Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.1% lower at 19,276, signalling that Dalal Street was headed for negative start on Friday.

Asian stocks fell following a selloff on Wall Street as investors were on the sidelines awaiting Jerome Powell’s comments on the interest-rate outlook. The Nikkei 225 tanked 1.92% and Topix dropped 0.88%. The Hang Seng index dropped 0.81% and the CSI 300 index lost 0.38%.

The Indian rupee strengthened by 10 paise to close at Rs 82.58 against the US dollar on Thursday.

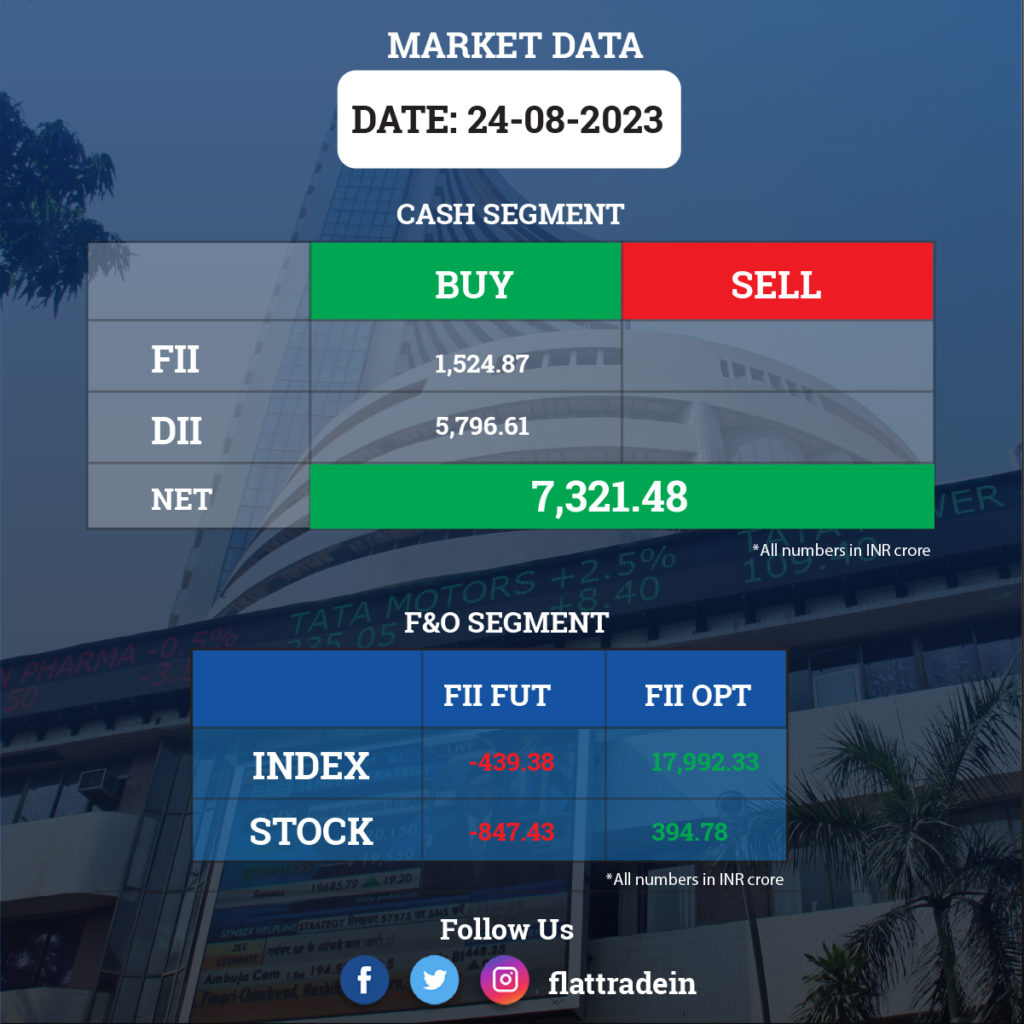

FII/DII Trading Data

Stocks in News Today

One 97 Communications (Paytm): The fintech company’s promoter, Antfin, may sell 3.6% stake or 2.3 crore shares of Paytm via a block deal on August 25, Bloomberg reported. The floor price for the deal is likely to be at a discount of Rs 880.10 per share, a 2.7% discount from the August 24 closing price.

