Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.03% higher at 19,499.50, signalling that Dalal Street was headed for muted start on Wednesday.

Asian shares were trading lower as data showed that China’s service sector growth slowed down, weighing on investors’ sentiments. The Hang Seng index slumped 1.16% and the CSI 300 index fell 0.49%. The Nikkei 225 index was down 0.36% and the Topix was slipped 0.08%.

Indian rupee fell 6 paise to 82.02 against the US dollar on Tuesday.

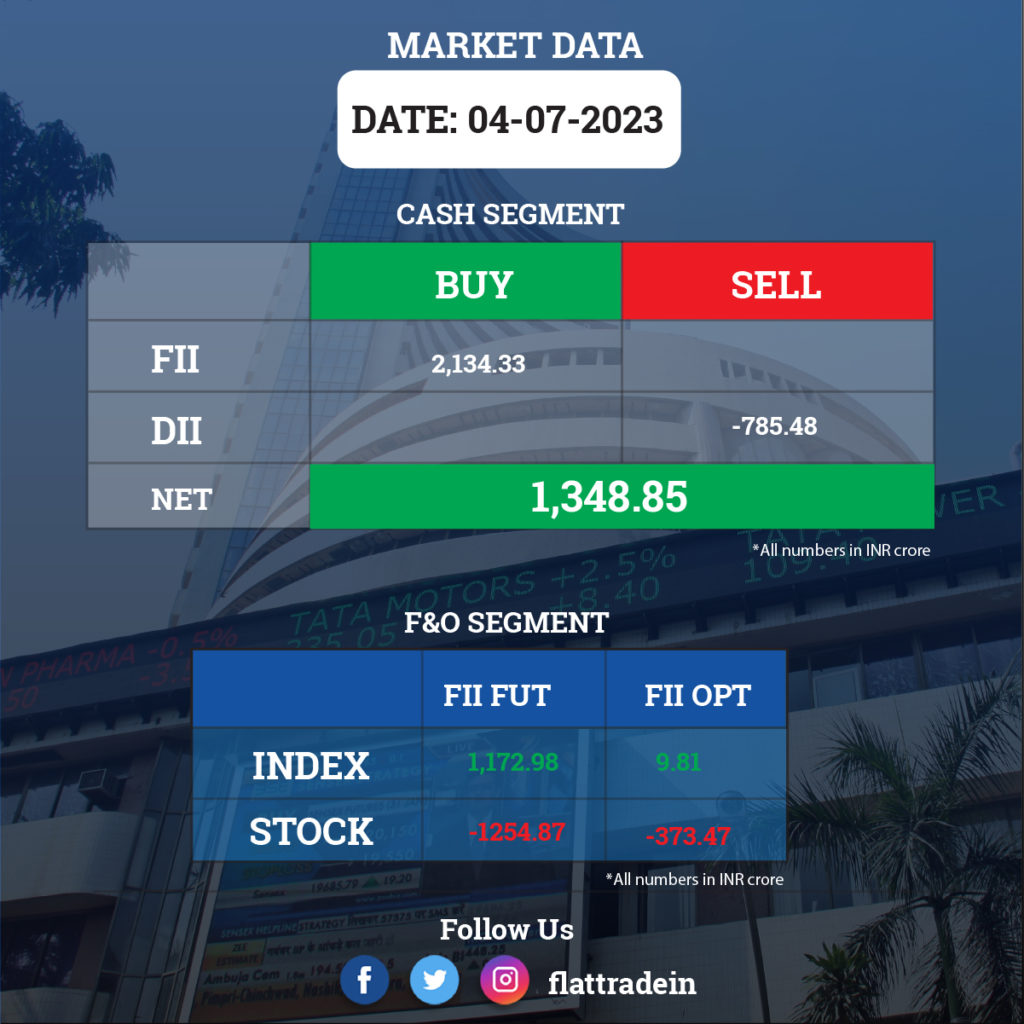

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI): India’s largest lender has received approval from its Executive Committee of the Central Board (ECCB) for acquiring the entire stake held by SBICAPS in SBICAP Ventures, subject to receipt of all regulatory approvals. SBICAPS is a wholly owned subsidiary of SBI. The estimated cost of capital for the said acquisition will be Rs 708.07 crore.

LTIMindtree: The Index Maintenance Sub-Committee (Equity) of NSE Indices has decided to exclude HDFC and include LTIMindtree in Nifty50 and Nifty Next 50 indices with effect from July 13. Jindal Steel & Power will replace HDFC in the Nifty 100 and Nifty Midcap 150 indices, while Mankind Pharma will replace HDFC in the Nifty 500 index. LIC Housing Finance will replace HDFC in the Nifty Financial Services index.

Bandhan Bank: The private sector lender said its advances in quarter ended June FY24 grew by 6.7% YoY to Rs 1.03 lakh crore, but fell by 5.5% QoQ. Total deposits increased by 0.4% QoQ and 16.6% YoY to Rs 1.08 lakh crore. Retail deposits rose 5.9% YoY to Rs 77,239 crore and bulk deposits increased by 55.4% YoY to Rs 31,240 crore. Meanwhile, the bank’s Chief Financial Officer Sunil Samdani has resigned, with effect from September 30, and decided to explore professional opportunities outside the bank. The bank is in the process of identifying a suitable candidate for the office of CFO.

Samvardhana Motherson International: The company will buy 81% stake in Yachiyo’s 4W business, housed under Japan’s Yachiyo Industry Co. Ltd. The stake is valued at JPY 22.9 billion (Rs 1,301 crore) for 100% stake. Honda Motor will own 19%, making it 81:19 joint venture.

Syngene International, Strides Pharma: Stelis Biopharma, the biologics arm of Strides, has signed a binding term sheet with Syngene International Ltd. to divest its Unit 3 multi-modal facility in Bengaluru for a gross consideration of Rs 702 crore. Syngene will further invest up to Rs 100 crore to repurpose and revalidate the facility. The site will have a manufacturing capacity of 20,000 litres of installed biologics drug substance.

Genus Power Infrastructures: Genus Power Infrastructures has signed definitive agreements with Gem View Investment, an affiliate of GIC, Singapore, for setting up a platform for undertaking advanced metering infrastructure service provider (AMISP) concessions. GIC will hold 74% stake while Genus will hold 26% stake in the Platform. The partners have committed $2 billion in investment.

Aurobindo Pharma: The Pharma firm’s subsidiary — CuraTeQ Biologics — announced positive result in phase 3 clinical trials for its proposed Trastuzumab biosimilar product. Trastuzumab is a breast cancer biosimilar product, BP02.

Lupin: The pharma company has received tentative approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application (ANDA), Dolutegravir tablets for oral suspension. The company will market a generic equivalent of Tivicay PD tablets for oral suspension, which are available in 5 mg strength, of ViiV Healthcare Company, in the United States.

RBL Bank: The private sector lender said its total deposits in Q1FY24 grew by 8% year-on-year to Rs 85,638 crore and gross advances increased by 20% to Rs 74,792 crore. Retail advances grew 32% YoY while wholesale advances rose 8% YoY for the quarter.

Bharat Heavy Electricals: The company has extended its gas turbines technology agreement with General Electric Technology GmbH Switzerland. Under this extension, BHEL has gained access and enhanced rights for existing, uprated and new gas turbine models.

Bata India: The company’s board has approved the appointment of Anil Ramesh Somani as chief financial officer for a period of five years from April 25, 2023.

Manali Petrochemicals: The company has signed two captive power agreements with two separate units of First Energy for procurement of wind power and solar power for a total consideration of Rs 356.4 lakh.