Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading 0.35% lower at 19,656, signalling that Dalal Street was headed for negative start on Tuesday.

Asian shares were trading lower as US Treasury yields rose and the US dollar strengthened against other currencies. The Nikkei 225 index fell 0.91% and the Topix was down 0.49%. The Hang Seng dropped by 0.6% and the CSI 300 lost 0.23%.

The Indian rupee fell 20 paise to 83.14 against the US dollar on Monday.

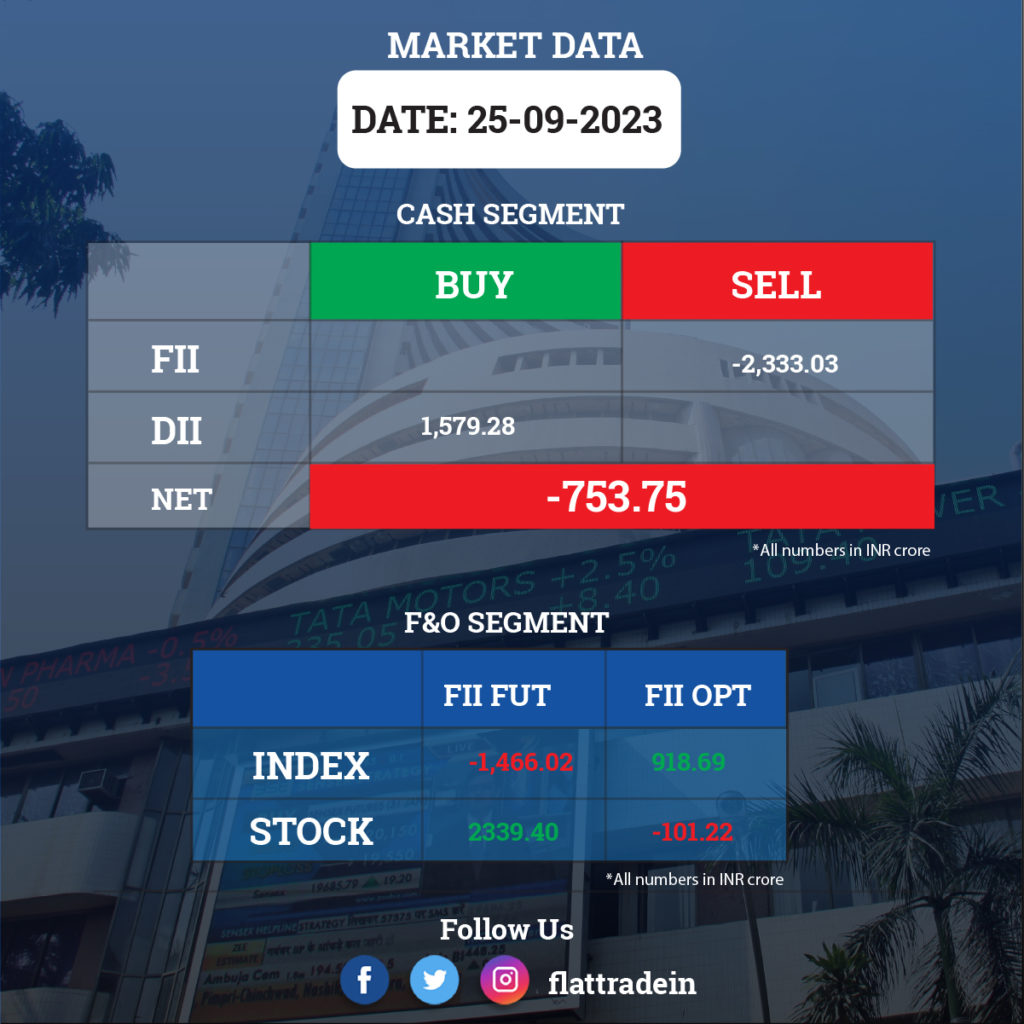

FII/DII Trading Data

Stocks in News Today

Tata Steel: Global credit rating agency Moody’s has upgraded the corporate family rating of Tata Steel from Ba1 to Baa3, and revised the outlook from Positive to Stable. The rating agency said the upgrade reflects the continued strength in Tata Steel’s credit profile and expects the company’s profitability to increase even as softer steel prices dent revenues. The rating agency expects Tata Steel to maintain conservative financial policies with well-balanced capital allocation and financial metrics.

Reliance Industries (RIL): The conglomerate has issued a postal ballot notice to seek shareholders’ approval to appoint Isha Ambani, Anant Ambani, and Akash Ambani as non-executive directors. The voting will be held for one month from September 27 and October 26.

