Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.22% lower at 19,387, signalling that Dalal Street was headed for a lower opening on Friday.

Most Asian shares were trading higher as investor optimism improved after Beijing extended support to its ailing economy through more stimulus. The Nikkei 225 index rose 0.62% and the Topix jumped 0.88%. The Hang Seng fell 0.55% and the CSI 300 index gained 0.68%.

The Indian rupee fell by 4 paise to 82.78 against the US dollar on Thursday.

India’s economy grew by 7.8% in the April-June quarter of current fiscal, compared to a growth of 6.1% in the previous January-March quarter of FY23, according to official data released by the National Statistical Office. Further, Chief Economic Advisor V Anantha Nageswaran on Thursday said that the country’s economy is expected to grow at 6.5% in the current fiscal.

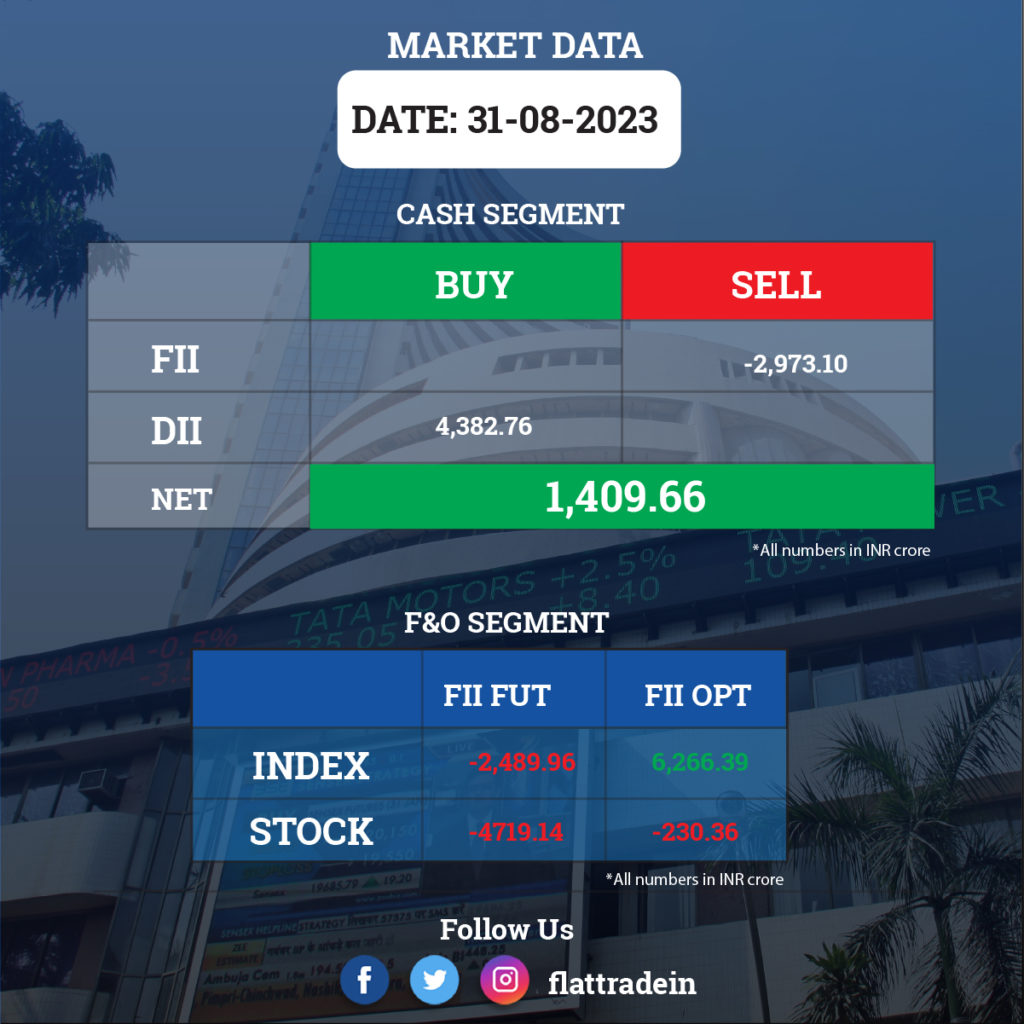

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The company’s media arm Viacom 18 has bagged the BCCI TV and digital right for the domestic and international games to be played in India. The deal is for the next five years and its cumulative bid is Rs 5963 crore. Viacom 18 beat competitors Star India and Sony in an e-auction conducted by the BCCI. As per the new deal which has 88 international matches, Viacom18 is estimated to be paying INR 67.75 crore per game to the BCCI, which is 12.91% higher than the Rs 60 crore Disney Star had paid during the 2018-23 period.

Torrent Pharmaceuticals and Cipla: Torrent Pharma may have submitted a non-binding bid to acquire the stake of promoters of pharma major Cipla, CNBC-TV18 reported citing sources. According to the news report, the company is also holding talks with three to four private equity companies and foreign institutions as it considers several funding options for the offer.

Jet Airways: The Jalan Kalrock consortium, which was the successful bidders of Jet Airways, have paid Rs 100 crore as part of the process to take over the non-operational airline. The payment comes after the National Company Law Appellate Tribunal allowed it to make payment in tranches earlier this week. With this development, the consortium has so far invested Rs 250 crore in the airline.

Jio Financial Services: The company shares will be removed from S&P BSE indices before trading starts on September 1.

Aditya Birla Fashion and Retail: The company said that it has completed the acquisition of a 29% stake in TCNS Clothing pursuant to the open offer. It also plans to raise Rs 750 crore on or after Sept. 4 through bonds on a private placement basis.

