Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.10% lower at 17,862, signalling that Dalal Street was headed for negative start on Thursday.

Most Asian shares were trading lower tracking Wall Street overnight after minutes from the US Federal Reserve meeting showed that its economists had projected a mild recession. The Nikkei 225 index rose 0.04% and Topix fell 0.07%. The Hang Seng dropped 0.75% and the CSI 300 index fell 0.48%.

Indian rupee rose 5 paise to 82.08 against the US dollar.

India’s consumer price index-based (CPI) inflation eased to 5.66% in March, as per data released by the National Statistics Office (NSO). The data showed rural inflation stood at 5.51%, while urban inflation was higher at 5.89%. Meanwhile, the Consumer Food Price Index fell to 4.79% in March, compared to 5.95% in February.

Meanwhile, the US Labor Department data showed headline inflation rising 5% on a year-over-year basis in March. The core measure, which excludes volatile food and energy prices, climbed 5.6%, in line with consensus estimates.

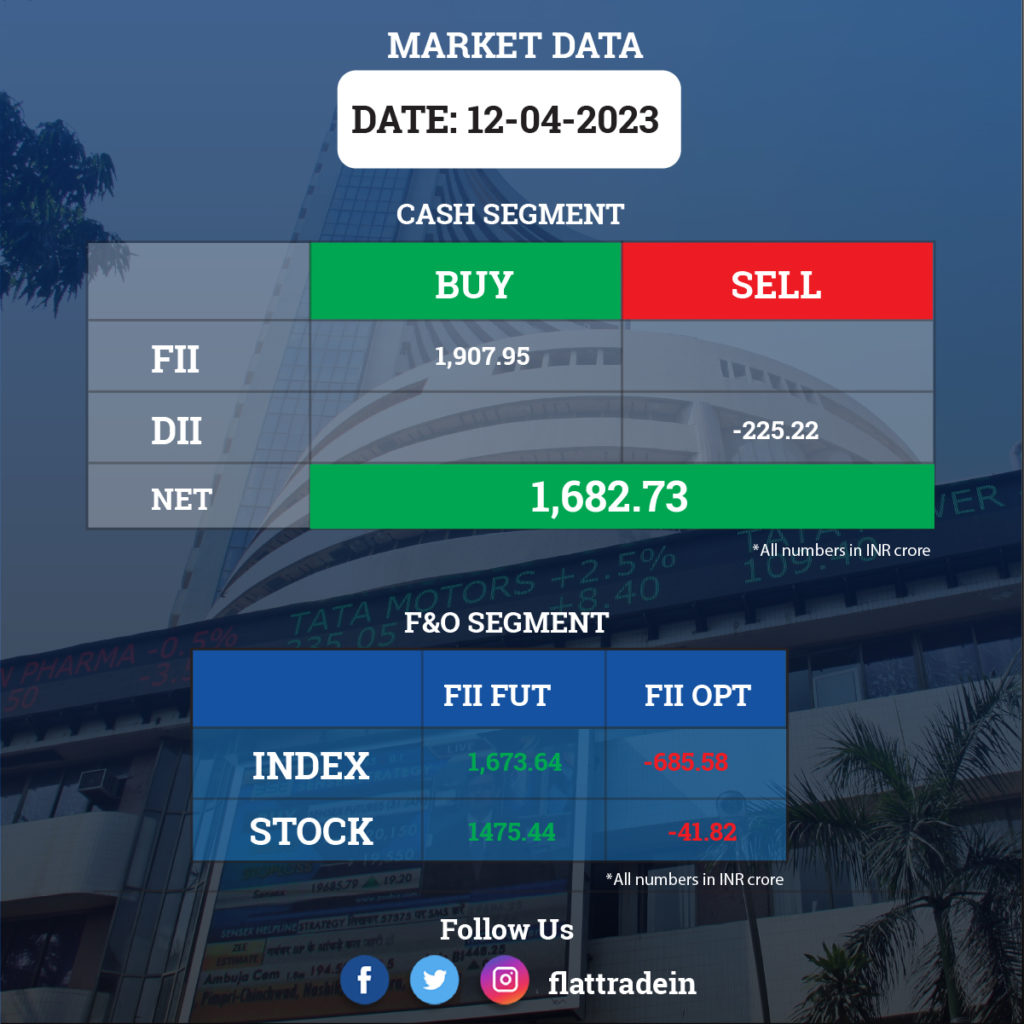

FII/DII Trading Data

Upcoming Results

Infosys, Amalgamated Electricity, Avantel, Roselabs Finance, and Thirdwave Financial Intermediaries will report their quarterly results.

