Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.1% lower at 19,651, signalling that Dalal Street was headed for flat-to-negative start on Wednesday.

Asian markets were mixed with the Chinese market trading lower as weak economic data weighed on its markets, while Japanese markets were trading higher as weaker yen against the US dollar pushed the market higher. The CSI 300 fell 0.68% and the Hang Seng dropped 0.55%. The Nikkei 225 index rose 0.68% and the Topix jumped 0.65%.

The Indian rupee plunged by 29 paise to 83.04 against the US dollar on Tuesday.

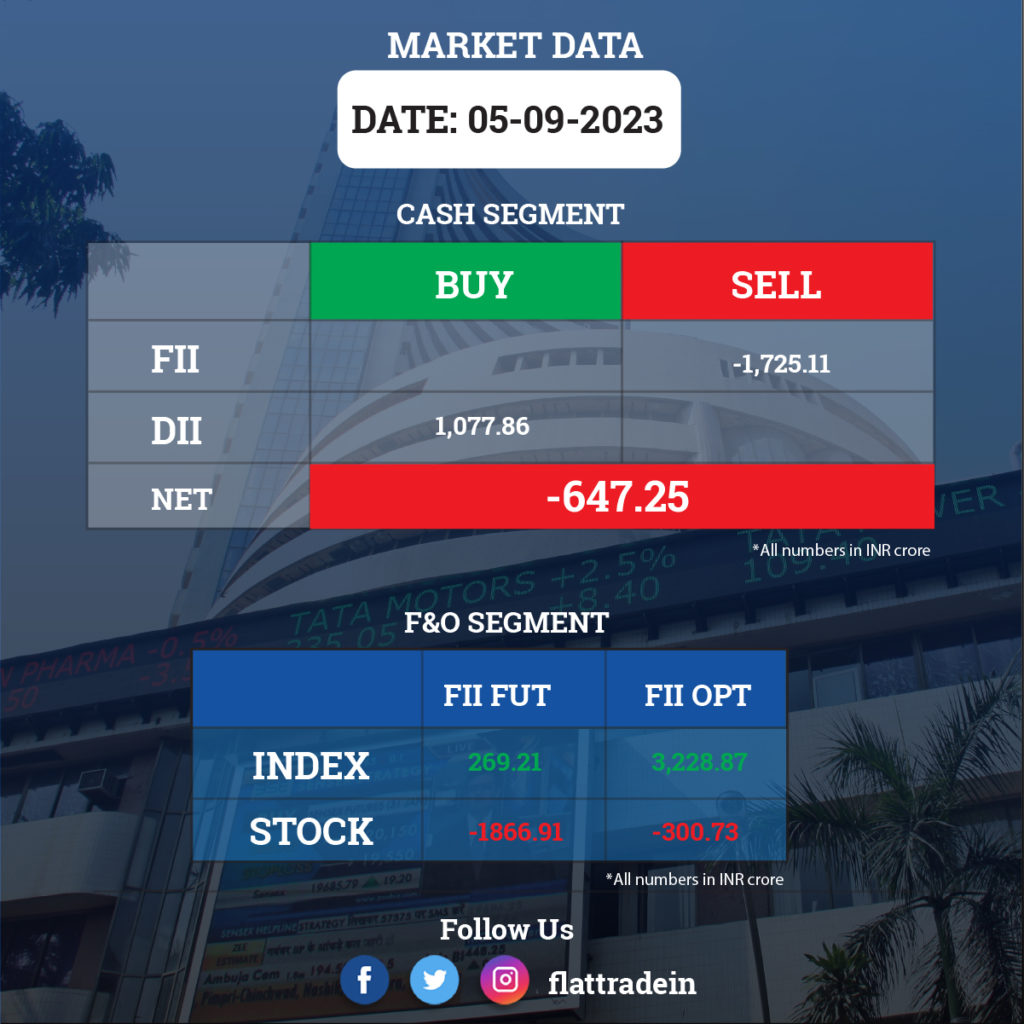

FII/DII Trading Data

Stocks in News Today

Jio Financial Services: The company will be removed from the NSE indices including the Nifty50 from September 7, as the stock has not hit price band on two consecutive trading days on September 4 and September 5 at NSE. If Jio Financial Services hits the price band on September 6, the exclusion shall not be deferred further, the exchange said. The stock will also be removed from Nifty 100, Nifty 200, Nifty 500, Nifty Energy, Nifty India Manufacturing and 13 other indices.

Vedanta: The Zambian government has agreed to return ownership of Konkola Copper Mines to billionaire Anil Agarwal-owned Vedanta Resources. Konkola Copper Mines assets have reserves of 16 million tonnes of copper.

Power Grid Corporation of India: The state-run electric services company has won the inter-state transmission system project on build, own, operate and transfer (BOOT) basis in Rajasthan. It will build the transmission system for evacuation of power from REZ in Rajasthan (20 GW) under Phase-III Part H.

NBCC (India): The state-owned construction company has signed an MoU with Kerala State Housing Board, for development of 17.9 acres land parcel belonging to the board in Kochi. The value of the project is about Rs 2,000 crore.

Shriram Finance: The company approved and allotted senior, secured, rated, listed, redeemable, and taxable nonconvertible debentures (NCD) on a private placement basis for an issue size of Rs 75 crore plus a greenshoe option of Rs 150 crore.

IDBI Bank, Zee Entertainment: IDBI Bank has filed an appeal against the NCLT order which approved the merger of Zee Entertainment Enterprise Ltd (ZEEL) with Culver Max Entertainment, formerly known as Sony Pictures Networks India. In August, the Mumbai bench of the National Company Law Tribunal (NCLT) approved the proposed merger.

GAIL India: The Central Bureau of Investigation has arrested KB Singh, Executive Director (ER & Projects), and a chief general manager of the company along with three others in an alleged bribery case of Rs 50 lakh in which favours were granted to a Vadodara-based company in the contract for two pipeline projects, PTI reported.

Union Bank of India, Bank of Baroda: Indian Renewable Energy Development Agency (IREDA) has signed Memorandums of Understanding (MoUs) with the two state-owned lenders to co-finance renewable energy projects, including both established and emerging RE technologies.

HDFC Asset Management Company: Amaresh Jena has resigned as Head of Marketing of the asset management company due to unavoidable personal reasons, with effect from September 8.

Nila Infrastructures: The company has received work for construction of 1,694 residential flats in Wadaj, Ahmedabad, from Shree Infracon. The construction work is expected to be executed within 18 months.

GTL Infrastructure: The company’s board has appointed Sunali Chaudhry as an additional director of the company with effect from September 5, subject to approval of the company’s shareholders.

Federal Bank: The bank’s board has approved the appointment of Elias George as an Additional Director (Independent), for period of five years with effect from September 5.

Bikaji Foods International: Lighthouse India Fund III has sold 32.42 lakh equity shares (1.3% stake) in the company, through open market transactions at an average price of Rs 480 per share, while Plutus Wealth Management LLP has bought 13.5 lakh shares in the company at an average price of Rs 480.11 per share. As on June 30, Lighthouse India held 2.7% in Bikaji Foods.