Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.03% lower at 19,785, signalling that Dalal Street was headed for a flat-to-negative start on Monday.

Asian shares were trading higher as investors’ sentiments were buoyed by fresh signs of softening inflation and on expectations of more government stimulus to support the Chinese economy. The Nikkei 225 index jumped 1.65% and the Topix gaiend 1.44%. The Hang Seng surged 1.815 and the CSI 300 index rose 0.86%.

Indian rupee fell by 3 paise to 82.25 against the US dollar on Friday.

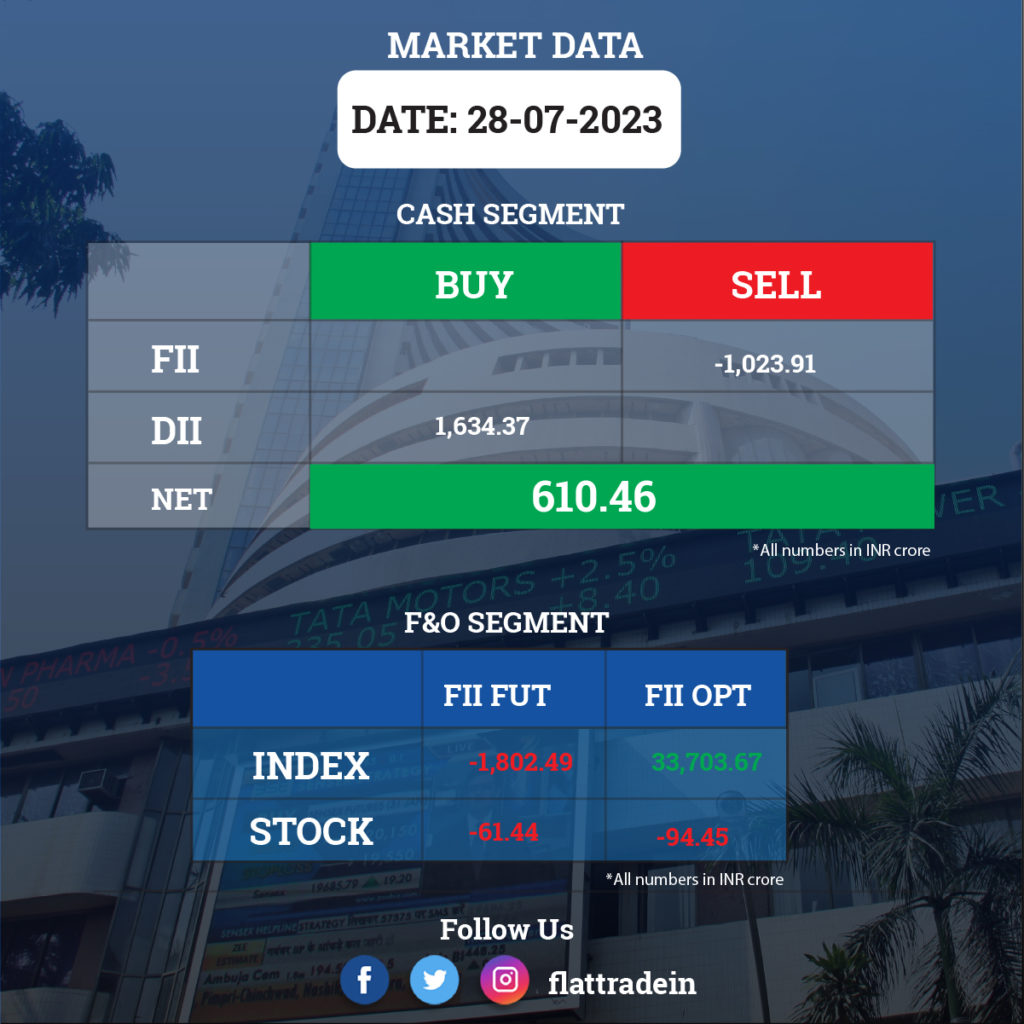

FII/DII Trading Data

Stocks in News Today

Power Grid Corporation of India: The state-owned company has been declared the successful bidder for two inter-state transmission system projects, which will come up under the build, own operate and transfer (BOOT) mode in Andhra Pradesh and Rajasthan. The company will also raise capital of about Rs 5,700 crore in FY24 in multiple tranches by selling bonds of up to Rs 1,900 crore in the first tranche. The base size of the first tranche is Rs 500 crore, with a green shoe option of Rs 1,400 crore.

SBI Cards and Payment Services: The company reported a rise of 5% in consolidated net profit at Rs 593 crore in Q1FY24, compared to Rs 626.9 crore in the corresponding period last year. The revenue from operations of the credit card issuing company increased 24% to Rs 4,046 crore, compared to Rs 3,263 crore in the year-ago period. The interest income increased by 30% at Rs 1,804 crore in Q1FY24, compared to Rs 1,387 crore in Q1FY23. The net interest margins of the company stood at 11.5%, down 176 basis points (bps). Its net non-performing assets were at 0.89% as of June 30, 2023, as against 0.79% as of June 30, 2022.

