Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.07% lower at 17,863, signalling that Dalal Street was headed for a flat-to-negative start on Monday.

Shares in Asia declined after traders increased their bet on higher interest rate ahead of the key US inflation data due on Tuesday. The Nikkei 225 index fell 1.31% and the Topix dropped 0.68%. The Hang Seng was down 0.67%, while the CSI 300 index was up 0.43%.

Indian rupee ended at 82.50 against the US dollar on Friday (February 10, 2023).

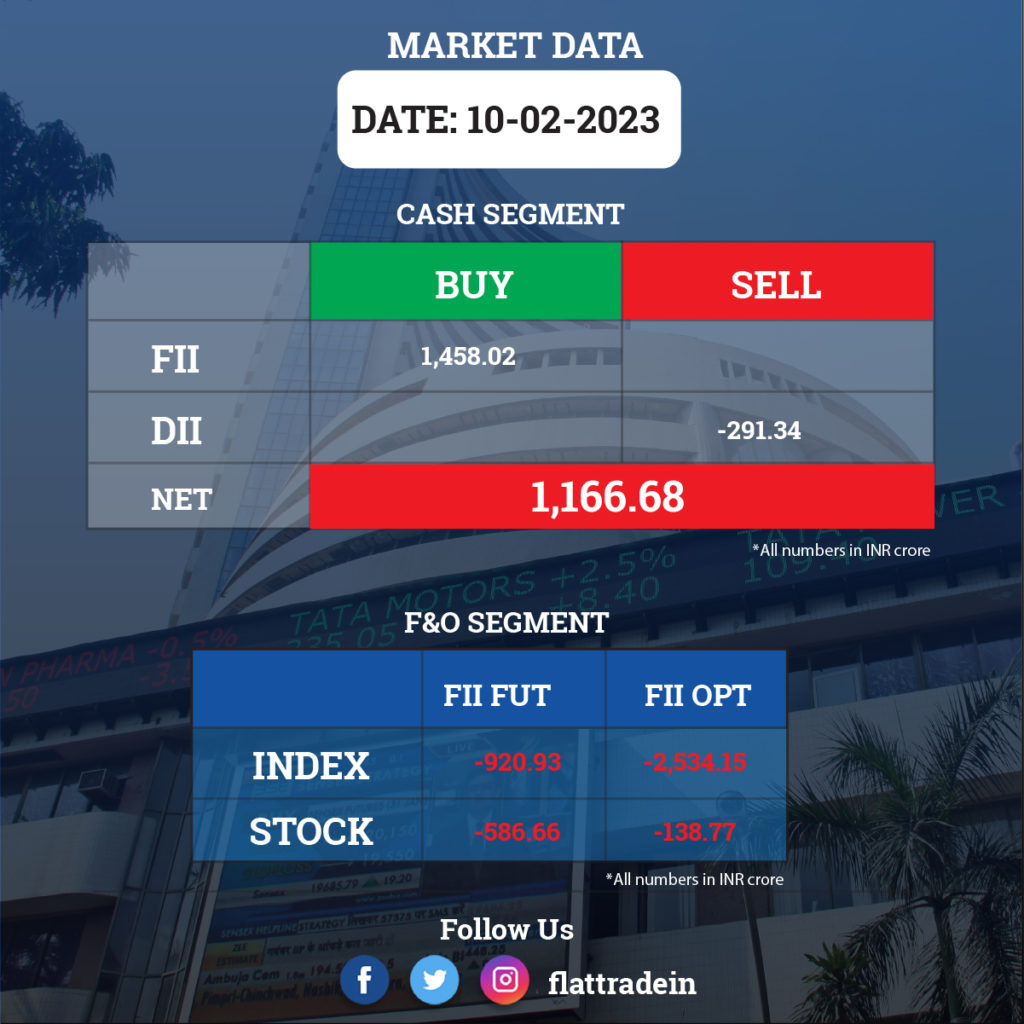

FII/DII Trading Data

Upcoming Results

SAIL, FSN E-Commerce Ventures (Nykaa), Zee Entertainment Enterprises (ZEEL), Power Finance Corporation, Sun Pharma Advanced Research Company, Shree Renuka Sugars, Wockhardt, Ahluwalia Contracts, Allcargo Logistics, Bajaj Healthcare, Bajaj Hindusthan Sugar, BF Utilities, BGR Energy Systems, Campus Activewear, Castrol India, Godrej Industries, Greenply Industries, Grindwell Norton, GR Infraprojects, Gujarat State Petronet, Gujarat Gas, GVK Power & Infrastructure, HeidelbergCement India, Hinduja Global Solutions, Hindustan Oil Exploration, Hindware Home Innovation, HUDCO, ICRA, IFCI, Insecticides (India), IRB Infrastructure Developers, Indian Railway Finance Corporation, ISGEC Heavy Engineering, ITI, IVRCL, Krsnaa Diagnostics, Landmark Cars, Liberty Shoes, Linde India, Lumax Auto Technologies, Mcnally Bharat Engineering, MMTC, The New India Assurance Company, NLC India, Schneider Electric Infrastructure, Shalimar Paints, Texmo Pipes & Products, and Zuari Industries will report their quarterly earnings.

