Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading lower by 0.67% at 19637, signalling that Dalal Street was headed for a significant negative start on Monday.

Most Asian shares were trading lower as oil prices surged due to the conflict between Israel and Hamas. The Nikkei 225 index fell 0.26% and the Topix inched up 0.01%. The CSI 300 index was down by 0.53%. The Hong Kong stock exchange delayed trading in both the securities and derivatives markets on Monday morning due to Typhoon Koinu.

The Indian rupee closed at 83.25 against the US dollar on Friday.

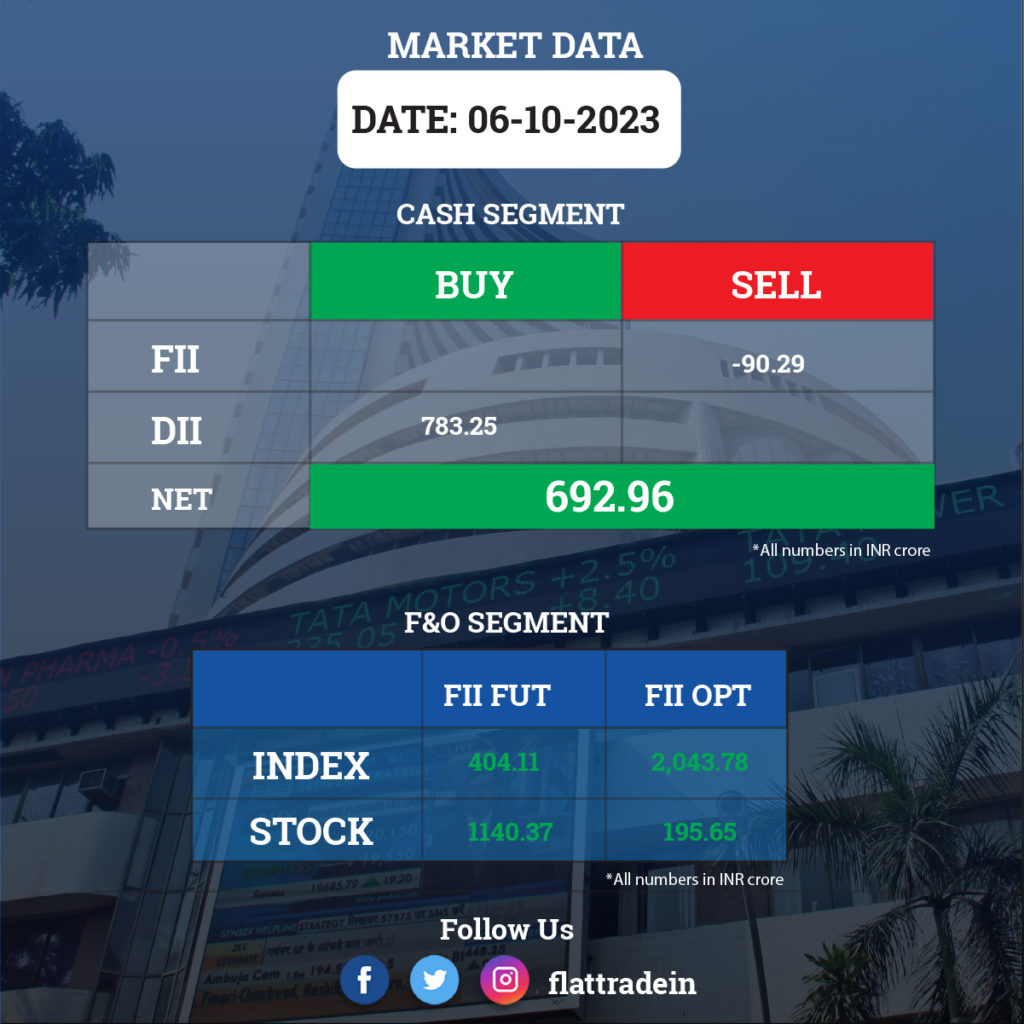

FII/DII Trading Data

Stocks in News Today

TCS: The IT services company said that the company’s board would consider a proposal for buyback of equity shares of the company, on October 11. The company is also scheduled to announce earnings for July-September and April-September periods of FY24.

