Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.21% higher at 19,491.50, signalling that Dalal Street was headed for positive start on Friday.

Asian markets were mixed. China’s stock market was trading higher after the country’s central bank said it would increase funding support for the private sector. The CSI 300 index rose 0.26% and the Hang Seng jumped 0.62%. Meanwhile, Japanese markets were down with the Nikkei 225 index falling 0.09% and the Topix index dropping 0.04%.

The Indian rupee fell 14 paise to 82.73 against the US dollar on Thursday.

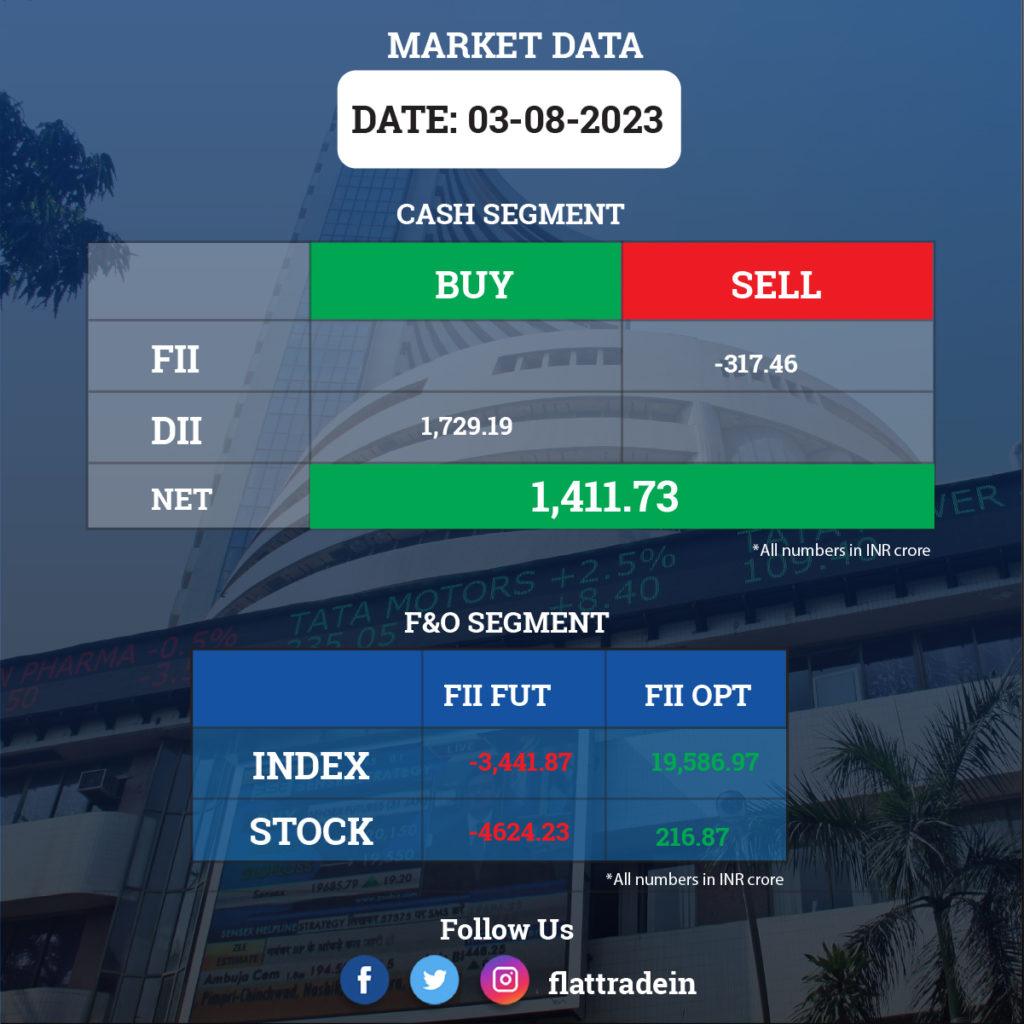

FII/DII Trading Data

Stocks in News Today

Bharti Airtel: The telecom operator has registered a profit of Rs 1,612.5 crore for the quarter ended June FY24, falling 46.4% from Rs 3005.6 crore in the previous quarter due to a foreign exchange loss of Rs 3,416 crore. Revenue from operations grew by 4% sequentially to Rs 37,440 crore in the quarter under review. Its mobile ARPU stood at Rs 200 in the reported quarter as against Rs 193 in the preceding period.

