Market Opening - An Overview

GIFT Nifty futures on the NSE IX were trading lower by 0.03% at 19805, signalling that Dalal Street was headed for flat-to-negative start on Tuesday.

Most Asian shares were trading higher as investors shifted their focus to corporate earnings amid the ongoing Israel-Hamas conflict. The Nikkei 225 index rose 0.92% and the Topix gained 0.54%. The Hang Seng rose 0.25% and the CSI 300 fell 0.06%.

The Indian rupee closed at 83.28 against the US dollar on Monday.

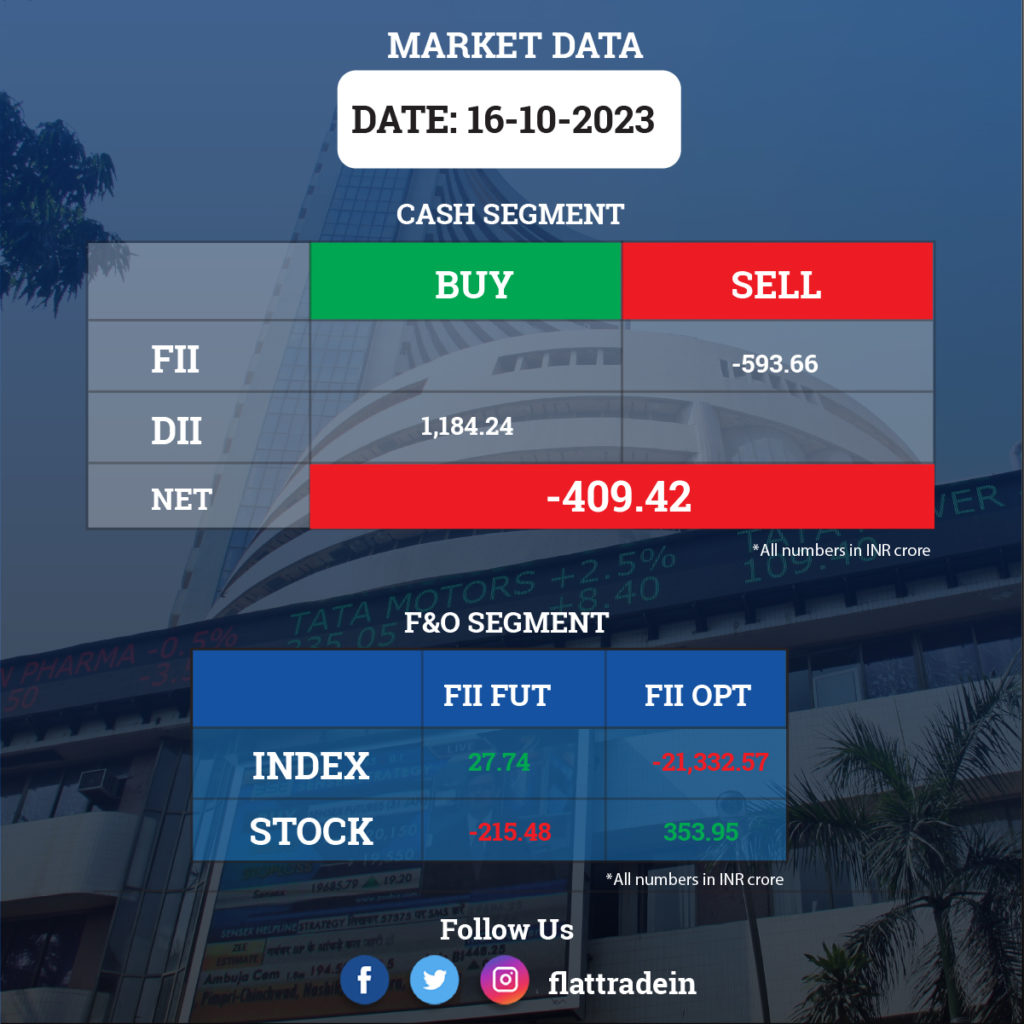

FII/DII Trading Data

Stocks in News Today

HDFC Bank: The private sector lender has registered a standalone profit at Rs 15,976 crore for the quarter ended September FY24, up 50.6% over the year-ago period. Net interest income grew by 30.3% at Rs 27,385 crore during the reported quarter. Gross advances increased by around Rs 1.1 lakh crore YoY to Rs 23.54 lakh crore and total deposits stood at Rs 21.72 lakh crore at the end of September 2023.

ICICI Securities: The company said its net profit rose 41% YoY to Rs 423.6 crore and revenue jumped 45.5% YoY to Rs 1,249 crore in Q2FY24. The company’s EBITDA soared by 54.8% YoY to Rs 810 crore and margin expanded by 390 bps to 64.9% percent for the quarter ended September 2023. The company said its board has approved an interim dividend of Rs 12 per equity share with a face value of Rs 5 each for all eligible shareholders. The record date is October 27, 2023.

Jio Financial Services: The company said that its net profit rose 101.3% quarter-on-quarter to Rs 668.18 crore and revenue from operations jumbed 46.8% QoQ to Rs 608.04 crore. The company infomed that its board has appointed AR Ganesh as Group Chief Technology Officer of the company with effect from October 16.

