Market Opening - An Overview

GIFT Nifty Future on the NSE IX were trading lower by 0.05% at 19,815, signalling that Dalal Street was headed for a negative start on Thursday.

Asian shares were trading lower as rising oil prices stoked inflation fears. The Nikkei 225 index tanked 1.73% and the Topix tumbled 1.49%. The CSI 300 index fell 0.25% and the Hang Seng was down 0.97%.

The Indian rupee closed flat at 83.23 against the US dollar on Wednesday.

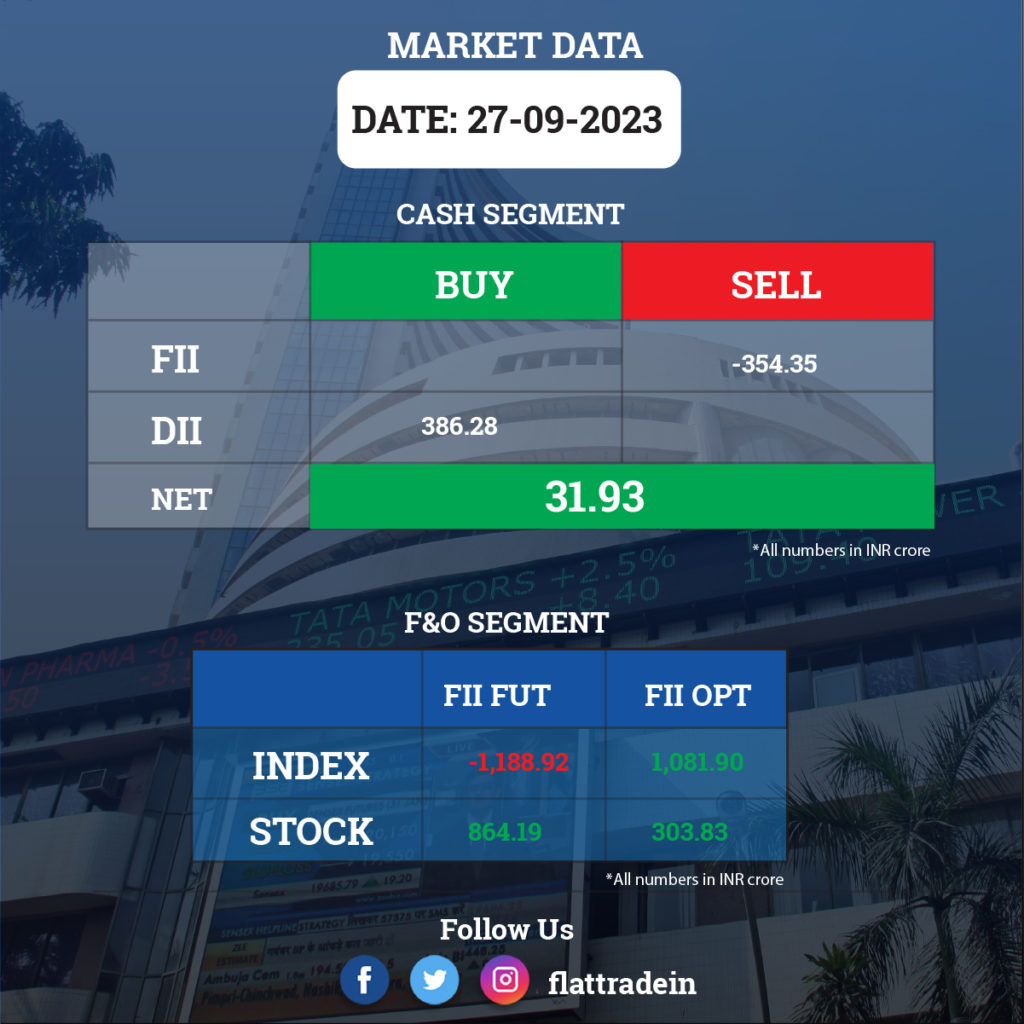

FII/DII Trading Data

Stocks in News Today

Reliance Industries, Airtel, Vodafone Idea: RIL’s Jio gained 39.1 lakh users in July as against a net addition of 22.7 lakh users in June. Airtel gained 15.2 lakh users in July compared with a net addition of 14.1 lakh users in June. Vodfone Idea lost 13.2 lakh users in July as against a net lost of 12.9 lakh users in June. Jio’s market share stood at 38.6%, Airtel’s market share stands at 32.74%, and Vodafone Idea’s market share was at 19.9%.