Stocks in News Today

Adani Group: Three companies of the company have pledged additional shares for State Bank of India, according to stock exchange filings. Adani Ports and Special Economic Zone (APSEZ), Adani Transmission Ltd and Adani Green Energy pledged shares to SBICAP Trustee Company. The additional pledges are part of a $300 million letter of credit – issued by a bank to another bank as a guarantee for payments made – provided by SBI for Adani Group’s Carmichael coal mining project in Australia. As many as 75 lakh more shares of APSEZ have been pledged, taking the total to 1% of all shares with SBICAP. In the case of Adani Green, 60 lakh more shares were pledged taking the total to 1.06% and 13 lakh more shares of Adani Transmission were pledged taking the total to 0.55%, the filings showed.

Meanwhile, Moody’s Investors Service has affirmed the ratings on eight Adani Group companies, including Adani Green Energy. Moody’s has changed the outlook of four Adani Group companies—Adani Green Energy, Adani Green Energy Restricted Group, Adani Transmission Step-One, and Adani Electricity Mumbai—to “negative” from “stable”. It maintained a “stable” outlook for four others—Adani Ports and Special Economic Zone, Adani International Container Terminal, Adani Green Energy Restricted Group-2, and Adani Transmission Restricted Group 1.

Kotak Mahindra Bank: The private sector lender has entered into share purchase agreements with the shareholders of Sonata Finance, a non-banking finance company, to acquire 2.64 crore equity shares for Rs 537 crore. The deal is expected to be completed by first half of fiscal 2024.

BEML: The railway transportation company has received an order to supply of 118 units of track width mine plough (TWMP) for Arjun MBT MK-1A from HVF, Avadi. The contract value is Rs 377.98 crore and the supply of TWMP is expected to be completed by January 2026.

ABB India: The company has registered a 58% YoY growth in profit at Rs 305.91 crore for the December quarter, driven by healthy operating performance. Revenue for the quarter at Rs 2,427 crore grew by 15.5% from the year-ago period. EBITDA surged 97% YoY to Rs 364.3 crore. ABB India received orders worth Rs 2,335 crore for Q4 CY2022, growing 4 percent YoY.

PB Fintech: The Policybazaar operator posted a consolidated loss of Rs 87.3 crore in the December quarter, significantly lower from Rs 298 crore in the yar-ago period. Consolidated revenue was up 66.1% YoY at Rs 610 crore. Other income jumped 105.3% YoY to Rs 68.9 crore in the third quarter of the financial year 2022-23.

Delhivery: The logistics services provider posted a consolidated loss of Rs 195.65 crore in the December quarter, widening from a loss of Rs 126.5 crore in the year-ago period. EBITDA loss for the quarter stood at Rs 73.3 crore against a profit of Rs 54.2 crore in the corresponding period of the last fiscal. Consolidated revenue at Rs 1,823.8 crore was down 8.6% from the third quarter of the previous year.

Oil India: The state-owned oil company reported a standalone profit of Rs 1,746 crore in the December quarter, up by 1.5 percent QoQ impacted by lower other income (down 89 percent QoQ). Revenue at Rs 5,376.2 crore was up 15.8 percent. On the operating front, EBITDA surged 54.5 percent sequentially to Rs 2,855 crore with a margin expansion of 1,330 bps to 53.1 percent. The company also announced an interim dividend of Rs 10 a share.

Hitachi India: The company, which is part of the Japanese conglomerate Hitachi, plans to contribute $20 billion in the overall consolidated global revenue for the parent company by 2030 with a ‘higher double-digit profit’, said Managing Director Bharat Kaushal. By 2030, Hitachi India aims to occupy an “influential position” across rail, energy, and digital, automotive businesses of the group, he added.

Shriram Finance (SFL): The company has raised its workforce by 10% this financial year, hiring 3,536 people in the third quarter, driven by strong business growth. In the current (January-March) quarter too, SFL is planning to add around 1,000 employees. The company’s staff strength stood at 60,918 in December 2022. The expansion has also been triggered by the additional staff requirement after the completion of the merger of Shriram Transport Finance Company and Shriram City Union Finance.