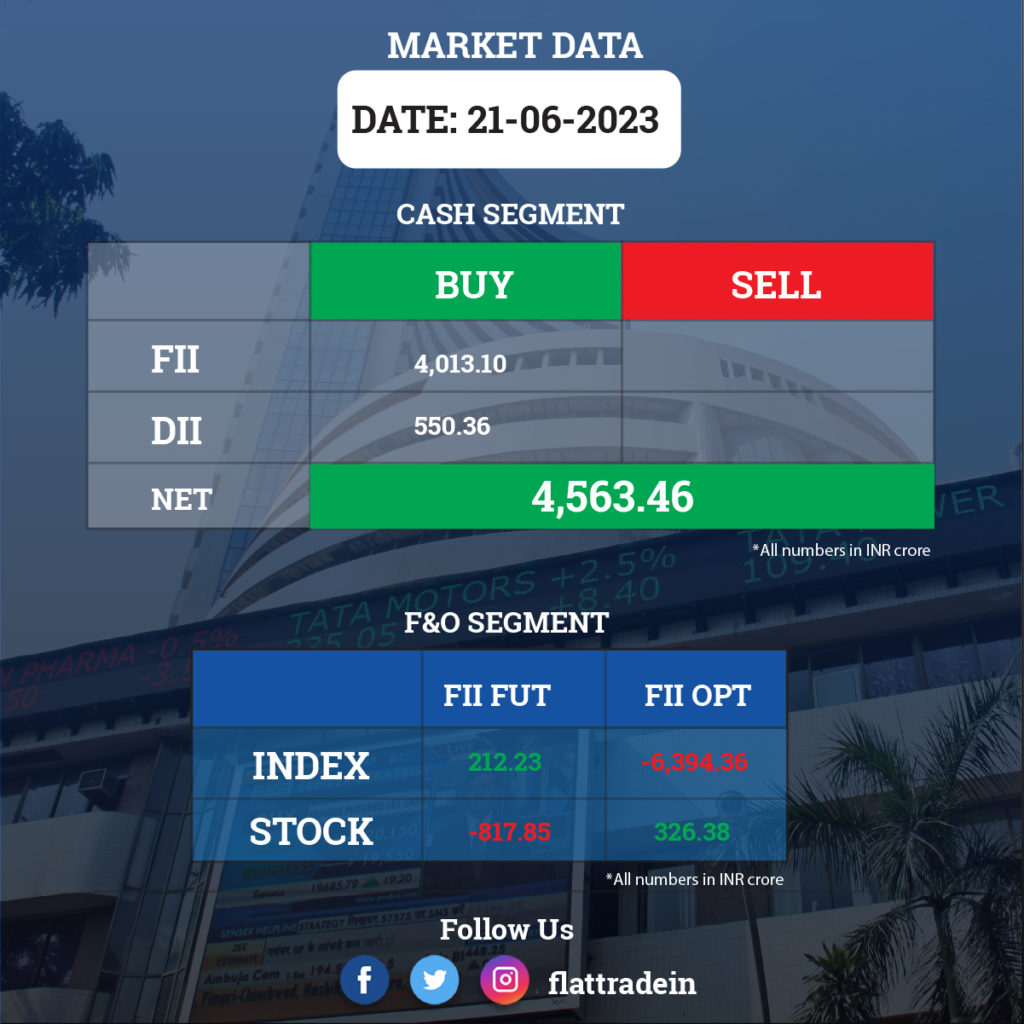

FII/DII Trading Data

Stocks in News Today

Reliance Industries Limited (RIL): The conglomerate has received the Reserve Bank of India (RBI)’s approval to retain $2 billion over and above the $3 billion loan it had raised during the last financial year, The Economic Times (ET) reported citing sources. RIL had to seek RBI’s permission since the funds raised was more than the limit set by the central bank, the report said. The funds are likely to be used for the company’s working capital and also expansion in energy and telecom businesses.

Tata Consultancy Services (TCS): The IT services company and UK’s largest workplace pension scheme National Employment Savings Trust (NEST) have expanded their long-standing partnership to focus on digitally transforming NEST’s scheme administration services, and delivering enhanced member experiences. The contract value was signed for 840 million pounds with an initial tenure of 10 years.

Bharti Airtel: The company has entered into an agreement to acquire 12.07% equity shares in Egan Solar Power, a special purpose vehicle formed for the purpose of owning and operating the Captive Power Plant.

HDFC Asset Management Company: SBI Mutual Fund acquired a 3.96% stake in the asset management company via open market transactions on June 20 and raised shareholding to 6.86% from 2.9% earlier. SBI MF was one of the buyers for shares in the HDFC AMC sold by promoter entity Abrdn Investment Management.

Delhivery: Global private equity firm Carlyle is planning to offload about 1.84 crore shares or 2.5% equity stake in the logistics company via block deals, according to media reports. The floor price for the deal is likely to be at Rs 385.50 per share.

LTIMindtree: The technology consulting and digital solutions company launched Canvas.ai, an enterprise-ready generative AI platform designed to accelerate the concept-to-value journey for businesses using mindful AI principles. The platform enables clients to build, manage and consume generative AI solutions responsibly.

NMDC: Life Insurance Corporation of India (LIC) has offloaded a 2.07% stake in the state-run iron ore company via open market transactions in the last three months. As a result, LIC’s stake in the company decreased to 9.62%, from 11.69% earlier.

NTPC: The country’s largest power generation company said the board will meet on June 24 to consider the issue of non-convertible debentures (NCDs) worth up to Rs 12,000 crore. However, the decision is subject to the approval of shareholders in the ensuing Annual General Meeting.

Kalpataru Projects International: The company said the executive committee of the board has approved the issuance of non-convertible debentures of Rs 300 crore on a private placement basis. The coupon rate offered for these NCDs is 8.07% per annum.

Sansera Engineering: Client Ebene and CVCIGP II Employee Ebene to sell 47.8 lakh shares (9%) and 26.8 lakh shares (5.1%), respectively. Shares are offered in the price range of Rs 799.85 to Rs 841.95 apiece, representing a discount of up to 5% to Wednesday’s closing price.

Glenmark Pharmaceuticals: The U.S. FDA has issued a warning letter to the Monroe facility in North Carolina. The company did a voluntary recall of all its products from this site in August 2021, and since then it has not been commercialising any products from this site. Hence, the warning letter will have no impact on the existing revenues, it said.

Krishna Institute Of Medical Science: SBI Mutual Funds, under its various schemes, has acquired 52,08,276 shares of the company, which is 6.5% of the paid-up share capital of the company.

Shyam Metalics and Energy: The company announced the commissioning of production capacities at their manufacturing facility at Jamuria, West Bengal. The capacity of the captive power plant will increase by 90 MW, from 267 MW to 357 MW.