Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.11% higher at 19,171, signalling that Dalal Street was headed for positive start on Friday.

Asian shares were mixed as Japanese stocks fell, while Chinese stocks rebounded to trade in the green. The Nikkei 225 index fell 0.53% and the Topix dropped 0.75%. The Hang Seng rose 0.17% and the CSI 300 index was up 0.43%.

Indian rupee closed at 82.05 against the US dollar on Wednesday.

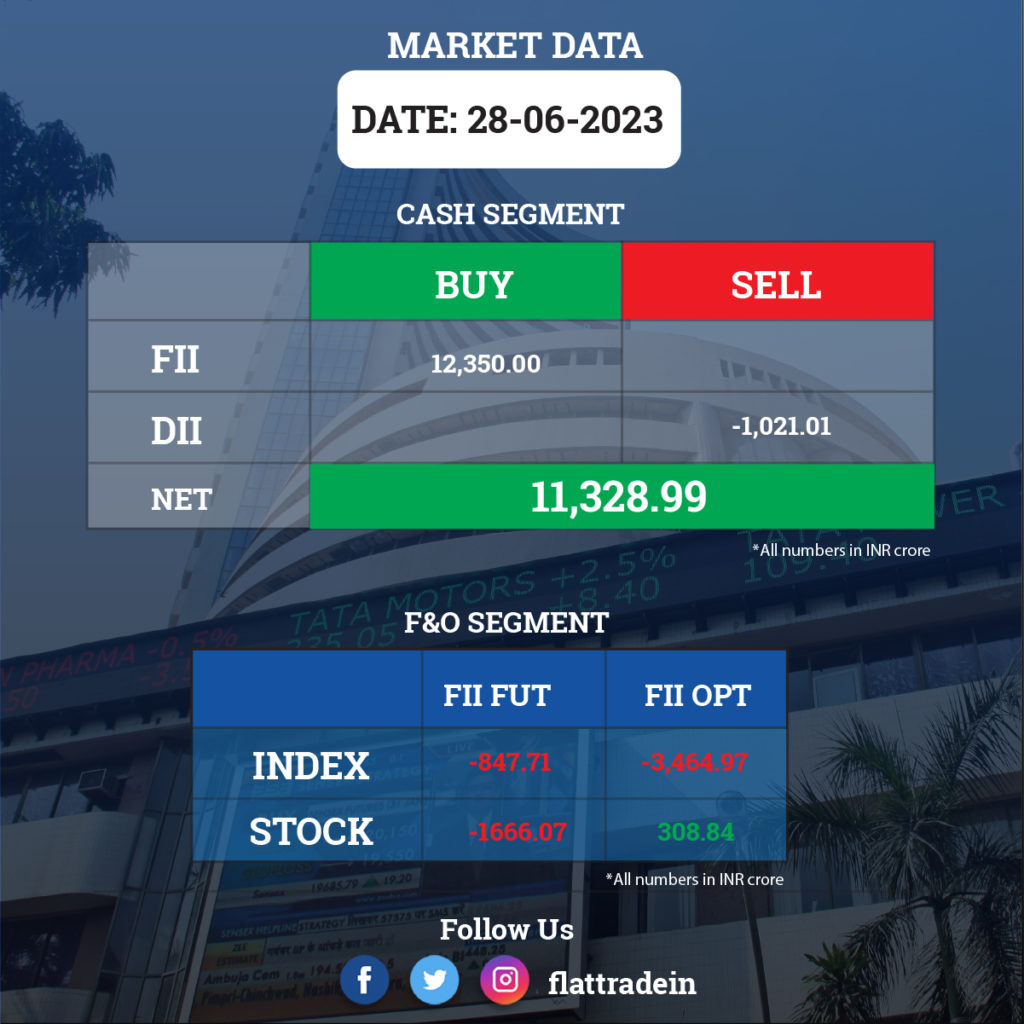

FII/DII Trading Data

Stocks in News Today

ICICI Securities, ICICI Bank: ICICI Bank said that the board members have approved the draft scheme of arrangement for delisting of equity shares of ICICI Securities. The public shareholders of ICICI Securities will get 67 equity shares of the bank for every 100 shares held by them in ICICI Securities. As a result, ICICI Securities will become a wholly-owned subsidiary of the bank.

Bharat Petroleum Corporation (BPCL): The oil marketing company has received approval from its board of directors for raising capital up to Rs 18,000 crore. This capital will be raised via an issue of equity shares on a rights issue basis to eligible equity shareholders of the Corporation.

Canara Bank: The public sector lender has received board approval for its capital raising plan for FY24 amounting up to Rs 7,500 crore via debt Instruments. The bank will raise capital through Basel III compliant additional Tier I bonds to the extent of Rs 3,500 crore and additional Tier II bonds to the extent of Rs 4,000 crore during FY24.

