Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.09% lower at 19,721, signalling that Dalal Street was headed for negative start on Tuesday.

Most Asian equity indices were trading higher as investors were optimistic over more economic support from Beijing and ahead of monetary poilcy decision from the Fed. China’s CSI 300 index jumped 2.36% and the Hang Seng soared 3.51%. Japan’s Topix edged up 0.08%, while the Nikkei 225 index was down 0.29%.

Indian rupee rose 13 paise to 81.83 against the US dollar on Monday.

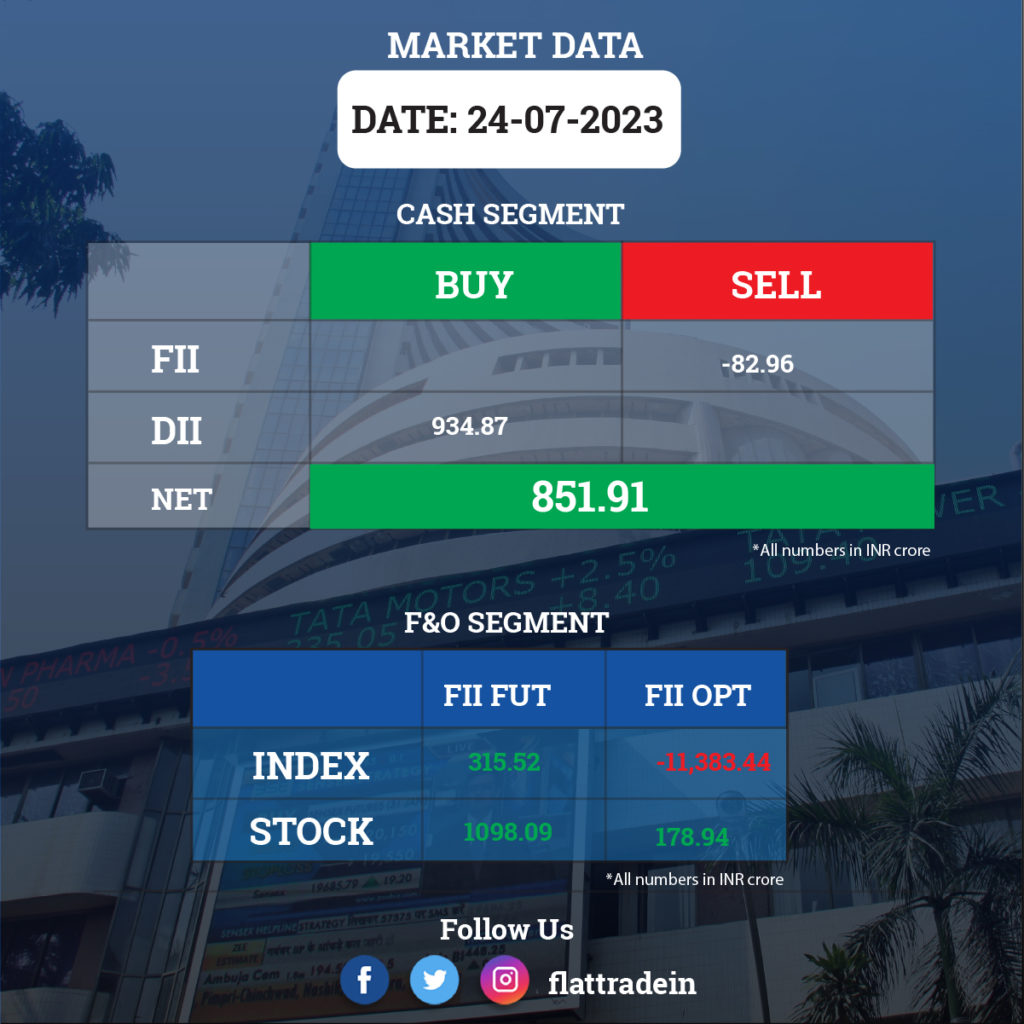

FII/DII Trading Data

Upcoming Results

Larsen & Toubro, Asian Paints, UTI Asset Management Company, Tata Motors, Bajaj Auto, Jubilant FoodWorks, KPIT Technologies, Amber Enterprises India, Apollo Pipes, Aurionpro Solutions, Ceat, Cyient, Delta Corp, Dixon Technologies, Indoco Remedies, Jyothy Labs, Mahindra Holidays & Resorts India, SBI Life Insurance Company, Suzlon Energy, Triveni Engineering & Industries will post their quarterly earnings data today.

Stocks in News Today

Reliance Industries (RIL): The oil-to-telecom conglomerate will invest Rs 378 crore in Mercury Holdings, a 50:50 joint venture between Brookfield Infrastructure and Digital Realty. It also committed to further invest up to Rs 622 crore via equity and debt.

Tata Steel: The Tata Group company reported a net profit of Rs 525 crore in the first quarter of 2023-24 weighed down by its Europe operations. Its net profit was Rs 7,714 crore in the same quarter a year ago, and Rs 1,566 crore in the quarter ending March 2023. The total revenue from operations came in at Rs 59,490 crore, which is 6.3% lower as against Rs 63,430 crore reported in the year-ago period. The company approved re-appointing T. V. Narendran as the chief executive officer and managing director of the company for a further period of five years from Sept. 19, 2023, till Sept. 18, 2028.

Vedanta: The company’s application under the government’s Modified Semi-Scheme for fab manufacturing is under consideration for approval. The company will also apply for display manufacturing under the Modified Display Scheme.

