Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.08% higher at 19,447, indicating that Dalal Street was headed for positive start on Monday.

Asian shares were trading higher as investors remained hopeful that the US central bank has reached the interest rate cycle peak. The Nikkei 225 index surged 2.41% and the Topix soared by 1.77%. The Hang Seng advanced 1.76% and the CSI 300 rose 1.03%.

The Indian rupee fell 2 paise to 83.28 against the US dollar on Friday.

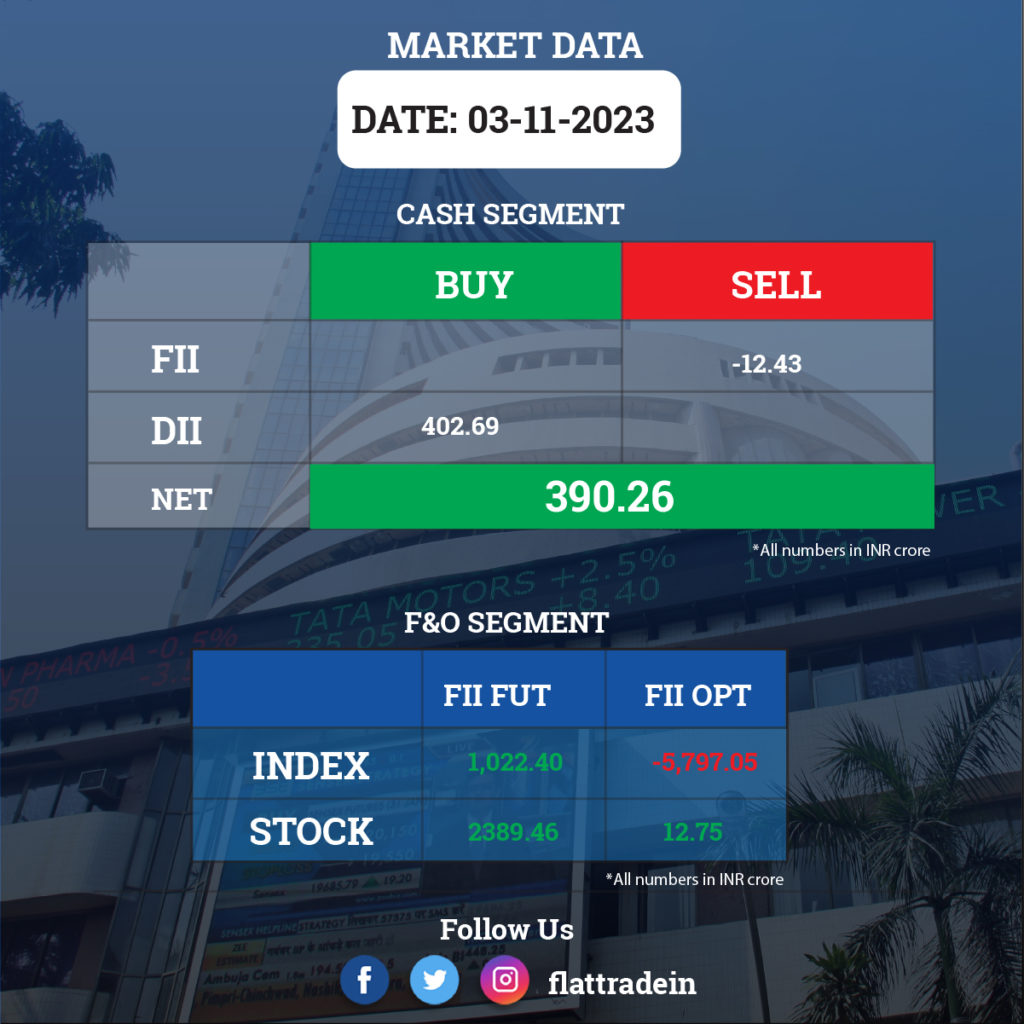

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI): The largest lender in India has registered 8% YoY growth in standalone net profit at Rs 14,330 crore on lower provisions and higher other income. Net interest income rose 12.3% YoY to Rs 39,500 crore during the quarter under review, while net interest margin declined 3 bps YoY to 3.29%. Advances grew by 12.4%, and deposits rose by 11.9% in Q2FY24. Gross NPA fell 21 bps QoQ to 2.55% and the net NPA dropped 7 bps to 0.64% for the reported quarter.

