Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.03% higher at 19,863.50, signalling that Dalal Street was headed for muted start on Friday.

Most Asian shares were trading higher. Japan’s Topix rose 0.26%, while the benchmark Nikkei 225 index fell 0.22%. The Hang Seng jumped 1.09% and the CSI 300 index rose 0.52%.

Indian rupee appreciated by 11 paise by to 81.99 against the US dollar on Thursday.

Utkarsh Small Finance Bank shares will debut on the bourses today. The issue price has been fixed at Rs 25 per share.

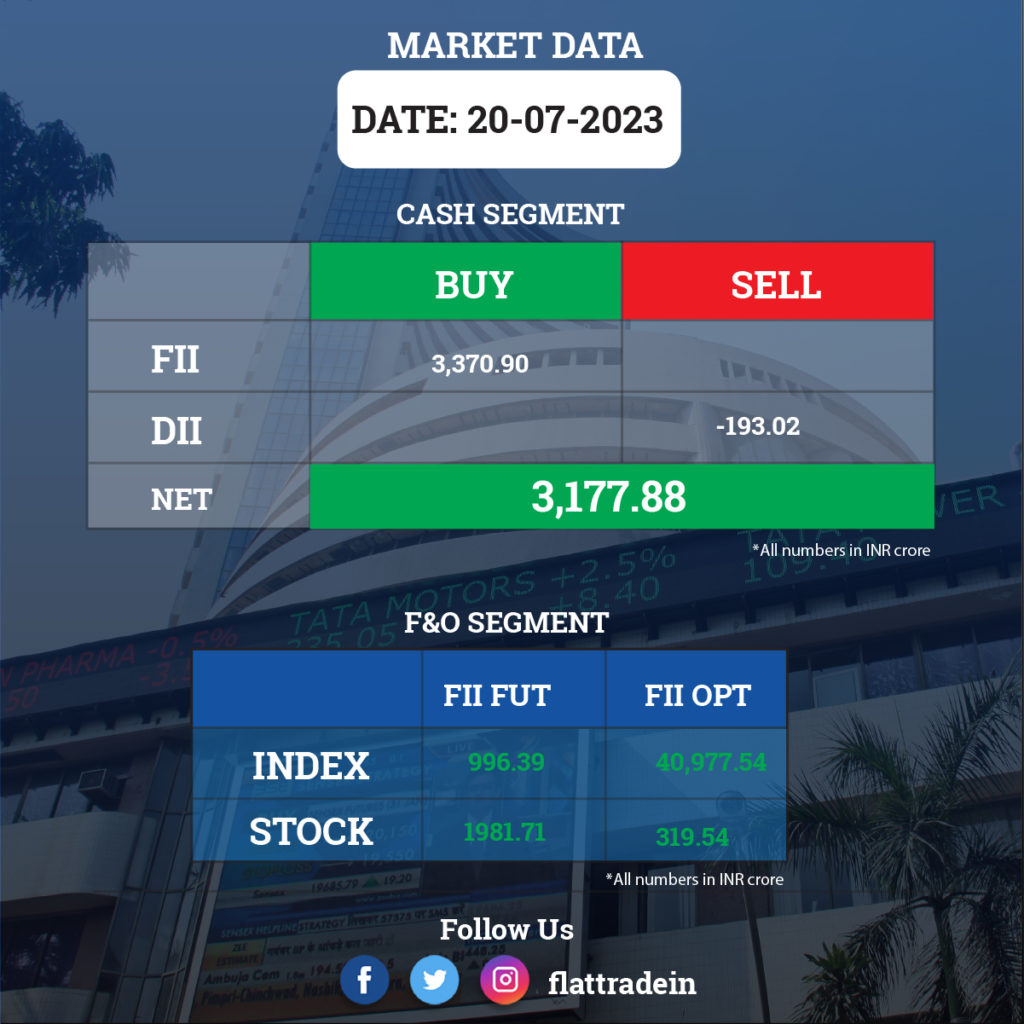

FII/DII Trading Data

Upcoming Results

Reliance Industries, HDFC Life Insurance Company, JSW Steel, UltraTech Cement, Ashok Leyland, Vedanta, One 97 Communications, Aarti Drugs, CMS Info Systems, CreditAccess Grameen, Cyient DLM, DLF, Dodla Dairy, Glenmark Life Sciences, Hindustan Zinc, Ramkrishna Forgings, Tejas Networks, Atul, Aditya Vision, GNA Axles, Kabra Extrusiontechnik, PNB Gilts, Rajratan Global Wire, and Wendt (India)

Stocks in News Today

Infosys: The IT major said its net profit (after minority interest) grew 10.9% YoY to Rs 5,945 crore for the June quarter compared with Rs 5,360 crore in the same quarter last year. Net sales rose 10% YoY to Rs 37,933 crore from Rs 34,470 crore in the corresponding quarter last year. Revenue came in at $4,617 million in dollar terms, with the IT firm clocking 1% sequential (up 4.2% YoY) sales growth in constant current (CC) terms. Large deal wins came in at $2.3 billion. The IT firm has revised downward its FY24 CC revenue guidance to 1-3.5% compared with 4-7% suggested earlier. It has maintained its Ebit margin guidance at 20-22%.

Hindustan Unilever (HUL): The FMCG major registered a 6.1% year-on-year growth in revenue at Rs 15,148 crore and 8% YoY growth in profit at Rs 2,472 crore for quarter ended June FY24 over the year-ago period, as the company registered growth in all its key segments. EBITDA grew by 8.4% to Rs 3,521 crore with margin expansion of 50 bps at 23.2% compared to year-ago period. The underlying volume growth stood at 3% for the quarter.

