Market Opening - An Overview

GIFT Nifty on the NSE IX were trading higher by 0.13% at 19725.50, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were trading lower as investors were concerned over the Israel-Hamas conflict. The Nikkei 225 index tanked 1.64% and the Topix was down 1.28%. The Hang Seng fell 0.38% and the CSI 300 dropped 0.8%.

The Indian rupee closed at 83.26 against the US dollar on Friday.

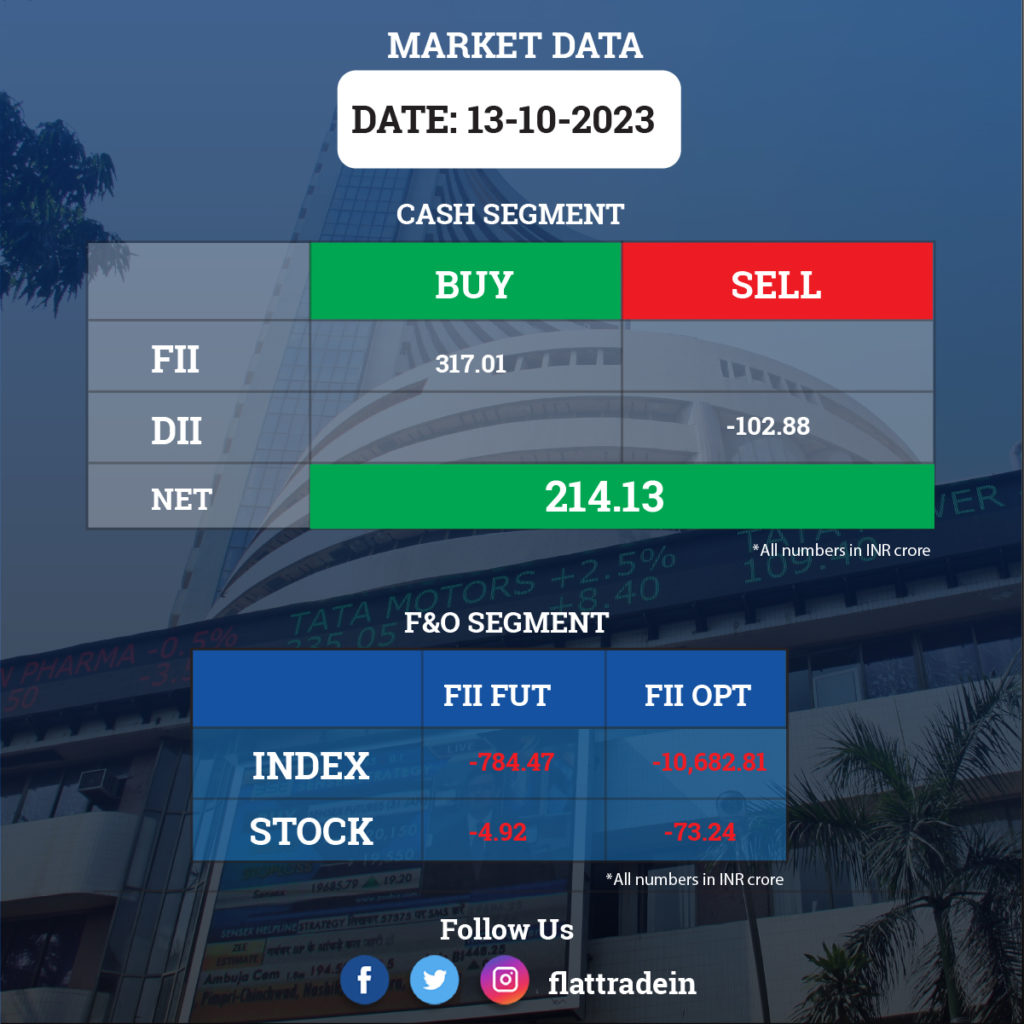

FII/DII Trading Data

Stocks in News Today

Adani Enterprises: The Ministry of Corporate Affairs, Hyderabad, has initiated investigation of books of accounts and other books and papers of Mumbai International Airport (MIAL) and Navi Mumbai International Airport (NMIAL), step-down subsidiaries of Adani Enterprises. The ministry has sought information and documents pertaining to the prior period starting from 2017-18 to 2021-22. Adani Enterprises had completed the acquisitions of MIAL and NMIAL during FY22.

Tata Motors: The vehicle manufacturer has entered into share purchase agreements with certain investors for sale of 9.9% stake in its subsidiary Tata Technologies for Rs 1,613.7 crore. TPG Rise Climate SF Pte Ltd, a climate focused private equity fund, is buying 9% stake in Tata Technologies, and Ratan Tata Endowment Foundation acquiring 0.9% stake, from Tata Motors.

Avenue Supermarts (D-Mart): The company has recorded a 9.2% YoY decline in consolidated profit at Rs 623 crore for quarter ended September FY24, impacted by lower margin and high base. In Q2FY23, the profit was supported by lower tax cost. Revenue from operations grew by 18.67% YoY to Rs 12,624 crore.

Mahindra & Mahindra: The company said its sales rose 18.14% YoY to 73,185 units in September, while production increased by 21.88% to 79,410 units. Separately, The Income Tax Department has filed an appeal in Bombay High Court against relief previously granted by the Income Tax Tribunal to the company over a Rs 432 crore tax dispute.

