Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading 0.04% higher at 19,608.50, signalling that Dalal Street was headed for positive start on Tuesday.

Asian shares were trading higher, following Wall Street gains overnight, as investors’ sentiments were boosted by dovish Federal Reserve comments and as oil prices slipped. The Nikkei 225 index surged 2.49% and the Topix jumped 2.09%. The Hang Seng gained 1.65% and the CSI 300 index fell 0.38%.

The Indian rupee weakened 2 paise to close at 83.27 against the US dollar on Monday.

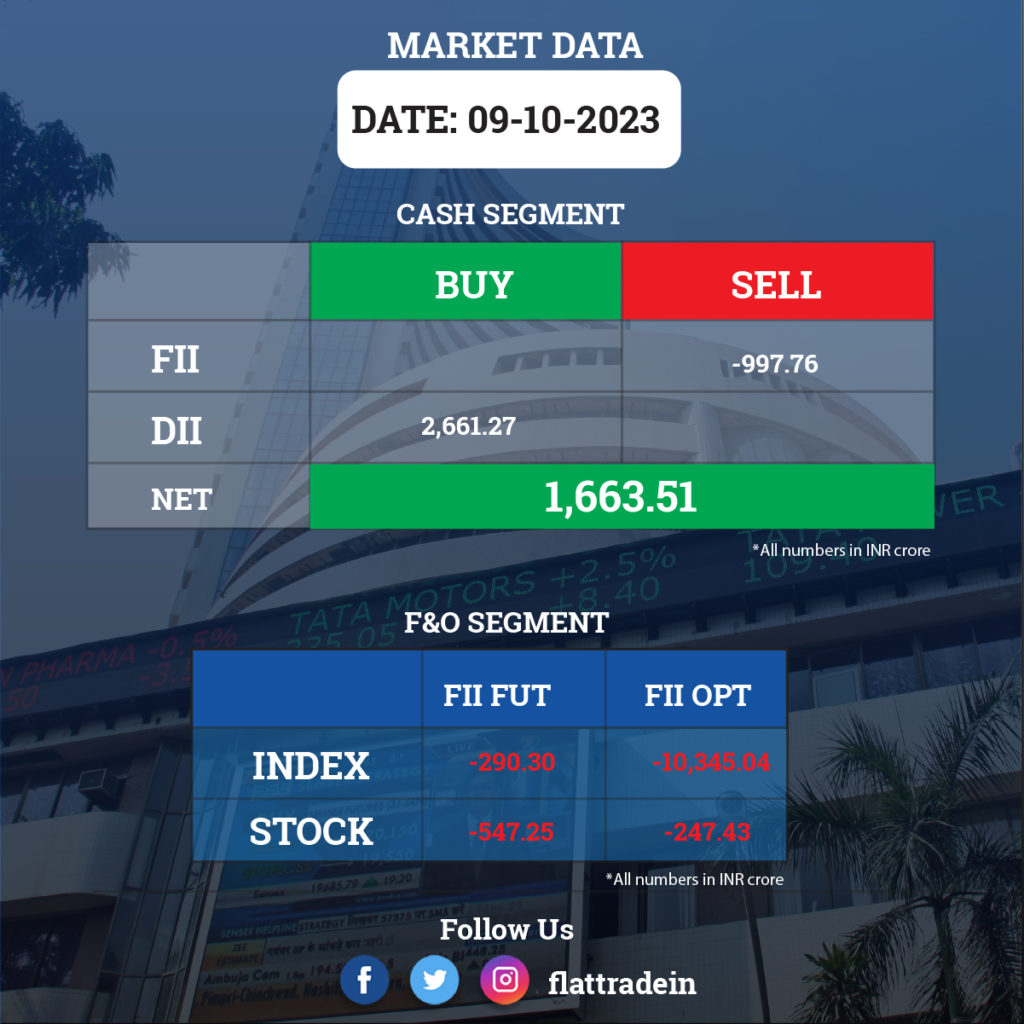

FII/DII Trading Data

Stocks in News Today

Dr Reddy’s Laboratories: The pharmaceutical company and othe pharma firms were named in an antitrust complaint filed in California court by Mayo Clinic and Lifepoint Corporate Services, which alleged that the defendants improperly restrained competition and maintained a shared monopoly in the sale of brand and generic Revlimid through their respective settlements of patent litigation.

