Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.31% lower at 19,488, signalling that Dalal Street was headed for negative start on Friday.

Asian shares were trading lower following a decline on Wall Street as investors were worried over the prospect of more US interest rate hikes after data showed a strong labor market boosting bond yields. The Nikkei 225 index was down 0.47% and the Topix fell 0.39%. The CSI 300 index dropped 0.59% and the Hang Seng tanked 1.32%.

Indian rupee weakened by 28 paise to close at 82.51 against the US dollar on Thursday.

Ideaforge Technology, a drone manufacturing company, will make debut on the exchanges on July 7. The issue price has been fixed at Rs 672 per share.

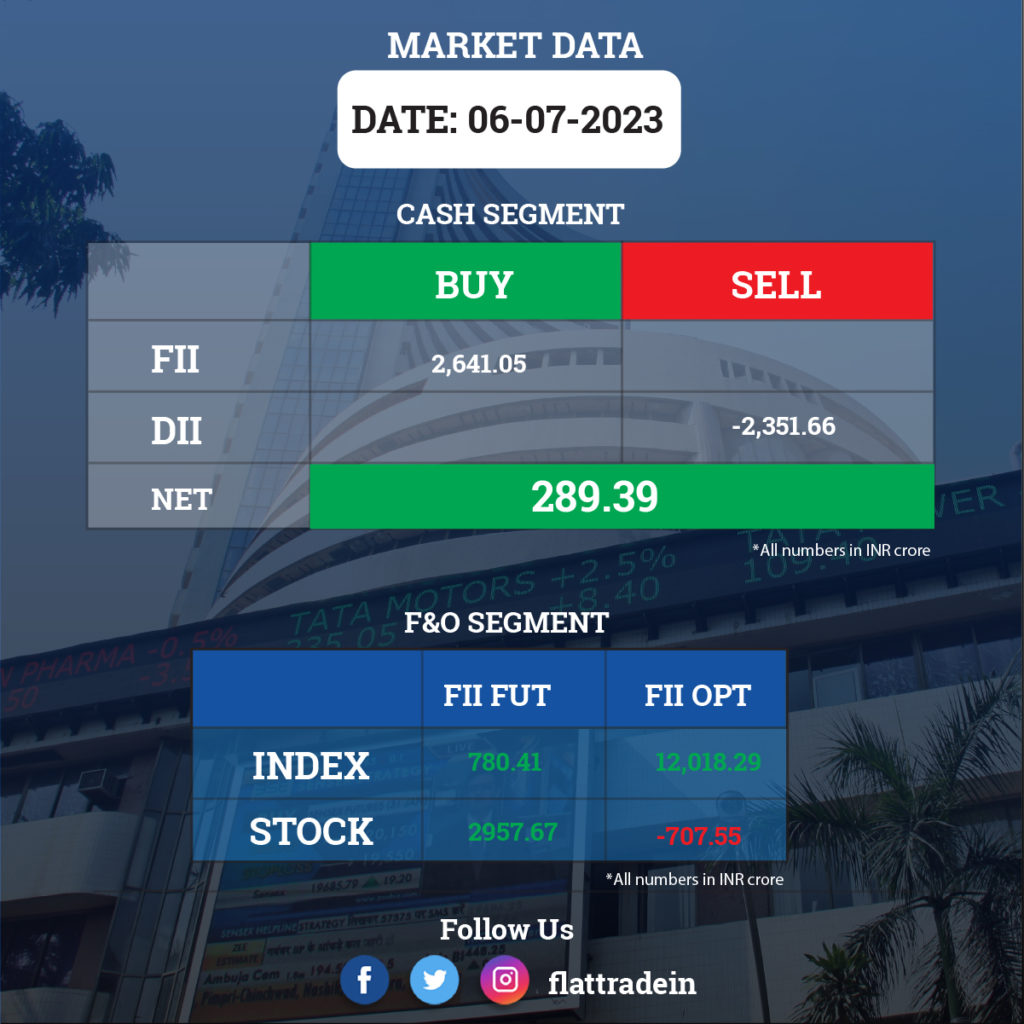

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The National Company Law Tribunal has approved the demerger of Reliance Industries’s financial services undertaking into Reliance Strategic Investments, to be renamed Jio Financial Services. Reliance Industries and Reliance Strategic Investments will take the necessary steps, including fixing the record date for allotment and listing of equity shares of Reliance Strategic Investments, to be renamed Jio Financial Services.

