Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.4% lower at 17,093, indicating a negative start for Dalal Street.

Most Asian shares were trading lower on negative global cues. The Nikkei 225 index fell 0.83%, the Topix was down 0.90%. The Hang Seng index tanked 1.92% and the CSI 300 index rose 0.36%.

Indian rupee rose 18 paise to 82.55 against the US dollar on Friday [17-03-2023].

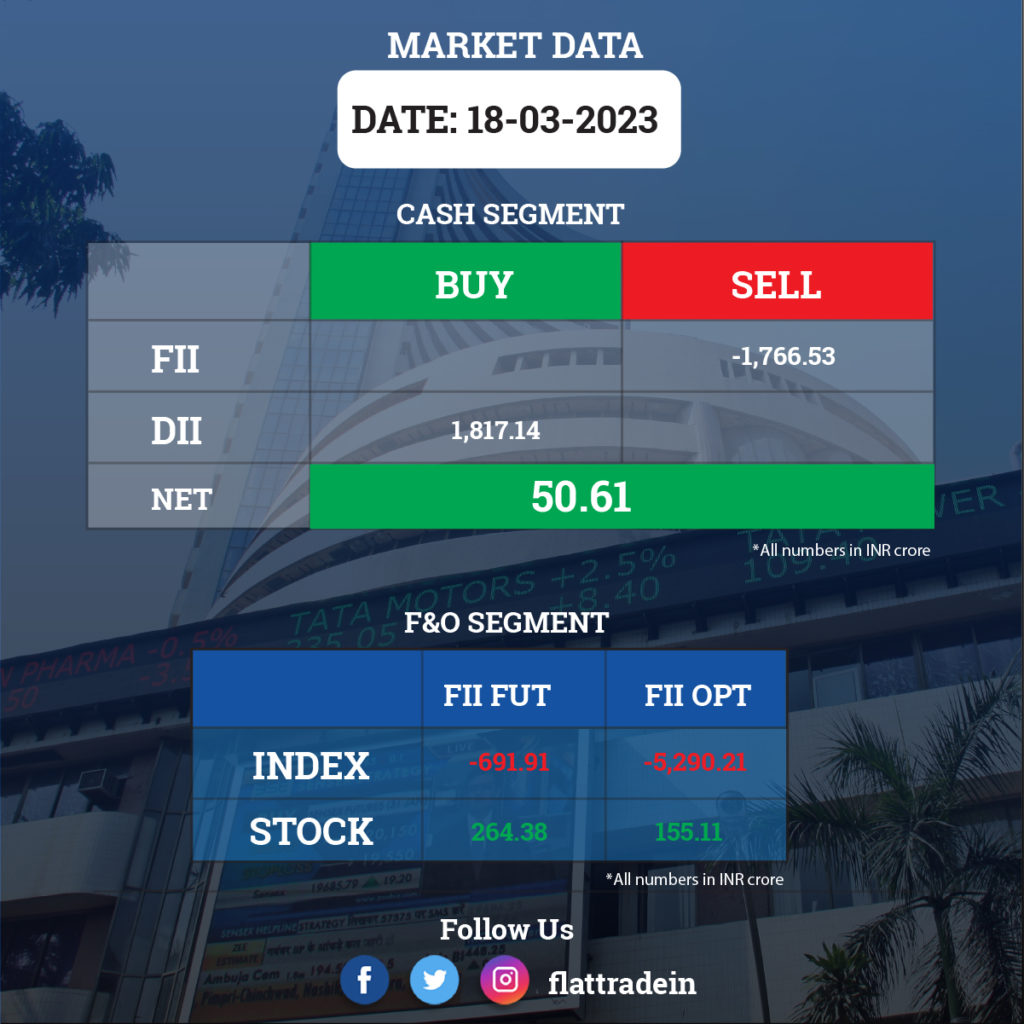

FII/DII Trading Data

Stocks in News Today

Tata Consumer Products: The company said that it has ceased negotiations with Bisleri with regard to a potential transaction and confirmed that the company has not entered into any definitive agreement or binding commitment on this matter. In November 2022, the company had said it evaluated various strategic opportunities for growth and expansion of its business, and pursuant to this, the management remained in discussions with various parties, including Bisleri International.