Tata Steel: Global credit rating agency Fitch has upgraded the Issuer Default Rating (IDR) of Tata Steel to BBB- from BB+ with a ‘Stable’ outlook. The rating agency cited the resason for the upgrade is due to a reduction in uncertainty and financial risk from its U.K. operations.

Maruti Suzuki India: The automaker said it has received a show cause notice from the customs department. The department has accused the company of evading customs duty amounting to Rs 16.27 lakh by wrongly availing of the basic customs duty concession based on the end use of the imported goods.

Indian Oil Corporation (IOCL): The state-owned oil refiner has appointed Anuj Jain as Director (Finance) with effect from October 9. Anuj Jain has over 27 years of experience in finance, taxation and commercial aspects of the oil & gas industry. Sanjay Kaushal has ceased to be CFO of the company.

IDFC First Bank: The lender has signed an agreement with the National Securities Depository (NSDL) for the sale of its premises at Naman Chambers, BKC, Mumbai, for Rs 198 crore. The sale was part of the consolidation of the company’s operations near its corporate office.

Glenmark Life Sciences: The pharma company has declared an interim dividend of Rs 22.50 per share for FY24. The record date for reckoning the list of shareholders who will be entitled to receive the said interim dividend will be October 17. The interim dividend will be paid by October 23.

Cummins India: The company’s Pune unit in MIDC Phaltan will be excluded from the SEZ scheme from Oct. 11, 2023. The unit shall continue to operate as Domestic Tariff Area plant.

Container Corporation of India: The PSU company registered a 26.13% YoY growth in domestic volumes at 2.61 TEUs (twenty feet equivalent) for the quarter ended September FY24, and EXIM volumes rose 3.50% to 9.69 TEUs. Total volumes increased 7.59% YoY to 12.3 TEUs during the quarter.

Star Health: The company gets a Rs 39 crore show cause cum demand notice from DGGI for for non-payment of GST on co-insurance premiums from July 2017 to March 2023.

Phoenix Mills: The company said its total consumption grew by 20% YoY to Rs 2,637 crore, and on a like-to-like basis, the consumption increased by 10% YoY. Retail collections during the same period jumped 23% YoY to Rs 638 crore.

Dilip Buildcon: The infrastructure company has signed an agreement with the Water Resources Zone, Udaipur, Rajasthan, for construction of Dewas III and IV Dams in Gogunda on engineering, procurement and construction single responsibility turnkey basis, including 10 years operation and maintenance. The project worth Rs 396.93 crore is expected to be completed within 44 months.

Mazagon Dock Shipbuilders: The state-owned shipping company has signed a Letter of Intent (LOI) with an European client for the construction of six firms and four optional units of 7,500 DWT multi-purpose hybrid power vessels. The prices for the units would be firmed up at the time of contract signing.

Dhanuka Agritech: The company launches a new product named Semacia, which is a broad-spectrum insecticide against lepidopteran insect pests on a range of crops.

GR Infraprojects and Patel Engineering: Dibang Power (Lot 4) consortium, the joint venture between GR Infraprojects and Patel Engineering, has executed the contract agreement for the project worth Rs 3,637.12 crore with the NHPC. The share of GR Infraprojects in the project in Arunachal Pradesh is 50% and the project that includes construction of civil works for Lot 4 is expected to be completed within 86 months.

Genus Power Infrastructures: The electricity metering solutions company said Its wholly owned subsidiary has received two letters of awards (LOA) worth Rs 3,115.01 crore for appointment of Advanced Metering Infrastructure Service Providers (AMISPs).

Punjab National Bank: The central government has appointed Bibhu Prasad Mahapatra as executive director on the board of Punjab National Bank with effect from October 9. Mahapatra was the chief general manager of the bank.

Bank of Baroda: The government has appointed Lal Singh as Executive Director of the bank for three years, with effect from October 9. Singh was the chief general manager at Union Bank of India.

Union Bank of India: The Central Government has appointed Sanjay Rudra as Executive Director of the bank, with effect from October 9. Rudra was the general manager at the Bank of Maharashtra.

Bhageria Industries: The company has received a turnkey international Solar EPC project with comprehensive operation & maintenance and water proofing in APM terminal, Kingdom of Bahrain. The project’s capacity is 11.40 MWp and the total order value is Rs 104.49 crore.