Maruti Suzuki India: The country’s largest car maker said that the board of directors will meet on August 8 to consider the mode of discharging consideration for the acquisition of 100% equity stake of Suzuki Motor Corporation in Suzuki Motor Gujarat. The payment will be done via either cash or preferential issuance of equity shares of Maruti Suzuki to Suzuki Motor Corporation.

Eicher Motors: The automobile company said its net profit surged 50.4% YoY to Rs 918.3 crore for the quarter ended June FY24 from Rs 611 in the year-ago period. Revenue rose 17.3% to Rs 3,986.4 crore in the quarter under review from Rs 3397.5 crore in the year-ago period. Ebitda was up 23% at Rs 1,021 crore in the reported quarter compared with Rs 831 crore in the year-ago period.

Hindalco Industries: The company’s subsidiary, Novelis Inc, has announced net income attributable to the common shareholders at $156 million for the quarter ended June FY24, falling 49% compared to the year-ago period. Net sales decreased 20% YoY to $4.1 billion during the quarter.

LIC Housing Finance: The housing finance company has registered a massive 43% YoY growth in profit at Rs 1,323.7 crore for the quarter ended June FY24. Net interest income grew by 38.4% to Rs 2,252.3 crore compared to the year-ago period. Net Interest Margin was at 3.21% in the reported quarter versus 2.51% in the preceding quarter. The board has appointed Tribhuwan Adhikari as Additional Director in the capacity of managing director and chief executive officer.

Paytm: Merchant payment volumes clocked by Paytm during the month of July surged by 39% on-year to Rs 1.47 lakh crore, as per its regulatory filing. Paytm’s loan distribution business during the month marked a growth of 148% on-year at Rs 5,194 crore. The number of loans disbursed in July stood at 43 lakh, which was up by 46% as against the year-ago period, the company informed the stock exchanges. Average monthly transacting users (MTU) stood at 9.3 crore in July, rising by 19% as compared to the same month of the previous year, Paytm said. The number of merchants paying subscription for payment devices has increased by 3.8 lakh in July to reach a total of 82 lakh, it further noted.

Zomato: The company’s consolidated revenue rose 70.86% to Rs 2,416 crore in Q1FY24 from Rs 1,414 crore in Q1FY23. Consolidated net profit stood at Rs 2 crore in Q1FY24 versus a net loss of Rs 186 crore reported in the year-ago period. Ebitda loss stood at Rs 48 crore in the quarter under review as against an EBITDA loss of Rs 307 crore in the year-ago period.

Torrent Power: The company through its subsidiary Torrent Urja 8, entered into a power transfer agreement with subsidiaries of Shapoorji Pallonji & Company (SPCPL) for the supply of 132 MW solar power for its desalination plants in Gujarat. The estimated project cost of the 132 MW project is Rs 700 crore.

NBCC: The company won a contract worth Rs 301 crore to construct a hostel-cum-residential block at University of Delhi on Design, Engineering, Procurement and Construction

(EPC) basis, according to its exchange filing. The contract is expected to be completed within 20 months.

KEC International: The company has secured new orders of Rs 1,065 crores across its various businesses including energy transmission and distribution and cables. The year-to-date order intake stands at Rs.4,500 crores, a growth of 30% y-o-y.

