Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.1% higher at 19,566, signalling that Dalal Street was headed for a slightly higher opening on Monday.

Asian shares were trading higher as investors’ confidence improved after China’s latest property stimulus measures. The Nikke i 225 index roese 0.58% and teh Topix gained 0.79%. The Hang Seng surged 2.44% and the CSI 300 index rose 1.36%.

The Indian rupee rose 8 paise to 82.71 against the US dollar on Friday.

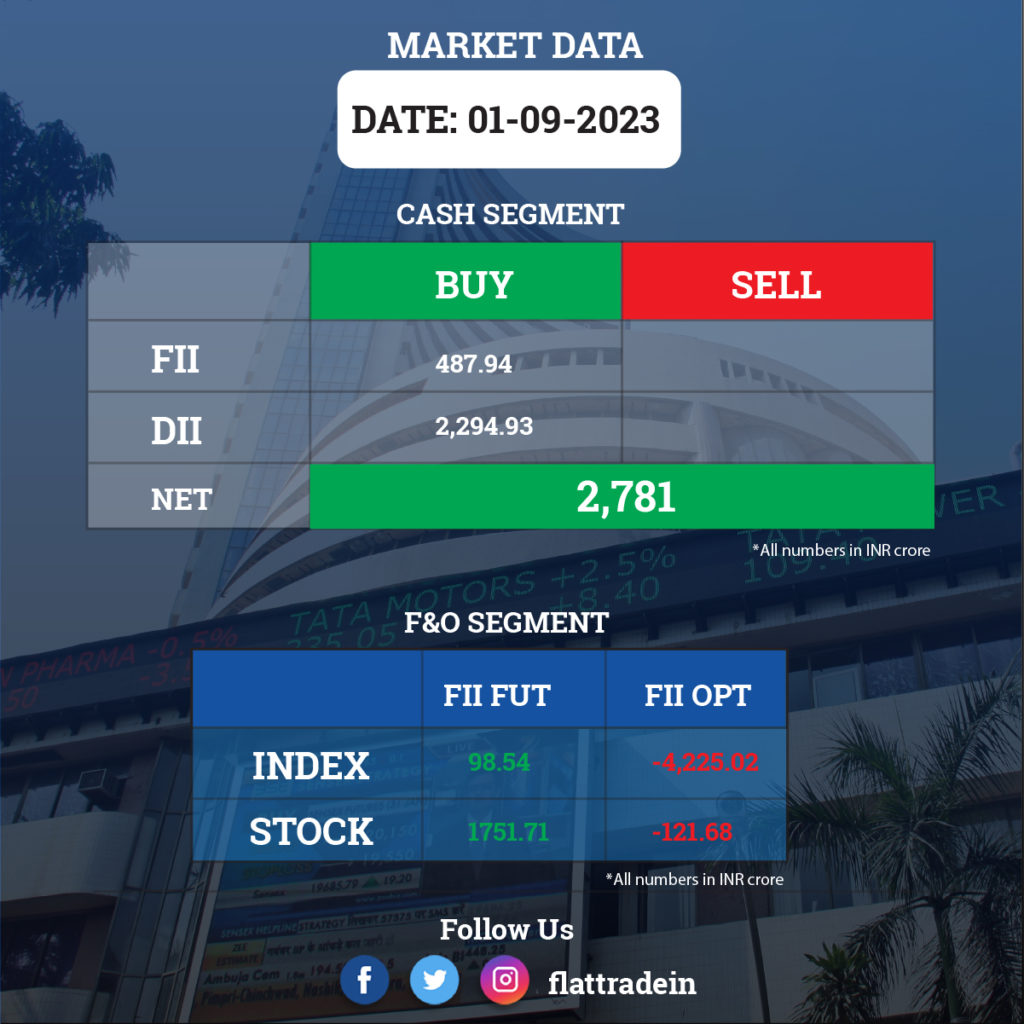

FII/DII Trading Data

Stocks in News Today

Kotak Mahindra Bank: Uday Kotak has resigned as managing director & CEO of the private sector lender, with effect from September 1, three months ahead of schedule. He will now be a non-executive director. As an interim arrangement, Dipak Gupta, the joint managing director, will carry out the duties of the MD and CEO until December 31, subject to approval of the RBI and the members of the bank.

ONGC: The board has approved capital restructuring of ONGC Petro additions (OPAL). It includes buyback of convertible debentures of Rs 7,778 crore by ONGC and an investment of Rs 7,000 crore in equity/quasi-equity security of OPaL.

IDBI Bank: The Department of Investment and Public Asset Management has invited bids for asset valuers for the bank and the bids are expected to be submitted by Oct. 9. The government plans to sell 30.48%, while Life Insurance Corp. of India is likely to offload 30.24% of its stake in IDBI Bank.

Infosys: The IT major has completed the acquisition of Danske Bank’s IT centre in India. Danske Bank selected Infosys as a strategic partner to accelerate digital transformation initiatives with speed and scale.

