Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.11% higher at 17,709, signalling that Dalal Street was headed for a marginally positive opening on Monday.

Most Asian shares were trading higher as inverstors bet that the Fed would increase the key interest rate at a slower pace to bring down inflation. The Nikkei 225 index rose 0.32% and Topix was up 0.13%. China’s CSI 300 index jumped 1.21%, while Hang Seng fell 0.8%.

Indian rupee rose 7 paise to 81.52 against the US dollar on Friday.

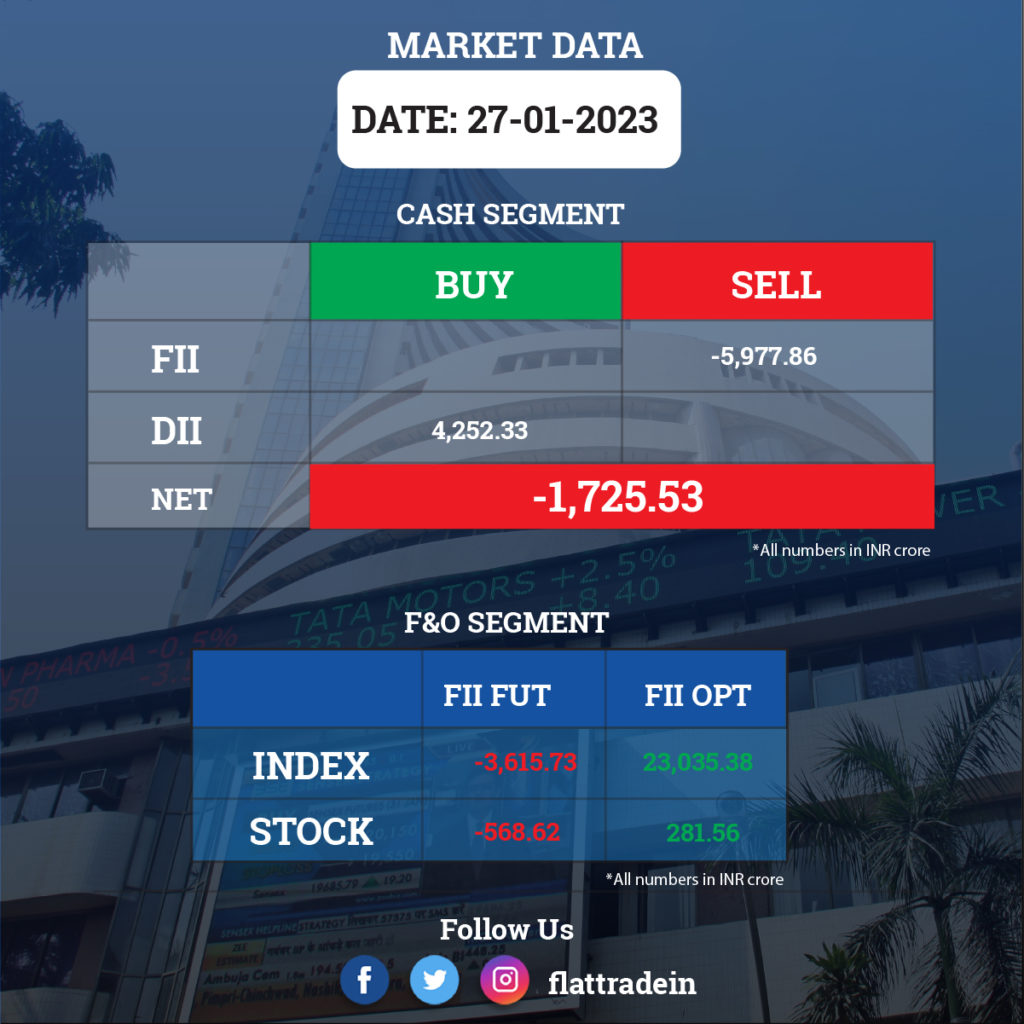

FII/DII Trading Data

Upcoming Results

Larsen & Toubro, Tech Mahindra, Bharat Petroleum Corporation, Bajaj Finserv, Bajaj Holdings & Investment, CSB Bank, Emkay Global Financial Services, Exide Industries, GAIL (India), Inox Leisure, Laurus Labs, Mazagon Dock Shipbuilders, Nippon Life India Asset Management, Punjab National Bank, REC, SRF, Trident, and Welspun India will report their quarterly earnings today.

Stocks in News Today

Bajaj Finance: The NBFC registered a 40% YoY growth in consolidated net profit at Rs 2,973 crore for the December FY23 quarter. Loan losses and provisions fell 20% YoY to Rs 841 crore. Net interest income increased 24% YoY to Rs 7,435 crore and assets under management (AUM) grew by 27% to Rs 2.3 lakh crore. New loans booked in the December 2022 quarter rose 5% YoY to 7.84 million. Customer franchise stood at 66.05 million, a 19% YoY growth. The company recorded its highest-ever quarterly increase in its customer franchise by 3.14 million during the quarter.

