Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.13% lower at 19,587, indicating that the Indian equities market was headed for a negative start on Thursday.

Asian stocks were mixed. Japan stock markets recouped losses to trade in the green. The Nikkei 225 index was up 0.42% and the Topix gained 0.59%. Meanwhile, Chinese equities markets were trading lower as investors digested the recently released weak economic data. The Hang Seng dropped 0.82% and the CSI 300 index fell 0.11%.

The Indian rupee rose 2 paise to 82.82 against the US dollar on Wednesday.

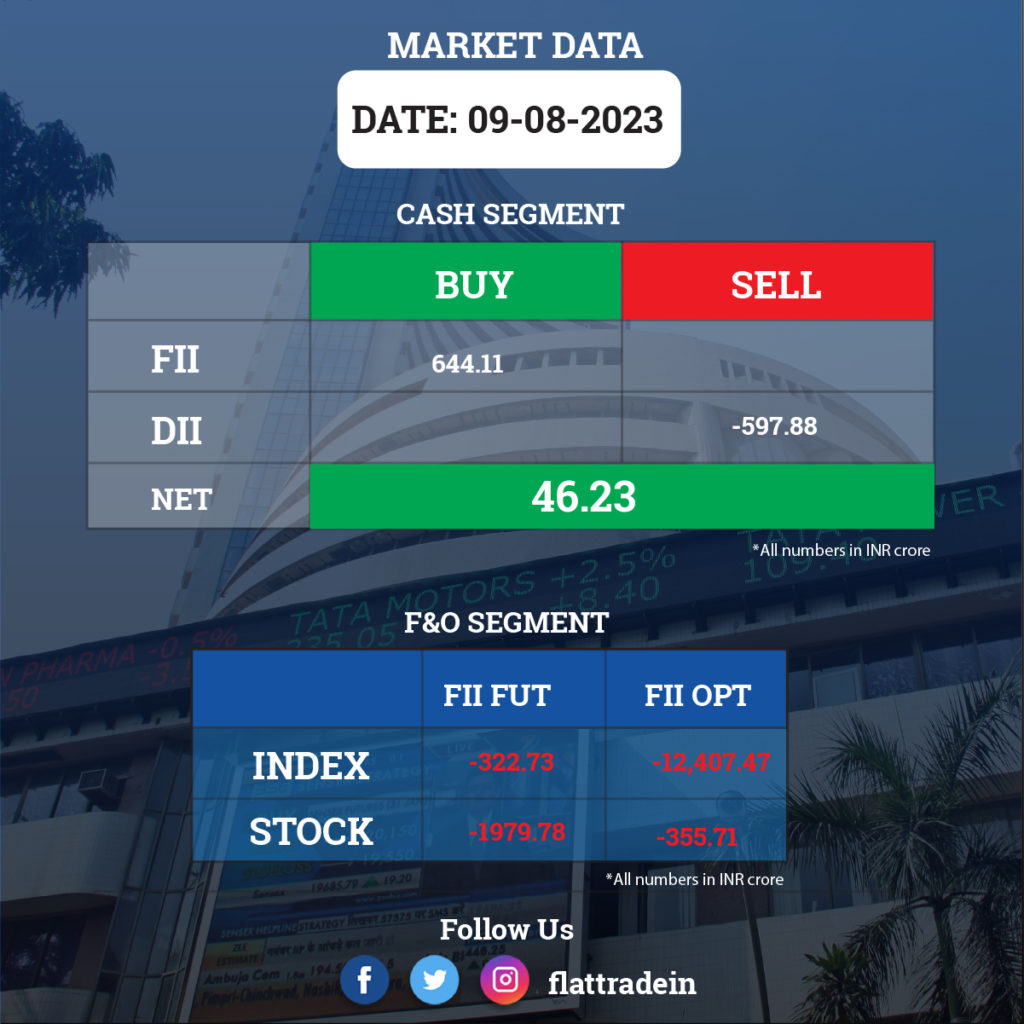

FII/DII Trading Data

Stocks in News Today

Tata Power Company: The Tata Group company has registered a consolidated profit of Rs 972.5 crore for the quarter ended June FY24, rising 22.4% over a year-ago period, while exceptional gain stood at Rs 234.7 crore. Revenue grew by 5% YoY to Rs 15,213.3 crore in the quarter under review from Rs 14,495.48 crore in the year-ago period. Ebitda was up 74.9% at Rs 2,943.59 crore in Q1FY24 as against Rs 1,683.39 crore in Q1FY23.

Axis Bank: The lender’s board has approved the proposal to infuse Rs 1,612 crore in Max Life through preferential allotment. After this infusion, the bank’s direct stake in Max Life will increase to 16.22%, and the collective stake of Axis Entities will increase to 19.02%. The bank plans to acquire 14.25 crore shares with a face value of Rs 10 each and a market value of Rs 113.06 apiece.

Zee Entertainment Enterprises (ZEE): The media company said its consolidated revenue from operations was up 7.6% at Rs 1983.80 crore in Q1FY24 as against Rs 1843.15 crore in Q1FY23. Ebitda was down 40.8% YoY at Rs 158.78 crore in Q1FY24 as against Rs 268.42 crore in Q1FY23. It reported a consolidated net loss of Rs 53.42 crore in Q1FY24 as against a net profit of Rs 106.60 crore in the year-ago period. Meanwhile, NCLT will give its verdict on the Zee-Sony merger today.

