Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.44% lower at 19,389, signalling that Dalal Street was headed for negative start on Wednesday.

Asian shares were trading lower as inverstors were worried over China’s sluggish economic recovery and hawkish monetary policy stance by the Fed to bring down inflation. The Nikkei 225 index fell 1.03% and teh Topix was down 0.9%. The Hang Seng dropped by 1.47% and the CSI 300 index lost 0.55%.

The Indian rupee fell 10 paise to 82.95 against the US dollar on Monday.

India’s consumer price index (CPI) inflation surged sharply to a 15-month high of 7.44% in July 2023, driven by higher food and vegetable prices. The consumer food price index (CFPI) in July surged to 11.51%, according to India’ statistics agency.

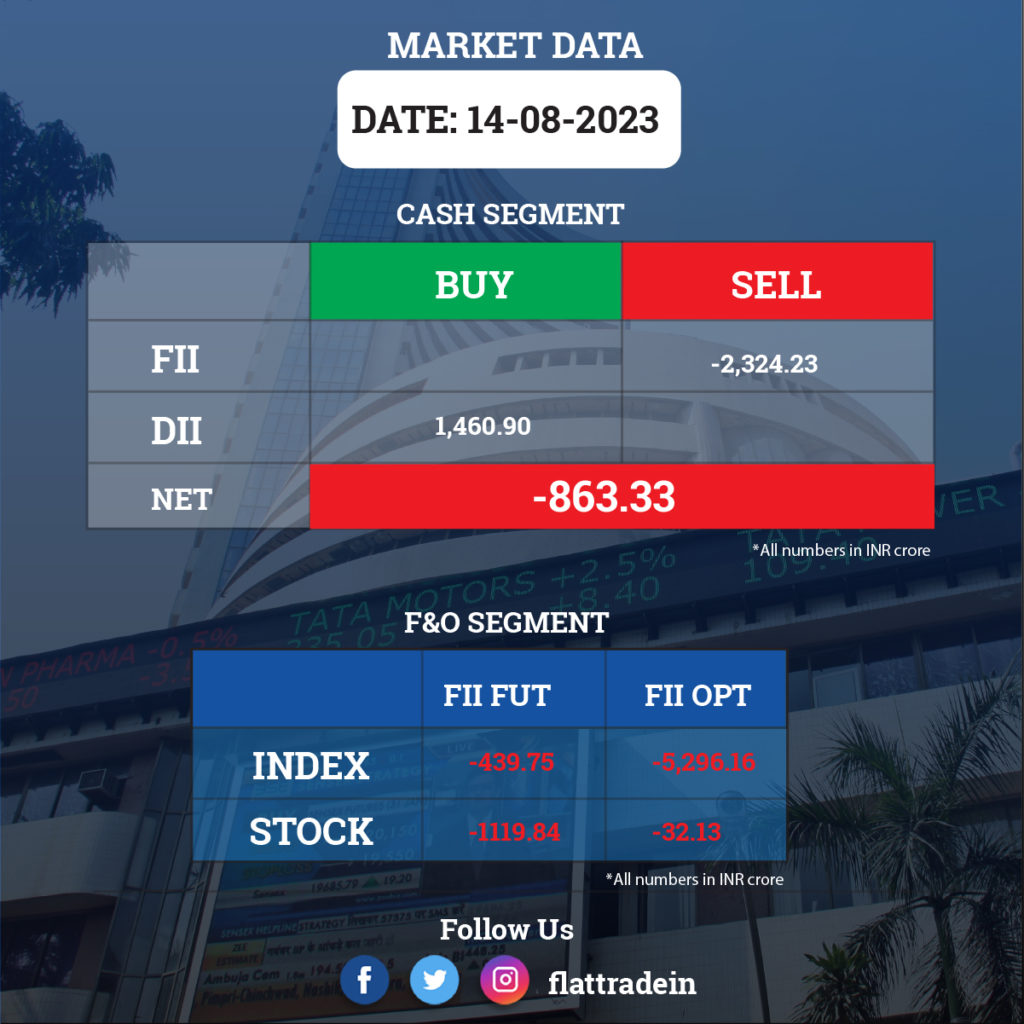

FII/DII Trading Data

Stocks in News Today

ITC: The company said its consolidated revenue was down 6% at at Rs 18639.5 crore in Q1FY24 as against Rs 19831.3 crore in Q1FY23. Consolidated Ebitda was up 10% at Rs 6670.07 crore in Q1FY24 as against Rs 6077.13 crore in Q1FY23. Net profit rose 16% at Rs 5104.9 crore in Q1FY24 from Rs 4389.8 crore in Q1FY23.

Meanwhile, the company’s board has approved the demerger of its hotel business. Shareholders will get one share in ITC Hotels for every 10 shares held in the parent company. The indicative timeline for listing ITC Hotels is approximately 15 months. The hotel business will be given a licence to use the ‘ITC’ brand. The board has alos approved the acquisition of a 25% stake in Maharaja Heritage from Russell Credit and a 45.36% stake in International Travel House.