Jindal Steel and Power Ltd (JSPL): The company said it will manufacture India’s first fire-resistant steel structures at its unit in Raigarh, Chhatisgarh. With the production of a special steel item for the first time in India, the company will target segments like refineries, bridges, metro projects, industrial structures, steel, power plants, hospitals, commercial and residential buildings, JSPL said in a statement.

BPCL: The state-owned oil marketing has raised Rs 935 crore by allotting 93,561 unsecured, listed, rated, non-cumulative, redeemable, non-convertible, taxable, debentures of face value of Rs 1,00,000 each.

SJVN: The company said its green energy subsidiary has bagged a 200MW solar project entailing an investment of Rs 1,000 crore in Maharashtra. The project shall be constructed in a period of 18 months which shall be reckoned from the date of signing of PPA (power purchase agreement) with MSEDCL.

Rail Vikas Nigam (RVNL): The company has emerged as the lowest bidder for a composite contract package in connection with the new BG railway line of HORC project by Haryana Rail Infrastructure Development Corporation. The cost of the project is Rs 1,088.49 crore and IT is expected to be executed within 1,460 days.

Torrent Pharmaceuticals: The USFDA has conducted a pre-approval inspection (PAI) of the company’s oral-oncology manufacturing facility in Gujarat between March 13 and March 17. The US drug regulator issued a ‘Form 483’ with 1 observation, which is procedural in nature.

Navin Fluorine International: The company’s subsidiary, Navin Fluorine Advanced Sciences, said its board of directors has approved a capital expenditure of Rs 450 crore for setting up a new 40,000 tonnes per annum hydrofluoric acid capacity at Dahej. Currently, the company has an AHF manufacturing plant with a capacity of approximately 20,000 tonnes per annum at Surat. The new capacity is expected to come on stream in two years.

Havells India: The electric equipment maker has commenced commercial production of air-conditioners at its Sri-City plant from March 17. In July 2022, it had intimated about setting up of new facility to manufacture air-conditioners at Sri City in Andhra Pradesh.

SKF India: The company plans to invest in renewable energy company, Cleanmax Taiyo, by acquiring its 2,600 fully paid-up equity shares, equivalent to 26% shareholding. Earlier, SKF board had approved investment via equity participation in the special purpose vehicle company for commissioning a captive project (wind + solar) via open access for the Bangalore plant. The acquisition will be completed by June 2023.

Welspun Corp and Sintex Plastics Technology: The National Company Law Tribunal has approved the resolution plan submitted by the consortium of Propel Plastic Products, a wholly-owned subsidiary of Welspun Corp, and Plastauto, a related party of Welspun Corp, with respect to corporate insolvency resolution process of Sintex-BAPL on March 17. Sintex-BAPL is a wholly-owned subsidiary of Sintex Plastics Technology.

Can Fin Homes: The company’s board has appointed Suresh Srinivasan Iyer as the Managing Director and Chief Executive Officer (CEO) of the company with immediate effect.

Federal Bank: The private sector lender has approved the issuance of unsecured basel III compliant tier-II subordinate bonds amounting up to Rs 1,000 crore on a private placement basis.

HDFC: The Reserve Bank of India (RBI) has imposed a penalty of Rs 5 lakh on HDFC for non-compliance of national housing bank provisions.

Atul Auto: Investor Vijay Kedia has picked up another 7.05% stake in smallcap Atul Auto by converting warrants into equity shares.

Bliss GVS Pharma: The United States Food and Drug Administration (USFDA) has conducted an inspection at the company’s manufacturing unit at Palghar and issued three 3 observations.