Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading traded 0.11% higher at 19,851, signalling that Dalal Street was headed for positive start on Thursday.

Asian shares were trading higher, tracking Wall Street gains overnight, after the minutes of the US Federal Reserve’s latest meeting hinted at dovish stance among policymakers boosting investor sentiments. The Nikkei 225 index rose 1.25%, the Topix gained 1.1%, the Hang Seng jumped 1.95% and the CSI 300 index advanced 0.62%.

The Indian rupee rose 7 paise to 83.19 against the US dollar on Wednesday.

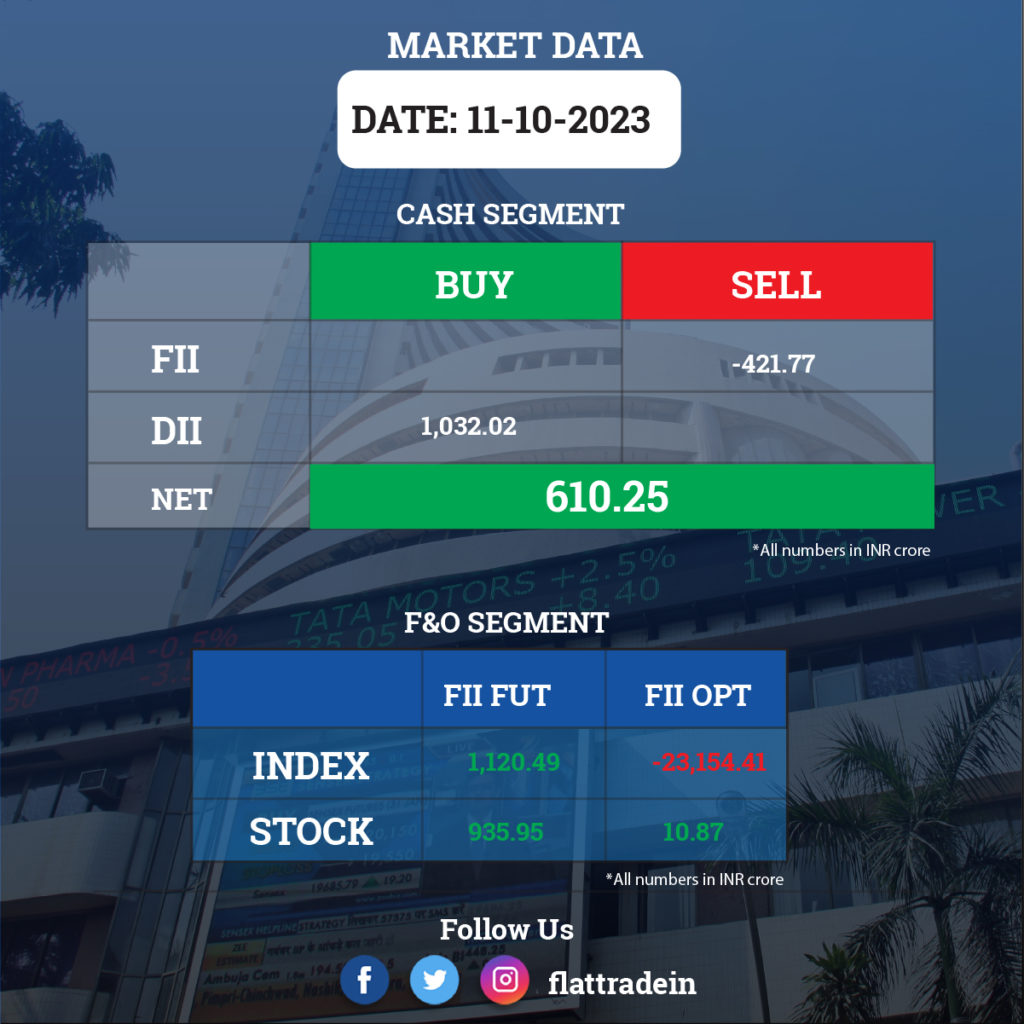

FII/DII Trading Data

Stocks in News Today

Tata Consultancy Services (TCS): The country’s largest IT services company has recorded 8.7% YoY growth in profit at Rs 11,342 crore for the quarter ended September FY24, better than analysts’ estimates. Revenue for the quarter grew by 7.9% YoY to Rs 59,692 crore, with constant currency revenue growth of 2.8%. The IT major’s board has approved a buyback of 4.09 crore shares (1.12%) at Rs 4,150 per share aggregating to Rs 17,000 crore. An interim dividend of Rs 9 per share was also approved by the board, with October 19 as the record date.

Maruti Suzuki: The automaker has started exports of its off-roader Jimny 5-Door. The vehicle will be shipped to destinations including Latin America, Middle East, and Africa regions.

