Market Opening - An Overview

GIFT Nifty on the NSE IX traded 0.04% lower at 19,392, hinting at a flat start for Indian benchmark indices on Tuesday.

Asian shares were trading higher, tracking gains in Wall Street overnight as technology-related stocks advanced. The Nikkei 225 index rose 0.67%, Topix gained 0.73%, the Hang Seng climbed 0.62% and the CSI 30 index was up 0.13%.

The Indian rupee closed at 83.10 against the US dollar on Monday.

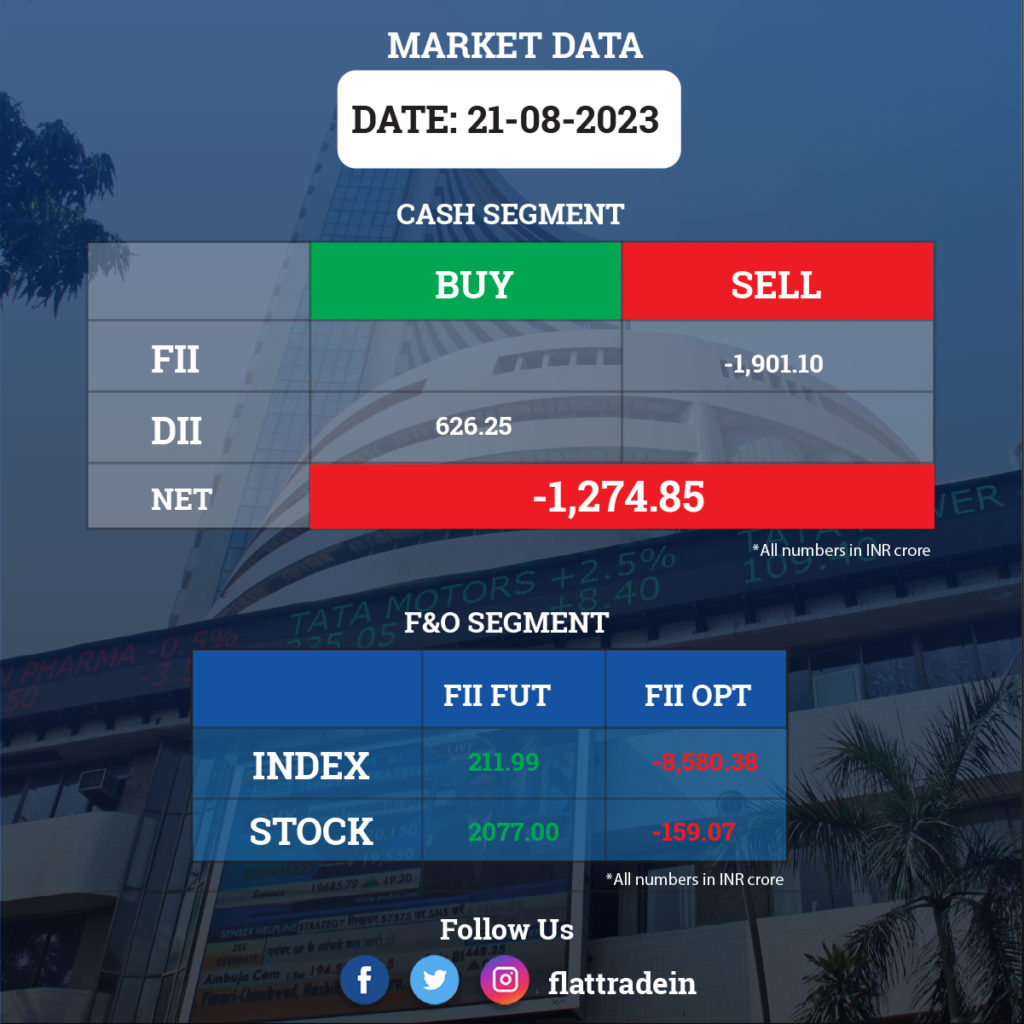

FII/DII Trading Data

Stocks in News Today

Tata Power: The company’s subsidiary, Tata Power Renewable Energy, has signed a power purchase agreement (PPA) for 9MWp on campus solar plant with Tata Motors’ Pantnagar plant in Uttarakhand. This solar plant will be the largest on campus solar facility in Uttarakhand. The project will be commissioned within 6 months from the PPA execution date.

Union Bank of India: The public sector lender has received approval from the board of directors for the raising of funds up to Rs 5,000 crore via qualified institutions placement (QIP) of equity shares. The QIP issue opened on August 21. The floor price has been fixed at Rs 91.10 per equity share for the issue.

Adani Enterprises: Promoter entity Kempas Trade & Investment has acquired 2.53 crore equity shares or 2.22% stake in the Adani Group company via open market transactions between August 7 adn August 18. With this transaction, its shareholding in Adani Enterprises increased to 69.87%, from 67.65% earlier.

Welspun Enterprises: The infrastructure development arm of Welspun World completed the acquisition of 50.10% stake in Michigan Engineers (MEPL), a trenchless technology-based EPC company in the urban water infrastructure segment, from the existing shareholders for Rs 137.07 crore. With the completion of the transaction, MEPL is now a subsidiary of Welspun Enterprises and enables company’s expansion into the promising water and tunnelling solutions segment in India.

Sanghi Industries: Ambuja Cements has made an open offer to acquire a 26% stake for Rs 767.16 crore. The offer opens on Sept. 29 and closes on Oct. 13.

Lemon Tree Hotels: The hospitality company has signed license agreements for two properties in Bhubaneswar (Odisha) and Kasauli (Himachal Pradesh) under the brand Lemon Tree Hotel and Lemon Tree Mountain Resort, respectively. The hotels in Bhubaneswar and Kausali are expected to be operational by Q4FY25 and Q3FY26, respectively.

Brigade Enterprises: The Bengaluru-based real estate developer has entered into a sale deed for acquiring 6.54 acres of land parcel in Chennai in which a residential project will be developed.

BLS International: The company’s subsidiary BLS International FZE is in process to subscribe 100% share capital of Saudi Arabia-based BLS International Travel & Tourism.

RITES: The company signed an MoU with NHPC to collaborate on comprehensive consultancy services for rail infrastructure facilities for NHPC’s hydropower projects in Arunachal Pradesh.

Rail Vikas Nigam: The company incorporated a wholly-owned subsidiary Masakani Paradeep Road Vikas.

Eris Lifesciences: The pharma company has entered into term loan agreement to avail the rupee term loan facility worth Rs 120.82 crore from Citi Bank NA.

Glenmark Pharma: The company has reached an antitrust settlement with the US Department of Justice, Antitrust Division (DOJ) subject to a $30 million fine with regard to historical pricing practices of Pravastatin drug. It has entered into a three-year Deferred Prosecution Agreement and if the company adheres to the terms of the agreement, the DOJ will dismiss the pending superseding indictement.