Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.14% lower at 18,698 signalling that Dalal Street was headed for negative start on Tuesday.

Asian shares were trading higher, led by gains in realty stocks. The Nikkei 225 index rose 0.41%, while the Topix gained 0.19%. The Hang Seng jumped 1.02%, while the CSI 300 index edged up 0.14%.

Indian rupee fell 36 paise to 82.68 against the US dollar on Monday.

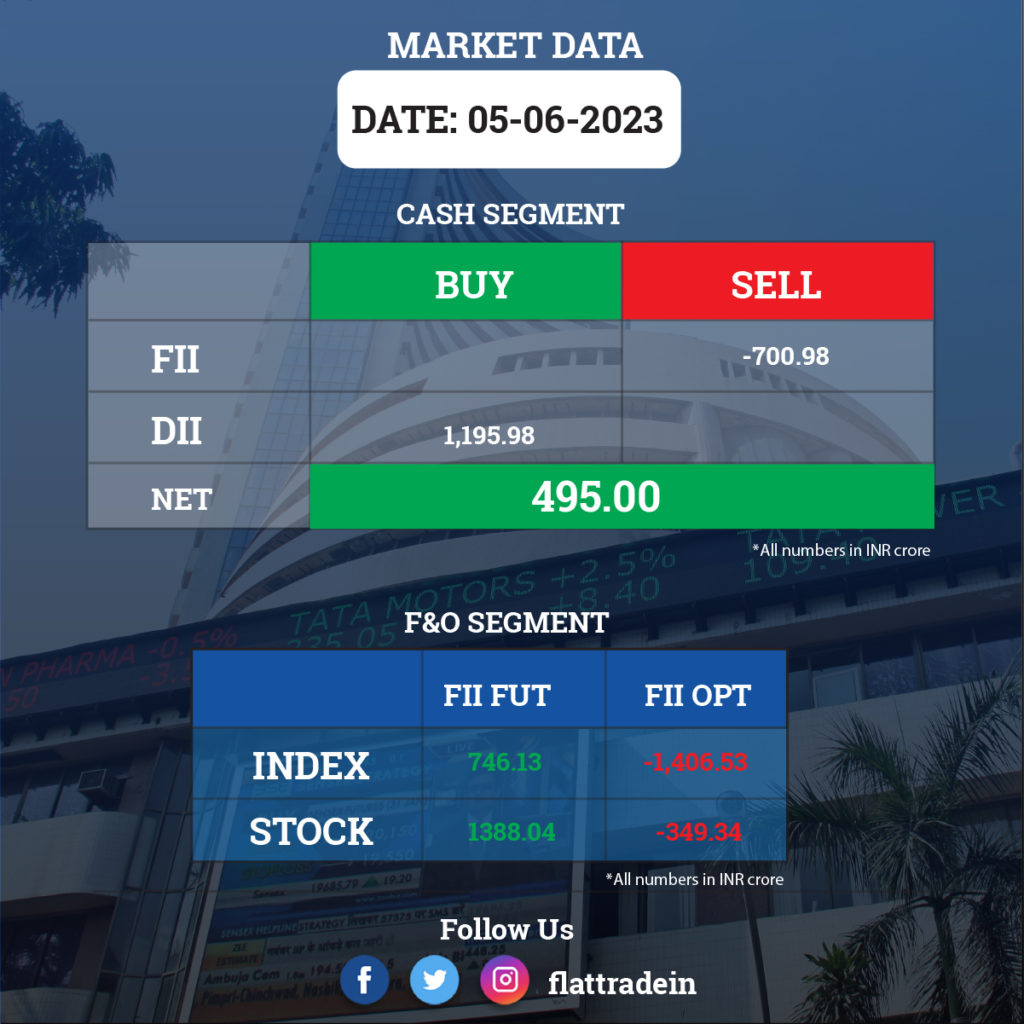

FII/DII Trading Data

Stocks in News Today

SBI Cards and Payment Services: The company said its board has approved the fundraising of up to Rs 3,000 crore via the issuance of non-convertible debentures (NCDs). The fundraising will take place in one or more tranches, on a private placement basis.

Adani Group: The group said that it has repaid loans aggregating $2.65 billion to complete a prepayment programme to cut overall leverage. In a credit note, Adani Group said that it has made a full prepayment of $2.15 billion of loans that were taken by pledging shares in the group’s listed firms and also another $700 million in loans taken for the acquisition of Ambuja Cement. “The prepayment was done along with interest payment of $203 million,” the Adani Group said.

State Bank of India (SBI): The country’s largest lender said its board of directors will meet on June 9 to consider raising funds during FY24 via issuance of debt instruments including capital instruments in INR and/or foreign currency, on a private placement basis.

JK Cement: The cement company has received the board approval to sign and execute a Share Purchase Agreement with Toshali Cements for the acquisition of 100% shareholding in Toshali, from all the existing shareholders. After an investment of Rs 157 crore, Toshali will become a subsidiary of JK Cement, and the acquisition will help the company expand its footprint into the eastern region.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 147 crore, from Nzuri Pune Knowledge Park. With this, the total order book of the company stands at Rs 2774 crore till date.

Godrej Consumer Products: The board of directors has appointed Aasif Malbari as Chief Financial Officer (CFO) of the FMCG company with effect from August 10, 2023. Sameer Shah ceased as the CFO of the company as he will move to a group role leading consumer investments. Malbari is currently the chief financial officer of Tata Passenger Electric Mobility and director of Tata Motors Passenger Vehicles.

Wipro: The IT services company said its dynamic digital signage solution, Wipro VisionEDGE, will power Bowling Center TV (BCTV), a new digital out-of-home television network distributed across bowling centres in the United States. BCTV is a partnership between Strike Ten Entertainment, the Bowling Proprietors’ Association of America (BPAA), and Equity Sports Partners.

Indian Energy Exchange (IEX): The company reported 8,251 MU overall volume in May, up 8% YoY. The market clearing price declined 30% YoY to Rs.4.74 per unit. The company said power demand is expected to increase in coming months and supply side liquidity may improve due to enhanced coal supply, reduction in e-auction coal prices, and declining imported coal and gas prices. This will lead to competitive prices and higher clearance for Discoms & Open Access consumers.

Mahindra & Mahindra (M&M): In an exchange filing, the company said that the Sunrise Trust has sold entire stake of 81.58% in Mahindra Marine to Ocean Blue Boating. Ocean Blue currently holds the balance 18.42% stake in Mahindra Marine.

Allcargo Logistics: The company said Transindia Real Estate has agreed to further divest 10% stake each in five subsidiaries of Allcargo and a 100% stake in Allcargo Multimodal to Blackstone.

NELCO: The company has inked pact to acquire 9.09% stake in Piscis Networks with an initial investment of Rs 99.99 lakhs. It plans to increase stake in the company to up to at least 30%.

Veranda Learning Solutions: The company’s unit Veranda RACE partnered with Talent Academy & Publications to augment its reach in Kerala. Veranda RACE is also teaming up with placement-oriented company Phire, which offers expert training for recruitment in private banking and BFSI sector.

L&T Finance: The company company plans to meet on June 8 to consider recommendation of final dividend on the equity shares for fiscal 2022-2023.

CSB Bank: Mr. Satish Gundewar, who was former CFO of DCB Bank, has taken charge as chief financial officer of CSB Bank from Jun.5 .