Punjab National Bank: The public sector lender has raised its lending rates by 5 basis points across tenures and the revised lending rates will be effective from September 1.

Nykaa: The company has invested Rs 3.97 crore in its international arm, FSN International, by acquiring 39.78 lakh shares of Rs 10 each on a rights basis for providing long-term funds.

Sula Vineyards: Verlinvest Asia Pte has sold 12.6% stake in Sula Vineyards Ltd. for Rs 513.17 crore on Thursday. HDFC Mutual Fund bought 35.2 lakh shares, or a 4.2% stake. Other buyers include Morgan Stanley Asia (1.6%), Societe Generale (0.8%), and Ghisallo Master Fund (0.6%).

LIC: Mini Ipe has ceased to be the MD, and Gajraj Singh Gill has ceased to be the Executive Director (Senior Business Associate) with effect from August 31 upon superannuation.

CONCOR: The comapny said Sanjay Swarup will be appointed as Chairman and Managing Director with effect from October 1. Sanjay Swarup is currently Director (International Marketing & Operations) at the comapny.

Genus Power Infrastructure: The company’s step-down wholly owned subsidiary has bagged a Rs 2,247.37 crore order for 24.18 lakh smart metres, including their design, supply, installation, and commissioning. With this development, the total order book now stands at around Rs 11,000 crore.

India Pesticides: The agrochemical company plans to buy 11,461 square meters of land adjacent to its existing Sandila plant for setting up a manufacturing unit of pesticides. The acquisition of the new land will help the company in expansion of the Sandila plant.

ITD Cementation: The company has bagged a marine contract worth Rs 3,290 crore, excluding GST.

GlaxoSmithKline Pharma: The Assistant Commissioner of State Tax Maharashtra initiated a search at certain premises of the company on Thursday. The officials are extending their full cooperation and responding to the queries raised by them, it said.

Shakti Pumps: The company received an order from the Haryana Renewable Energy Department for the supply, installation, and commissioning of solar water pumping systems. The order will be executed within a 120-day period from the date of issue of the work order.

India Pesticides: The company acquired 11,461 sq m of land adjacent to its existing Sandila plant in UP to set up a pesticide manufacturing unit. The cost of acquisition is Rs 9.61 crore.

Navneet Education: The board has approved a composite scheme of arrangement for the amalgamation of Genext Students and the demerger of the Edtech business of Navneet Futuretech into Navneet Education. This scheme will help the company in rationalising the group structure and cost by utilising the existing Navneet Education workforce and resources.