Reliance Industries (RIL): A subsidiary of Abu Dhabi Investment Authority (ADIA) will invest Rs 4,966.8 crore in Reliance Retail Ventures, a subsidiary of RIL. This investment values Reliance Retail Ventures at a pre-money equity value of Rs 8.381 lakh crore. The investment by ADIA will translate into an equity stake of 0.59% in Reliance Retail Ventures on a fully-diluted basis.

Titan Company: The Tata Group company registered a revenue growth of 20% YoY for the quarter ended September FY24, with jewellery division growing 19%, watches & wearables segment rising 32% and eyecare segment registering 12 percent YoY growth. Emerging businesses growth stood at 29% YoY, while CaratLane grew by 45% YoY for the quarter.

Bank of Baroda: The public sector lender said its total business crossed Rs 22 lakh crore mark in the quarter ended September FY24, up 15.88% over a year-ago period, as per provisional numbers. Total advances of the bank grew by 17.43% YoY and 3.51% QoQ to Rs 10.25 lakh crore and deposits increased by 14.63% YoY and 4.15% QoQ to Rs 12.49 lakh crore as of September FY24.

Biocon: The company announced the signing of a partnership agreement with Juno Pharmaceuticals, a specialty pharmaceutical company in Canada, for the

commercialization of its vertically integrated, complex formulation, Liraglutide, a drug-device combination for the treatment and management of Type 2 diabetes and obesity. Under the terms of this agreement, Biocon will be responsible for obtaining regulatory approval for Liraglutide, and thereafter, for the manufacture and supply of the product in the Canadian market.

Adani Energy Solutions: The company has acquired a 100% stake in Sangod Transmission Service Limited (“STSL”) from Rajasthan Rajya Vidyut Prasaran Nigam Limited as per the Share Purchase Agreement. The transaction was through cash at a face value of Rs 10 apiece.

Metropolis Healthcare: The company has recorded 13% YoY growth in its core business revenue for the quarter ended September FY24, which included Hi-tech but excluded Covid, Covid allied & PPP contracts, as per provisional data. Revenue growth was largely driven by volume growth demonstrating strong customer acquisition.

Tata Motors: JLR Automotive PLC, a subsidiary of the company, announced the commencement of three separate offers to purchase for cash any and all of the outstanding series of notes. The offers for notes will expire on October 13.

Prestige Estates Projects: The real estate developer recorded a 102% year-on-year growth in sales at Rs 7,092.6 crore for the quarter ended September FY24. The quarterly collections at Rs 2,639.8 crore grew by 1% YoY.

Punjab National Bank: The public sector lender has appointed Sanjeevan Nikhar as Group Chief Compliance Officer with immediate effect.

TVS Motor: The company has started production of CE 02 at the company’s Hosur manufacturing plant in Tamil Nadu. CE 02 is the company’s first electric vehicle which is jointly designed and developed with BMW Motorrad.

IDFC First Bank: The company informed in an exchange filing that the Capital Raise and Corporate Restructuring Committee of the Board of Directors of the Bank has approved the issue and allotment of 33,24,09,972 equity shares of face value of Rs 10 each to qualified institutional buyers at an issue price of ₹ 90.25 per equity share aggregating to Rs 3,000 crore.

Kaynes Technology: The company announced the setting up of a semiconductor plant in Kongara Kalan, Telangana, with an investment of Rs 2,800 crore.

Indian Energy Exchange: The company has signed a Share Subscription Agreement and Shareholders’ Agreement with Enviro Enablers India Private Limited (EEIPL), a prominent player in the environmental sector. Under this agreement, IEX will acquire 10% stake in the Company through Compulsory Convertible Preference Shares (CCPS) from EEIPL.