Tata Power: The company’s subsidiary, Tata Power Renewable Energy, has signed a power delivery agreement (PDA) with Endurance Technologies, an auto component manufacturer, through a special purpose vehicle (SPV) TP Green Nature, for the development of 12.5MW AC captive solar plant. The plant will be set up at Aachegaon in Maharashtra and will generate 27.5 million units (MUs) of electricity every year.

Grasim Industries: The board has approved the raising of funds not exceeding Rs 4,000 crore by way of a rights issue to the eligible equity shareholders as on the record date. The proposed rights issuance by Grasim aims to fund the ongoing capital expenditure plan, repay existing borrowings, and support general corporate purposes.

Bombay Dyeing: The company has signed a conveyance deed with Goisu Realty Private Limited, a subsidiary of Sumitomo Realty & Development Company Limited, and transferred the land along with associated FSI of Phase-I located at Worli, Mumbai for a total consideration of about Rs 4,675 crore. The company has received the consideration of about Rs 4,675 crore towards Phase-I and the proceeds realized shall be used for repaying loans of the company and the balance will be invested in approved securities for future developments.

NLC India: The company incorporated a new wholly owned subsidiary, ‘NLC India Green Energy’ (NIGEL), which currently undertakes projects of 2 GW of renewable energy.

SBI Cards and Payment Service: Amit Batra has resigned as Executive Vice President and Head of Open Market and Corporate Sales of the company due to personal reasons, with effect from December 26.

Varun Beverages: The company’s board has approved the acquisition of 5.03% of the paid-up capital of the manufacturing subsidiary Lunarmech Technologies for Rs 10 crore. Post-acquisition, Varun Beverages will hold a 60.07% stake in the company. The board also has approved an investment of Rs 1.92 crore for a 9.80% stake in Isharays Energy Two, a special-purpose vehicle by Sunsource Energy to supply solar power in Uttar Pradesh.

CEAT: The tyre manufacturer recorded a consolidated profit of Rs 208 crore for the quarter ended September FY24, compared to Rs 7.8 crore in the same period last year. The rise was attributed to decline in input cost. Revenue from operations rose 5.5% YoY to Rs 3,053.3 crore for the quarter.

Cyient DLM: The electronic manufacturing services company has reported a 106.4% YoY growth in profit at Rs 14.6 crore for the quarter ended September FY24. Revenue from operations surged 71.5% YoY to Rs 291.8 crore for the quarter. Ebitda slipped 0.51% to Rs 23.53 crore in Q2FY24 as against Rs 23.65 crore in Q2FY23.

KEC International: The RPG Group company has secured new orders worth Rs 1,315 crore across its various businesses including transmission & distribution projects in India, the Middle East, Australia and the Americas.

Gujarat Mineral Development Corporation: The company presented a substantial dividend cheque of Rs 269.44 crore to the Gujarat government. The Gujarat government has 74% stake in GMDC.

Mphasis: The company informed that Ayaskant Sarangi has joined the company as the new Chief Human Resource Officer (CHRO) as of Oct. 16. Srikanth Karra will continue as the Chief Administrative Officer role (CAO) to facilitate the transition.

Data Patterns: The company announced a licencing and transfer of technology (ToT) agreement with IN-SPACe, an autonomous agency in the Department of Space. This agreement will provide data patterns with miniature SAR radar capability.

Electronics Mart India: The company has commenced the commercial operation of a new multi-brand store under the brand name ‘BAJAJ ELECTRONICS’ on Oct. 15 in Andhra Pradesh.

JK Paper: The company’s board has approved the acquisition of Manipal Utility Packaging Solutions Pvt. (MUPSPL). The said transaction is likely to be completed within six weeks of the execution of a Share Purchase Agreement (SPA) between the the two entities.

Piramal Pharma: The company’s Pharma Solutions (PPS) business announced the launch of a high-throughput screening facility that augments the existing in-vitro biology capabilities at its drug discovery services site in Ahmedabad, India. This new expansion significantly adds primary and secondary screening capabilities of compounds prepared at the Ahmedabad site.

Lemon Tree Hotels: The company has signed an agreement for a 55-room property in Dehradun, Uttarakhand, under the brand “Keys Prime by Lemon Tree Hotels” and it is expected to be operational by FY 2027. Teh newproperty will be managed by the company’s subsidiary Carnation Hotels.

Lupin: The company has signed a business transfer agreement with Lupin Manufacturing Solutions Limited (‘LMSL’), wholly owned subsidiary of the company, to carve out two Active Pharmaceutical Ingredients manufacturing sites situated at Dabhasa and Visakhapatnam and select R&D operations, including fermentation, at Lupin Research Park, Pune.

Som Distilleries: The company said that it has inked a strategic contract manufacturing agreement in Jammu and Kashmir for the manufacture of IMFL to deliver high quality products to the Canteen Stores Department (CSD).

Just Dial: The company informed that the Karnataka Industrial Areas Development Board (“KIADB”) has cancelled the allotment of land situated in Bengaluru Urban District alleging breach of conditions imposed under the lease deed. The company said it is evaluating the matter and will take necessary action as legally advised. The financial impact of the aforesaid action is estimated to be up to Rs 19 crore and there will be no impact on the operations or other activities of the company.