Tata Steel Long Products: The company’s net loss for the quarter ended September FY24 narrowed to Rs 135.8 crore, from Rs 333.4 crore in year-ago period, helped by lower input cost. Revenue from operations fell 9.4% YoY to Rs 1,734 crore during the quarter.

Infosys: The New York State Taxation Department has imposed a penalty of $15,076 for underpayment of advance tax in FY22. The company said there no material impact on financials, operations or other activities of the company.

Laurus Labs: The company announced that its associate company Immunoadoptive Cell Therapy Private Limited (ImmunoACT) has received the approval of India’s first CAR-T cell therapy, NexCAR19 (Actalycabtagene autoleucel), for the treatment of r/r B-cell lymphomas and leukemia from the Central Drugs Standard Control Organization (CDSCO).

NHPC: The company said in an excahnge filing that it estimates approximately Rs 788 crore worth of damages due to flash floods in Teesta Basin impacting its 510 MW Teesta-V Power Station in Sikkim. The damages are fully insured, and the company said it will lodge a formal claim for the damages.

HDFC Life: The company’s board has approved re-classification of Abrdn (Mauritius Holdings) 2006 from ‘Promoter’ to ‘Public’ category. HDFC Bank will be the sole promoter post-reclassification.

ICICI Lombard: The company announced that it has received favourable orders from Jaipur’s Tax Authority, squashing a penalty of Rs 7.7 crore for FY18, FY19 and FY20.

L&T Finance Holdings: NCLT has approved the amalgamation of L&T Finance, L&T Infra Credit, and L&T Mutual Fund Trustee with L&T Finance Holdings on Oct. 13.

Federal Bank: The private sectoe lender informed that International Finance Corp. acquires an additional 7.26 crore shares of face value Rs 2 per share at an issue price of Rs 131.91 per equity share via preferential issue, increasing its stake to 7.32%.

Bajaj Electricals: The company has secured a service contract worth Rs 564 crore from Power Grid for 400 kV transmission lines in Andhra Pradesh. The project is expected to be completed in 21 months.

Mankind Pharma: The company has resumed operation at the Sikkim facility as of Oct. 13. It has reported no damage to property due to flash floods when the facility’s operations were disrupted.

Gati: Total volume in Q2 volume rose 18% year-on-year to 333,000 metric tonnes on account of strong pre-festive ordering. Also, the company’s Bengaluru transshipment hub is now online.

NBCC India: The company has received an order worth Rs 80 crore for the renovation of office buildings from the Visakhapatnam Port Authority.

Bajaj Healthcare: The company has completed the construction of an alkaloid extraction plant at Vadodara, Gujarat. The plant has a capacity for the extraction of 2500 metric tonnes of poppy straw and 300 metric tonnes of poppy gum per year.

Pidilite: The comapny’s subsidiary, Pidilite Ventures, plans to invest Rs 20 crore in Imagimake, a company involved in design and distribution of innovative ranges of educational toys.

NLC India: The company has incorporated a wholly owned subsidiary, NLC India Green Energy, to undertake future renewable energy projects.

Indian Bank: The bank has declared loans worth Rs 24.8 crore as fraud and has reported to the RBI as per regulatory requirement. The nature of fraud is submission of fake documents and diversin of funds.

Union Bank of India: The Reserve Bank of India has imposed a monetary penalty of Rs 1 crore for non-compliance related to loans and advances, statutory and other restrictions.

RBL Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 64 lakh for non-compliance related to prior approval for the acquisition of shares.

Intellect Design Arena: The company has partnered with Premiere Bank, Philippines, for bank-wide digital transformation in APAC. The partnership includes Intellect’s iKredit360 loan origination system, with the aim of improving the bank’s customer experience.

Dalmia Bharat: The cement manufacturing company has registered a consolidated profit of Rs 124 crore in Q2FY24, up 121.4% YoY. Revenue from operations for the quarter grew by 6% YoY to Rs 3,149 crore. Cement volume increased 6.6% YoY to 6.2 million tonnes.

Delta Corp: The company’s subsidiary, Deltatech Gaming, has received an intimation for payment of shortfall tax from the Directorate General of GST Intelligence, Kolkata. The amount of alleged tax shortfall is Rs 6,236.81 crore for the period between January 2018 and November 2022, and Rs 147.51 crore for July 2017 to October 2022 period.

Texmaco Rail & Engineering: The company posted a consolidated revenue of Rs 805.05 crore in Q2FY24, up 66.19% from Rs 484.42 crore in Q2FY23. Consolidated net profit was up 70% at Rs 20.2 crore in Q2FY24 as against Rs 11.88 crore in Q2FY23. Ebitda rose 75.92% to Rs 76.25 crore in Q2FY24 from Rs 43.34 crore in Q2FY23.

GTPL Hathway: The company’s consolidated revenue was up 18.97% to Rs 779.19 crore in Q2FY24 from Rs 654.98 crore in the year-ago period. Ebitda fell 5.34% to Rs 124.32 crore in Q2FY24 as against Rs 131.33 crore in Q2FY23. Consolidated net profit was down 24.44% to Rs 35.87 crore in Q2FY24 as against Rs 47.48 crore in Q2FY23.

KIOCL: The company said it has resumed operations at the Mangalore Pellet Plant, where operations were suspended on September 28 due to the non-availability of iron-ore fines and maintenance activities.

Transformers and Rectifiers: The company informed that Amarendra Kumar Gupta has resigned as CFO with effect from October 14, due to personal reasons.