Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.07% higher at 19,871, indicating that Dalal Street was headed for positive start on Wednesday.

Asian markets fell on Wednesday as investors remained cautious ahead of the Federal Reserve’s rate decision. The Nikkei 225 index slipped 0.04% and the Topix was down 0.12%. The Hang Seng lost 0.68% and the CSI 300 index dropped by 0.34%.

Indian rupee fell by 3 paise to 81.87 against the US dollar on Tuesday.

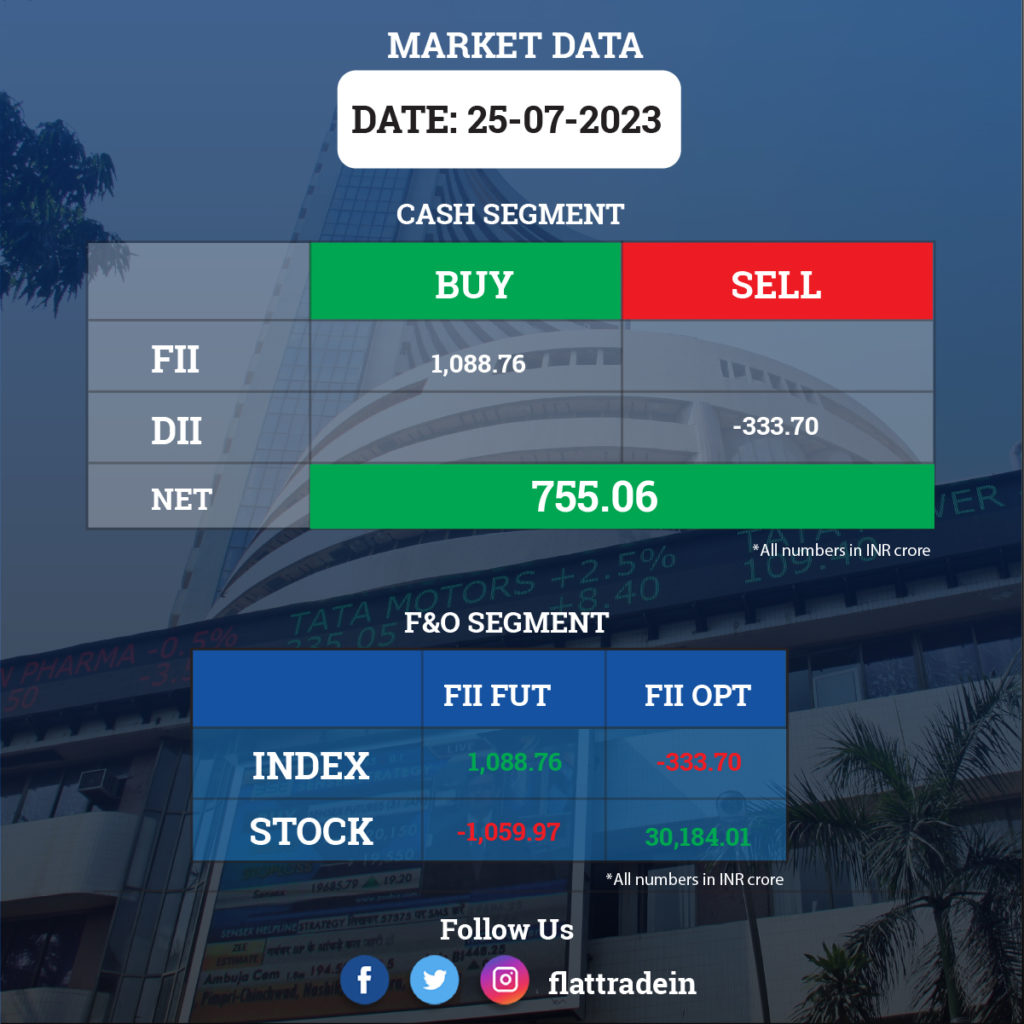

FII/DII Trading Data

Upcoming Results

Bajaj Finance, Axis Bank, Dr Reddy’s Laboratories, Tech Mahindra, Shree Cement, Tata Consumer Products, Bharat Petroleum Corporation (BPCL), Cipla, Punjab National Bank, REC, Colgate-Palmolive, Aditya Birla Sun Life AMC, Aegis Logistics, Aether Industries, Deepak Fertilisers, Glaxosmithkline Pharmaceuticals, Godfrey Phillips India, HFCL, Jindal Stainless, Mahindra Lifespace Developers, Novartis India, Oracle Financial Services Software, Praj Industries, Syngene International, and TeamLease Services will report their quarterly earnings today.

Stocks in News Today

Tata Motors: The automaker’s consolidated net profit stood at Rs 3,203 crore in Q1FY24 as against a loss of Rs 5,007 crore in the year-ago period. The rise in profit was attributed to improved margin of its passenger vehicle (PV) business and strong sales at its luxury car unit, Jaguar Land Rover (JLR). Its consolidated revenue from operations increased 42% YoY to Rs 1.02 lakh crore in the quarter under review. Ebidta surged to Rs 13,218 crore in Q1FY24 from Rs 2,413 crore in Q1FY23.

Further, Tata Motors said that its board has approved the NCLT scheme of arrangement for cancellation of ‘A’ Ordinary Shares or DVR shares. It will cancel DVR shares and issue ordinary shares. The DVR shareholders will receive 7 ordinary shares for every 10 DVR shares held. The shareholding of the promoter and promoter group will decline by 3.16% post-DVR swap.