Piramal Enterprises: The diversified non-banking finance company reported a consolidated profit of Rs 509 crore for the first quarter of the financial year 2023-24, led by a gain of Rs 855 crore following the sale of stake in Shriram Finance. Profit in Q1FY23 was Rs 8,155 crore supported by an exceptional gain of Rs 7,614 crore related to pharma demerger. Net interest income fell 17% to Rs 891 crore compared from the year-ago period.

United Breweries: The beer manufacturer reported a decline of around 16% in consolidated net profit at Rs 136 crore, compared to Rs 161.8 crore in the corresponding period last year. The decline was attributed to higher excise duty and company costs. Its net revenue from operations during the first quarter of current fiscal stood at Rs 2,274.8 crore, a decline of 6.7% from Rs 2,438.7 crore in the year-ago period. Its Ebitda came in at Rs 223.1 crore, a decline of 16.2% YoY from Rs 265 crore in the corresponding period last year.

Bank of India: The public sector lender recorded a standalone profit of Rs 1,551 crore for the June quarter of FY24, up 176% YoY. Its net interest income increased 45% YoY to Rs 5,915 crore. Operating profit grew 72% to Rs 3,752 crore and non-interest income 27% to Rs 1,462 crore. Its net NPA improved by 56 bps year-on-year.

Star Health and Allied Insurance: The company reported a 35% increase in standalone net profit to Rs 288 crore in Q1FY24 as against a net profit of Rs 213 crore during the year-ago period. The company’s standalone total income during the June 2023 quarter rose to Rs 3,190 crore from Rs 2,809 crore in the year-ago period. Gross written premium increased to Rs 2,949 crore in Q1FY24 compared to Rs 2,464 crore in the same period a year ago.

Equitas Small Finance Bank: The bank reported a Profit After Tax (PAT) of Rs 191 crore in Q1FY24, up 97% YoY. Its quarterly disbursements stood at Rs 4,757 Cr, indicating a substantial 47% YoY growth. The bank’s gross advances grew by 36% YoY to Rs 29,601 crore. The bank’s net interest margin remained healthy at 8.76%. Its gross NPA improved by 135bps YoY to 2.60% in Q1FY24, while Net NPA improved by 95bps YoY to 1.12%.

Gland Pharma: The US Food and Drug Administration (US FDA) has concluded the inspection of the firm’s Visakhapatnam facility with zero 483 observations, with no action indicated. The FDA conducted the good manufacturing practice inspection of the oncology facility during July 20-28.

Godrej Properties: The Mumbai-based real estate developer’s board will meet on August 2 to consider a proposal to raise funds by way of debt securities via private placement.

Nazara Technologies: The gaming company posted an 31% rise in profit after tax at Rs 20.9 for the quarter ended June 2023. The profit after tax stood at Rs 15.9 crore in the corresponding period last year. Revenue from operations stood at Rs 254.4 crore in the quarter under review, up 13.9% from Rs 223.1 crore in the year-ago period a year ago. The company said gaming, esports and adtech segments contributed 43%, 46% and 11%, respectively, to the company’s overall revenues in Q1FY24.

Marico: The FMCG company reported a consolidated profit of Rs 436 crore in the June quarter, rising 15.6% from the year-ago period backed by healthy operating performance. Revenue from operations fell by 3.2% YoY to Rs 2,477 crore on weak India business and moderate growth in international business, with domestic volume growth at 3 percent.

Chalet Hotels: The company posted revenue from operations of Rs 311 crore for the quarter ended June 2023, up 23% YoY. The company reported a profit of Rs 89 crore for the quarter, a significant rise of 207% YoY. Sanjay Sethi, MD and CEO of Chalet Hotels, said average room rates have been holding strong with a 38% growth year-on-year, a key business performance indicator for the company.

Fino Payments Bank: The board approved a proposal for transitioning to a small finance bank. The approval is subject to fulfilling all regulatory requirements for the transition. The holding company Fino Paytech Ltd. proposed a corporate restructuring proposal. Fino Payments Bank board has created a committee to explore the possibilities of group corporate restructuring.

Divgi TorqTransfer Systems: The company has received an order from an overseas customer to supply components for the OE programme, worth Rs 180 crore. The company said production is expected to begin in the fourth quarter of fiscal 2024.

RITES: The company has appointed Krishna Gopal Agarwal as Chief Financial Officer of the company for a period of five years starting on or after August 1, 2023.

Shree Cement: The company has commenced commercial production at its clinker grinding unit in Purulia district of West Bengal, which has an annual cement capacity of three million tonnes.