Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading 0.12% lower at 19570, signalling that Dalal Street was headed for negative opening on Thursday.

Asian shares were trading lower, tracking losses on Wall Street, as investors became risk averse due to higher interest rates and worsening situation in the Middle East. The Nikkei 225 index tanked 1.75% and the Topix fell 1.4%. China’s CSI 300 index dropped 1.19% and the Hang Seng lost 1.6%.

The Indian rupee closed at 83.26 against the US dollar on Wednesday.

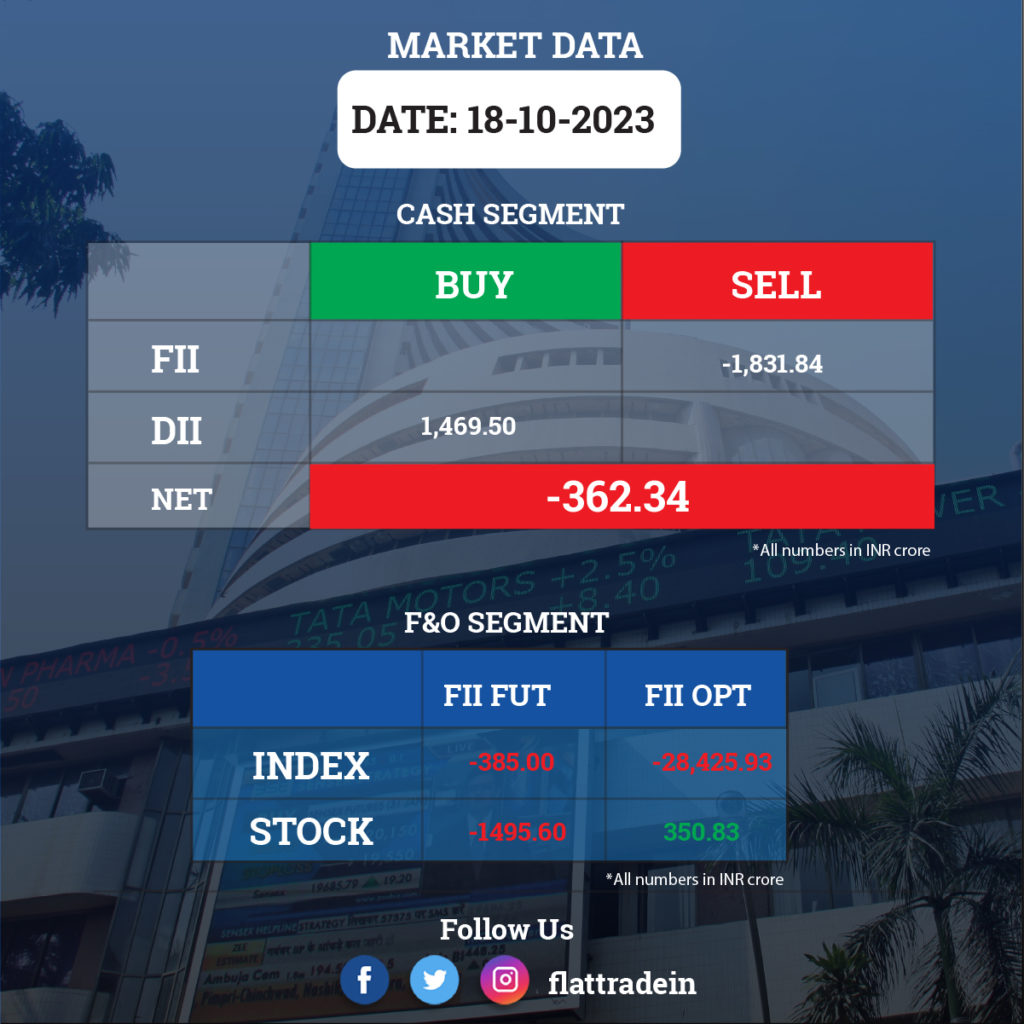

FII/DII Trading Data

Stocks in News Today

Bajaj Auto: The two-wheeler manufacturer reported a standalone profit of Rs 1,836.1 crore in Q2FY24, up 20% YoY from Rs 1530 in the same period last fiscal. Its standalone revenue from operations rose 5.6% YoY to Rs 10,777.3 crore as against Rs 10,203 crore in the corresponding period last fiscal, supported by robust volume growth and strong domestic demand. Ebitda stood at Rs 2133 crore, up 21% YoY and margin stood at 19.8%, up 260 basis points.

ICICI Lombard General Insurance: The company reported a 2.2% decline in net profit to Rs 577 crore in Q2FY24 as against a net profit of Rs 591 crore in the year-ago period. Gross direct premium income grew 17.4% to Rs 6,086 crore during the quarter ended September 2023 as against Rs 5,185 crore in the same period last fiscal. The solvency ratio was 2.59 times in the reported quarter compared to 2.53 times in the preceding quarter. It stood at 2.51 times on March 31, 2023.

IndusInd Bank: The private sector lender recorded a standalone profit of Rs 2,181.5 crore for the quarter ended September 2023, up 22.09% YoY, helped by a decline in provisions and stable asset quality. Net interest income grew by 18% YoY to Rs 5,076.7 crore during the same period, while net interest margin remained flat at 4.29% QoQ but grew 5 basis points YoY.

Wipro: The IT services firm recorded a consolidated net profit of Rs 2,667.3 crore for the quarter ended September 2023, up 0.70% YoY. The IT major’s profit stood at Rs 2,649.10 crore in the corresponding quarter of last fiscal. The consolidated revenue from operations for the quarter under review stood at Rs 22,515.90 crore, down 0.10% from Rs 22,539.70 crore in the year-ago period. The company expects revenue from the IT Services business segment to be in the range of $2,617 million to $2,672 million, which is a sequential guidance of -3.5% to -1.5% in constant currency terms. The IT major’s board approved the merger of its five wholly owned subsidiaries into self.

