Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.72% lower at 17,571, signalling that Dalal Street was headed for a negative start on Thursday.

Asian shares were mixed after Federal Reserve Chair Jerome Powell said the US central bank had made progress in taming inflation and raised hopes that the central bank will soon end its monetary tightening policy. The Nikkei 225 index was up 0.16%, while Topix was sown 0.29%. The Hang Seng rose 0.25%, while CSI 300 index slipped 0.06%. The US central bank increased interest rate by 25 basis points after a year of aggressive rate hikes.

Indian rupee stood at 81.92 against the US dollar on Wednesday

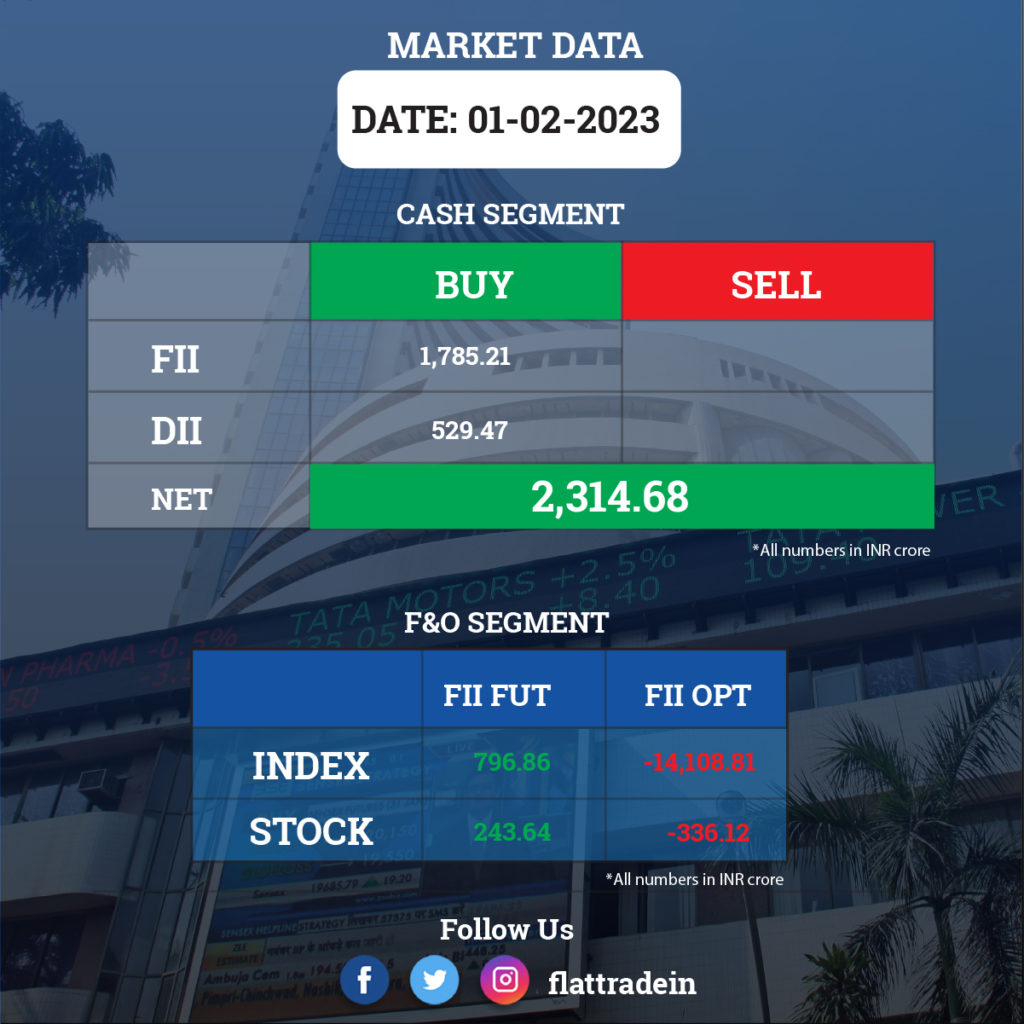

FII/DII Trading Data

Upcoming Results

HDFC, Tata Consumer Products, Titan Company, Aditya Birla Capital, Dabur India, Deepak Fertilisers, Godrej Properties, Aegis Logistics, Apollo Tyres, Bajaj Electricals, Berger Paints India, Birlasoft, Cera Sanitaryware, Coromandel International, Crompton Greaves Consumer Electricals, Karnataka Bank, Max India, SIS, Ujjivan Small Finance Bank, and Welspun Corp will report their quarterly results today.

Stocks in News Today

Adani Enterprises: The company in an exchange filing said that it has cancelled its Follow-On Public Offering (FPO) and will return money to its investors amid ongoing controversy after American short seller, Hindenburg Research, accused the company of using tax havens and flagged debt concerns in a report. The company’s board at its meeting on Wednesday (February 1, 2023) has decided, in the interest of its subscribers, not to proceed with the further public offer (FPO) of equity shares aggregating up to Rs 20,000 crore of face value Rs 1 each on partly paid-up basis, which was fully subscribed, the company said. Gautam Adani, Chairman, Adani Enterprises, said that the decision was taken amid the fluctuations the group’s stocks saw during the day’s trading.