Infosys: The IT services company has announced the launch of Infosys Cobalt Airline Cloud (ICAC), a first-of-its-kind industry cloud offering designed for commercial airlines to help them accelerate their digital transformation journey. I

Vedanta: The company plans to split its units into newly listed entities, Bloomberg reported citing sources. The official announcement regarding the split will come in a few days. The company’s businesses including aluminium, oil and gas, iron, and steel will be listed as separate, pure-play entities as part of the move.

Info Edge: The company informed that Redstart Labs (India) Ltd., a wholly-owned subsidiary of the company, plans to invest about USD 500,000 in SkyServe Inc. Skyserve provides Insights-as-a-Service platform enabling satellite-based edge computed insights for core industries and solution providers to scale faster and affordably. Skyserve feed multispectral imagery to models deployed on the edge and facilitate timely predictions.

ONGC, Mangalore Refinery and Petrochemicals: Oil and Natural Gas Corporation (ONGC) Ltd has inked a Crude Oil Sales Agreement (COSA) with Mangalore Refinery and Petrochemicals Ltd (MRPL) for the sale and purchase of crude oil. The agreement between the two entities will be applicable till March 31, 2024.

JSW Steel: The company has acquired the remaining 50% stake in NSL Green Steel Recycling from National Steel Holding. Consequent to completion of this acquisition and other closing conditions as mentioned in the SPA, the company’s shareholding in NSL has increased from 50% (pre-acquisition) to 100% (post-acquisition) and NSL has become a wholly owned subsidiary of the company.

Tata Power: The company’s subsidiary Tata Power Renewable Energy (TPREL) will set up a 41 MW captive solar plant at Thoothukudi in Tamil Nadu for TP Solar’s new greenfield 4.3 GW solar cell and module manufacturing facility at Tirunelveli in Tamil Nadu. The project will be commissioned 12 months from the signing of the project development agreement (PDA) and TP Solar’s manufacturing plant is expected to start commercial production of cells and modules by FY25.

SJVN: The company has commenced the mechanical spinning of unit-I of 60 MW Naitwar Mori Hydro Electric Project (NMHEP) at Mori in Uttarakhand and it is expected to generate about 265.5 million units of electricity annually.

Aurobindo Pharma: The company’s subsidiary Auro Vaccines has entered into a licence agreement with Hilleman Laboratories Singapore Pte Limited to develop, manufacture and commercialise a pentavalent vaccine candidate used in children’s vaccination. Auro Vaccines will make milestone payments to Hilleman upon achieving certain development and clinical study outcomes, while Hilleman will also be paid royalties upon commercialisation of the vaccine candidate.

Dixon Technologies: The company’s subsidiary, Padget Electronics, has entered into an agreement with Xiaomi Technology India for the manufacturing of smartphones and other related products for Xiaomi. The production of Xiaomi products will be at Padget’s manufacturing facility in Uttar Pradesh.

NBCC India: The state-owned construction company has announced the sale of commercial built-up space in World Trade Centre, New Delhi, through e-auction. It launched the sale on September 27 and the e-auction will take place on October 23 this year. The area offered for sale is 14.75 lakh square feet and the value of the area offered is Rs 5,716.43 crore.

Oberoi Realty: The realty company has entered into a Development Agreement for development and redevelopment of approximately 13,450 square meters of land at Tardeo in Mumbai and it expects to generate a free sale component of around 2.5 lakh sq. feet. of carpet area.

Nazara Technologies: The company said that it has received a show cause notice from Director General of GST Intelligence, Mumbai, stating a tax demand of Rs 2,83,96,324.

PNC Infratech: The company has submitted claims to the National Highways Authority of India worth Rs 259 crore for the project of ‘Four Laning of km 51 to 61 on the Dholpur-Morena Section of NH-3 on the North-South Corridor in Rajasthan-Madhya Pradesh.