Vedanta: The mining company reported a consolidated net loss of Rs 1,783 crore in Q2FY24 as against a net profit of Rs 1,808 crore in the year-ago period. Consolidated revenue from operations rose 6.3% YoY to Rs 38,945 crore in Q2FY24. The loss was due to a sharp increase in the net tax outgo to Rs 9,092 crore during the quarter from Rs 1,674 crore in the year-ago period. Ebitda grew 49% YoY to Rs 11,479 crore in the reported quarter, while the operating margin expanded 847 basis points to 29.47%.

Meanwhile, its aluminium business revenue declined by over 11% YoY to Rs 11,952 crore, while its copper business reported about 15% growth in revenue to Rs 4,606 crore, and the iron ore business saw a 38% growth to Rs 2,083 crore. The oil & gas business revenue surged to Rs 8,229 crore from Rs 3,869 crore a year ago.

InterGlobe Aviation (IndiGo): The company reported a net profit of Rs 188.9 crore for the quarter ended September 2023, against a net loss of Rs 1,583.3 crore in the year-ago period. Revenue from operations increased by 19.6% YoY to Rs 14,944 crore. EBITDAR surged nearly 11 times to Rs 2,446.4 crore, while the margin improved to 16.4% from 1.8% during the same period last fiscal.

Larsen & Toubro (L&T): The infrastructure conglomerate said its subsidiary, L&T Infrastructure Development Projects (L&T IDPL), has signed a share purchase agreement with CPPIB India, Allianz Infrastructure Luxembourg II S À R L, and 2726247 Ontario Inc. for the sale of its entire shareholding in Interise Investment Managers for Rs 103.86 crore. Interise Investment Managers is a wholly owned subsidiary of L&T IDPL.

Bank of Baroda (BoB): The public sector lender posted a 28.4% YoY rise in standalone net profit at Rs 4,253 crore for Q2FY24, helped by strong other income. Net interest income grew by 6.5% YoY to Rs 10,831 crore. The lender said its deposits rose 14.6% and advances increased by 17.3% year-on-year. Its Gross NPA fell 19 bps QoQ to 3.32% and its net NPA was down marginally 2 bps to 0.76% for the quarter under review.

JSW Infrastructure: The company posted 89% YoY growth in consolidated profit at Rs 254.4 crore for the quarter ended September FY24. Revenue from operations during the quarter under review rose 28.1% YoY to Rs 848.3 crore. Meanwhile, the company has received approval from its board for the acquisition of Marine Oil Terminal Corp. and its Fujairah branch by subsidiary JSW Terminal (Middle East) FZE from MPT Commodities, British Virgin Islands (Mercuria Group).

PB Fintech: The fintech company posted a consolidated net loss of Rs 21.1 crore in Q2FY24 compared to a net loss of Rs 186.64 crore in the year-ago period. Consolidated revenue grew by 42% YoY to Rs 812 crore, and its core online revenue increased by 46% YoY to Rs 597 crore. Adjusted EBITDA stood at Rs 13 crore in Q2FY24 as against a loss of Rs 53 crore in the year-ago period. The company’s Ebitda margin stood at 2% compared with an negative Ebitda margin of 9%.

Punjab National Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 72 lakh on PNB for non-compliance of certain rules and regulations with respect to interest rate on deposits, interest rate on advances, and customer service.