Wipro: Wipro FullStride Cloud has partnered with Pure Storage, a provider of enterprise data storage solutions, to help clients accelerate their sustainability journey through the power of technology. The goal is to empower customers to drive a more sustainable data centre footprint by providing more efficient strategies to minimize the environmental impact.

Maruti Suzuki: The carmaker has recalled 87,599 S-Presso and Eeco models manufactured between July 5, 2021, and Feb. 15, 2023. The recall is over a possible defect in a part of the steering tie rod that may break and affect vehicle steerability and handling.

LIC Housing Finance: The company has fixed August 18 as the record date for the purpose of ascertaining the eligibility of members for payment of the final dividend. The final dividend, if approved by the members in the 34th AGM, will be paid to eligible members within the stipulated period of 30 days from the date of AGM.

Federal Bank: The lender has approved allocating 23 crore shares at Rs 131.9 apiece to eligible, qualified institutional buyers.

Chennai Petroleum Corporation (CPCL): The company’s consolidated revenue fell 34% YoY to Rs 17,985.67 crore in Q1FY24 from Rs 27,449.52 crore in the year-ago period. Consolidated net profit was down 76% at Rs 556.5 crore in Q1FY24 from Rs 2,357.62 crore in Q1FY23. Ebitda fell 72% YoY to Rs 949.87 crore in Q1FY24 from Rs 3,406.59 crore in Q1FY23.

SJVN: The Government of Arunachal Pradesh has allotted five projects totalling 5,097 MW to the company. The projects allocated are 3,097 MW Etalin, 680 MW Attunli, 500 MW Emini, 420 MW Amulin and 400 MW Mihumdon. All the five projects are located in Dibang Basin, which will result in optimal resource utilisation and timely completion of projects, the company said. The development of these projects will involve an investment of more than Rs 50,000 crore.

AstraZeneca Pharma India: The Drugs Controller General of India has granted permission to the company to import pharmaceutical formulations of a new drug for sale or distribution in Form CT-20, which is a marketing authorisation, for Dapagliflozin tablets of dosage 10 mg. Dapagliflozin Tablets are used to treat heart failure in adults.

Relaxo Footwear: The company’s Q1 profit after tax stood at Rs 56 crore, up 46% YoY, from Rs 39 crore. Its first quarter revenue came in at Rs 739 crore, up 11% YoY. Ebitda stood at Rs 108 crore, while margins rose by 165 bps to 14.6% on a yearly basis. The decline in raw material prices led to improved operating efficiency and profitability during the quarter, the company said.

Jammu & Kashmir Bank: The lender has nearly doubled its net profit to Rs 326.5 crore for the first quarter of FY24 from Rs 166 crore a year ago. Its asset quality improved in Q1FY24 with gross non-performing assets (GNPA) declining to 5.77% from 9.09% last year. The bank’s net interest income (NII) rose 24% YoY to Rs 1283.30 crore in the first quarter of FY24, while the Net Interest Margin (NIM) improved to 3.98% as compared to 3.46% registered in Q1FY23.

PNB Housing Finance: Its net Interest Income improved by 70% YoY and 6% QoQ to Rs 629 crore. Profit after tax increased by 48% YoY and 24% QoQ to Rs 347 crore. It also recorded its highest ever Return on Assets in a decade at 2.07% in Q1FY24 as compared to 1.61% in FY23.

DCM Shriram: The company’s consolidated total revenue from operations was down 1% to Rs 2,937.17 crore in Q1FY24 as against Rs 2,971.83 crore in the year-ago period. Consolidated net profit was down 78% at Rs 56.58 crore in Q1FY24 compared with Rs 253.96 crore in Q1FY23. Ebitda fell 62% YoY to Rs 166.02 crore in Q1FY24 from Rs 436 crore in the same period last fiscal.

JK Paper: The company reported an 18.3% increase in its net profit to Rs 312.56 crore in the first quarter of FY24. The company had posted a net profit of Rs 264.23 crore during the same quarter a year ago. Its revenue from operations was up 10.77% YoY to Rs 1,584.36 crore during the period as against Rs 1,430.23 crore in the year-ago period, the company said. The total expenses in Q1FY24 stood at Rs 1,238.34 crore, up 12.43% YoY .

Spandana Sphoorty Financial: The company’s standalone revenue jumped 108% to Rs 468.93 crore in Q1FY24 from Rs 225.84 crore in Q1FY23. Its standalone net interest income surged 105% to Rs 273.69 crore in Q1FY24 from Rs 133.39 crore in Q1FY23. It posted a net profit of Rs 111.13 crore in the reported quarter as against a net loss of Rs 222.69 crore in the year-ago period.

IIFL Securities: The financial services company said its standalone revenue was up 27% YoY at Rs 58.59 crore in Q1FY24 as against Rs 46.15 crore in Q1FY23. Standalone net interest income was up 14% YoY at Rs 41.123 crore in Q1FY24 compared with Rs 30.87 crore in Q1FY23. Its standalone net profit jumped 73% to Rs 68.96 crore in Q1FY24 from Rs 39.79 crore in Q1FY23.

Shoppers Stop: The apparel retailer said its Q1FY2024 consolidated revenue was up 5% YoY at Rs 993.61 crore in Q1FY24 as against Rs 948.44 crore in Q1FY23. Consolidated net profit fell 37% to Rs 14.49 crore in Q1FY24 from Rs 22.83 crore in the year-ago period. Ebitda rose 6% to Rs 171.86 crore in the reported quarter from Rs 162.5 crore in the year-ago period.