Vedanta: The company reported a 42.3% YoY fall in consolidated profit at Rs 3,091 crore for the December quarter. Revenue from operations was at Rs 34,102 crore growing by 0.01% from the year-ago period. The company has approved plans to source 91 MW hybrid renewable power aluminium, copper, oil & gas operations, and 600 MW solar power for aluminium operations. Its EBITDA for the December quarter stood at Rs 7,100 crore with EBITDA margin of 24%. The company also announced 4th interim dividend of Rs 12.5/share.

NTPC: The company reported a 5.4% YoY rise in standalone net profit for the quarter ended December 2022 to Rs 4,476.25 crore. Its revenue from operations rose 37% YoY to Rs 41,410.50 crore. EBITDA rose 36% YoY to Rs 13,239 crore. The board has also approved an interim dividend of Rs 4.25 a share for the current financial year.

Aditya Birla Sun Life: The company reported an 11% decline in profit after tax (PAT) to Rs 166.3 crore for three months ended December 2022. In comparison, the company had posted a PAT of Rs 186.2 crore in the same quarter of the preceding fiscal, the asset management firm said in a regulatory filing. However, its total income rose to Rs 363.17 crore in the quarter under review from Rs 353 crore a year ago.

Tata Motors: The company will be raising its passenger vehicles’ prices by 1.2 per cent on a weighted average basis depending on the variant and model from February 1, given a rise in overall input costs.

Bharat Electronics: The state-owned company’s standalone net profit increased to Rs 598.77 crore in Q3FY23 from Rs 583.37 crore in the same period a year ago. The company’s board recommended an interim dividend of Rs. 0.60 per share. The record date has been fixed as Feb 10, 2023.

CMS Info Systems: The banking logistics and technology services provider has clocked a 26% YoY growth in profit at Rs 76 crore for the quarter ended December 31, 2022, with EBITDA rising 29% YoY to Rs 135 crore and revenue climbing 21% to Rs 488 crore. The company’s operating profit margin expanded 171 bps YoY at 27.7% for the quarter.

Jyothy Labs: The company posted a 77.25% jump in its consolidated net profit at Rs 67.39 crore in the third quarter ended December 2022. The company had posted a consolidated net profit of Rs 38.02 crore in the same period last fiscal, it said in a regulatory filing. Its consolidated revenue from operations was at Rs 612.67 crore during the quarter under review as compared to Rs 539.03 crore in the year-ago period.

Embassy Office Parks REIT: The company’s net operating income grew by 13% YoY to Rs 704.9 crore, with an operating margin of 81%, for the third quarter that ended December 31, 2022. The revenue for third quarter stood at Rs 865 crore as against Rs 741 crore, up 17%. Embassy Office Parks REIT leased one msf across 19 deals in Q3 at 13% leasing spreads, with year-to-date total leasing of 4.4 msf across 71 deals.

Tata Elxsi: The design and technology services provider has registered a 29% year-on-year growth in profit at Rs 195 crore for the quarter ended December FY23, backed by topline and other income. Revenue from operations for the quarter at Rs 818 crore grew by 29% over a year-ago period.

Tube Investments of India: Subsidiary TI Clean Mobility has entered into a share purchase agreement for the acquisition of the remaining 30.04% equity shares held by the founders of Cellestial E-Mobility for Rs 50.90 crore. The proposed investment is part of TI Clean Mobility’s plan to consolidate its holding in the electric tractors business.

Godfrey Phillips India: The cigarette manufacturer has reported a 60% year-on-year increase in consolidated profit at Rs 187 crore for the December quarter of FY23, led by healthy operating income growth of 64% and margin expansion. Revenue from operations grew by 28% YoY to Rs 1,112 crore in the quarter.

Hi-tech Pipes: The company reported over 28% jump in its consolidated net profit to Rs 13.02 crore for the December 2022 quarter helped by higher revenue. Its total income also rose to Rs 569.80 crore from Rs 440.03 crore in the year-ago quarter. The company’s board also approved a proposal for sub-division/split of existing equity share from one equity share into 10 equity shares.

Borosil Renewables: The company has informed the exchanges that trial production from SG-3 solar glass furnace, with the capacity of 550 Tonnes Per Day (TPD), commenced on January 26, 2023, in its first rolling line. The trial production from the second rolling line also commenced from January 27, 2023.

Kajaria Ceramics: The company has reported a 41% YoY drop in its net consolidated profit during Q3FY23 at Rs 73.6 crore. The company’s consolidated income grew just 2 per cent YoY to Rs 1,098.6 crore. The company’s board has approved additional acquisition of up to 11,40,968 equity shares of Kajaria Vitrified (KVPL), a subsidiary company, at a consideration of Rs 1.80 crore.

Hinduja Global Solutions (HGS): The company has announced that the it sboard has approved buyback programme worth Rs 1,020 crore. The company said that it has fixed final buyback price of Rs 1,700 per equity share.

Dilip Buildcon: The National Highways Authority of India has declared the company as the lowest bidder for two projects in Andhra Pradesh. The bid value for the two projects was Rs 1,370 crore.

Aarti Drugs: The pharma company registered a 37% year-on-year decline in consolidated profit at Rs 36.67 crore for the quarter ended December 31, 2022, hit by weak operating performance and tepid topline growth. Consolidated revenue at Rs 664 crore was up 4.6% from the year-quarter compared.