Bharat Electronics: The Defence Acquisition Council has granted Acceptance of Necessity for procurement and installation of electronic warfare (EW) suite on Mi-17 V5 helicopters under buy (Indian-IDDM) category which will enhance better survivability of helicopters. The EW Suite will be procured from state-owned company Bharat Electronics.

Astra Microwave Products: The company has received orders worth Rs 158 crore from ISRO, DRDO, and DPSU for the supply of satellite sub-systems, airborne radar, sub-systems of radar, and EW projects.

Bharti Airtel, Reliance Jio, Vodafone Idea: Telecom operator Bharti Airtel has net added 14.09 lakh users in June against 13.28 lakh addition in May. Reliance Jio has net added 22.7 lakh users in June as against an addition of 30.38 lakh users in May. Vodafone Idea lost 12.85 lakh users in June against a loss of 28.15 lakh users in May.

Reliance Industries (RIL) and EIH: RIL and Oberoi Hotels will jointly manage three properties across India and the UK. Properties include Anant Vilas in Mumbai, Stoke Park in the UK, and a new project in Gujarat.

Shoppers Stop: The company’s MD and CEO, Venu Nair, has resigned with effect from August 31 due to personal reasons. Homestop chief Kavindra Mishra has been promoted as executive director and CEO for a period of three years, with effect from September 1.

Granules India: The drugmaker received approval from the Brazilian Health Regulatory Agency (ANVISA) for compliance with the guidelines of Good Manufacturing Practices for its Bonthapally API facility, Hyderabad, and an Accreditation Certificate of Foreign Drug Manufacturer from the Pharmaceuticals and Medical Devices Agency (PMDA), Japan, for its Jeedimetla API facility, Hyderabad.

Mankind Pharma: The company’s board has approved the incorporation of a wholly owned subsidiary, Mankind Medicare, with an authorised capital of Rs 5 crore. The subsidiary will manufacture and produce various types of pharmaceutical dosage forms and consumer healthcare products.

KPI Green Energy: The company has received commissioning certificates from the Gujarat Energy Development Agency for a 4.10 MW wind-solar hybrid power project at the Samoj site in Jambusar, Gujarat.

Aditya Birla Capital: The company said that Aditya Birla Sun Life AMC has ceased to be the material subsidiary of the company after dilution of its stake to less than 50%.

Prakash Industries: The company has received the Environment Ministry’s approval for the Bhaskarpara coal mine in Chhattisgarh, which will reduce costs and boost revenue through the open market sale of coal.

SKF India: The company has acquired acquired 26,267 shares of Cleanmax Taiyo Private Limited at a premium of Rs 1,596/- each share, equivalent to 26% of the total issued and paid-up share capital. Post-acquisition of aforesaid share, the company owns 26% of the total issued and paid-up share capital of Cleanmax.

Kaynes Technology: The company has entered into an MoU with the Government of Karnataka for Rs 3,750 crore to setup a semiconductor assembly and testing facility and a printed circuit board manufacturing plant through its step-down subsidiaries.

GlaxoSmithKline Pharmaceuticals: The drug maker has reported contingent liabilities of Rs 350 crore on account of ongoing litigation.

eMudhra: The company’s board has approved a proposal for raising of funds of up to and not exceeding Rs. 250 crores by way of creation, offering and issuance of any instrument or security for cash, with or without green shoe option, according to its exchange filing.

Monte Carlo Fashions: The company has increased its investment in the wholly owned subsidiary, Monte Carlo Home Textiles, by Rs 2 crore to Rs 15.7 crore.

ADF Foods: The company has set September 11 as the record date for the stock split in the ratio of 5:1.

DB Realty: The company has sold its entire stake in unit Royal Netra Constructions for Rs 2.55 crore to Man Infraconstruction and Platinumcorp Constructions.

Garden Reach: The company has signed an MoU with DEMPO Group to build commercial vessels in their shipyards in Goa and Bhavnagar, Gujarat.