Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.34% lower at 17,755.50, signalling that Dalal Street was headed for a negative start on Friday.

Asian shares fell, tracking losses in the US market on Thursday, over hawkish comments from Federal Reserve officials and rising geopolitical tensions. Japan’s Nikkei 225 index tanked 1.82% and Topix dropped 1.58%. China’s CSI 300 index was down 0.44% and Hang Seng fell 0.43%.

Indian rupee closed 3 paise higher to 81.86 against the US dollar on Thursday.

The RBI’s Monetary Policy Committee will announce the monetary policy decision today at 10:00 a.m. The Reserve Bank of India (RBI) is expected to raise interest rate for the fourth time in a row to tame inflation and improve foreign capital inflow.

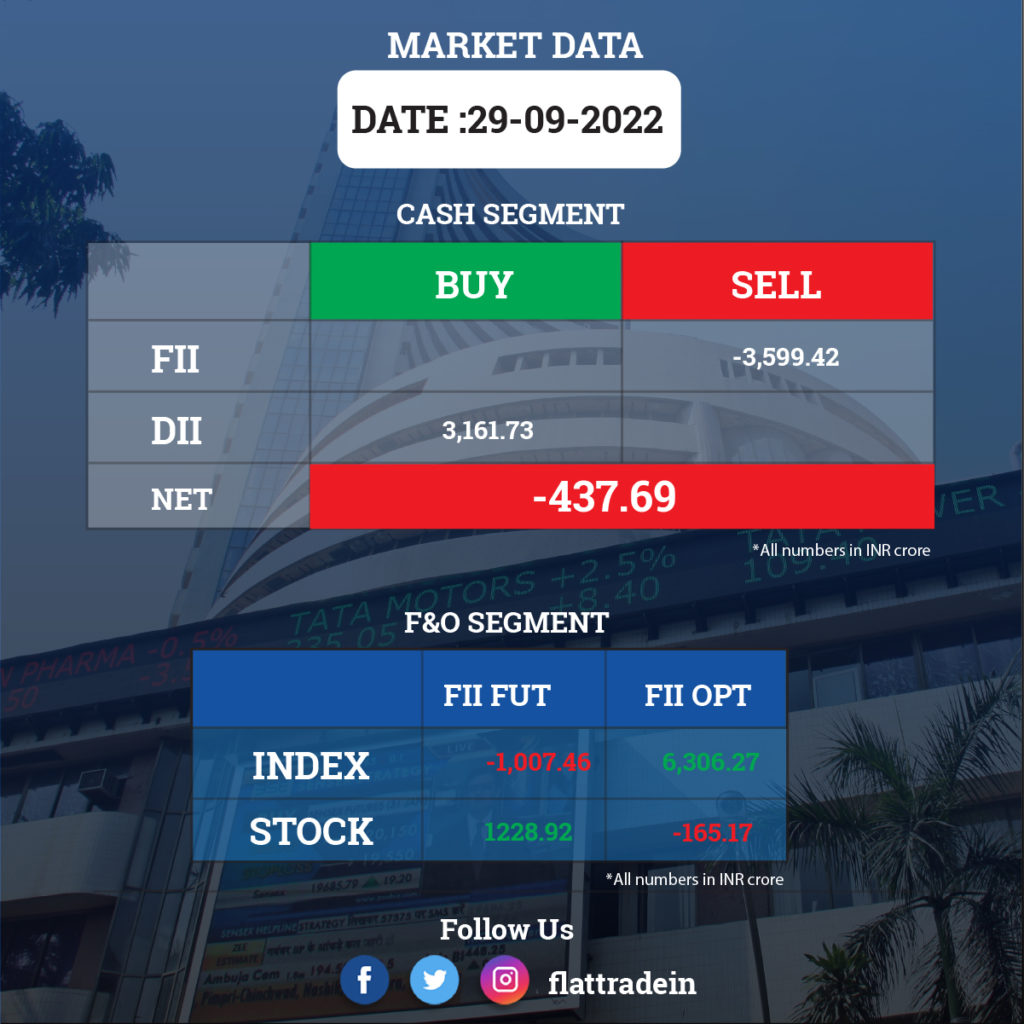

FII/DII Trading Data

Stocks in News Today

Reliance Retail: The retail arm of Reliance Industries launched a premium fashion and lifestyle store brand AZORTE in Bengaluru as it aims to make a mark in the luxury market segment. The size of the store is around 18,000 square feet and it will compete with the likes of Mango and Zara. The store will cater to millenials and Gen-Z, according to Akhilesh Prasad, CEO of fashion and lifestyle at Reliance Retail.

IndiGo: The airline announced the induction of its first freighter aircraft converted from a passenger plane. The induction of A321 P2F (passenger to freighter) will help the airline offer cargo services on both domestic and international routes, IndiGo said.

