Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading higher by 0.09% at 19794.50, signalling that Dalal Street was headed for a positive start on Wednesday.

Most Asian shares were trading higher after comments from Fed official raised hopes of a pause in rate hikes for now. The Nikkei 225 index rose 0.54% and the Topix slipped 0.04%. The Hang Seng jumped 1.62% and the CSI 300 index 0.63%.

The India rupee appreciated by 3 paise to 83.25 against the US dollar on Tuesday.

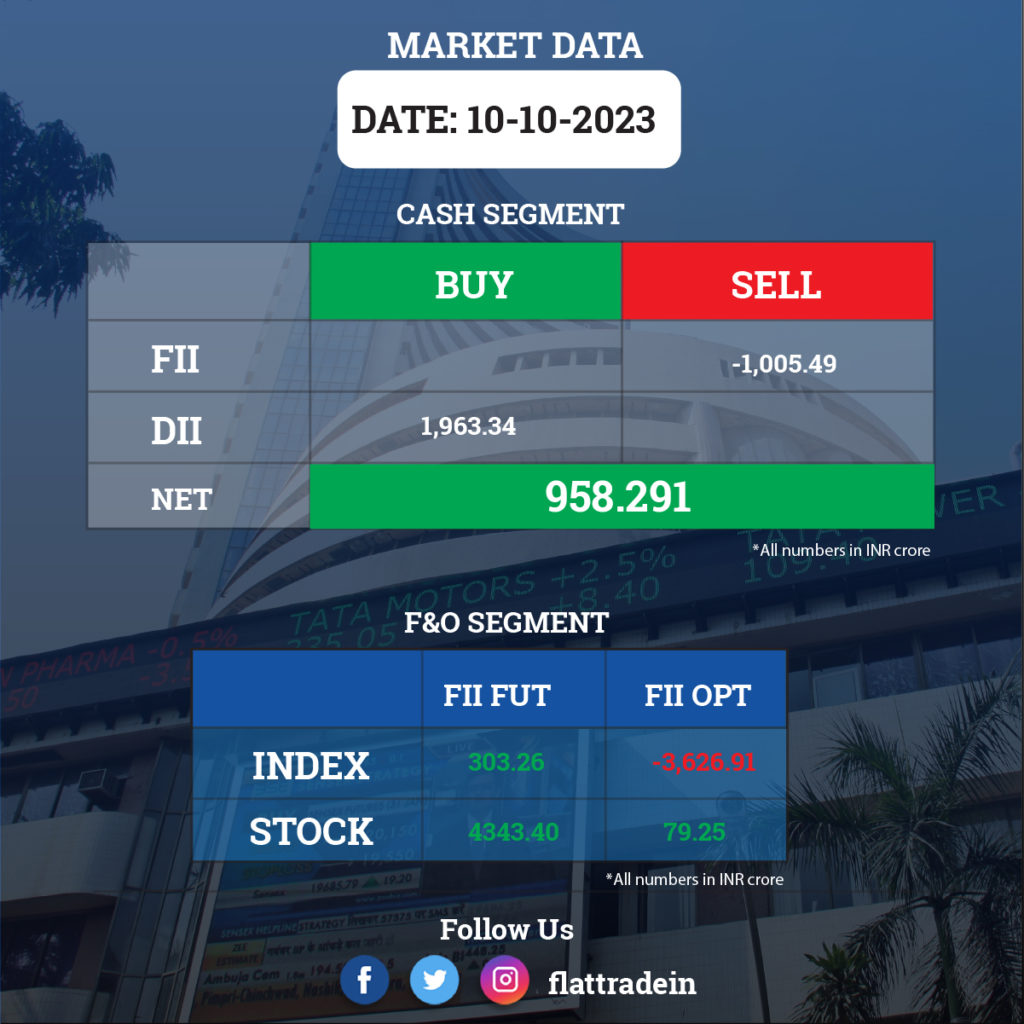

FII/DII Trading Data

Stocks in News Today

Multi Commodity Exchange of India (MCX): The company said it will go live with the new commodity derivatives platform on October 16. The exchange will conduct mock trading on October 15.