Hero MotoCorp: The two-wheeler manufacturer dispatched 4.89 lakh units in August, a 5.6% growth over 4.63 lakh units sold in the year-ago period. Domestic sales grew by 4.9% YoY to 4.73 lakh units and exports jumped 32.87% to 15,770 units.

Biocon: The company’s subsidiary Biocon Generics has acquired Eywa Pharma Inc’s oral solid dosage manufacturing facility in New Jersey for $7.7 million. The existing workforce of the facility will transition to Biocon Generics. The facility has the potential for capacity expansion of up to 2 billion tablets a year.

Mahindra & Mahindra: The company entered into an Asset Transfer Agreement and a Business Transfer Agreement with unit Mahindra Last Mile Mobility (MLMM) for transfer of identified assets and business pertaining to the Last Mile Mobility Business to (MLMM).

ICICI Bank: ICICI Bank received the nod from IRDAI for increasing its stake in ICICI Lombard General Insurance by 4%, thus making it a subsidiary of the company. The lender will have to increase its stake in the insurance company in one or more tranches by Aug. 31, 2024.

JSW Steel: The steel manufacturer has surrendered its Jajang iron ore block located in Keonjhar, Odisha citing uneconomic operations. The surrender is subject to the government’s approval. The company had four iron ore mining leases in Odisha acquired through auction in 2020.

Bharat Electronics: The company has inked a pact with Israel Aerospace Industries to collaborate on short range air defense systems.

GMR Power and Urban Infra: The company’s subsidiary GMR Smart Electricity Distribution (GSEDPL) has received the Letter of Award (LOA) from Purvanchal Vidyut Vitran Nigam to implement smart metering project in Purvanchal (Varanasi, Azamgarh zone and Prayagraj, Mirzapur zone), Uttar Pradesh. The total contract value for Prayagraj & Mirzapur zone is about Rs 2,386.72 crore and for Varanasi & Azamgarh zone is about Rs 2,736.65 crore.

Hindalco Industries: The aluminium major has entered into a shareholder’s agreement and power purchase agreement with renewable energy company Seven Renewable Power (SRPL) for the acquisition of a 26% stake in SRPPL for Rs 32.5 lakh. The company intends to develop and operate captive power generation plant to supply 100 MW round-the-clock renewable energy to the smelter located in Odisha.

Eicher Motors: The company said Royal Enfield’s total sales in August stood at 77,583 units, up 11% from 70,112 bikes sold in the year-ago period. Exports increased by 13% to 8,190 units during the period.

Deepak Fertilisers & Petrochemicals: The company has signed two gas purchase agreements with GAIL. The company’s gas requirements for the next three years have been tied up with a gas basket consisting of a combination of Brent, HH & domestic linked for a risk-mitigated basket.

Coal India: The state-run miner’s production rose 13.2% year-on-year to 52.3 million tonnes in August 2023. Comparative production for the month surged ahead by 6.1 MTs. Total coal supplies to all consuming sectors shot up by 15.3% to 59 MTs in August 2023. Supplies were up nearly 8 MTs in a single month.

C.E. Info System: The company acquired 35,000 CCPS at Rs 2,571 apiece constituting 18.62% on fully diluted basis of Kogo Tech Labs aggregating to around Rs 9 crore. The total shareholding shall become 39.89% on a fully diluted basis.

Tata Power: The company’s unit Tata Power Renewable Energy signed a Power Delivery Agreement of group captive project for 6 MW AC with Chalet Hotels. The plant will generate 13.75 million units of clean energy from renewable sources under this arrangement.

Lemon Tree Hotels: The company has signed a license agreement for an 80-room property in Dehradun, Uttarakhand under the brand “Lemon Tree Premier”. The hotel is expected to be operational by Q3 of FY25.

Delta Corp: The company approved the voluntarily strike off of subsidiary Delta Offshore Developers, Mauritius. The striking off process will be undertaken as per the laws of Mauritius. It also approved the incorporation of Deltin Foundation, along with Highstreet Cruises and Entertainment.

Lupin: The drugmaker completed the acquisition of French pharma firm Medisol, following regulatory approval.

Rail Vikas Nigam: The company won a Rs 282 crore order from Madhya Gujarat Vij (MGVCL) for full Turnkey contract (design, supply and installation) for development of distribution infrastructure work for loss reduction at Dahod. The duration of the contract is 31 months.

Mindspace Business Parks REIT: The company has acquired 0.24 million square feet of leasable office space at Commerzone Porur in Chennai for Rs 181.6 crore as part of its expansion plan. Mindspace REIT, through its asset special purpose vehicle, now owns 100% of the project with a total leasable area of about 1.1 million square feet.

Mishra Dhatu Nigam: The company said that it had supplied specialised metals and alloys used in Aditya-L1 launcher vehicle.