Bharti Airtel: The telecom operator has signed a share purchase agreement (SPA) with Manipura Digital Infrastructure Opco Pte Ltd for the transfer of its entire stake in Firefly Networks for Rs 6.05 crore. With this transaction, Firefly will cease to be a joint venture of the company.

JK Cement: The cement company has recorded a consolidated net profit of Rs 178.1 crore for the quarter ended September FY24, up 58.5% YoY. Consolidated revenue from operations rose 23% to Rs 2,753 crore in Q2FY24 compared to the same period last fisal.

JK Paper: The company recorded a consolidated net profit of Rs 305.7 crore for the July–September period of FY24. The company said its consolidated revenue from operations rose marginally by 0.4% YoY to Rs 1,650 crore for the quarter.

Bank of India: The public sector lender has recorded a standalone net profit of Rs 1,458 crore for the quarter ended September FY24, an increase of 52% YoY. Net interest income rose 13% YoY to Rs 5,740 crore for the quarter, with deposits rising 8.68% and advances jumping 10% YoY. Its Gross NPA dropped 83 bps QoQ to 5.84% and the net NPA fell 11 bps to 1.54% for the quarter.

Crompton Greaves Consumer Electricals: The company has reported consolidated profit at Rs 97.22 crore for the quarter ended September FY24, declining 22.7% compared to the year-ago period, impacted by weak operating performance. Revenue from operations grew by 4.9% to Rs 1,782.3 crore compared to the corresponding period last fiscal.

Godrej Agrovet: The company has reported a consolidated net profit of Rs 103.9 crore for the July–September period of FY24, increasing by 49.3% YoY. The company’s consolidated revenue from operations rose by 5% YoY to Rs 2,571 crore in Q2FY24.

Delhivery: The company’s consolidated net loss narrowed to Rs 103 crore in Q2FY24 from Rs 254 crore in the year-ago period. Consolidated revenue from operations rose 8% YoY to Rs 1,942 crore in the quarter under review. At the operating level, the its adjusted loss fell to Rs 13 crore in Q2FY24 from Rs 125 crore in the year-ago period. Revenue from the express parcel services grew 8% YoY to Rs 1,210 crore, while the volumes in the segment grew 12% YoY during the reported quarter.

Lemon Tree Hotels: The hospitality chain has signed a licence agreement for its 150-room property in Yadagirigutta, Telangana, under the brand Keys Select by Lemon Tree Hotels. The hotel is expected to be operational by FY26.

Shipping Corporation of India: The state-owned company has reported a consolidated net profit of Rs 65.7 crore for the quarter ended September FY24, down 42.5% compared to the year-ago period due to decline in revenue. The company’s revenue from operations fell by about 23% YoY to Rs 1,093.2 crore in Q2FY24.

Greaves Cotton: The company has executed a definitive agreements with Runal Developers LLP to sell its land parcel in Pune for Rs 284 crore.

Ethos: The luxury watch retailer said its fund raising committee has approved the allotment of 11,31,210 equity shares to eligible qualified institutional buyers at an issue price of Rs 1,547 per share, amounting to Rs 175 crore.

Thermax: The company recorded a consolidated net profit of Rs 158.6 crore in Q2FY24, up 45.3% YoY helped by strong business across all segments. The company’s consolidated revenue from operations rose by 11% YoY to Rs 2,302.5 crore during the quarter under review.

Metropolis Healthcare: The diagnostics company posted a 12.2% YoY fall in net profit at Rs 36 crore in Q2FY24. However, revenue from operations grew by 3% YoY to Rs 309 crore, and its core business revenue that excludes COVID and COVID-allied PPP contracts jumped 13.5% to Rs 302 crore in Q2FY24.

Affle (India): The IT services company posted a 13.8% YoY rise in net profit at Rs 66.8 crore in Q2FY24. Revenue from operations rose 21.6% YoY to Rs 431.3 crore compared in the quarter under review, on the back of strong business growth in CPCU and non-CPCU segment across India and oversees markets.