Wipro: The IT major has completed a subscription to the 9.95% equity share capital of FPEL Ujwal for Rs 6.3 crore. FPEL Ujwal is engaged in the business of developing, building, and managing a portfolio of solar power assets and the transaction is likely to be completed by May 31, 2024.

Bank of Baroda: The lender has been directed by the RBI to suspend the onboarding of new customers onto its ‘bob World’ app, with immediate effect, due to certain supervisory concerns. The bank said it has initiated steps to plug in gaps identified in its app, and it will work closely with the RBI to address their concerns.

NCL Industries: The company has announced cement production for the quarter ended September FY24 at 6,59,300 metric tonnes (MT), up 9% YoY, and cement dispatches at 6,69,587 MT, up 11% YoY, while cement boards production grew by 12% YoY to 21,509 MT, and cement board dispatches increased 9% to 20,239 MT.

Samvardhana Motherson International: The company has incorporated Motherson Groups Investments USA Inc. as an indirect wholly owned subsidiary.The newly incorporated company will be involved in acquiring, investing and holding movable and immovable assets of group.

PI Industries: Therachem Research Medilab (TRM) and Solis Pharmachem have been merged into parent company PI Health Sciences (PIHSL), a wholly owned subsidiary of PI Industries. PIHSL is engaged in providing Comprehensive Research & Development and Contract Development and Manufacturing (CDMO) services to pharmaceutical companies. TRM is engaged in the business of research, development and manufacturing of chemical compounds which are ultimately used for manufacturing of API (active pharmaceutical ingredients) and other pharmaceutical products.

Thermax: The Bombay High Court has passed an order, which was received by the company, wherein a stay of operation and execution of the arbitral award dated June 05, 2023 has been granted, subject to the company depositing an amount of Rs 218.45 crore which is returnable with interest in the event the award is set aside by the High Court.

Zee Entertainment: The company has been served with an appeal on behalf of IDBI Trusteeship Services against it before the NCLAT, Delhi. The appeal challenges the scheme of arrangement involving Zee Entertainment Enterprises, Bangla Entertainment, and Culver Max Entertainment.

Birla Corporation: The company has received an order from the Office of Collector (Mining), Satna, Madhya Pradesh, imposing a penalty of Rs 8.43 crore for excess production of limestone from captive mining for the period from 2000-01 to 2006-07, without obtaining environment clearance as per EIA Notification 1994. The company further said that it did not take Environment Clearance due to the ambiguity in the provisions of EIA Notification 1994 which was only clarified subsequently by the principles laid down in the Common Cause judgement of Supreme Court in August 2017.

Ugro Capital: The company said its overall AUM as on Q2FY24 stood at Rs 7,590 crore compared to Rs 6,777 crore in Q1FY24 and Rs 4,375 Cr in Q2FY23. Their quarterly gross loan origination for Q2FY24 was Rs 2,500 crore compared to Rs 2,036 crore in Q1FY24 and Rs 1,653 crore in Q2FY23. Its collection efficiency has improved from 96.8% in Q1FY24 to 97.6% in Q2FY2.

IFGL Refractories: The company has been awarded the status of ‘Three Star Export House’ by the Directorate General of Foreign Trade for the period of October 1, 2023, to March 31, 2028.

Apollo Micro Systems: The company has been granted listing approval by BSE and NSE for an additional 6,66,670 equity shares, issued and allotted on a preferential issue basis to non-promoters.

EIH Associated Hotels: Shib Sanker Mukherji has resigned from the office of Chairman and Director of the company due to personal reasons, with effect from October 10.

Fine Organic Industries: The chemical manufacturing firm has incorporated a wholly owned subsidiary company, Fine Organic Industries (SEZ), in India. The new subsidiary will be involved in the business of manufacturing specialty chemical products.

Crompton Greaves Consumer Electricals: The company launched a new product named Acenza in the Storage Water Heater category catering to the domestic market.