Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.46% higher at 17,787, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were mixed as investors were cautious ahead of the Fed’s monetary policy meeting and US economic data reports. The Nikkei 225 index was flat and Topix rose 0.05%. The Hang Seng was up 0.23%, while CSI 300 index fell 0.24%.

Indian rupee rose 3 paise to 81.50 against the US dollar on Monday.

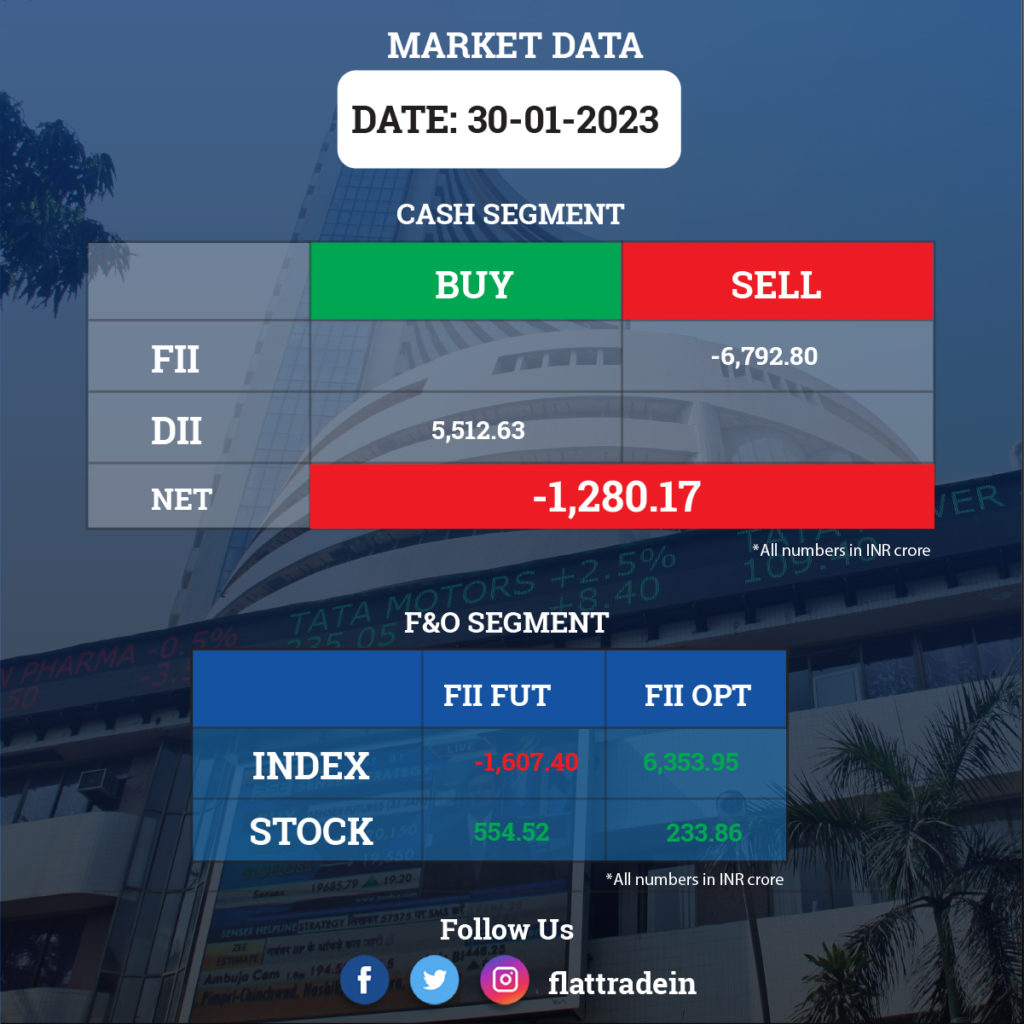

FII/DII Trading Data

Upcoming Results

Coal India, Power Grid Corporation of India, Sun Pharmaceutical Industries, UPL, ACC, BASF India, Blue Star, Edelweiss Financial Services, Great Eastern Shipping, Godrej Consumer Products, Indian Hotels, Indian Oil Corporation, Jindal Steel & Power, KEC International, KPIT Technologies, Max Financial Services, MOIL, RailTel Corporation of India, Spandana Sphoorty Financial, Star Health, and TTK Prestige will be in focus ahead of quarterly earnings on January 31.

Stocks in News Today

Larsen & Toubro (L&T): The infrastructure behemoth has reported a robust 24% year-on-year growth in consolidated profit at Rs 2,553 crore. Consolidated revenues at Rs 46,390 crore for the quarter grew by 17% YoY aided by improved execution in the infrastructure projects segment and continued growth momentum in the IT&TS portfolio. The company received orders worth Rs 60,710 crore during the quarter, a 21% YoY growth, taking the total order book to Rs 3.86 lakh crore as of December FY23.