Larsen & Toubro (L&T): The engineering and infrastructure major said the board of directors will meet on July 25 to consider the buyback of equity shares of the company, and special dividend for FY24. If approved, the record date for determining the entitlement of the equity shareholders for the said dividend will be August 2.

IndiaMart InterMesh: The company’s consolidated net profit jumped 78% to Rs 83 crore for the first quarter ended June. It was Rs 47 crore in the year-ago period. Revenue from operations jumped 26% to Rs 282 crore for the April-June period, as against Rs 225 crore in the same period of last year. The company reported an Ebitda of Rs 77 crore for the quarter ended June, while margins stood at 27.4%. Further, the board has approved a proposal for a buyback of 12.5 lakh equity shares for an amount not exceeding Rs 500 crore. The buyback price is fixed at Rs 4,000, which is a 37% premium from the current levels. The buyback will be executed on a proportionate basis through the tender route.

ICICI Securities: The company’s standalone revenue was up 18% YoY to Rs 934.31 crore in Q1FY24 as againt Rs 793.55 crore in Q1FY23. Its net interest income was up 17% YoY to Rs 749.7 crore in Q1FY24 as against Rs 693.2 crore in Q1FY23. Standalone net profit fell 1% to Rs 270.84 crore in Q1FY24 from Rs 273.59 crore in the same quarter last fiscal.

Coforge: The company’s consolidated revenue was up 2.4% at Rs 2221 crore in Q1FY24 as againt Rs 2170 crore in the preceding quarter. EBIT was up 2.9% at Rs 230.3 crore in the reported quarter from Rs 223.8 crore in the preceding quarter. Net profit jumped 44% to Rs 165.3 crore in Q1FY23 as againt Rs 114.8 crore in Q4FY23.

Union Bank of India (UBI): The public sector lender’s standalone net interest income was up 16.5% YoY to Rs 8839 crore in Q1FY24 as againt Rs 7581 crore in the year-ago period. Its standalone net profit doubled to Rs 3236 crore in Q1FY24 as against Rs 1558 crore in Q1FY23. Net NPA stood at 1.58% as againt 1.70% in the preceding quarter.