Britannia Industries: The company has reported a 156% year-on-year growth in consolidated profit at Rs 932.4 crore for December FY23 quarter led by strong operating performance and exceptional income of Rs 359 crore. Revenue from operations at Rs 4,197 crore grew by 17.4% over a year-ago period. EBITDA jumped 51.5% to Rs 817.6 crore for the quarter YoY.

Jubilant FoodWorks: The company recorded a 36% fall in net profit at Rs 88 crore for the three months ended December 2022 as against Rs 137 crore in the same period last fiscal. The operator of Domino’s food chain in India, saw a 10% YoY growth in revenue from operations to Rs 1,316 crore. The company’s EBITDA stood at Rs 290 crore, while margins declined 457 basis points to 22%. The performance during the quarter was mainly impacted due to high input and raw material costs. During the quarter, the company opened 64 new stores in India, resulting in a network of 1,814 stores across all brands.

Tata Chemicals: The company reported a 25.72% year-on-year (YoY) rise in its net profit to Rs 391 crore for the quarter ended December 2022. The company had reported a profit of Rs 311 crore in the same quarter of last fiscal. The company clocked a 32% increase in the revenue from operations at Rs 4,148 crore during the reported quarter as against Rs 3,141 crore in the year-ago period. The company’s EBITDA stood at 922 crore in Q3FY23, up 59.9% YoY, whereas, the EBITDA margin increased to 22.3% from 17.4%.

Ashok Leyland: The commercial vehicle maker has sold 17,200 units in the month of January 2023, growing 23% over a year-ago period with healthy growth across segments. Medium & heavy commercial vehicle sales increased by 28% to 11,050 units in the same period, and light commercial vehicle segment registered 17% YoY growth at 6,150 units for January.

Eicher Motors: Royal Enfield has sold 74,746 motorcycles in January 2023, rising 27% over 58,838 units sold in same month last year. But exports dropped by 23% to 7,044 motorcycles in the same period. The company has registered a 45% YoY growth by selling 6.91 lakh motorcycles in April 2022-January 2023 period.

Coal India: The country’s largest coal mining company has announced production of 71.9 million tonnes of coal for January 2023, growing 11.5% over a year-ago month, while offtake rose by 6.1% to 64.5 million tonnes in the same period.

Lakshmi Machine Works: The textile machinery manufacturer has reported a massive 76% year-on-year growth in profit at Rs 113 crore for quarter ended December FY23, backed by healthy operating performance and topline. Revenue from operations at Rs 1,222 crore increased by 34% compared to year-ago period.

Syngene International: Promoter Biocon has sold four crore shares of the company via open market transactions on February 1. As a result, its shareholding in Syngene reduced by 9.96% to 54.6 percent, from 64.56% earlier. Government of Singapore bought 1.57 crore shares of Syngene at Rs 560 per share.

Mahindra Logistics: The company’s consolidated net profit for the quarter ended December fell 22% YoY to Rs 1.39 crore, while revenue increased 17% YoY to Rs 1,330 crore.

IDFC: The financial services company reported a consolidated net profit of Rs 272 crore for the quarter ended December as against to Rs 18.2 crore a year ago. Meanwhile, the company’s revenue slumped 45% YoY to Rs 29.7 crore.

CDSL: The company’s consolidated net profit for the quarter ended December 2022 declined 11% YoY to Rs 74.6 crore, and revenue dropped 7% YoY to Rs 141 crore.

Rail Vikas Nigam: The company has bagged orders worth Rs 41.8 crore from Southern Railway to build railway infrastructure in the Chittoor district of Andhra Pradesh.

Hindustan Copper: The net profit for the quarter ended December 2022 plunged 53% YoY to Rs 80.2 crore, while revenue from operations rose slightly by 2.3% YoY to Rs 557 crore.

Dilip Buildcon: The infrastructure developer has bagged two hybrid annuity projects worth Rs 1,370 crore in Andhra Pradesh.

Craftsman Automation: The auto ancillary company has completed acquisition of 76% stake in DR Axion India. In December 2022, it had signed a definitive agreement for acquiring 8.57 crore shares of DR Axion India.

Alembic Pharmaceuticals: The pharma company has registered a 29% year-on-year decline in consolidated profit at Rs 122 crore for quarter ended December FY23. Revenue from operations increased 19% yoY to Rs 1,509 crore. Its US business grew by 10% to Rs 432 crore and India segment reported a 12% growth at Rs 545 crore.

Gillette India: The FMCG company has recorded a 5.6% YoY growth in profit at Rs 74.45 crore for quarter ended December FY23. Revenue for the reported quarter jumped 10% YoY to Rs 618.62 crore, helped by improved retail execution. At the operating level, EBITDA grew by 10.4% YoY to Rs 126 crore and margin increased by 12 bps to 20.37% weighed by higher input cost.

Ajanta Pharma: The specialty pharmaceutical formulation company reported a 30% YoY decline in net profit at Rs 135 crore. Revenue from operations grew by 16% YoY to Rs 972 crore. Its EBITDA fell 29% to Rs 170 crore in the same period.