Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading lower by 0.01% at 19,359, signalling that Dalal Street was headed for muted start on Friday.

Asian shares were trading higher, tracking gains in Wall Street overnight, as investors hoped that the US Federal Reserve has reached the end of its interest rate hike cycle. The Nikkei 225 index rose 1.1% and the Topix was up 0.51%. The Hang Seng jumped 2.31% and the CSI 300 index climber 0.98%.

The local currency strengthened 4 paise to close at 83.25 against the U.S dollar on Thursday.

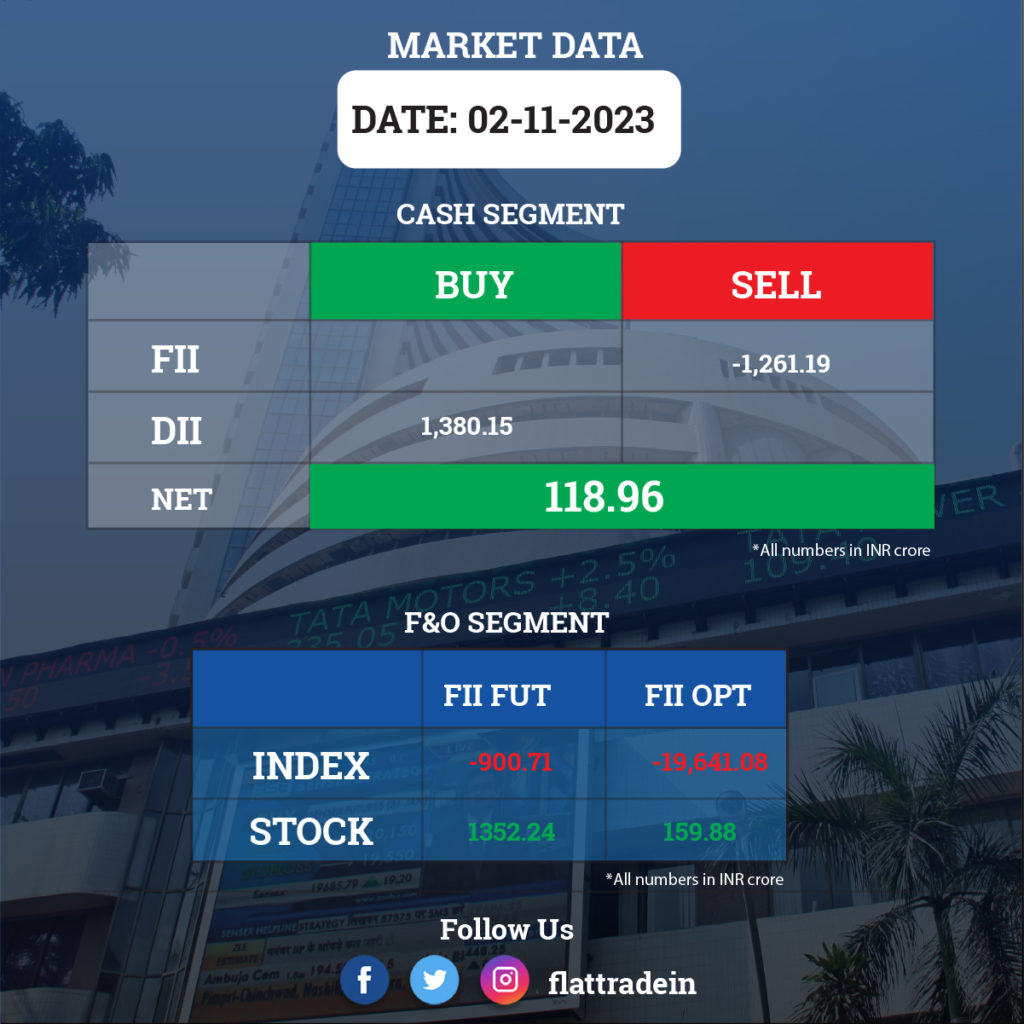

FII/DII Trading Data

Stocks in News Today

Tata Motors: The automaker reported a consolidated net profit of Rs 3,764 crore in Q2FY24 as against a net loss of Rs 945 crore in the year-ago period. Consolidated revenue from operations increased by 32% YoY to Rs 1.05 lakh crore. The automaker’s Ebitda rose 93% YoY to Rs 21,214 crore and operating margin expanded by 638 basis points year-on-year to 20.18% during the reported quarter.

Meanwhile, British subsidiary Jaguar Land Rover Automotive Plc reported a strong 30.4% YoY growth in revenue at 6.86 billion sterling pounds, driven by higher wholesale sales and cost reductions. The net debt declined to 2.2 billion sterling in the September quarter, with gross debt of 6.5 billion sterling. The profit before tax for the quarter was 442 million sterling, up by over 600 million sterling from the same period last year and the company generated a free cash flow of 300 million sterling in the September quarter.

Larsen & Toubro (L&T): The company has offloaded 100% stake in L&T Infrastructure Engineering (LTIEL) to STUP Consultants, a subsidiary of Assystem SA of France, for Rs 60 crore. This transaction aligns with the company’s commitment to focus on its core businesses and assets. The transaction is expected to be completed by January 15, 2024.

Container Corporation of India (CCI): The state-owned company posted over 21% rise in consolidated net profit at Rs 368.49 in Q2FY24 as against Rs 303.80 crore net profit in the year-ago period. The company’s total income rose to Rs 2,299.78 crore in Q2FY24 from Rs 2,029.74 crore in the year-ago period. Its expenses were at Rs 1,818.02 crore in Q2FY24 as against Rs 1,634.07 crore in Q2FY23. The board declared an interim dividend of Rs 3 per equity share of face value of Rs 5 each, amounting to Rs 182.79 crore for FY24 and the record date for payment of interim dividend is November 16.