United Spirits: The liquor manufacturer reported a 82% YoY jump in consolidated net profit to Rs 476.7 crore June 2023 quarter as against Rs 261.10 crore posted in the corresponding quarter last fiscal. The company reported an 18% fall in its revenue from the operations for the reported quarter ended June 2023 to Rs 5,804 crore as against Rs 7,131.3 crore in the year-ago quarter. Its consolidated Ebitda was at Rs 714 crore, up 129.4% on rebased prior year comparators.

Jindal Stainless: The country’s largest stainless steel manufacturing company has completed the acquisition of Jindal United Steel. Earlier, the company held 26% stake in Jindal United Steel, and now it has acquired the remaining 74% equity stake in Jindal United Steel for a cash consideration of Rs 958 crore. With this, Jindal United Steel becomes a 100-percent subsidiary of Jindal Stainless.

LTIMindtree: The company has announced strategic partnership with CYFIRMA, an external threat landscape management platform company, to enhance the threat intelligence capabilities of its XDR platform and help global enterprises identify, evaluate, and manage potential risks and threats.

Hindustan Aeronautics: The state-owned defence major and Argentina have signed a Letter of Intent (Lol) on productive cooperation and acquisition of light and medium utility helicopters for the armed forces of the Argentine Republic.

Persistent Systems: The Pune-based IT company has reported net profit at Rs 228.8 crore for the quarter ended June FY24, a drop of 9% compared to previous quarter, dented by weak operating performance. Revenue in rupee terms grew by 3% QoQ to Rs 2,321.2 crore and topline in dollar terms also increased by 3% to $282.90 million for the quarter.

IndusInd Bank: The board of the bank approved raising Rs 20,000 crore via debt securities on a private placement basis.

Mphasis: The company’s revenue fell 3% to Rs 3,252 crore in Q1FY24 as againt Rs 3,361 crore in the preceding quarter. Net profit fell 2% QoQ to Rs 396.05 crore in Q1FY24 as againt Rs 405.3 crore in the previous quarter. EBIT fell 3% to Rs 500 crore in Q1FY24 from Rs 515.27 crore in Q4FY23.

Dalmia Bharat: The company’s consolidated revenue was up 10% at Rs 3,624 crore in Q1FY24 as againt Rs 3,302 crore in Q1FY23. Ebitda rose 4% to Rs 610 crore in the reported quarter as againt Rs 586 crore in the year-ago period. Net profit plunged 30% to Rs 144 crore in Q1FY24 as againt Rs 205 crore in Q1FY23.

HMT: The company’s consolidated revenue was up 31% to Rs 108 crore in Q1FY24 as againt Rs 82 crore in Q1FY23. Ebitda loss stood at Rs 29 crore in Q1FY24 as againt Rs 47.6 crore in Q1FY23. Net loss was at Rs 33.5 crore in Q1FY24 as againt a net profit of Rs 635.12 crore in Q1FY23.

Tanla Platforms: The company’s consolidated revenue rose 14% YoY to Rs 911 crore in the quarter ended June 2023 as againt Rs 800 crore in the same quarter last fiscal. Ebitda rose 39% to Rs 182.22 crore in the reported quarter as againt Rs 130.7 crore in the eyar-ago period. Net profit rose 35% YoY to Rs 135.4 crore in the quarter ended June as againt Rs 100.41 crore in the corresponding quarter last fiscal.

360 One Wam: The company has reported total income of Rs. 566.85 crores during the period ended June 30, 2023 as compared to Rs.479.29 crores during the period ended June 30, 2022. The company has posted net profit of Rs.183.76 crore for the period ended June 30, 2023 as against net profit of Rs.156.58 crore for the period ended June 30, 2022. The company has reported EPS of Rs.5.05 for the period ended June 30, 2023 as compared to Rs.4.35 for the period ended June 30, 2022. The company has fixed 28 July 2023 as record date for second interim dividend for FY24 of Rs 4 per equity share of face value of Re 1 each. The said dividend will be paid on or before 18 August 2023.