Market Opening - An Overview

GIFT Nifty on the NSE IX was trading 0.12% at 20,190, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were trading lower amid investors awaiting monetary policy decision from the Federal Reserve and Bank of Japan due this week. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.5%, the Hang Seng index fell 0.58%, and the CSI 300 index rose 0.61%. Japanese markets are closed for a holiday.

The Indian rupee weakened by 14 paise to close at Rs 83.18 against the US dollar on Friday.

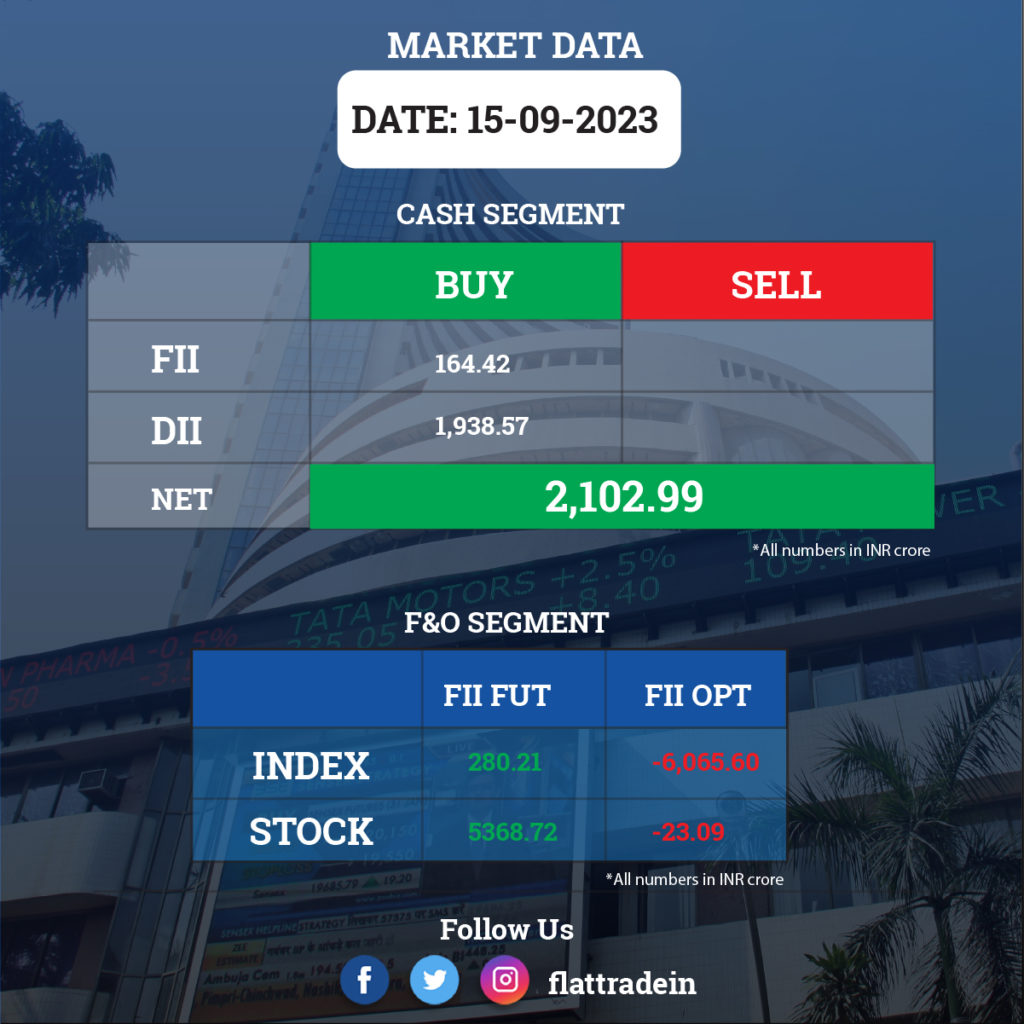

FII/DII Trading Data

Stocks in News Today

Tata Steel: The steel manufacturer and the UK government announced a joint agreement on a proposal to invest in electric arc furnace steelmaking at the Port Talbot site with a capital cost of £1.25 billion inclusive of a grant from the UK Government of up to £500 million, subject to necessary regulatory approvals. The Company also announced its plans to invest about £20 million over four years to set up two additional Centers of Innovation & Technology in the UK at the Henry Royce Institute at Manchester (for advanced materials research) and at Imperial College London (for research in Sustainable Design & Manufacturing).

