Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.12% lower at 19,389, signalling that Dalal Street was headed for negative start on Thursday.

Asian shares were trading lower as investor optimism was dented due to fears of slowing growth in China and possible further interest rate hikes by the Fed. The Nikkei 225 index tanked 1.46% and the Topix was down 0.94%. The CSI 300 index fell 0.22% and the Shanghai Composite index slipped 0.12% and the Hang Seng dropped 0.41%.

The Indian rupee fell 10 paise to 82.95 against the US dollar on Wednesday.

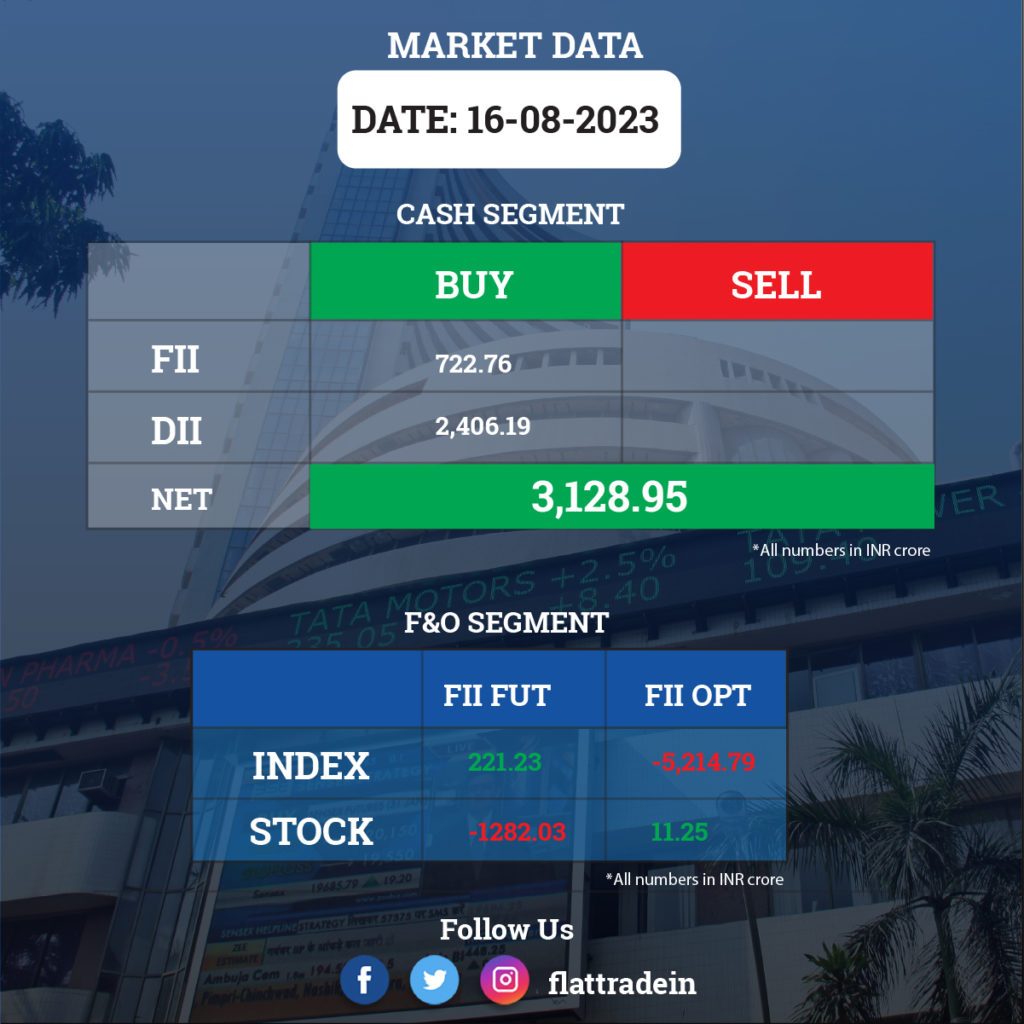

FII/DII Trading Data

Stocks in News Today

Adani Power: Investment firm GQG Partners and other investors bought about 8.1% stake in Adani Power for over Rs 9,000 crore ($1.1 billion). They bought 31.2 crore shares of Adani Power in a block deal as promoter, Adani family, which held 74.97% in the firm, sold 31.2 crore or an 8.1% stake at an average price of Rs 279.17 per share.

Aurobindo Pharma: The pharma company is going to launch HIV triple combination product for children living with HIV in low- and middle-income countries under a voluntary licence from ViiV Healthcare. This is the first generic to get USFDA tentative approval for a dispersible tablet formulation of the fixed-dose combination of abacavir, dolutegravir and lamivudine.

One 97 Communications (Paytm): Chinese e-commerce major Alibaba Group firm Antfin has offloaded 6.53 crore equity shares or a 10.3% stake in the payment app Paytm operator, in an off-market transactions. As a result, Antfin’s stake in Paytm has been reduced to 13.49% from 23.79%. Founder and CEO Vijay Shekhar Sharma was the buyer in the off-market transaction.

Power Grid Corporation of India: The state-owned utility company has successfully commissioned assets under the North Eastern Region Strengthening Scheme-VI. The company had received notification for the commercial operation on August 16.

JSW Energy: According to the block deal data from BSE, JSW Investments offloaded 2.10 crore shares or 1.27% stake in JSW Energy, for Rs 717 crore via open market transactions. Investment firms such as GQG Partners, Washington State Investment Board, AustralianSuper, Reliance Trust Institutional Retirement Trust Series Twelve among others were the buyers.

Lupin: The drugmaker announced the launch of ‘Jeet’, its patient support program dedicated to heart-health. It also launched Tiotropium Dry Powder for inhaler for the treatment of chronic obstructive pulmonary disease in the U.S.

Cipla: The company has received an order of suspension of FDA license issued to its manufacturing unit in Maharashtra for a period of 10 days in December due to non-conformance of good manufacturing practices. The company is in the process of appealing the order to the state government.

Ujjivan Financial Services: NewQuest Asia Investments II has reduced its equity stake in the financial services company to 2.7% on August 14, from 5.17% earlier. The foreign investor sold its 2.47% stake via block deals on August 14.

Essar Shipping: The company has received board approval for disinvestment in overseas direct investments (ODI) and sale of shares of wholly owned subsidiary companies – Energy II Limited (Bermuda), Essar Shipping DMCC (Dubai), and OGD Services Holdings Limited (Mauritius). With this sale of shares, the three companies will cease to be the subsidiaries of Essar Shipping.

RPSG Ventures: Investor Porinju Veliyath-owned Equity Intelligence India & EQ India Fund have sold a 0.71% stake in RPSG Ventures through an open market transactions on August 11. As a result, their shareholding in the company has reduced to 2.08% from 2.79%.

Nava: The company has suspended silico manganese production at its Odisha plant after failure of raw material feeding infrastructure.

Skipper: The power T&D structure manufacturer has received board approval for the issuance of equity shares worth Rs 200 crore via Rights Issue to the eligible equity shareholders as on the record date.

IRFC: The government plans to sell some stake in the state-owned company through an offer for sale (OFS) in the current fiscal to comply with SEBI’s minimum public shareholding (MPS) norm. The government currently holds 86.36% stake, and will have to dilute about 11.36% in IRFC.