Wipro: The IT services company announced the sale of land measuring 14 acres and 2 cents, in Chennai, together with a 20-year-old building for Rs 266.38 crore. The company executed the sale deed on September 25 and Casagrand Bizpark was the buyer.

Mahindra & Mahindra (M&M): The company said Canada’s Ontario has agreed to subscribe to 25,000 equity shares of face value of Rs 10 each of Mahindra Teqo Private Limited (MTPL) for a consideration of Rs 35 crore (including premium) representing 20% of the post issue capital of MTPL. Upon completion of the above subscription and allotment of shares, MTPL will cease to be a wholly owned subsidiary of Mahindra Sustainable Energy Private Limited.

HDFC AMC: The asset management company will invest Rs 25 crore in its wholly owned subsidiary, HDFC AMC International, to enable HDFC AMC International to meet the net worth requirements prescribed for Registered Fund Management Entity (Retail) under IFSC rules.

Indian Hotels: The company will invest $11.5 as equity in its wholly owned subsidiary in Netherlands i.e. IHOCO BV. The investment amount will be used by IHOCO BV to further make investment in its subsidiary viz. United Overseas Holding Inc in USA to repay its debt & for other operational purposes.

Welspun Corp: The company’s subsidiary Sintex BAPL has entered into an MOU with the Telangana government to set up a manufacturing unit with an investment of Rs 350 crore over the next three fiscals. The proposed project is under the state government’s incentive scheme and will be manufacturing water tanks and PVC pipes.

Kalpataru Projects International: The company’s board has approved the issuance of unsecured, rated, listed, redeemable, non-convertible debentures of Rs 150 crore on private placement basis.

Fortis Healthcare: The hospital chain has received an approval from its board for acquiring 99.9% stake in Artistery Properties. The enterprise value of the stake buy is Rs 32 crore. Artistery owns land and building situated adjacent to Fortis Hospital, Anandpur in Kolkata.

Ujjivan Small Finance Bank: SMC Global Securities announced a strategic partnership with Ujjivan Small Finance Bank (Ujjivan SFB) to offer online trading services to the bank’s customers. This association will offer services comprising Savings, Demat and Trading accounts. With this partnership, SMC Global plans to expand its client base by tapping into Ujjivan SFB’s extensive pan-India presence.

Strides Pharma: The company informed that the its step-down wholly owned subsidiary in Singapore viz., Strides Softgels Pte. Ltd., shall undertake the acquisition of CDMO business and Soft Gelatin business from Strides Pharma Global Pte. Ltd., another step-down wholly owned subsidiary of the company. The said entities have entered into a binding MoU and have agreed that definitive agreements shall be executed within three months from date of signing the binding MoU.

D B Realty: The company has today entered into separate share purchase agreements to acquire shares of Bamboo Hotel Global Centre (Delhi) Private Limited, Goan Hotels & Realty Private Limited and BD And P Hotels (India) Private Limited. The total cost of acquisition is Rs 2358.68 crore, according to its regulatory filing.

Ind-Swift Laboratories: The company’s board has approved the scheme of arrangement for amalgamation of Ind Swift Limited with Ind Swift Laboratories Limited on a going concern basis. The above mentioned scheme shall be subject to the approval of the BSE Limited, National Stock Exchange of India Limited, SEBI, National Company Law Tribunal, shareholders and creditors of both the companies, and other regulatory approvals.

RPP Infra Projects: The company has received a letter of acceptance for road and drain works for CBR project of CPCL at Nagapattinam, Tamilnadu, at a contract value of Rs 300.44 crore. In addition, it has received a contract worth Rs 90.18 crore for the provision of civil works and allied services for the engine test facility along with ancillary work for GRTE at Rajankute, Bengaluru, and a contract worth Rs 16.88 crore for the construction of a stormwater drain from Thoothukudi City Municipal Corporation, Tamil Nadu.

GR Infraprojects: The bids for 2 ropeway projects won by GR Infraprojects are annulled by National Highways Logistics Management. In February 2023, GR Infraprojects emerged as the L1 bidder for the development, operation and maintenance of a ropeways contract worth Rs 3,613 crore in Uttarakhand on Hybrid Annuity Mode.

Century Textiles: The company announced that it has successfully launched Phase 1 of Birla Trimaya in Devanahalli, Bengaluru. The project is expected to have a revenue potential of about Rs 3000 crore.