Market Opening - An Overview

GIFT Nifty futures on the NSE IX was trading 0.15% higher at 19,525, signalling that Dalal Street was headed for higher start on Wednesday.

Asian shares were mixed as investors were concerned over global economic growth amid decline in oil price due to drop in gasoline demand. The Nikkei 225 index rose 0.18%, while the Topix dropped 0.59%. The Hang Seng rose 0.04% and the CSI 300 index fell 0.09%.

The Indian rupee depreciated by 5 paise to close at 83.27 against the US dollar on Tuesday.

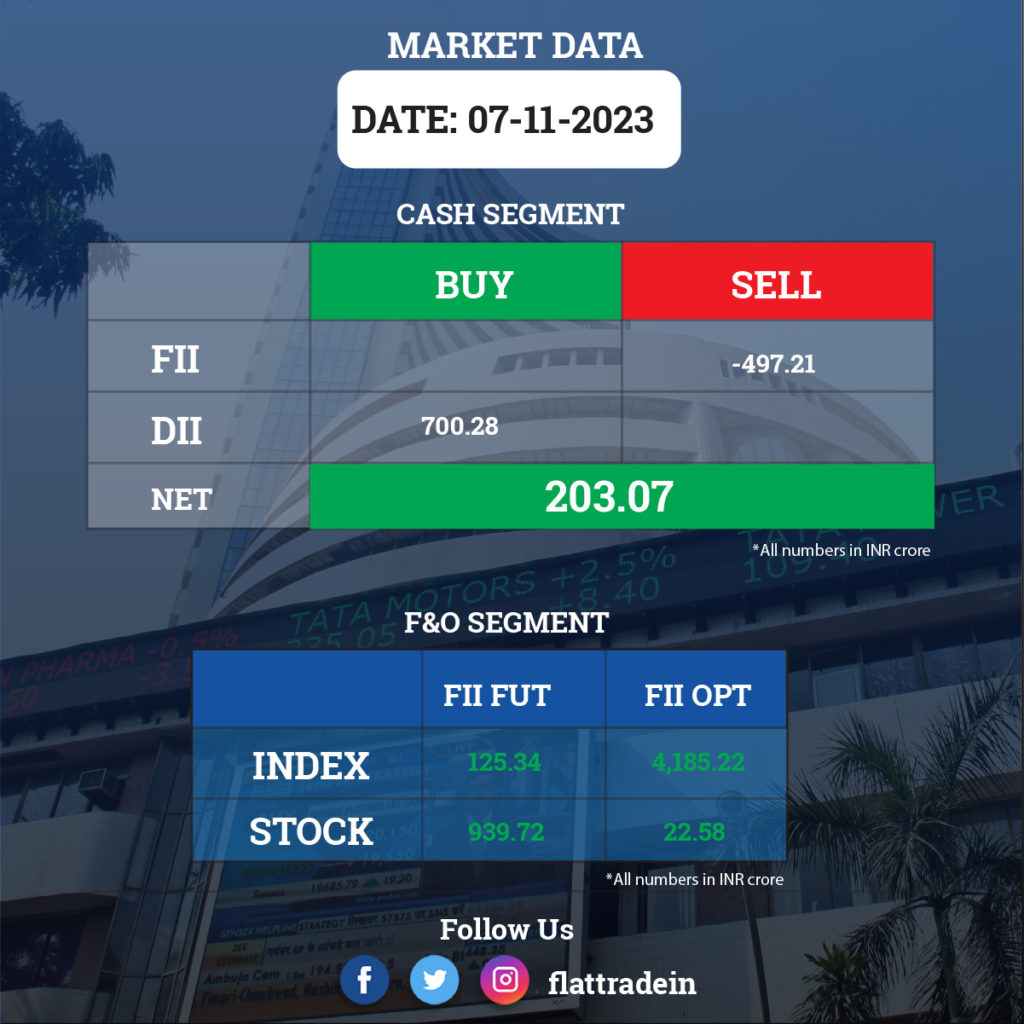

FII/DII Trading Data

Stocks in News Today

SJVN: The state-owned entity has received a Letter of Intent for the purchase of 200 MW solar power from Uttarakhand Power Corporation (UPCL). UPCL intends to purchase 200 MW power at a tariff of Rs 2.57 per unit from company’s 1,000 MW Bikaner solar project.

InterGlobe Aviation (IndiGo): The low-cost carrier anticipates aircraft on ground (AOG) in the range of mid-thirties in Q4FY24 due to accelerated engine removals after getting additional information on the powder metal issue from Pratt & Whitney.