Kalpataru Projects International (KPIL): The company posted a consolidated net profit of Rs 90 crore in Q2FY24, down 8.8% from a net profit of Rs 98 crore in the year-ago period. Its total income rose to Rs 4,530 crore in the quarter under review as against Rs 3,808 crore in the year-ago quarter. Expenses also surged to Rs 4,398 crore from Rs 3,659 crore in the September quarter of the previous fiscal. Its order book stood at Rs 47,040 crore as of September 30, 2023, an increase of 22% year-on-year.

Akzo Nobel India: The paints and coatings manufacturer reported a 44% increase in its consolidated net profit to Rs 94.2 crore in Q2FY24 from a net profit of Rs 65.4 crore in the year-ago period. Its revenue from operations was up 3.24% to Rs 956.3 crore during the second quarter of the current fiscal as against Rs 926.2 crore in the year-ago period. Its total expenses were down marginally year-on-year to Rs 838.3 crore in Q2FY24.

JK Lakshmi Cement: The cement company reported a 55 percent on-year growth in consolidated profit at Rs 96 crore for July-September period of FY24, driven by higher volume, better product & sales mix, and reduction in fuel cost. Revenue from operations increased by 14.6 percent on-year to Rs 1,574.5 crore during the quarter, with sales volume rising 13.8 percent YoY to 28.78 lakh tonnes.

Bombay Dyeing & Manufacturing: The company said its consolidate loss after tax narrowed to Rs 51.99 crore in Q2FY24 compared with a net loss of Rs 93.02 crore in the year-ago period. Its revenue from operations fell 40.87% to Rs 440.60 crore in Q2FY24 as against Rs 745.22 crore in the year-ago period. Total expenses for the September quarter were at Rs 581.11 crore, down% YoY. Revenue from the Polyester segment stood at Rs 344.19 crore in Q2FY24 as against Rs 449.24 crore in the corresponding quarter last fiscal. Its income from the Real Estate segment declined to Rs 80.60 crore in the reported quarter compared to Rs 280.48 crore in the year-ago period.

Indian Energy Exchange (IEX): The energy exchange registered a consolidated net profit at Rs 86.5 crore for the July–September period of FY24, up 21.4% over the corresponding period last fiscal. Revenue from operations grew by 14% YoY to Rs 108.5 crore during the quarter under review.

Ratnamani Metals and Tubes: The company’s consolidated revenue was up 25.7% YoY to Rs 1,131.2 crore in Q2FY24 as against Rs 899.8 crore in Q2FY23. Consolidated Ebitda was up 30.7% at Rs 244.8 crore in Q2FY24 as against Rs 187.4 crore in Q2FY23. Consolidated net profit was up 66.4% at Rs 164.3 crore in Q2FY24 as against Rs 98.8 crore in Q2FY23.

Sheela Foam: The company’s consolidated revenue was down 10.2% at Rs 613 crore in Q2FY24 as against Rs 683 crore in Q2FY23. Consolidated Ebitda fell 15.4% at Rs 66.2 crore in Q2FY24 as against Rs 78.3 crore in Q2FY23. Consolidated net profit fell 17.3% to Rs 44.3 crore in Q2FY24 from Rs 53.6 crore in Q2FY23.

Gujarat Gas: The company’s consolidated revenue grew 1.7% QoQ to Rs 3,845.4 crore in Q2FY24 from Rs 3,781.5 crore in the preceding quarter. Consolidated Ebitda was up 28% QoQ at Rs 496.6 crore in Q2FY24 from Rs 388 crore in Q1FY24. Consolidated net profit was up 37.2% at Rs 296.3 crore in Q2FY24 as against Rs 216 crore in the preceding quarter.

Chemplast Sanmar: The company’s consolidated revenue was down 17.3% at Rs 987.7 crore in Q2FY24 as against Rs 1,194.4 crore in Q2FY23. Consolidated Ebitda fell 53.3% to Rs 45.95 crore in Q2FY24 from Rs 98.42 crore in Q2FY23. Consolidated net profit fell 32.4% at Rs 26.05 crore in Q2FY24 compared with Rs 38.5 crore in the year-ago period.

KSB: The company’s consolidated revenue was up 30.7% at Rs 563.7 crore in Q2FY24 as against Rs 431.3 crore in Q2FY23. Consolidated Ebitda was up 29.9% at Rs 70.3 crore in Q2FY24 as against Rs 54.1 crore in Q2FY23. The company’s consolidated net profit rose 28.5% to Rs 50.1 crore in Q2FY24 as against Rs 39 crore in Q2FY23.

Religare Enterprises: The company recorded consolidated profit of Rs 40.4 crore for the quarter ended September FY24, against a loss of Rs 176.7 crore in the year-ago period. The company’s revenue from operations grew by 36% YoY to Rs 1,584.4 crore during the quarter.

Shilpa Medicare: The company has acquired Pilnova Pharma Inc. in the United States, which will now be a wholly owned subsidiary at a par value of $1 per share, according to its exchange filing. The transaction is expected to eb completed by November 15. The main object of the acquisition is to provide the marketing and sales support in the US market.

IFB Industries: The company has registered a 10.7% YoY decline in consolidated profit at Rs 21.53 crore in Q2FY24 due to decline in sales. Consolidated revenue from operations slipped 1.6% to Rs 1,101 crore compared to the year-ago period.