Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.10% higher at 19,639, signalling that Dalal Street was headed for muted start on Monday.

Most Asian shares were trading lower as investor sentiments were dented by lower-than-expected Chinese economic growth. Gross domestic product of China expanded by 6.3% in the second quarter from the year-ago period, which was lower than analysts’ estimates. The CSI 300 index was trading 0.96% lower and the Shanghai Composite index was down by 1.1%.

Indian rupee fell by 8 paise to 82.16 against the US dollar on Friday.

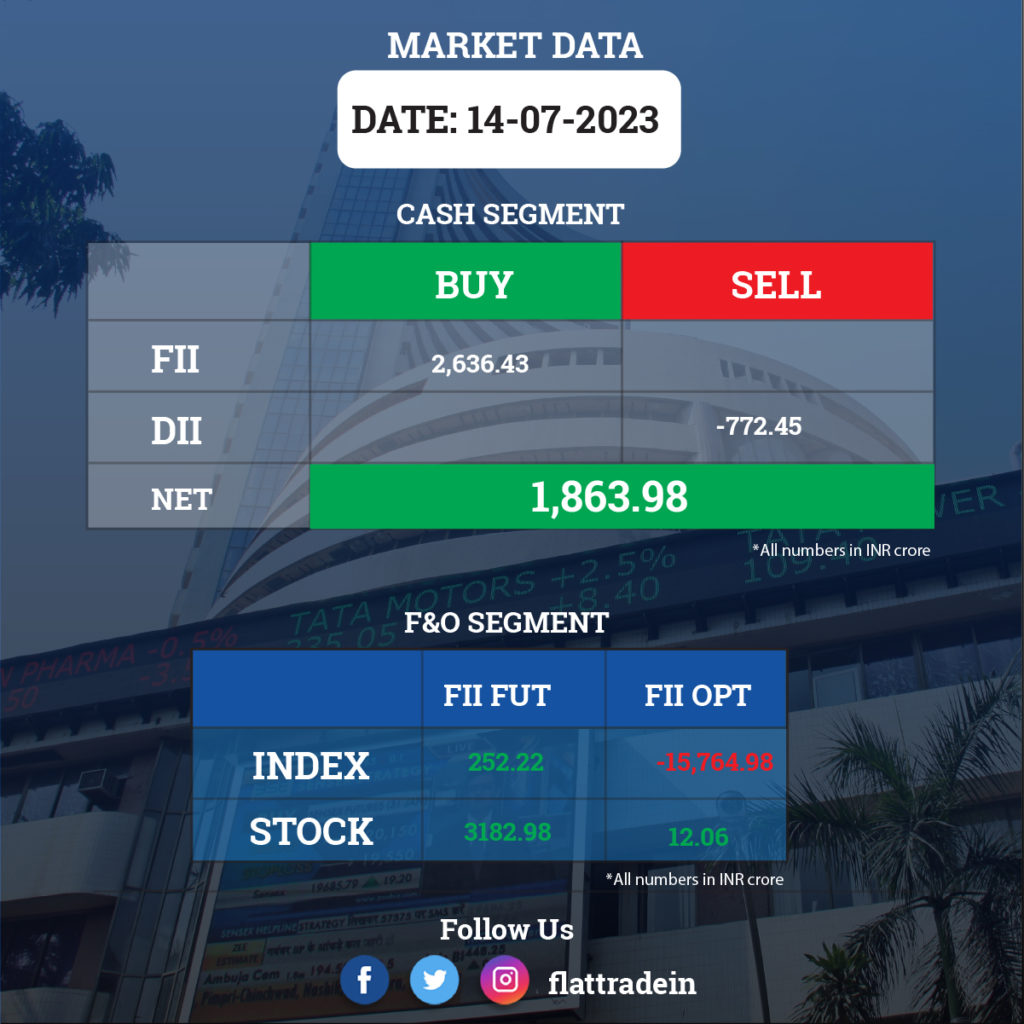

FII/DII Trading Data

Upcoming Results

HDFC Bank, LTIMindtree, Tata Elxsi, Tinplate Company of India, Central Bank of India, CRISIL, Hathway Cable & Datacom, Huhtamaki India, Onward Technologies, Seacoast Shipping Services, and Tarapur Transformers will report their quarterly earnings today.

Stocks in News Today

HDFC Bank: The lender has allotted 3,11,03,96,492 new equity shares of Rs 1 each of HDFC Bank according to the share exchange ratio of 42 shares of HDFC Bank for every 25 shares of HDFC Ltd. The bank’s paid-up share capital will increase from Rs. 559.17 crore to Rs. 753.75 crore post cancellation of promoter holding of 116.46 crore equity shares. HDFC Bank is a now publicly held company following the merger with no clear promoter.