Power Grid Corp: The company’s consolidated revenue from operations was up 1.04% to Rs 11,267 crore in Q2FY24 from Rs 11,151 crore in Q2FY23. The mainstay transmission business saw a 0.5% drop in revenue to Rs 10,359 crore. The consultancy business reported a 13% growth in revenue to Rs 157 crore. Its Ebitda rose 5.1% to Rs 9,908 crore in Q2FY24 from Rs 9,426 crore in Q2FY23. Its net profit increased 3.4% to Rs 3,781 crore in Q2FY24 from Rs 3,650 crore in Q2FY23.The company’s board has announced an interim dividend of Rs 4 per share for FY24.

Indian Railway Catering and Tourism Corporation (IRCTC): The company posted an increase of 30.4% in net profit at Rs 294.7 crore, compared to Rs 226 crore in the corresponding period last year. Revenue from operations in Q2FY24 stood at Rs 995.3 crore, up 23.5% from Rs 805.8 crore in the year-ago period. Its Ebitda rose 20.2% to Rs 366.5 crore in Q2FY24, from Rs 304.9 crore in the same period last year. The company’s board has declared an interim dividend of Rs 2.5 per equity share for FY24 and November 17 is the record date for the payment of the dividend.

Shree Cement: The cement manufacturing company has recorded standalone net profit at Rs 491 crore for the July-September period of FY24, growing 159% YoY. Standalone revenue from operations increased by 21% YoY to Rs 4,585 crore with sale volumes increasing 10% YoY to 82 lakh tonnes.

Apollo Tyres: The company said its consolidated net profit rose to Rs 474.26 crore in Q2FY24 from a consolidated net profit of Rs 179.39 crore in the same period last fiscal. Its consolidated revenue from operations during the quarter under review stood at Rs 6,279.67 crore in Q2FY24 as against Rs 5,956.05 crore in the year-ago period. The company said the cost of materials consumed was lower at Rs 2,634.92 crore in the quarter under review as against Rs 3,101.56 crore in the corresponding quarter last fiscal.

JB Chemicals and Pharmaceuticals: The company reported a 35% YoY rise in net profit at Rs 151 crore in Q2FY24 as against a net profit of Rs 111 crore in the year-ago period. Revenue during the quarter under review rose 9% YoY to Rs 882 crore. The company’s Ebitda was at Rs 251 crore in Q2FY24, up from Rs 202 crore in the year-ago period, while margin improved 350 basis points YoY to 28.5%. Domestic formulations business reported 11% YoY growth to Rs 481 crore in Q2 FY24. International business registered 7% YoY growth to Rs 401 crore.

Cummins India: The engine manufacturer has registered a 30% YoY increase in standalone net profit at Rs 328.5 crore in Q2FY24, driven by healthy operating margin and higher other income. Standalone revenue from operations declined 2.6% YoY to Rs 1,900 crore during the quarter.

CRISIL: The rating agency recorded a consolidated net profit at Rs 152 crore for the quarter ended September 2023, up 2.8% over a year-ago period. Revenue from operations grew by 7.7% YoY to Rs 736 crore during the quarter. The ratings services segment saw revenue grow 9.1 % on-year in Q3 2023. The company announced an interim dividend of Rs 11 per share.

Balrampur Chini Mills: The company’s consolidated revenue was up 38.3% to Rs 1,540 crore in Q2FY24 from Rs 1,113 crore in Q2FY23. Consolidated Ebitda stood at Rs 165 crore in Q2FY24 from a net loss of Rs 15.9 crore in Q2FY23. The company reported a net profit of Rs 166 crore in Q2FY24 as against a net loss of Rs 28.9 crore in the year-ago period.

Greaves Cotton: The engineering company has posted a consolidated net loss of Rs 190.8 crore for quarter ended September FY24, against a net profit of Rs 28.9 crore in year-ago period. Consolidated revenue from operations grew by 4% YoY to Rs 726.7 crore during the reported quarter.

Dilip Buildcon: The infrastructure company’s consolidated net profit jumped four-fold YoY to Rs 68.6 crore for the quarter ended September FY24, against Rs 17 crore in the year-ago period. Revenue from operations rose 9.7% YoY to Rs 2,849 crore in Q2FY24 compared to the corresponding period in the previous fiscal.

Deepak Nitrite: The chemical manufacturing company has registered a 17.5% YoY increase in consolidated net profit at Rs 205 crore in Q2FY24, driven by lower input costs despite a decline in revenue. Its revenue from operations fell by 9.4% YoY to Rs 1,778 crore in Q2FY24.

Lux Industries: The company has reported a consolidated net profit of Rs 35.9 crore for the quarter ended September FY24, down 12.6% compared to the year-ago period, due to weak operating performance. Revenue from operations grew by 0.6% YoY to Rs 639.3 crore during the quarter under review.

Inox Wind: The company said its board has approved fundraising through the issuance of 0.01% non-convertible, non-cumulative, participating redeemable preference shares worth up to Rs 500 crore on a private placement basis.