PI Industries: The company’s consolidated revenue was up 23.8% at Rs 1,910.40 crore in Q1FY24 as against Rs 1,543.20 crore in Q1FY23. Consolidated Ebitda was up 35.4% at Rs 467.80 crore in Q1FY24 as against Rs 345.60 crore in Q1FY23. Consolidated net profit jumped 45.9% to Rs 382.90 crore in Q1FY24 from Rs 262.40 crore in Q1FY23.

Suzlon Energy: The company has set the floor price at Rs 18.44 apiece for Qualified Institutional Placements that opened on August 9. It aims to raise Rs 1,500 crore, with a green shoe option of Rs 500 crore.

BSE: The stock exchange operator has recorded a consolidated profit of Rs 442.66 crore for the quarter ended June FY24, rising 10-fold over Rs 44 crore in the year-ago period, driven by 5% stake sale in associate company CDSL, higher investment income and other income. Revenue for the quarter grew by 15.4% YoY to Rs 215.62 crore.

Bata India: The footwear major has reported a consolidated profit of Rs 106.9 crore for the June FY24 quarter, falling 10.5% from Rs 119.4 crore from the year-ago period, primarily on the early start of the end-of-season sale and tepid operating performance. Revenue from operations for the quarter at Rs 958.15 crore, up by 1.6% YoY. Ebitda was down 2.1% to Rs 239.52 crore in Q1FY24 from Rs 244.67 crore in Q1FY23.

Indian Railway Catering and Tourism Corporation (IRCTC): The state-owned company has recorded a profit of Rs 231 crore for the quarter ended June 2023, down 7% from corresponding period last fiscal due to exceptional loss of Rs 51.9 crore and lower operating margin. Revenue from operations rose 17.5% YoY to Rs 1,001.8 crore during the reported quarter.

Bombay Dyeing: The company’s board has approved the termination of the deposit agreement and the delisting of GDR from the Luxembourg Stock Exchange.

Angel One: The stock broking company said its board has approved the Scheme of Arrangement involving the transfer of business undertakings to two subsidiaries—Angel Securities and Angel Crest. No cash consideration is payable for slump sales.

FDC: The board approved the acquisition of an additional 7% stake in its subsidiary FDC SA from other existing shareholders and the settlement of their existing outstanding loan with interest. It also approved the buyback of up to 31 lakh shares (1.87% of the total paid-up equity capital) at a price of Rs 500 apiece, for an aggregate amount not exceeding Rs 155 crore. Meanwhile, its consolidated revenue rose 8.4% to Rs 536.38 crore in Q1FY24 from Rs 494.66 crore in Q1FY23. Consolidated net profit jumped 55.4% YoY to Rs 109.81 crore during the quarter under review.

Waaree Renewable Technologies: The company received a work order for Turnkey EPC for engineering, procurement, and construction services in the setting up of a rooftop solar power project of 287 KWp capacity.

Abbott India: The company’s consolidated revenue was up 13.4% at Rs 1479 crore in the quarter ended June 2023 as agains Rs 1304.12 crore in the year-ago period. Consolidated Ebitda was up 31.4% at Rs 355 crore in the quarter under review from Rs 270.15 crore in the same period last fiscal. Consolidated net profit jumped 41.1% to Rs 290.24 crore in April-June 2023 quarter from Rs 205.64 crore in the year-ago period.

Force Motors: The company recoreded a consolidated revenue of Rs 1487.55 crore in Q1FY24, a jump of 53.2% from Rs 970.80 crore in Q1FY23. Ebitda soared over three times to Rs 180.6 crore in the quarter under review as against Rs 44.78 crore in Q1FY23. Consolidated net profit stood at Rs 68.49 crore in Q1FY24 versus a net loss of Rs 16.59 crore in the year-ago period.

V-Mart Retail: The clothing retialer said its consolidated revenue was up 15.4% YoY at Rs 678.52 crore in Q1FY24 as against Rs 587.88 crore in Q1FY23. Consolidated net loss stood at Rs 21.95 crore in Q1FY24 as against a net profit of Rs 20.45 crore in Q1FY23. Segment-wise, the revenue recorded through retail trade in Q1FY24 stood at Rs 661.15 crore, whereas, Rs 17.36 crore was through digital market place.

GMR Power and Urban Infra: The company in Q1FY2024 posted a consolidated revenue of Rs 1,124.22 crore, up 5.2% from Rs 1,068.68 crore in Q1FY24. Ebitda was up 4.7% at Rs 152.5 crore in Q1FY24 from Rs 145.61 crore in Q1FY23. Consoldiated net loss stood at Rs 217.75 crore in Q1FY24 as against a net profit of Rs 201.67 crore oin Q1FY23.

J B Chemicals and Pharmaceuticals: The company registered a consolidated net profit of Rs 142.32 crore in Q1FY24 from Rs 105.2 crore in Q1FY23. Consolidated revenue was up 14.2% YoY at Rs 896.20 crore in Q1FY24 as against Rs 784.81 crore in Q1FY23. Ebitda jumped 34.4% to Rs 232.11 crore in Q1FY24 from Rs 172.76 crore in Q1FY23.