Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading higher by 0.09% higher at 19693, signalling that Dalal Street was headed for positive start on Friday.

Asian shares were trading lower on Friday as higher-than-expected US inflation data dented investors’ optimism. The Nikkei 225 index fell 0.39% and the Topix tanked 1.25%. The Hang Seng fell 1.8% and the CSI 300 index was down 0.95%.

The Indian rupee fell 4 paise to 8.24 against the US dollar on Thursday.

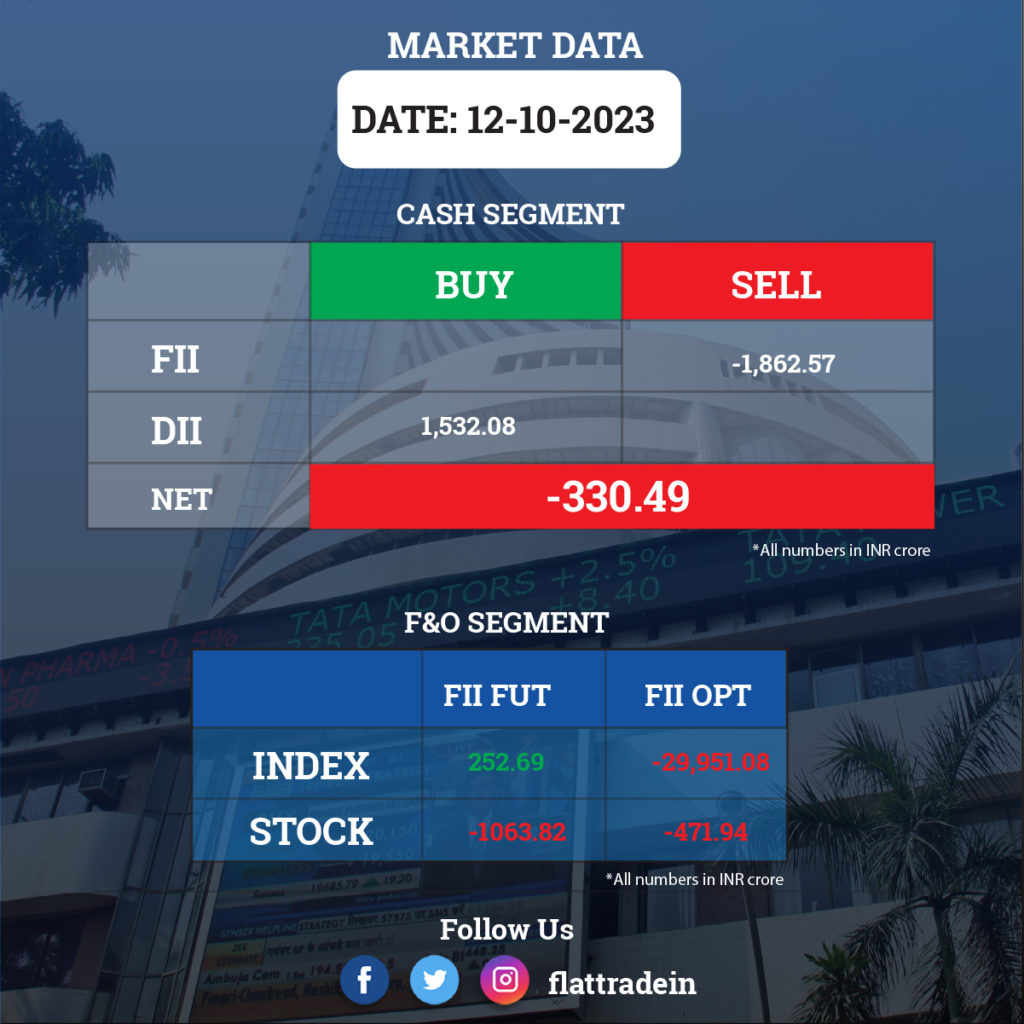

FII/DII Trading Data

Stocks in News Today

Infosys: The IT services company has posted a 4.5% sequential growth in net profit at Rs 6,212 crore for the quarter ended September 2023. Revenue rose 2.8% QoQ to Rs 38,994 crore, with sales in dollar terms rising by 2.2% QoQ to $4,718 million, and constant currency revenue growth stood at 2.3% for the quarter. The company announced an interim dividend of Rs 18 per equity share and the record date is October 25. Meanwhile, Temasek has extended the Infosys-Temasek digital services JV by five years.

HCLTech: The IT services company has recorded a net profit of Rs 3,832 crore for the quarter ended September FY24, up 8.4% over the preceding quarter. Revenue rose by 1.4% sequentially to Rs 26,672 crore, with dollar revenue growing 0.8% and constant currency revenue growth at 1% compared to the preceding quarter. An interim dividend of Rs 12 per equity share was declared, with the record date set for Oct. 20.