Bharat Electronics (BEL): The state-owned defence company has bagged multiple orders worth Rs 3,000 crore which include an order of Rs 2,118.57 crore from Cochin Shipyard for the supply of various equipment consisting of sensors, weapon equipment, fire control systems and communication equipment for six numbers of Next Generation Missile Vessels (NGMV), class of anti-surface warfare corvettes for Indian Navy. The Company has also received additional orders worth Rs.886 crore pertaining to upgrade of AFNET SATCOM N/W, upgrade of Akash Missiles with RF Seeker, Inertial Navigation System and other equipments with accessories and spares etc.

Indian Oil Corporation (IOC): The state-owned oil marketing company company has received its board approval for an additional investment of Rs 903.52 crore in Hindustan Urvarak and Rasayan (HURL) for setting up of fertiliser plants at Gorakhpur, Sindri and Barauni.

Tata Elxsi: The company has partnered with INVIDI Technologies to transform addressable advertising for Pay-Tv operators. This will allow broadcasters and operators to provide brands and advertisers with enhanced audience targeting capabilities, driving more impactful campaigns, less wasted reach, and better return on advertising investment.

Hindustan Aeronautics (HAL): The Defence Acquisition Council has given its approval for Acceptance of Necessity (AON) for the procurement of 12 Su-30MKI Aircraft from the defence company, with associated equipment and avionics upgradation of Dornier Aircraft.

Zomato: Zomato Slovakia, the step-down subsidiary of the company in Slovak Republic, has initiated the process of liquidation on September 14. Further, Zomato Slovakia does not have any active business operations and the liquidation of Zomato Slovakia will not affect the total sales of the company.

Lemon Tree Hotels: The company announced the opening of Peninsula Suites, operated by Lemon Tree Hotels, Bengaluru, the sixth property in the city under the Lemon Tree umbrella. The property will have 101 well-appointed rooms and suites, a multicuisine coffee shop – Citrus Café, a recreation bar – Slounge; meeting rooms and a well-equipped fitness center.

Dhanlaxmi Bank: Independent Director Sridhar Kalyanasundaram has resigned from the board citing “belligerent attitude of the MD & CEO” on various issues including rights issue, capital enhancement, whistleblower issues by the directors and unethical conduct of the bank’s business.

Brigade Enterprises: The company’s wholly owned subsidiary, Brigade Tetrarch, has entered into a sale deed for acquiring five acres of land parcel in Bengaluru for a consideration of Rs 123.50 crore from Bangalore Ceramics. It will develop a residential project on this land parcel with an overall development of 1 million sq. ft. with an overall sales potential of Rs 800 crore.

Texmaco Rail & Engineering: The company has received an approval from its for raising capital up to Rs 1,000 crore via the issuance of equity shares through qualified institutions placement (QIP). Further, it also got approval for raising funds up to Rs 50 crore via preferential issue to promoters.

Samvardhana Motherson International: The company in an exchange filing said that Motherson Electroplating US LLC (MR-US) has been incorporated in Delaware, USA, as an indirect wholly owned subsidiary of the company. ME-US will own and operate the business and assets recently acquired by SMP Automotive Systems Alabama Inc. from Bolta US Ltd, the company said in the exchange filing.

Excel Industries: The company has entered into a share subscription and shareholders agreement with First Energy and First Energy 7. The company will acquire 26% or more of equity share capital of First Energy 7, the SPV formed for constructing Captive Solar Power Plant. The acquisition is expected to be completed in five months and the cost of acquisition is Rs 5.24 crore.

PVR Inox: The company opened five screen multiplex at Himalaya Mall in Ahmedabad, Gujarat. With this launch, PVR INOX now operates the largest multiplex network with 1713 screens across 362 properties in 115 cities (India and Sri Lanka).

Gensol Engineering: The company has acquired 58,779 equity shares of Scorpius Trackers, constituting 54.38% of shares capital and voting rights in Scorpius for Rs 135 crore. The company proposes to acquire 100% of the share capital of Scorpius in the second tranche.

Elpro International: The company completed acquisition of 100% of the equity shares of Fortune Capital Holding for Rs 3.34 crore.

Deccan Gold Mines: The board has approved allotment of 17.70 lakh equity warrants at an issue price of Rs 53.47 per share to non-promoters which are convertible into equivalent number of equity shares of Rs 1 each, at an issue price of Rs 53.47 per equity share within 18 months from the date of allotment.

WPIL: The company said that it has received a contract for the supply of onboard range of centrifugal pumps and spares for different classes of ships from the Ministry of Defence for Rs 14.3 crore.

Jupiter Life Line Hospitals: The healthcare services provider will list its equity shares on the BSE and NSE on September 18. The issue price has been fixed at Rs 735 per share.