Market Opening - An Overview

SGX Nifty futures were trading 0.06% lower at 17,706, signalling that Dalal Street was headed for negative start on Monday.

Asian shares were trading higher after strong US jobs data. The Nikkei 225 index gained 0.44% and Topix advanced 0.54%. The Hang Seng rose 0.28%, while the CSI 300 index fell 0.18%.

Indian rupee rose 11 paise to 81.88 against the US dollar on Thursday.

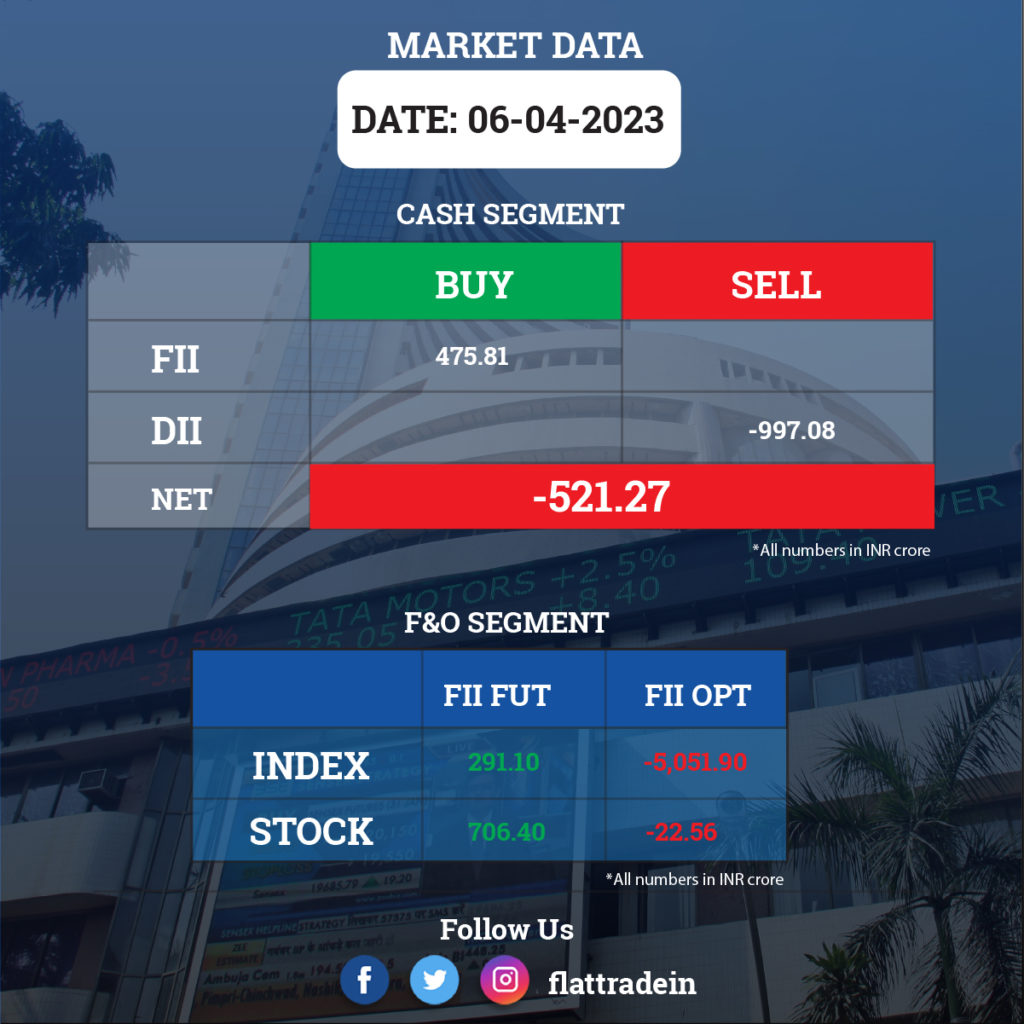

FII/DII Trading Data

Stocks in News Today

Titan Company: The company reported 25% YoY rise in revenue on higher growth contributions from watches and wearables and emerging businesses segments in Q4FY23. Total stores, including CaratLane, increased by 173 during the quarter to 2,710. Watches and wearables section recorded 41% growth, while the emerging businesses segment saw 84% growth. Jewellery segment saw 23% growth during the quarter.