Mphasis: The company’s wholly owned subsidiary has acquired US-based Sonnick Partners for $132.5 million. With this buyout, Mphasis expects to strengthen its position as an end-to-end Salesforce enterprise cloud solutions and services provider, offering clients capabilities for cloud-first digital transformation.

Maruti Suzuki India: The automaker said that the board of directors will meet on October 17 to consider the issue of equity shares of the company to Suzuki Motor Corporation on a preferential basis. The consideration of issuance of equity shares will be other than cash, for the acquisition of a 100% equity stake of Suzuki Motor Corporation in Suzuki Motor Gujarat Private Limited.

Dr Reddy’s Laboratories: The US drug regulator has issued a Form 483 with 9 observations for the company’s manufacturing facility in Bachupally, Hyderabad, after completion of its product-specific pre-approval inspection at the said facility. The US health regulator conducted a product-specific pre-approval inspection (PAI) at the company’s biologics manufacturing facility during October 4-12.

One 97 Communications: The company said the Reserve Bank of India (RBI) has imposed a monetary penalty of Rs 5.39 crore on its subsidiary, Paytm Payments Bank, for non-compliance with Know Your Customer (KYC) norms. The company further said that it is taking necessary steps to ensure complete adherence to the supervisory instructions.

Tech Mahindra: The company plans to sell a 33% stake in a South African unit for ZAR 23.95 million. The divestment is undertaken to comply with the local Broad-Based Black Economic Empowerment guidelines in South Africa.

SJVN: The company’s subsidiary, SJVN Green Energy, has received the Letter of Award (LOA), at a tariff of Rs 2.62 per unit, for the development of a 100 MW solar power project from Rajasthan Urja Vikas Nigam (RUVNL) in Rajasthan. The solar project will be developed on a build, own, and operate (BOO) basis and the tentative cost of development of this project is about Rs 600 crore.

Aditya Birla Fashion & Retail: The company plans to invest an additional Rs 75 crore in its subsidiary Aditya Birla Digital Fashion Ventures via partly paid equity and preference shares.

IRCON International: The company said that Department of Public Enterprise has granted the Navratna Status to IRCON. IRCON will be the 15th Navratna amongst the CPSEs.

IRB Infrastructure Trust: The company has executed definitive agreements to implement the Samakhiyali Santalpur BOT project in Gujarat. The trust will acquire a 99.96% stake in STPL for a total consideration of Rs 116.2 crore. The cost of the total project is Rs 2,092 crore.

Zaggle: The company has won a deal worth $20 million from Visa for a period of five years to issue various forex co-brand cards, according to the company’s regulatory filing.

Lupin: The pharmaceuticals company said that it has received a tentative approval from the USFDA to market a generic equivalent of Xywav Oral Solution, of Ireland’s Jazz Pharmaceuticals. The product will be manufactured at Lupin’s Somerset facility in the U.S.

BGR Energy Systems: The company has secured a contract worth Rs 112.74 crore from Mangalore Refinery and Petrochemicals for the supply of air-cooled heat exchanges, which is expected to be delivered by October 9, 2024.

Angel One: The company’s Q2FY24 consolidated revenue was up 40.6% at Rs 1047.9 crore as against Rs 745.3 crore in the year-ago period. Consolidated net profit climbed 42.62% to Rs 304.5 crore in Q2FY24 as against Rs 213.5 crore in Q2FY23.

Kesoram Industries: The company’s consolidated revenue jumped 12.83% to Rs 953.8 crore in Q2FY24 from Rs 845.27 crore in Q2FY23. Consolidated Ebitda was up 32.54% YoY at Rs 69.08 crore in Q2FY24 from Rs 52.12 crore in Q2FY23. It posted a net loss of Rs 58.37 crore in Q2FY24 as against a net loss of Rs 59.05 crore in Q2FY23.

Anand Rathi Wealth: The company said its consolidated revenue was up 34.19% YoY to Rs 182.58 crore in Q2FY24. Its consolidated net profit rose 34.29% YoY to Rs 57.68 crore in Q2FY24 from Rs 42.95 crore in Q2FY23. The company’s asset under management grew 33.8% to Rs 47,957 crore in Q2FY24 from Rs 35,842 crore in the eyar-ago period.

Steel Strips Wheels: The company informed in an exchange filing that the acquisition of AMW Autocomponent under under Corporate Insolvency Resolution Process of the Insolvency and Bankruptcy Code 2016, has been approved verbally by National Company Law Tribunal, Ahmedabad.