State Bank of India (SBI): The lender has raised MCLR by 5 bps across tenors. The hike is effective from July 15. The Central Government nominated Ajay Kumar, Executive Director, Reserve Bank of India as director on the Central Board of State Bank of India with immediate effect and until further orders.

JSW Energy: The utilities company recorded a consolidated profit of Rs 290 crore for the June quarter of FY24, declining 48.3% year-on-year, dented by higher finance cost. Revenue from operations fell 3.25% YoY to Rs 2,928 crore, as incremental revenue from Mytrah and renewable capacity additions were offset by lower realisation in thermal assets on account of a decline in coal prices. Ebitda up 19.57% to Rs 1222.08 crore int he reported quarter as against Rs 1022 crore in the year-ago period.

Mahindra and Mahindra: The automobile company signed an MoU with NXP Semiconductors, a world leader in secure connectivity solutions for embedded applications. They will jointly explore the electric and connected vehicle landscape, covering a range of vehicles including utility vehicles, light commercial vehicles, farm equipment, and tractors.

Nestle India: The food processing company has received Odisha state government’s approval to set up food processing unit at Mundaamba, Khordha district. It plans to invest about Rs 894.10 crore in the state.

Bandhan Bank: The Kolkata-based private sector lender reported June quarter profit at Rs 721 crore, down 18.7% year-on-year on lower net interest income and pre-provision operating profit. Provisions and contingencies, however, were down 6.3% YoY. Net interest income dropped 0.9% YoY to Rs 2,491 crore during the quarter, with net interest margin declining 70 basis points (bps) to 7.3% in the same period. Net NPA stood at 2.18% in the reportd quarter as against 1.17% in the preceding quarter.

Avenue Supermarts (D-Mart): The company reported a 2.3% year-on-year growth in standalone profit at Rs 695.4 crore for the June quarter, impacted by lower operating margin. Revenue for the quarter at Rs 11,584.4 crore grew sharply by 18.1% over a year-ago period.

Suzlon Energy: The renewable energy solutions provider has secured an order for the development of a 100.8 MW wind power project for Everrenew Energy. Suzlon will install 48 wind turbine generators (WTGs) of their S120 – 2.1 MW with a hybrid lattice tubular tower at Velliyanani Phase II in Karur district and Vengaimandalam in Trichy in Tamil Nadu. The project is expected to be commissioned in March 2024.

Punjab National Bank: Uma Sankar has been nominated as a director on the Board of the Bank with immediate effect and until further orders, in place of Anil Kumar Misra.

Ircon International: The company has commissioned the first phase upgradation work of railway line from Maho to Omanthai Track Rehabilitation Project from Sri Lanka Railways.

JK Lakshmi Cement: The company has made an additional investment in subsidiary company through equity subscription by rights issue. The unit, Udaipur Cement Works Ltd., has allotted 19.45 crore equity shares at a premium of Rs 14 per equity share leading to a total consideration of Rs 350.12 crore. JK Lakshmi Cement’s holding is increased from 72.54% to 75%.

Just Dial: India’s local search engine company reported a profit of Rs 83.4 crore in June quarter of FY24 against a loss of Rs 48.4 crore in the same period last year, backed by healthy operating performance and topline. Revenue from operations grew by 33.1% YoY to Rs 247 crore during the quarter, with traffic rising 15.9% YoY to 171.4 million users and mobile traffic increasing 17.5%.

Devyani International: The NCLT has approved the merger scheme of units Devyani Food Street Private and Devyani Airport Services (Mumbai) with Devyani International.

Som Distilleries and Breweries: The company will consider and approve, on Aug. 5, to issue of up to 2.5 lakh equity shares on a preferential and private placement basis to an identified non-promoter entity

Archean Chemical Industries: The company’s Managing Director and Promoter Ranjit Pendurthi has acquired 16.08 lakh equity shares comprising 1.31 % of the paid-up share capital of the company. Post acquisition, total shareholding of the managing director is 22.97 % of the paid-up share capital of the company.

GTPL Hathway: The company said its consolidated revenue was up 23% YoY at Rs 774 crore in Q1FY24 as agianst Rs 631 crore in Q1FY23. EBITDA fell 1% at Rs 119.65 crore in Q1FY24 as against Rs 120.83 crore in Q1FY23. EBITDA margin fell 15.5% in Q1FY24 from 19% in the year-ago period. Net profit dropped 27% to Rs 35.19 crore in Q1FY24 from Rs 48.21 crore in Q1FY23.

VST Industries: The company’s consolidated revenue rose 7.5% YoY to Rs 333 crore in Q1FY24 from Rs 310 crore in the corresponding period last fiscal. EBITDA fell 14% YoY to Rs 105.35 crore om Q1FY24 from Rs 121.93 crore in the year-ago period. Net profit was down 4% at Rs 83.7 crore in the reported quarter compared to Rs 87.14 crore int he year-ago period.