Tata Motors: The company said Jaguar Land Rover total wholesale figures, excluding China, rose 24% YoY to 94,649 units in Q4FY23. Retail sales, including China, rose 30% YoY to 1.03 lakh units. Orderbook stood at around 2 lakh units and free cash flow estimated at over £800 million positive. The Tata Motors Group global wholesales in Q4 FY23, including Jaguar Land Rover, were at 3,61,361 nos., higher by 8%, as compared to Q4 FY22.

Adani Wilmar: The FMCG company registered a year-on-year volume growth of close to 14% in FY23, which enabled it to cross Rs 55,000 crore of revenue for the year. It closed the financial year 2023 with around Rs 3,800 crore of revenue in the food & FMCG segment, a growth of about 40% YoY in volumes and 55 percent YoY in revenue terms.

ONGC/OIL India: The Cabinet revised domestic natural gas pricing guidelines for gas produced from nomination fields of ONGC and OIL, New Exploration Licensing Policy blocks and pre-NELP blocks, to notify these prices on a monthly basis.

Mahindra & Mahindra Financial Services: The Reserve Bank of India fined the company Rs 6.77 crore for violation of RBI directions on disclosure of annualised rate of interest charged on loans to the borrowers at the time of sanction and failure to give notice of change in terms and conditions of loan to its borrowers, when it charged higher rate of interest than what was communicated at the time of sanction, during financial years 2018-19 through 2020-21.

Rail Vikas Nigam: The consortium of Siemens and the company emerged as the lowest bidder for design, manufacture, supply, installation, testing and commissioning of two 110kV receiving substation and complete SCADA system for main line and depot of Mumbai Metro line 2B of MMRDA. The project cost is Rs 378.16 crore.

Adani, GMR group companies: Two Uttar Pradesh power distribution companies (discoms) have cancelled the bids of Adani and GMR group companies to supply smart meters under the state’s Rs 25,000-crore road map, Business Standard reported. The discoms — Dakshinanchal Vidyut Vitran Nigam and Purvanchal Vidyut Vitran Nigam — have cancelled the tenders without citing any reasons.

Century Textiles Industries/ Sudarshan Chemical Industries: Birla Estates, the real estate arm of the Aditya Birla Group, has acquired 5.76 acres of land from Sudarshan Chemical Industries in Sangamwadi, Pune to foray into the city’s residential real estate market. The estimated revenue potential of the land parcel is Rs 2,500 crore.

Muthoot Finance: The company’s board has approved an interim dividend of Rs 22 per share. The total interim dividend outgo will amount to Rs 883.19 crore. Meanwhile, Muthoot Money, a wholly owned subsidiary of the company, has been fined Rs 10.5 lakh for non-compliance with provisions related to monitoring of frauds.

Indian Bank: The bank has been fined Rs 55 lakh by the Reserve Bank of India for non-compliance with KYC directions.

IIFL Finance: The company raised $100 million in long-term funding from Export Development Canada and Deutsche Bank

Gulshan Polyoyls: The company received an order from Excise Department under Government of Madhya Pradesh to supply 72 lakhs proof liter country liquor in Chhindwara, Balaghat and Singrauli districts during fiscal ending March 2024.

Axita Cotton: The company received an order from m Badsha Textiles, Bangladesh, for supply of raw Indian raw cotton at $3.28 million (around Rs 26.89 crore).

CreditAccess Grameen: The company said its assets under management (AUM) increased 27% YoY to Rs 21,032 crore in Q4FY23. Disbursements increased 24% YoY to Rs 7,171 crore and customer addition rose by 80% to 5.4 lakh during the quarter.

Apollo Micro Systems: The company has fixed May 4 as the record date to split its shares in ratio of 1:10.

CMS Info Systems: The firm has set sights on an annual turnover of Rs 5,000 crore by 2030, up from the estimated Rs 1,600 crore in FY23. It is looking to foray into new business lines, such as collection and recovery services.