Stocks in News Today

Tata Consultancy Services (TCS): The country’s largest IT services exporter has reported lower than expected earnings for March FY23 quarter with consolidated profit growing 5% sequentially to Rs 11,392 crore led by other income. Consolidated revenue grew by 1.6% QoQ to Rs 59,162 crore with revenue in dollar terms rising 1.7% to $7,195 million. Consolidated EBIT rose 1.4% to Rs 14,488 crore with margin flat at 24.5% for the quarter. The company has announced a final dividend of Rs 24 per share. Meanwhile, the company’s board has appointed K Krithivasan as MD and CEO of the company with effect from June 1, 2023 after the resignation of Rajesh Gopinathan.

HDFC Bank: The country’s largest private sector lender has signed a Master Inter Bank Credit Agreement with Export Import Bank of Korea for a $300 million line of credit. The pact was signed at GIFT City, Gujarat. This will help HDFC Bank raise foreign currency funds which it would extend to Korea-related businesses.

NTPC: The company will issue non-convertible debentures worth Rs 3,000 crore on April 17 on private placement basis with a coupon of 7.35% for a tenor of three years. The funds will be used towards capital expenditure, financing existing loans and other general purposes.

Maruti Suzuki India, IDFC First Bank: Maruti Suzuki India has signed a Memorandum of Understanding (MoU) with IDFC First Bank, wherein the bank will offer personalised finance options for new car loans, pre-owned car loans, and commercial vehicle loans while purchasing Maruti Suzuki vehicles.

Anand Rathi Wealth: The wealth solution firm has recorded a 23.4% year-on-year growth in consolidated profit at Rs 42.7 crore for the quarter ended March FY23. Consolidated revenue grew by 27% to Rs 143 crore in the same period. For FY23, profit increased by 33% to Rs 168.6 crore and net revenue grew by 31% to Rs 549 crore compared to the previous year.

Rail Vikas Nigam: The company received an order from North Western Railway worth Rs 63.08 crore for provision of automatic block signalling on Madar-Sakhun section of Jaipur Division. The order will be executed within nine months.

RITES: The state-owned company has received an order worth Rs 72 crore from Kerala Infrastructure Investment Fund Board. It will provide project management consultancy work to KIIFB.

AU Small Finance Bank: The Reserve Bank of India has approved the reappointment of Sanjay Agarwal as Managing Director and CEO, and Uttam Tibrewal as Whole Time Director of AU Small Finance Bank. Both are reappointed for three years with effect from April 19.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 141 crore from National High Speed Rail Corporation for the construction of training institute buildings at Vadodara. The total order book as on date stands at Rs 2,522 crore.

Bharat Heavy Electricals: The company signed an MoU with Nuclear Power Corporation of India to jointly pursue business opportunities around nuclear power plants based on pressurised heavy water reactor technology.

Campus Activewear: The company acquired land and building from Marico Industries in Ponta Sahib, Himachal Pradesh for a cash consideration of Rs 16.7 crore. The company will use this land parcel to expand its existing capacity for manufacturing of semi-finished goods and assembly of footwear.

HDFC: Securities and Exchange Board of India has approved change in control of the company’s subsidiary HDFC Capital Advisors under a composite scheme of amalgamation.

SRF: On April 12, the company commissioned and capitalised a project to create a pharma intermediates plant at Dahej for undertaking precursor processes for production of pharma products at a cost of Rs 223 crore.

Karnataka Bank: The Reserve Bank of India approved appointment of Sekhar Rao as interim managing director of the company for three months, effective April 15.

Torrent Power: The company said it has bagged a contract to supply 920 MW gas based electricity from its DGEN and SUGEN plants under a tender of NTPC Vidyut Vyapar Nigal Ltd (NVVN). The ministry of power had designated NVVN as the nodal agency for procurement of up to 4,000 MW power from gas-based plants during identified crunch period (April 10, 2023 to May 16, 2023, with actual offtake for 21 days).

Vardhman Special Steels: The board, at its meeting held on April 12, has approved the issue of bonus shares in the ratio of 1:1, i.e. issuance of one equity share for every one equity share already held in the company.

Vikas Lifecare: The company’s subsidiary, Genesis Gas Solutions, has received first-ever order for Ultrasonic Gas Meters valued at Rs 3 crore.