Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading lower 0.08% at 19,747.5, signalling lower opening for Dalal Street on Thursday.

Asian shares were trading lower as investors’ sentiments were dented after home prices fell in China and retail sales slowed in the US. The Nikkei 225 index fell 0.68% and the Topix slipped 0.03%. The Hang Seng tumbled 1.8% and the CSI 300 was down 0.81%.

The Indian rupee appreciated by 20 paise to 83.14 against the US dollar on Wednesday.

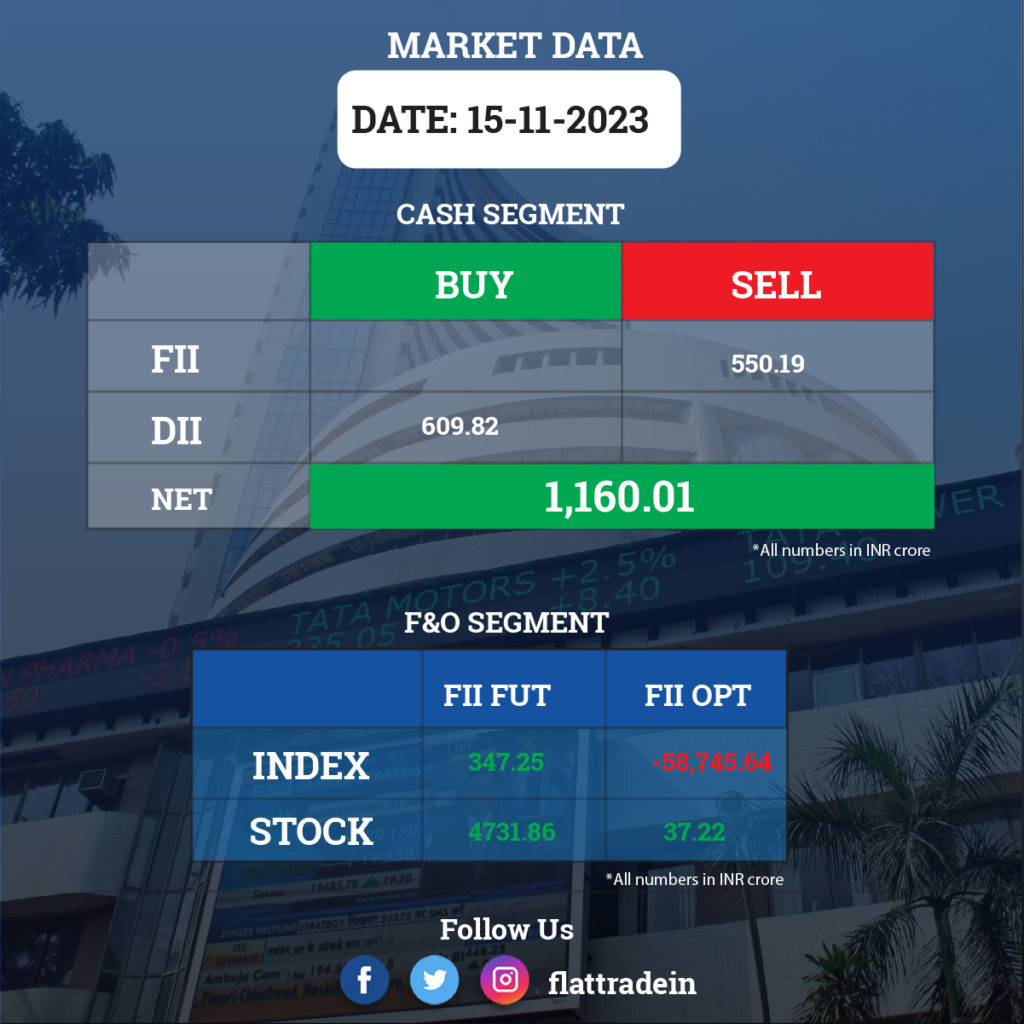

FII/DII Trading Data

Stocks in News Today

Bajaj Finance: The Reserve Bank of India (RBI) has directed the NBFC to stop sanction and disbursal of loans under its two lending products — eCOM and Insta EMI Card — with immediate effect. The action was taken by the Indian central bank due to non adherence of digital lending guidelines of the RBI, particularly, non-issuance of Key Fact Statements to the borrowers under these two lending products and the deficiencies in the Key Fact Statements issued in respect of other digital loans sanctioned by the company.

Tata Consultancy Services (TCS): The IT major’s board has approved the buyback of up to 4,09,63,855 fully paid-up equity shares of face value of Rs 1 each at Rs 4,150 per share for an aggregate amount not exceeding Rs 17,000 crore. The Company has fixed November 25, 2023, as the record date for the purpose of determining the entitlement and the names of the equity shareholders who shall be eligible to participate in the buyback, it said in an exchange filing.

Suzlon Energy: The renewable energy company said its S144 – 3 MW series of wind turbines received the RLMM (Revised List of Models & Manufacturers) listing from the Ministry of New and Renewable Energy (MNRE). The company said that considering India’s varied wind regimes and terrains, the S144 turbine is designed to make it customizable for the site‐specific requirements for higher PLFs (Plant Load Factor).

One 97 Communications (Paytm): The fintech company has announced a partnership with global travel technology company Amadeus. Under this collaboration, for the next three years, the company will integrate Amadeus’s expansive travel platform, enhancing the travellers’ experience from search to booking, and payments.

Vedanta: The mining company informed that Malco Energy Limited, a wholly owned subsidiary of the company, has incorporated a new wholly owned subsidiary in the name of ‘Vedanta Copper International VCI Company Limited’ in Saudi Arabia for copper business for SAR (saudi riyal) 1,00,000.

Dabur: The company informed that Dabur International and Dermoviva have been dismissed as defendants in federal cases, which were consolidated as a Multi-District Litigation before the United States District Court for the Northern District of Illinois, for lack of personal jurisdiction as neither Dabur nor Dermoviva manufactured, marketed, distributed or sold hair relaxer products in the US.

RateGain Travel Technologies: The software company that provides SaaS solutions for travel and hospitality opened its qualified institutions placement (QIP) issue on November 15. The floor price has been fixed at Rs 676.66 per share.

IIFL Finance: The NBFC will invest about Rs 200 crore in IIFL Samasta Finance Limited, a material subsidiary, by way of subscription to 7,47,94,315 fully paid up equity shares of face value of Rs 10 each, at a premium of Rs. 16.74 per share, through rights issue. The funds will be used for supporting growth and improving capital adequacy.

VST Tillers Tractors Ltd (VST): The farm equipment manufacturer unveiled three new tractors, including its indigenously developed electric tractor, at the Agritechnica 2023 at Hanover in Germany. VST has showcased its technological superiority by the display of these innovative machines under the FIELDTRAC brand. The three products, 929 EV, 932 DI with Stage V engine and 929 with HST Transmission were displayed at AGRITECHNICA, the 7-day exhibition that commenced on November 12, 2023.

Satin Creditcare Network: The microfinance company said the board members will meet on November 20 to consider the fund raising proposal through issuance of non-convertible debentures on private placement basis.

Bondada Engineering: The company has received work orders worth Rs 34.35 crore from Bharat Sanchar Nigam (BSNL) for providing infrastructure as a Service (IaaSP) for supply and erection of GBT, Infrastructure as a Service Provider (IaaSP) for supply installation of Infrastructure Item and subsequent O&M for five years for the cluster of Lakshadweep.