Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading lower by 0.01% at 19,896.5, signalling that Dalal Street was headed for muted start on Thursday.

Most Asian shares were trading higher as investor sentiments were boosted after property developers in China received financial support from Beijing. The Nikkei 225 index rose 0.29% and the Topix was up 0.44%. The Hang Seng fell 0.19% and the CSI 300 index edged up 0.04%.

The Indian rupee appreciated by 3 paise to close at 83.32 against the US dollar on Wednesday.

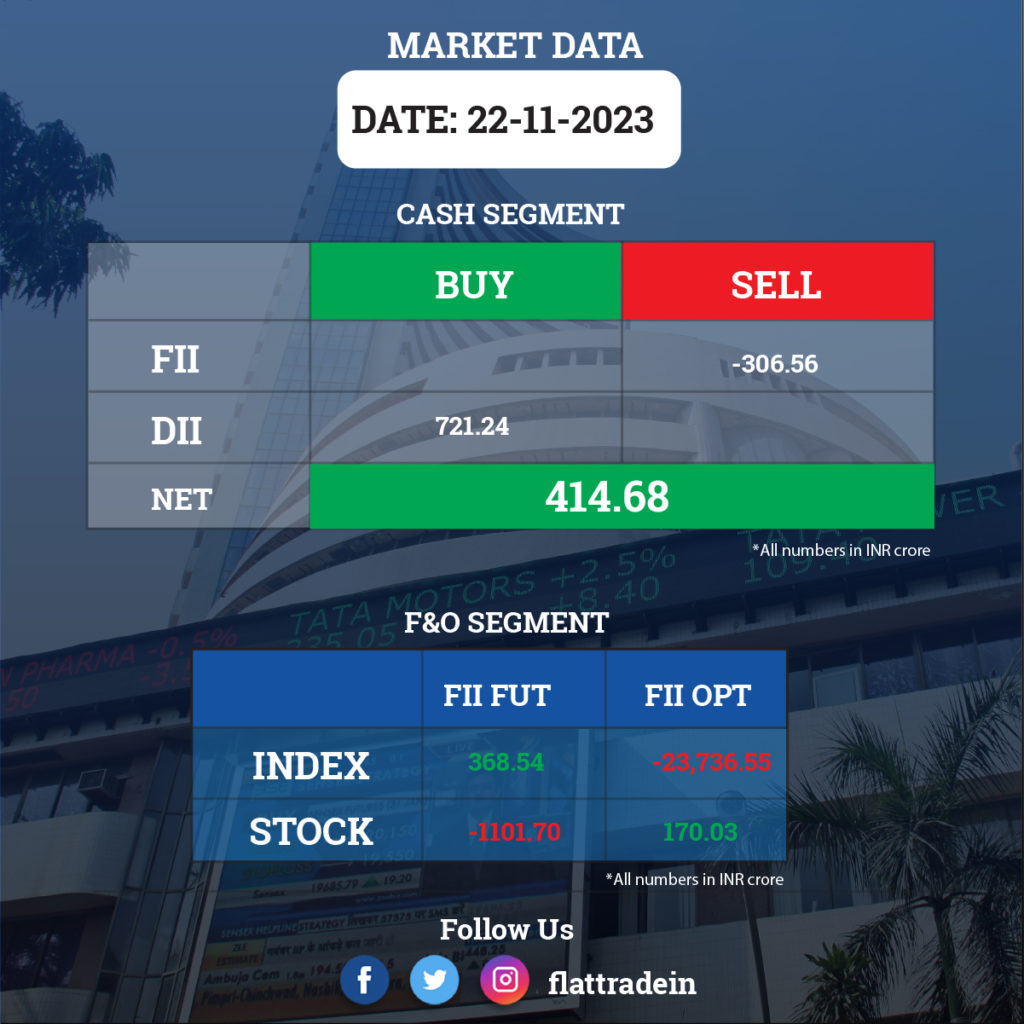

FII/DII Trading Data

Stocks in News Today

ICICI Bank: Credit rating agency Care Rating has reaffirmed CARE AAA; Stable to ICICI Bank’s infrastructure bonds. The stable outlook is on account of high systemic importance of the bank given its strong market position, healthy capitalisation, granular asset book growth and a strong deposit franchise along with improvement in the asset quality leading to better profitability parameters.

Infosys: The IT giant announced a strategic long-term collaboration with TK Elevator to consolidate, harmonise, and modernise TK Elevator’s digital landscape. The two companies will work together to transition the operations of all TK Elevator’s business applications across North America and major markets in Europe to Infosys, thereby enabling integrated applications management.

InterGlobe Aviation (IndiGo): The company has received tax demand notice of Rs 7,396.76 million for AY 2016-17 and Rs 9270.31 million for AY2017-18 from the Commissioner of Income Tax Appeals. The company said it will contest the same and will take appropriate legal remedies.

Power Grid Corporation of India: The state-owned company said it has approved an investment of Rs 142.69 crore for the augmentation of transformation capacity at Maheshwaram (PG) substation in Telangana and Rs 224.41 crore for the transmission system for the evacuation of power from the potential RE zone in the Khavda area of Gujarat.

TVS Motor Company: The two-wheeler manufacturer has entered Vietnam in collaboration with Minh Long Motors, its distribution partner. The company will offer a range of scooters and underbone motorcycles across multiple price points.

Welspun Corp: The company’s subsidiary, Sintex BAPL, has received approval from the Odisha Government for an investment of Rs 479.47 crore for establishing a manufacturing unit for CPVC, UPVC, SWR, agri pipes, PVC fittings and plastic tanks with an annual capacity of 37,520 MT in Sambalpur, Odisha.

Shalby: The company has executed the Amendment Agreement to the Operation and Management Agreement with The Santacruz Residents Association and Bhikhubai Chandulal Jalundwala General Hospital (BCJ) for the construction of a new hospital building at Santacruz, Mumbai.

Procter & Gamble Health: The company will trade ex-dividend with effect from November 23. It has announced a final dividend of Rs 50 per share.

Mastek: The company has received notice from BSE and the National Stock Exchange of India for delayed compliance with listing regulations during the quarter ended September 2023. Both exchanges have levied a fine of Rs 5,84,000 each plus GST on the company.

Honasa Consumer (Mamaearth ): The personal care products manufacturer registered 94% YoY growth in consolidated net profit at Rs 29 crore for the quarter ended September FY24, backed by healthy topline and operating performance. Revenue from operations during the quarter rose 21% YoY to Rs 496 crore, while volumes in terms of sales grew by 27%.

Indian Railway Finance Corporation: The company said that it has received notices from NSE and BSE which imposed a fine of Rs 5,42,800 each on the company for non-compliance with the norms.

Bharti Airtel: The company said that The Department of Telecommunications, Tamil Nadu LSA, has imposed a penalty of Rs 2,45,000 for an alleged violation of subscriber verification norms.