Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading lower by 0.11% at 20,078, signalling that Dalal Street was headed for a lower opening on Wednesday.

Asian shares were trading lower as traders awaited the US Federal Reserve’s monetary policy decision and its outlook on the economy. The Nikkei 225 index fell 0.36% and the Topix ended 0.66%. China’s CSI 300 index dropped by 0.31% and the Hang Seng lost 0.36%.

The Indian rupee depreciated 9 paise to close at 83.27 against the US dollar on Monday.

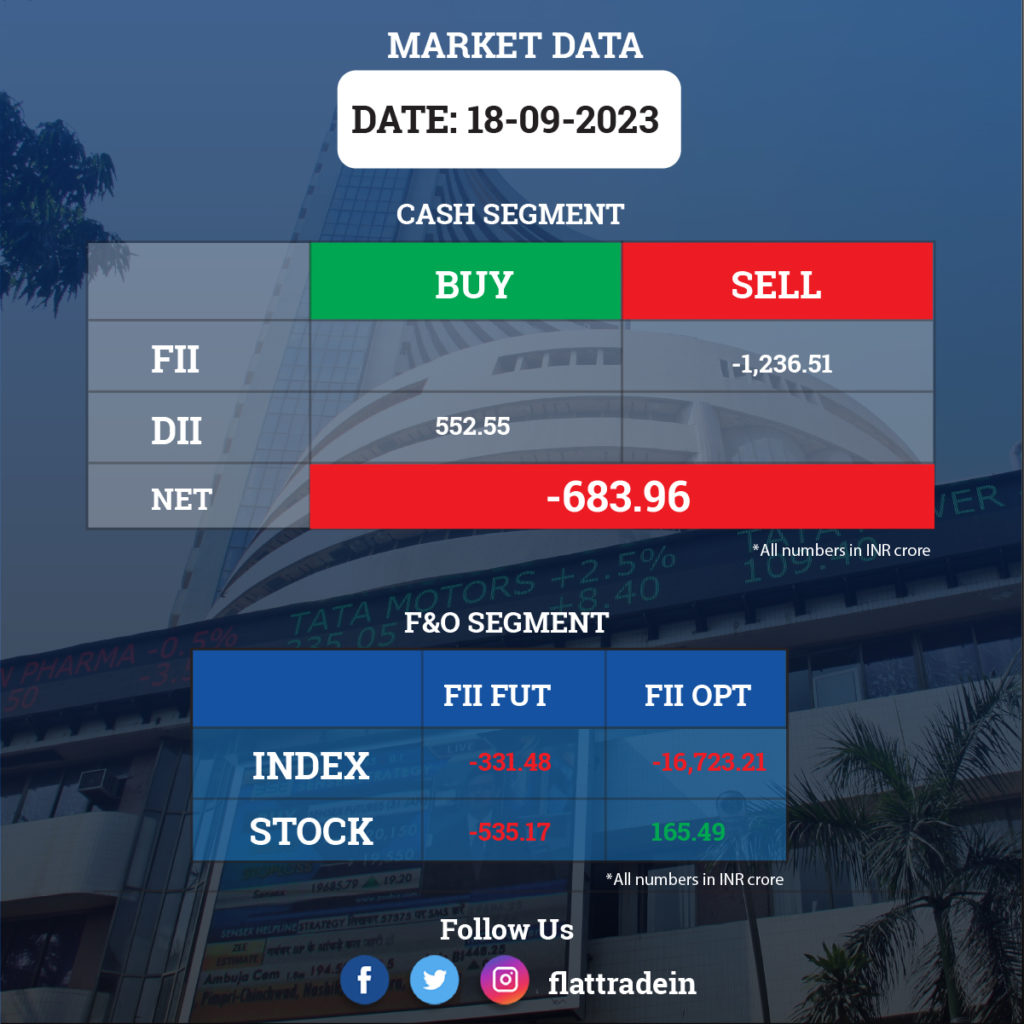

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The company’s telecom arm, Reliance Jio, has launched the Jio AirFiber and its related services in eight metro cities that include Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune.

Tata Motors: The automaker shall increase the prices of commercial vehicles by up to 3% starting from October 1, 2023, to offset the residual impact of past input costs and will be applicable across the entire range of commercial vehicles.

HDFC Bank: India’s central bank has approved the re-appointment of Sashidhar Jagdishan as the managing director (MD) and chief executive officer (CEO) of HDFC Bank for three years starting from October 27, 2023.

Biocon: The biopharmaceuticals company has received the approval from its board for the appointment of Peter Bains as the Group Chief Executive Officer (CEO), with effect from September 18. He will be reporting directly to Biocon Group Chairperson, Kiran Mazumdar-Shaw. Bains has stepped down from his role on the Biocon board as an Independent Director with immediate effect, to assume this strategic executive responsibility.

Bharat Dynamics: The company has signed a contract worth Rs 290.90 crore with IAF for supply of Surface to Air missiles, according to its excahnge filing.

Union Bank Of India: The state-owned lender said that Nitesh Ranjan’s term as the bank’s executive director has been extended by two years. His current term expires on March 9, 2024.

Jindal Steel and Power: Naveen Jindal will retire as executive director on September 30, but continue as non-executive director with edffect from October 1.

Bank of Maharashtra: The lender has signed an MoU with the Indian Renewable Energy Development Agency to promote and facilitate co-lending and loan syndication for a diverse spectrum of renewable energy projects across the country.

NBCC: The company has won a Rs 150 crore order from the Khadi and Village Industries Commission to construct office buildings, residential campuses, and redevelop, repair, and renovate KVIC properties across India.

Blue Star: The air conditioners manufacturer has opened the qualified institutions placement issue on September 18, to raise up to Rs 1,000 crore. The floor price has been fixed at Rs 784.55 per share.

Lemon Tree Hotels: The hospitality company announced the opening of Lemon Tree Hotel, Haridwar, in two phases. This is would be the eighth property of the group in Uttarakhand. The property will have 44 rooms and suites, and out of that 24 rooms are opening in the first phase. The hotel will be managed by Carnation Hotels Private Limited, a wholly owned subsidiary of the company.

JK Lakshmi Cement: The company will acquire a 20.8% stake in Amplus Helios for Rs 21.6 crore to source 40 MWAC of solar power for its Durg unit under the captive power plant mode.

Amber Enterprises: The company’s unit, Iljin Electronics India, has entered into a joint venture with Nexxbase Marketing, owner of the ‘Noise’ brand, to design, manufacture, and sell electronic wearables, including smartwatches and earphones.

Welspun Corp: In an exchange filing, the company said it has entered into an agreement with a reputed party for liquidation of a part of specified assets lying at Dahej Shipyard of the company for a consideration of approximately Rs 80 crore.

Prakash Industries: The company announced that it has received environmental clearance for its Chhattisgarh commercial coal mine from the government. The development of the mine is in progress, and the mining lease is likely to be executed by the next quarter.

BL Kashyap and Sons: The civil engineering and construction company has bagged a new order worth Rs 167 crore from Delhi International Airport. The work order includes civil and structure works for SAM project and the total order book will stand at Rs 3,005 crore.

Ashoka Buildcon: The infrastructure company has received orders from Maharashtra State Electricity Distribution Company Limited (MSEDCL) for various projects under the ‘Development of Distribution Infrastructure under Revamped Distribution Sector Scheme (RDSS) for Loss Reduction Works’. The total contract value of all the projects is Rs 645.7 crore excluding GST.