Lupin: The company’s consolidated net profit jumped to Rs 452 crore in Q1FY24 from Rs 89 crore in the year-ago period. Consolidated revenue was up 29% YoY to Rs 4,814 crore in Q1FY24 as against Rs 3,744 crore in Q1FY23. Consoldiated Ebitda soared to Rs 856 crore in the quarter under review from Rs 164 crore in the corresponding quarter last fiscal.

Deepak Nitrite: The company’s consolidated revenue was down 14.07% at Rs 1,768.34 crore in Q1FY24 from Rs 2,057.99 crore in Q1FY23. Consolidated net profit fell 36.10% to Rs 149.9 crore in Q1FY24 from Rs 234.62 crore in Q1FY23. Ebitda was also down 41.07% to Rs 209.75 crore in the quarter under review from Rs 355.98 crore in the year-ago period.

Radico Khaitan: The liquor maker posted a 26% rise in consolidated revenue of Rs 4,023.32 crore in Q1FY24 as against Rs 3,183.80 crore in Q1FY23. Consolidated net profit was up 10% at Rs 68.27 crore in Q1FY24 as against Rs 61.99 crore in Q1FY23. Ebitda was up 29% YoY at Rs 119.51 crore in Q1FY24 as against Rs 92.51 crore in Q1FY23.

Mahanagar Gas: The company’s consolidated revenues was up 5.71% at Rs 1,537.79 crore in Q1FY24 as against Rs 1,454.75 crore in Q1FY23. Consolidated net profit surged 98.92% to Rs 368.4 crore in Q1FY24 from Rs 185.2 crore in Q1FY23. Ebitda jumped 82.55% to Rs 521.27 crore in Q1FY24 from Rs 285.55 crore in Q1FY23.

HCC: The company reported a 15.7% rise in consolidated revenue in Q1FY24 at Rs 2564.83 crore as against Rs 2228.92 crore in the year-ago period. Consolidated net profit at Rs 52.73 crore in Q1FY24 as against a net loss of Rs 280.67 crore in Q1FY23. Ebitda was up 11.02% at Rs 314.47 crore in Q1FY24 as against Rs 26.16 crore in Q1FY23.

KEC International: The company’s consolidated revenues surged 27.89% to Rs 4,243.59 crore in Q1FY24 from Rs 3,318.08 crore in Q1FY23. Consolidated Net profit was up 36.46% at Rs 42.33 crore in Q1FY24 from Rs 31.02 crore in Q1FY23. Ebitda was up 45.08% at Rs 244.36 crore in Q1FY24 from Rs 168.43 crore in Q1FY23.

JM Financials: The company’s consolidated revenues was up 34.59% at Rs 1,064.95 crore in Q1FY24 as against Rs 791.25 crore in Q1FY23. Consolidated net profit was down 10.99% YoY at Rs 176.56 crore in Q1FY24 from Rs 198.38 crore in Q1FY23. Net Interest Margin stood at 6% in Q1FY24 as against 6.9% in Q1FY23. Net NPA was unchanged at 2.3% in Q1FY24 over Q1FY23. Gross Loan Book rose 26.06% to Rs 15,891 crore in Q1FY24 from Rs 12,606 crore in Q1FY23.

Cummins India: The diesel and natural gas engines manufacturer recorded a standalone profit of Rs 315.7 crore for the quarter ended June FY24, climbing 58.8% over the corresponding period last fiscal led by healthy topline and operating numbers. Revenue from operations grew by 31% YoY to Rs 2,208.7 crore during the same period.

SJVN: The company inked an MoU with Sikkim Urja for trade of 180 MW hydro power from SUL’s 1200 MW Teesta-III hydro electric project in Sikkim to distribution licensees and open access consumers.

Hatsun Agro Product: The company inaugurated its chocolate manufacturing unit in Telangana that has a capacity to manufacture 7000 kgs of chocolate per day.

JM Financial: The board approved the appointment of Nishit Shah as the Chief Financial Officer in place of Manish Sheth effective October 1.