HDFC: The company acquired 612 equity shares of Xanadu Realty, representing 5.46% of its paid-up equity share capital upon conversion of 938 compulsorily convertible debentures held by it in Xanadu. The shares are acquired at Rs 4,08,501 apiece, aggregating to a total consideration of Rs 25 crore.

63 Moons Technologies and MCX India: Commodity exchange operator MCX has decided to extend the support services deal with existing software vendor, 63 Moons Technologies, for six months with effect from July 1, 2023. The service cost is Rs 125 crore per quarter.

PowerGrid: The state-owned electric services company has received board approval for three investment proposals worth Rs 389 crore. The company will invest Rs 164.38 crore for establishment of dedicated telecom network for NTAMC, Rs 115.09 crore for Western region expansion scheme – XXXIII – Part A and Rs 109.47 crore for ICT augmentation at Navsari (new) associated with integration of additional 7 GW RE power from Khavda RE park under Phase-III.

Tata Communications: The Tata Group company has entered into an agreement to acquire US-based Kaleyra Inc, for CPaaS business expansion on a global scale. The said acquisition is expected to be completed within 6-9 months and the purchase consideration of $7.25 per share will be in cash only. The aggregate consideration is expected to be around $100 million.

Zydus Lifesciences: The pharma company has received tentative approval from the United States Food and Drug Administration (USFDA) for Palbociclib tablets. Palbociclib is used to treat a certain type of breast cancer. The product will be manufactured at the group’s formulation manufacturing facility in SEZ, Ahmedabad. Palbociclib had annual sales of $3.3 billion in the US as per IQVIA MAT April 2023.

ICRA: Sushmita Ghatak has resigned as Managing Director & CEO of ICRA Analytics. The company is in the process of identifying the successor for the said position. ICRA Analytics is a material subsidiary of ICRA.

Zee Entertainment: The company has withdrawn its Expression of Interest in the resolution plan process for Reliance Broadcast Network.

Federal Bank: AP Hota will take charge as part-time chairman of the bank with effect from June 29, 2023 to January 14, 2026 following the retirement of C Balagopal.

SBI Life Insurance: The company reappointed Mahesh Kumar Sharma as a Managing Director and CEO of the company.

Zim Laboratories: The pharma company announced strategic investments in Australia and the MENA region to expand its presence in developed and pharmerging markets. For Australia and New Zealand markets, ZIM approved an investment in a local startup company for new innovative products (NIP) and oral thin films (OTF). In the MENA region, ZIM’s subsidiary, ZIM Laboratories FZE, Sharjah, will invest and partner with a local experienced business entrepreneur.

Aurobindo Pharma: The company’s subsidiary, Auro PR Inc, based at Caguas, Puerto Rico, is undertaking a restructuring of its facility to enhance production volume, after completion of commitment for product supply to third party by early July 2023. As a result, Auro PR will not be conducting any manufacturing activity until the repairs / restructuring is complete. During the previous year, Auro PR Inc contributed 1.76% to the consolidated turnover of the company.

Shalimar Paints: Mohit Kumar Donter has resigned as Chief Financial Officer of the paint company with effect from June 30 due to personal reasons. The board members have appointed Davinder Dogra as the chief financial officer of the company effective from July 1, and also appointed Atul Rasiklal Desai as an Additional Director for three consecutive years with effect from June 28.

Advanced Enzyme Technologies: Promoter entity Advanced Vital Enzymes has sold 25.5 lakh equity shares or 2.28% stake in the company at an average price of Rs 270.08 per share. However, ICICI Prudential Mutual Fund bought 10 lakh shares or 0.89% stake at an average price of Rs 270 per share.

Edelweiss Financial Services: The company said its Debenture Fund Raising Committee has approved the public issue of non-convertible debentures of the face value of Rs 1,000 each for amount up to Rs 150 crore with an option to retain oversubscription up to Rs 150 crore, aggregating up to Rs 300 crore (Tranche III issue). The Tranche III issue will remain open for subscription during July 4 and July 17.

KNR Constructions: Subsidiary KNR Kaveri Infra has signed concession agreement for construction of access controlled four laning road project with National Highways Authority of India (NHAI). KNR Kaveri Infra has been incorporated for implementation of construction of access controlled four laning with paved shoulder from Mysore to Kushalnagara section, on Hybrid Annuity Mode under NH(O) in Karnataka.

IndusInd Bank: The board members of the bank have approved an appointment of Vivek Bajpeyi as the Chief Risk Officer of the private sector lender with effect from June 28, 2023 till September 30, 2025. Further, the board appointed Arun Khurana, who is currently the deputy CEO, as an executive director i.e. whole-time director of IndusInd Bank for three years.

Tata Chemicals: Life Insurance Corporation increased stake from 5.06% to 7.12%.

Dalmia Bharat Sugar and Industries Limited: The company has demerged to form Dalmia Bharat Refractories, according to its regulatory filing.