Titan Company: The jewellery-to-watch retailer has registered a 20% year-on-year growth in revenue for June FY24 quarter, with all key consumer businesses exhibiting double-digit growth in the quarter. A total of 68 stores were added (including CaratLane) during the quarter taking Titan’s retail presence to 2,778 stores.

Tata Steel: The company’s consolidated production declined to 7.08 million tonnes (MT) in the first quarter of FY24. The company’s consolidated production was at 7.67 MT during April-June of the preceding financial year, Tata Steel said in a statement. Consolidated deliveries, however, rose 7.97% to 7.04 MT from 6.52 MT in the same period of the last fiscal.

Tata Motors: The automaker has achieved a new sales milestone with Tiago sales crossing the 500,000-mark. The last 1 lakh units were sold within a span of 15 months, the company said.

Sobha: The realty company recorded a 27.9% year-on-year growth in total sales at Rs 1,465 crore for quarter ended June FY24, which is the highest ever quarterly sales value, while sales volume increased by 2.6% YoY to 1.39 million square feet. Price realisation for the quarter surged 24.6% to Rs 10,506 per square feet compared to same period last year.

Dabur India: The FMCG major’s consolidated business including recently acquired Badshah Masala, is expected to register growth exceeding 10% for the quarter YoY. The international business is expected to report a strong performance with double-digit growth in constant currency as softening of inflation in international markets is having a positive impact on the business. India business is expected to post growth in high single digit.

JK Cement: The company’s subsidiary — JK Maxx Paints — has acquired 20% stake, as a second tranche, in Acro Paints for Rs 60.24 crore. Consequently, JK Maxx Paints has acquired total 80% stake in Acro Paints.

Capacite Infraprojects: The construction engineering company has raised Rs 96.3 crore as its board members approved an allotment of 56.65 lakh equity shares at an issue price of Rs 170 per share on preferential basis to 17 non-promoters including Param Value Investments, Vikas Vijaykumar Khemani, Capri Global Holding, and Value Prolific Consulting.

Indian Hotels: India’s largest hospitality company has expanded its portfolio to 270 hotels, with signing agreements for 11 hotels and opening 5 new hotels across destinations. With the current portfolio of 270 hotels, the company remains well poised to achieve its vision of over 325 hotels by 2025.

Infosys: The company’s North American-based unit, Infosys Public Services, opened a new subsidiary in Canada.

Indian Oil and Praj Industries: Both the companies have signed an agreement to boost biofuel production capacities in India. The joint venture will include the production of sustainable aviation fuel, ethanol, compressed biogas, biodiesel, and Bio-bitumen. In October 2021, the companies inked an agreement to form a JV for this.

Affle (India): The company’s unit in Singapore has agreed to acquire the remaining 5% shares of Appnext at a consideration of $1.5 million in tranches within three years.

Aster DM Healthcare: The company has acquired an additional 2.36% stake in unit Malabar Institute of Medical Sciences from several minority shareholders, thus increasing its holding from 76.01% to 78.37%.

Shyam Metalics: The company posted an increase of 12.7% in sale volume of Sponge Iron as compared to the previous quarter (Q4FY23), whereas realisations have dropped by 7.7%. Moreover, sales volume of Steel Billets increased by 19.7% in Q1FY24 sequentially, while realisations have dropped by 3.8%. Sales volume of Long Steel, too has decreased 8.2 per cnt QoQ in Q1FY24, while realisations have dropped by 3.6%.