Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading lower by 0.02% at 19,536, signalling that Dalal Street was headed for a flat start on Monday.

Most Asian markets were trading higher, tracking Wall Street gains on Friday last week, as investors awaited the US inflation data due on Tuesday.The Nikkei 225 index rose 0.56% and the Topix advanced 0.26%. The Hang Seng rose 0.02%, while the CSI 300 index fell 0.55%.

The Indian rupee fell 5 paise to 83.34 against the US dollar on Friday.

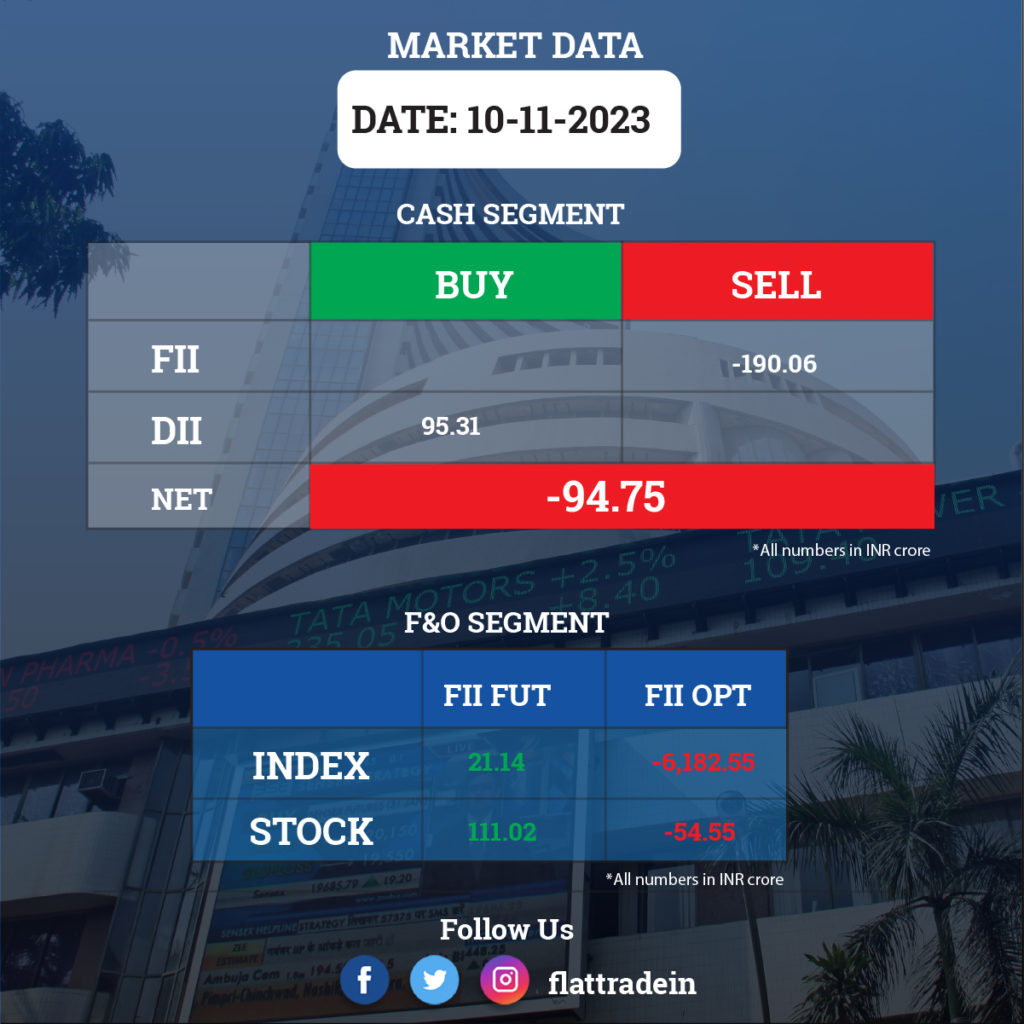

FII/DII Trading Data

Stocks in News Today

Life Insurance Corporation (LIC): The insurer reported a 50% decline in net profit at Rs 7,925 crore for the quarter ending September 2023. LIC had reported a net profit of Rs 15,952 crore in Q2FY23. The decline in net profit is due to chengee in accounting policy in September 2022 with respect to the transfer of the amount (net of tax) related to the accretion on the available solvency margin from the non-participating policyholder’s account to the shareholder’s account. During FY23, Rs 27,241 crore (net of tax) was transferred, including Rs 14,272 crore (net of tax) in the quarter ended September 2022. The first-year premium rose 10% to Rs 9,988 crore in Q2FY24 from Rs 9,142 crore in Q2FY23.

Oil and Natural Gas Corporation (ONGC): The company reported a 65.5% YoY rise in consolidated net profit for the quarter ended September 2023 at Rs 13,734 crore. Revenue from operations dropped by 13% on year to Rs 1.47 lakh crore. Other income for the quarter under review was at Rs 2,515 crore, compared to Rs 2,326 crore in the year-ago period. Total expenses in Q2FY24 was Rs 1.28 lakh crore, compared to Rs 1.61 lakh crore in the same period last fiscal. The board has recommended an interim dividend of Rs 5.75 per share for the current financial year. and the record date is fixed as November 21. The company has approved an additional investment of Rs 3,501 crore in JV ONGC Petro Additions.