Adani Enterprises: The company informed that the company has raised Rs 700 crores on 11th October, 2023, by allotment of 70,000 Secured, unrated, unlisted, redeemable, non-convertible debentures (“NCDs”) of the face value of Rs. 1,00,000 each on private placement basis.

JSW Steel: The company was declared the preferred bidder for Jaisinghpura North Block by Department of Mines and Geology, Government of Karnataka. The projected Iron Ore Resources is 17.66 in MMT.

IndusInd Bank: The company informed that the Reserve Bank of India has given the approval to SBI Mutual Fund for acquiring up to 9.99% of the paid-up share capital or voting rights in IndusInd Bank.

Cipla: The US drug regulator has inspected the manufacturing facility of InvaGen Pharmaceuticals Inc., a wholly owned subsidiary of the company in Central Islip, Long Island, New York, USA. The company has received the EIR (Establishment Inspection Report) from the USFDA on the classification of this inspection as Voluntary Action Indicated (VAI).

Vedanta: The company informed that India Ratings and Research has downgraded its ratings on the long-term bank facilities and debt instruments of the company to ‘IND AA-‘ from ‘IND AA’ and placed these ratings on ‘Rating Watch with Negative Implications’.

Aurobindo Pharma: The company wholly owned subsidiary CuraTeQ Biologics has signed a letter of intent with Singapore’s Merck Sharp & Dohme for contract manufacturing operations for biologicals. CuraTeQ will place orders for certain long-lead equipment and also begin civil works of the manufacturing facility, which will house largescale bioreactors for mammalian cell culture drug substance manufacturing and will include a vial filling isolator line for commercial drug product manufacturing.

RVNL: The company has emerged as the lowest bidder for the supply, installation, testing and commissioning of tunnel communication systems in Assam. The order is worth Rs 28.73 crore for a period of one year.

Shree Renuka Sugars: The company said the board of Anamika Sugar Mills has allotted 2,32,73,114 Equity Shares of Rs 10 each at issue price of Rs. 47.05 amounting to Rs 109.5 crore on rights issue basis to the Company. Shree Renuka Sugars recently completed 100% acquisition of Anamika Sugars.

Route Mobile: The company’s Bangladesh subsidiary has partnered with Robi Axiata in Bangladesh as a technical enabler and sales partner for Rich Communication Service Business Messaging.

Religare Enterprises: The company said that it has received an open offer for acquisition of up to 9,00,42,541 fully paid-up equity shares of face value of Rs 10 each, representing 26% stake, from M.B. Finmart, Puran Associates, VIC Enterprises and Milky Investment & Trading Company.

PCBL: The company has been received two patents for invention, from the Indian Patent Office. One of the patents is for the process for treatment of carbon black and oxidized carbon black obtained thereof, which is in relation to the innovative process for modifications of specialty grade carbon blacks for inks and coating applications. The other patent is for surface modified carbon black grades to improve the performance of rubber compounds, which is in relation to the innovative carbon black composition developed by the company to improve fuel efficiency and tyre life.

Signatureglobal (India): The company’s consolidated revenue was down 69.4% YoY at Rs 165.8 crore in Q2FY24 as against Rs 542 crore in the year-ago period. It posted an Ebitda loss of Rs 16.66 crore in Q2FY24 as against Ebitda profit of Rs 25.11 crore in the year-ago period. Consolidated net loss stood at Rs 7.18 crore in Q2FY24 as agaist a net profit of Rs 3.27 crore in Q2FY23.

Delta Corp.: The casino gaming company has posted a consolidated profit of Rs 69.44 crore for the quarter ended September FY24, rising 1.74% YoY. Revenue from operations for the quarter stood at Rs 270.6 crore, up 0.2% YoY. The board approved the appointment of Anil Malani as CFO and Manoj Jain as COO w.e.f. October 11.

Bhagiradha Chemicals & Industries: The company’s board has approved issuance of convertible warrants amounting to Rs 340.18 crore to promoters and certain identified non-promoters. The government granted a patent for “Novel Process for Preparation of Ethiprole” for 20 years, starting January 12, 2021.

Pricol: The automotive components maker has signed an agreement with Heilongjiang Tianyouwei Electronics for technology transfer and supply partnership in order to provide advanced technologies in driver information system solutions for Indian vehicle makers across various vehicle segments.

EMS: The company has secured a contract worth Rs. 270.82 crore from Jaipur Heritage’s Municipality for providing, laying, jointing, testing and commissioning of sewerage systems and all ancillary work for a period of 10 years.

India Tourism Development Corporation: The government appoints Mebanshailang Rynjah Synrem, Joint Secretary in the Tourism Ministry, as MD for one year.

Praveg: The company received a work order from the tourism department of Daman & Diu for the development and operation of the Damanganga Garden Kachigam project in Daman. The work order is for a period of seven years that could be extended up to another three years.