The aircraft will be able to service markets between China in the east and the Gulf in the west, as well as the Commonwealth of Independent States , the airline said. IndiGo also said it will be utilising the same pool of pilots and engineers that fly and service its current fleet for the cargo plane.

Hero MotoCorp: The company said it will invest about Rs 490 crore in US-based Zero Motorcycles to jointly develop electric motorcycles. The country’s largest two-wheeler maker said it is finalising a collaboration agreement with the California (US)-based manufacturer of premium electric motorcycles and powertrains.

Adani Power: The Competition Commission of India (CCI) has approved the acquisition of 100% equity of Diliigent Power and DB Power by Adani Power. DB Power operates a coal-based thermal power plant with an installed capacity of 1,200 MW per hour in Chhattisgarh and Diliigent Power is primarily engaged in the activities of a holding company.

Adani Ports and Special Economic Zone (APSEZ): The company said that it has incorporated a wholly-owned subsidiary Adani Aviation Fuels Limited (AAFL) to carry on the business of sourcing, transporting, supplying and trading of aviation related fuels.

The subsidiary was incorporated with an initial authorized share capital of Rs 5,00,000 and paid-up share capital of Rs 5,00,000 each to, interalia, carry on business of sourcing, transporting, supplying & trading of Aviation related fuels, constructing, developing, managing, maintaining, building, equip, hiring of infrastructure related to the business within and outside India.

Indian Oil Corp: The oil refiner has set up a subsidiary to pool funds of its overseas units in order to meet capital and trade finance needs, according to its exchange filing. The new subsidiary, Finance Company, will have its office in International Financial Services Centre (IFSC) at Gujarat International Finance Tec-City (Gift City). Companies based in GIFT City get a 100% income tax exemption for 10 years.

The company plans to carry out activities like fund pooling of foreign companies and utilize it for carrying out trade financing for IndianOil and group companies. It also plans to carry out Global Treasury Operations and utilize IFSC to raise capital and debt from overseas market.

Lupin: The pharma company has received approval from the US drug regulator for its abbreviated new drug application (ANDA), Mirabegron extended-release tablets, to market in the US. Mirabegron, which is used for treatment of certain bladder problem, is a generic equivalent of Myrbetriq extended-release tablets of Astellas Pharma Global Development. The product will be manufactured at Lupin’s facility in Nagpur, India. The drug had an estimated annual sales of $2403 million in the US as per IQVIA MAT data by June 2022.

In other news, the company launched Sildenafil for Oral Suspension, which is used for the treatment of pulmonary arterial hypertension in the US market.

Coforge: The company said it has received a US patent for its Copasys automated compliance audit and quality assurance platform. The platform helps banks and financial institutions manage their risk more effectively and improve upon business processes, according to its exchange filing.

Bajaj Electricals: The company has bagged an order worth Rs 332.6 cr from Power Grid and the order is for supply of goods and services under a transmission line project from Power Grid.

Zydus Lifesciences: The USFDA has issued 2 observations for Zydus Animal Health & Investments, Ahmedabad unit and the observations were not related to data integrity. The drug regulator had conducted an inspection at the facility from Sep 23 to Sep 29.

Life Insurance Corporation and Deepak Nitrate: LIC announced buying of additional stake in speciality chemicals maker Deepak Nitrite to take LIC’s overall shareholding in the company to over 5%. LIC increased its stake from 4.977% to 5.028% of the paid up capital of Deepak Nitrate, LIC said in a regulatory filing. The shares were bought at an average cost of Rs 2074.49 per piece.

Punjab National Bank: The public sector bank has decided to sell its entire stake in Asset Reconstruction Company (ARCIL) at an agreed price. Currently, its shareholding in ARCIL is 10.01%.

Arvind SmartSpaces: The company’s board of directors have approved the consolidation of the partnership interest of the company in Ahmedabad East Infrastructure (AEI) from 51.43% to 55.24% and profit sharing in AEI from 94% to 98% through acquisition of entire partnership interest of Arvind Infrabuild. The cost of the acquisition is Rs 7.1 crore and the transaction is expected to be completed within 30 days from the day of execution of the LLP agreement.

Rail Vikas Nigam: The company has received contract for construction of 4 lane highway from Samarlakota to Achampeta Junction, from National Highways Authority of India (NHAI). The contract is a part of Kakinada port to NH – 16 connectivity in Andhra Pradesh under Bharatmala Pariyojana on EPC mode at a cost of Rs 408 crore.

Bhageria Industries: The company said it has entered in a Share Purchase Agreement for sale of 100% equity shares held in subsidiary Bhageria Exim Private Limited, for Rs 1 lakh. After the stake sale, Bhageria Exim will cease to be the wholly owned subsidiary of the company.