Vodafone Idea: The telecom company said its consolidated revenue was up 1.16% at Rs 10,655 crore in Q1FY24 as against Rs 10,532 crore in the preceding quarter. Its net loss stood at Rs 7,840 crore in Q1FY24 as against a net loss of Rs 6,419 crore in Q4FY23. Ebitda fell 1.26% to Rs 4,157 crore in Q1FY24 as against Rs 4,210.3 crore in Q4FY23.

Reliance Industries (RIL): The company said Jio completed the minimum roll-out obligations of 5G ahead of schedule across all spectrum bands acquired in the 2022 auction. Jio customers are now using 26 GHz millimetre wave-based connectivity across all 22 telecom circles.

Adani Green Energy: The company’s subsidiary Adani Energy Holding has filed an appeal before the Commissioner of Income Tax (Appeals) in a matter relating to AY 2017-18. The expected financial implications, if any, due to compensation and penalty are Rs. 72.16 crore. The IT department computed the capital gain on account of the transfer of equity shares in the internal restructuring scheme by considering the cost of acquisition of these shares as Nil.

Ashok Leyland: The company’s board has given its approval to acquire 100% of OHM Global Mobility (OHM India) from OHM International Mobility for Rs 1 lakh. Ashok Leyland will invest up to Rs 300 crore as equity into OHM India to operationalise the company.

Zee Entertainment: The markets regulator SEBI passed a confirmatory order barring Chairman Emeritus Subash Chandra and former Managing Director Punit Goenka from company boards over allegations of diversion of the company’s funds.

Hero MotoCorp: The company received the family settlement deal from the promoter group, under which Sunil Kant Munjal has resigned as Joint Managing Director and will exit the company. Management and control will vest with the family group comprising Santosh Munjal, Renu Munjal, Suman Kant Munjal, and Pawan Munjal. An understanding has been reached between the family and Sunil Munjal on the usage of the trademark ‘Hero’.

Ashok Leyland: The company will acquire OHM Global Mobility (OHM India) from OHM International Mobility under a share purchase agreement. It will infuse fresh equity or preference capital of up to Rs 300 crore in one or more tranches for its business requirements.

Suzlon Energy: The company has raised Rs 2,000 crore via QIP and allotted 113.96 crore shares at Rs 17.55 apiece, representing a discount of 4.83% to the floor price. More than 5% of the equity shares offered were allotted to BNP Paribas, Bandhan Mutual Fund, HDFC Mutual Fund, Invesco Mutual Fund, and Max Life Insurance. Goldman Sachs and ICICI Prudential

SJVN: The company has signed a power purchase agreement worth Rs 7,000 crore for 1,200 MW of solar power projects with Punjab State Power Corp.

Waaree Renewable Technologies: The company has received a letter of Intent from one of India’s leading power generation companies for the execution of engineering, procurement, and construction works for a ground-mounted solar power project of 78 MWp capacity.

Swan Energy: The company has reported a consolidated revenue of Rs 804.3 crore in Q1FY24, up 208.89% from Rs 260.38 crore in th yeear-ago period. Consolidated Ebitda was up 43.23 times at Rs 237.35 crore in Q1FY24 as against Rs 5.49 crore in Q1FY23.

Consolidated net profit was up Rs 72.95 crore in Q1FY24 as against a net loss of Rs 26.35 crore in Q1FY23.

Indiabulls Housing Finance: The company’s consolidated revenue fell 8.42% to Rs 1,900.38 crore in Q1FY24 as against Rs 2,075.21 crore in Q1FY23. Ebitda dropped 7.55% to Rs 1753.4 crore in Q1FY24 from Rs 1896.53 crore in q!fY23. Consolidated net profit was up 3.33% at Rs 296.19 crore in Q1FY24 as against Rs 286.64 crore in Q1FY23.

KNR Constructions: The company’s consolidated revenue remained nearly flat at Rs 981.02 crore in Q1FY24 as against Rs Rs 980.45 crore in Q1FY23. Ebitda was up 2.12% at Rs 215.74 crore in Q1FY24 as against Rs 211.26 crore in Q1FY23. Consolidated net profit was up 9.34% at Rs 110.26 crore in Q1FY24 as against Rs 100.84 crore in Q1FY23.

Aster DM Healthcare: The company’s consolidated net revenue was up 20.78% at Rs 3,215.27 crore in Q1FY24 as against Rs 2,662.12 crore in Q1FY23. Consolidated Ebitda was up 32.70% at Rs 387.61 crore in Q1FY24 as against Rs 292.10 crore in Q1FY23.

Consolidated net profit was down 92.85% at Rs 4.9 crore in Q1FY24 as against Rs 68.54 crore in Q1FY23.

Ahluwalia Contracts India: The company’s consolidated revenue was up 25.34% at Rs 763.61 crore in Q1FY24 as against Rs 609.25 crore in Q1FY23. Consolidated net profit was up 31.61% at Rs 49.71 crore in Q1FY24 as against Rs 37.77 crore in Q1FY23. Ebitda jumped 36.43% at Rs 82.65 crore in Q1FY24 as against Rs 60.58 crore in Q1FY23.

Senco Gold: The Kolkata-based jewellery retailer registered a 22.7% YoY growth in consolidated profit at Rs 27.7 crore for the quarter ended June 2023. Revenue from operations rose 29.6% YoY to Rs 1,305.4 crore in the quarter under review.