Adani Enterprises: Abu Dhabi-based conglomerate International Holding Co (IHC) will invest $400 million in the follow-on public offer (FPO) of Adani Enterprises. The investment will be made through its subsidiary Green Transmission Investment Holding RSC Limited. The Rs 20,000 crore FPO subscribed 3% on second day of bidding.

UltraTech Cement: The company’s UAE subsidiary UltraTech Cement Middle East Investments has signed an agreement to acquire 70% stake in Duqm Cement Project International, LLC, Oman, for $2.25 million.

Tech Mahindra: The IT services company registered a 0.9% sequential growth in consolidated profit at Rs 1,297 crore for quarter ended December FY23. Revenue rose 4.6% QoQ to Rs 13,735 crore and in dollar terms revenue grew by 1.8% QoQ to $1,668 million. Deal wins stood at $795 million for the quarter.

Bharat Petroleum Corp (BPCL): The state-owned oil retailer registered a standalone profit of Rs 1,960 crore for December FY23 quarter against a loss of Rs 304.2 crore in the previous quarter, with strong operating performance amid a fall in oil prices. Revenue grew by nearly 4% sequentially to Rs 1.19 lakh crore.

REC: The power projects finance company has recorded a 4% year-on-year growth in standalone profit at Rs 2,878 crore for quarter ended December FY23, with a weak topline. Standalone revenue from operations at Rs 9,695 crore fell by 3.1% compared to the year-ago period.

IIFL Finance: The company has registered a massive 37% year-on-year growth in profit at Rs 423.2 crore for the quarter ended December FY23. Revenue from operations rose 18% YoY to Rs 2,121 crore for the quarter. Overall core loan portfolio grew by 26% YoY, but the non-core loan portfolio which includes construction and real estate finance shrunk by 7%. The company’s gross non-performing assets (NPA) falling 30 bps QoQ to 2.1% and net NPA declining 10 bps QoQ to 1.1% for the quarter.

Adani Enterprises: International Holding Company, the diversified Abu Dhabi-based conglomerate, will be investing $400 million in Adani Enterprises’ further public offering (FPO), through its subsidiary Green Transmission Investment Holding RSC Limited. The Rs 20,000 crore FPO was subscribed 3% on the second day of bidding.

KEC International: The infrastructure EPC major and an RPG Group company secured new orders of Rs 1,131 crore across various businesses including transmission and distribution, and civil segment. With these orders, the YTD order intake stands at over Rs 15,500 crore, a growth of 10% YoY.

Trident: The company reported a 32% year-on-year decline in consolidated profit at Rs 144.2 crore for quarter ended December FY23, impacted by weak sales and operating performance. Revenue from operations at Rs 1,641 crore fell by 17% compared to year-ago period.

Inox Leisure: The multiplex chain operator has reported a net loss of Rs 40.4 crore for quarter ended FY23 against loss of Rs 1.3 crore in same period last year, impacted by exceptional loss related to amalgamation expenses. Revenue grew by 74% YoY to Rs 515.6 crore for the quarter, with highest ever quarterly average ticket price of Rs 230 and highest ever quarterly spends per head at Rs 106.

Astec Lifesciences: The company has received approval from its board to raise funds of Rs 50 crore through issuance of non-convertible debentures (NCD) for expansion and development of business operations as well as for short term and long-term financial requirements. Meanwhile, the company recorded a consolidated profit at Rs 0.85 crore for quarter ended December FY23, down 97% YoY on lower sales. Revenue from operations at Rs 117.2 crore for the quarter grew by 32.4% YoY.

Cupid: The company reported a 302% year-on-year growth in profit at Rs 10.03 crore for December FY23 quarter aided by healthy operating performance. Revenue from operations grew by 16% YoY to Rs 42.9 crore for the quarter.

Dhampur Sugar Mills: The sugar company has registered a 20% YoY decline in profit at Rs 46.4 crore for quarter ended December FY23 with 14% decline in operating profit and lower-than-expected sales. Revenue from operations grew by 2% YoY to Rs 642 crore for the quarter.

Orient Electric: The company recorded a 14.5% year-on-year decline in profit at Rs 32.56 crore for December FY23 quarter, impacted by weak operating performance. Revenue from operations at Rs 739 crore for the quarter increased by 9% over a year-ago period.

Mangalore Refinery & Petrochemicals: The company which is a subsidiary of ONGC has posted standalone loss of Rs 188 crore for December FY23 quarter, narrowing from loss of Rs 1,789 crore in previous quarter with improving operating performance. Revenue from operations grew by 8% QoQ to Rs 26,557.4 crore for the quarter.