Larsen and Toubro (L&T): L&T reported a consolidated net profit of Rs 2,493 crore for the quarter ended June 2023, up 46.5% from Rs 1,702.07 crore in the same quarter last year. Its revenue from operations for the quarter stood at Rs 47,882 crore, registering a growth of 33.6% from Rs 35,853 crore a year ago.

The conglomerate has agreed to buy back 3.33 crore shares, equal to 2.4% equity capital, at a maximum price of Rs 3,000 per share, aggregating up to Rs 10,000 crore. The company has made an additional investment of up to Rs 506 crore in its unit, L&;T Energy Green Tech. The conglomerate also inked a pact to acquire the entire 40% shareholding held by Sapura Nautical Power in the joint venture L&T Sapura Offshore.

SBI Life Insurance: The company’s consolidated revenue was up 497% YoY at Rs 27,692 crore in Q1FY24 from Rs 4,641 crore in the year-ago period. COnsolidated net profit rose 45% to Rs 381 crore in Q1FY24 from Rs 263 crore in Q1FY23. Its VNB was down by 1% to Rs 870 crore in Q1FY24 from Rs 880 crore in Q1FY23.

Union Bank of India: The public sector lender said it has embarked on Project Sambhav, a Digital Transformation project powered by a state-of-the-art Digital Business Platform which aims at creating a Digital Bank within the Bank. The said project also envisages leveraging Data & Analytics to foster revenue growth through new value propositions and end-to-end banking and lifestyle services. The Bank has entered into a strategic partnership with IBM India which will act as System Integrator for accelerating growth via Digital Transformation.

UTI Asset Management Company: The AMC has reported strong earnings in the first quarter of the current fiscal. The net profit jumped 154% YoY to Rs 234 crore in Q1FY24. Its total revenue from operations rose 59.59% YoY to Rs 467.77 crore.

CEAT: The tyre maker said its consolidated revenue for Q1FY24 rose 4.1% YoY to Rs 2935.17 crore. Profit After Tax grew multifold to Rs 144 crore in the reported quarter from Rs 8.68 crore in the year-ago period. The company witnessed a healthy volume growth in replacement driven by seasonal uptick in passenger segments. Ebitda stood at Rs 387.10 crore in Q1FY24 as against Rs 165.26 crore in the year-ago period.

Asian Paints: The paint manufacturer has appointed R. Seshasayee as Chairman from Oct. 1, 2023, to January 22, 2027. R. Seshasayee is currently an Independent Director of the company.

Can Fin Homes: The company has reported a fraud of Rs 38.53 crore committed by employees at its Ambala branch. The fraud involved the transfer of funds to different personal bank accounts by misusing the cheque signing authority. The company has lodged an FIR and said it estimates no impact on assets or asset quality.

Delta Corp.: The company posted a consolidated revenue of Rs 272.80 crore in Q1FY24, up 9% from Rs 250.27 crore in Q1FY23. Consolidated net profit rose 19% YoY to Rs 67.91 crore in Q1FY24 as against Rs 57.13 crore in Q1FY23. Ebitda rose to Rs 95.82 crore in Q1FY24 from Rs 87.5 crore in the year-ago period.

Dixon Technologies: The contract manufacturer of electronics said its revenues from operations were up 15% to Rs 3,271.50 crore in Q1FY24 from Rs 2,855.07 crore in Q1FY23. Consolidated net profit rose 48% to Rs 67.19 crore in Q1FY24 as against Rs 45.43 crore in Q1FY23. Ebitda grew by 32% to Rs 131.87 crore in Q1FY24 from Rs 100.12 crore in the same period last fiscal.

Cyient: The IT services company said its standalone revenue fell 3.7% QoQ to Rs 1,686.5 crore in Q1FY24 from Rs 1,751.4 crore in the prior quarter. Its standalone net profit rose 3.6% to Rs 169.1 crore in Q1FY24 from Rs 163.2 crore in Q4FY23. EBIT stood at Rs 248 crore in Q1FY24 as against Rs 249.4 crore in Q4FY23.

Mindspace Business Parks REIT: The company’s consolidated revenues was up 23% YoY to Rs 589.9 crore in Q1FY24 from Rs 480.7 crore in Q1FY23. Its consolidated net profit rose to Rs 136.9 crore in the reported quarter from Rs 128.4 crore in the year-ago period. Ebitda rose to Rs 424.1 crore in Q1FY24 from Rs 360.7 crore in the year-ago period.

RattanIndia Power: The company’s revenue edged up 1% to Rs 847.27 crore in Q1FY24 from Rs 842.79 crore in the year-ago period. The company posted a net loss of Rs 549.36 crore in the reported quarter as against a net loss of Rs 389.3 crore in the year-ago period. Ebitda dropped by 28% to Rs 156.75 crore in Q1FY24 from Rs 219.17 crore in the year-ago period.

Amber Enterprises: The company’s consolidated revenue was fell 7% to Rs 1,701.99 crore in Q1FY24 from Rs 1,825.73 crore in Q1FY23. Consolidated net profit rose 9% to Rs 46.61 crore in the reported quarter from Rs 42.89 crore in the year-ago period. Ebitda jumped 33% to Rs 131.92 crore in Q1FY24 from Rs 99.24 crore in Q1FY23.

Satin Creditcare Network: The microfinance institution informed that a meeting of the working committee of the board of directors is scheduled to be held on July 28 to consider fund raising proposal by way of issuance of listed/unlisted, secured/unsecured, nonconvertible debentures on private placement basis.