Eicher Motors: The company registered its highest-ever net profit of Rs 1,016 crore for the second quarter ended September 2023, up 55% from Rs 657 crore net profit in the same period last fiscal. Revenue from operations stood at Rs 4,115 crores in the quarter under review, up 17% from Rs 3,519 crores in the corresponding quarter of FY23. Ebitda stood at Rs 1,087 crores, up 32% from Rs 822 crores in the same quarter of the last financial year. Royal Enfield sold 229,496 motorcycles in the reported quarter, an increase of 13% from 203,451 motorcycles sold over the same period in FY23.

Biocon: The company said its consolidated revenue was up 49.3% at Rs 3,462.3 crore in Q2FY24 as against Rs 2,319.7 crore in Q2FY23. Its consolidated Ebitda jumped 57.5% to Rs 741.6 crore in Q2FY24 from Rs 470.7 crore in Q2FY23. The company’s consolidated net profit soared 111.1% to Rs 172.7 crore in Q2FY24 from Rs 81.8 crore in Q2FY23.

Coal India: The state-owned company said its revenue was up 9.8% to Rs 32,776.4 crore in Q2FY24 from Rs 29,838.1 crore in Q2FY23. Consolidated Ebitda rose 11.8% to Rs 8,137 crore in Q2FY24 from Rs 7,280.3 crore in Q2FY23. Its consolidated net profit rose 12.7% to Rs 6,813.5 crore in Q2FY24 from Rs 6,044 crore in Q2FY23. The company’s board has approved an interim dividend of Rs 15.25 per share.

Dr Reddy’s Laboratories: The drugmaker has acquired a 26% stake in O2 Renewable Energy, a SPV, for Rs 24 crore for accessing renewable power through the Inter-State Transmission System under a captive structure. The Company will invest upto an amount not exceeding Rs. 24 crore by way of investment through equity and compulsory convertible debentures

Sun TV Network: The media company’s net profit rose 13.86% to Rs 456.24 crore in Q2FY24, up from Rs 400.71 crore in Q2FY23. Ebitda grew 36.48% YoY to Rs 716.21 crore in Q2FY24 from Rs 524.78 crore in Q2FY23. Total revenue for the quarter increased by 27.48% YoY to Rs 1,125.08 crore, while operating revenue was up by 28% to Rs 1,017.98 crore. The company’s board has declared an interim dividend of Rs 5 per share.

Glenmark Pharmaceuticals: The company said its consolidated revenue was up 6.3% at Rs 3,207.4 crore in Q2FY24 as against Rs 3,018 crore in Q2FY23. Consolidated Ebitda fell 3.5% to Rs 462.2 crore in Q2FY24 as against Rs 479 crore in Q2FY23. Ebitda margin fell 146 bps to 14.41% in Q2FY24 as against 15.87% in Q2FY23. The company reported a net loss of Rs 61.6 crore in Q2FY24 as against a net profit of Rs 278.6 crore iin Q2FY23.

SAIL: The company reported a consolidated revenue of Rs 29,712 crore in Q2FY24, up 13.2% from Rs 26,246 crore in Q2FY23. Consolidated Ebitda stood at Rs 3,875 crore in Q2FY24 as against Rs 735 crore in Q2FY23. The company’s net profit stood at Rs 1,306 crore in Q2FY24 as against a net loss of Rs 329 crore in Q2FY23.

Rashtriya Chemicals And Fertilizers: The company’s consolidated revenue fell 25.5% to Rs 4,155 crore in Q2FY24 from vs Rs 5,576 crore in Q2FY23. Its consolidated Ebitda tumbled 73.9% to Rs 106 crore in Q2FY24 from Rs 405 crore in Q2FY23. The company reported a net pf Rs 51 crore in Q2FY24, down 80.5% from Rs 262 crore in Q2FY23.

Tata Chemicals: The Tata Group company said its consolidated revenue fell 5.7% to Rs 3,998 crore in Q2FY24 from Rs 4,239 crore in Q2FY23. The company’s consolidated Ebitda fell 11% to Rs 819 crore in Q2FY24 from Rs 920 crore in Q2FY23. The company’s consolidated net profit fell 27.2% to Rs 495 crore in Q2FY24 from Rs 680 crore in Q2FY23. The operating performance was impacted due to lower volumes in the USA, the UK, and Kenya and price decline in India and Kenya.

PTC India: The company’s consolidated revenue rose 6.2% to Rs 5,203 crore in Q2FY24 from Rs 4,899 crore in Q2FY23. The company’s consolidated Ebitda was up 15.6% to Rs 414 crore in Q2FY24 from Rs 358 crore in Q2FY23. The company reported a net profit of Rs 202 crore in Q2FY24, up 46.4% from Rs 138 crore in Q2FY23.

Fortis Healthcare: The hospital chain reported a consolidated net profit of Rs 183.9 crore in Q2FY24, down 15.7% YoY due to a weak operating margin. Revenue from operations grew by 10% YoY to Rs 1,770 crore during the quarter under review.

Power Mech Projects: The infrastructure company has reported a 20% YoY rise in consolidated net profit at Rs 51.3 crore in the quarter ended September 2023. Revenue from operations grew by 20.9% YoY to Rs 932.5 crore in Q2 FY24.