LTIMindtree: The IT services company’s net profit rose 0.9% QoQ to Rs 1,161.8 crore in Q2FY24. Revenue grew 2.3% to Rs 8,905.4 crore, while revenue in dollar terms rose 1.6% QoQ to $1,075.5 million. The EBIT margin fell 70 bps quarter-on-quarter to 16% for Q2FY24. The company has declared an interim dividend of Rs 20 per share.

Persistent Systems: The technology services company reported a profit of Rs 263.3 crore in Q2FY24, up 15.1% QoQ. Revenue increased by 3.9% to Rs 2,411.7 crore during the quarter under review. Topline in dollar terms increased by 3.1% QoQ to $291.7 million in Q2FY24, while in constant currency term rose 3.2%.

Bandhan Bank: The private sector lender recorded a net profit of Rs 721.2 crore in Q2FY24, a rise of 245% YoY due to a sharp fall in provisions. Net interest income for the quarter jumped 11.4% YoY to Rs 2,443.4 crore in the quarter under review. Loan growth stood at 12.3% and deposits uncreased by 12.8%. Net NPA stood at 2.32% in the reported quarter as against 2.18% in the preceding quarter. The lender’s head of finance & accounts, Abhijit Ghosh was appointed as the Interim CFO and Key Managerial Personnel of the Bank, with effect from October 20 2023.

Infosys: The company said that it is expanding its alliance with Google Cloud to help enterprises build AI-powered experiences leveraging Infosys Topaz offerings and Google Cloud’s generative AI solutions. Infosys will create a new global Generative AI Labs to develop industry-specific AI solutions and platforms, the company said in a press release. The company will train 20,000 practitioners on Google Cloud’s gen AI solutions which includes Vertex AI and Duet AI in Google Workspace.

Shoppers Stop: The retailer reported a net profit at Rs 1.78 crore in Q2 FY24, down from Rs 18.14 crore in the same quarter a year ago. Its revenue from operations was at Rs 1,025.15 crore in Q2FY24, up from Rs 1,008.24 crore in the same quarter a year ago. Its expenses rose to Rs 1,028.25 crore in Q2FY24 compared to Rs 985.17 crore a year ago.

GPT Infraprojects: The company has received a contract worth Rs 739 crore to construct 4-lane Prayagraj Southern Bypass in Uttar Pradesh under Bharatmala on EPC mode.

Mastek: The company has received a three-year contract worth 8.5 million pounds from the UK’s Government Digital Service (GDS). The contract includes an option to extend it to a total of five years. The company, in collaboration with UK GDS, will design, build, and operate the GOV.UK One Login Technical Service Desk (TSD).

Crompton Greaves: The company has appointed D Sundaram as the Chairperson and also appointed Anil Chaudhry and Sanjiv Kakkar as the Non-Executive Independent Directors effective October 17.

ITC: The company increased its stake in Delectable Technologies to 39.32% by acquiring an additional 6% stake for Rs 3.5 crore.

RPG Lifesciences: The board of directors executed power delivery agreement with Sunpound Solar, a SPV for the supply of electricity by power producer to the company, by setting up a group captive solar power project in Maharashtra. The company will invest Rs 1.1 crore to subscribe to 26% share capital of Sunpound Solar.

Power Mech Projects: The company’s board has approved the opening of the QIP issue on October 18 and the floor price is set at Rs 4,085.44 apiece.

PowerGrid: The electrical services company received notification for commercial operation for Eastern Region Strengthening Scheme – XVII (Part-B) project. The project had commissioned with effect from Aug. 8 2023.

Alkyl Amines: The company has commenced commercial production in the newly set up plant at its existing Kurkumbh site and the company expects the new plant will enhance its manufacturing capacity of Ethyl Amines.

Allcargo Logistics: The company has reported a 1% decline in LCL volumes year-on-year and 4% decline quarter-on-quarter for September 2023. Overall muted demand led to a softer print for the quarter with Q2 FY24 LCL volumes declining 3% year-on-year to 2,294 ‘000cbm.

Coromandel International: The company commissioned sulfuric acid plant & desalination plant at Visakhapatnam with the production capacity of 1,650 metric tonnes per day. With this, Coromandel’s sulfuric acid capacity will increase to 11 lakh tonnes per annum from 6 lakh tonnes per annum.

Housing & Urban Development Corporation: The Government of India has decided to exercise the oversubscription option and will sell additional 3.5% stake or 7 crore equity shares in the offer-for-sale on October 19, in addition to the base issue size of 3.5% or 7 crore shares. The OFS has received a strong response from non-retail investors on October 18 and was subscribed nearly twice the base size. The OFS will open for retail investors on October 19.

Uno Minda: The company has received a no-objection letter from both the exchanges, NSE and BSE, with respect to the scheme of amalgamation with Kosei Minda Aluminium company and Kosei Minda Mould.

IIFL Finance: The NBFC reported a 32% YoY growth in net income at Rs 526 crore for the quarter ended September 2023 on higher interest income. Total income rose 33% to Rs 1,599.3 crore. Net NPA improving to 1% in the reported quarter from 1.2% in the same period last fiscal. The company’s overall loan portfolio rose 34% YoY to Rs 73,066 crore during the quarter under review. The NBFC approved raising funds up to Rs 3,000 crore via equity, convertible instruments.

UTI AMC: The company reported said its profit after tax dropped 9% to Rs 183 crore during the September 2023 quarter from Rs 200 crore in the same period a year ago. Revenue from operations fell 7% to Rs 404 crore during the quarter under review from Rs 435 crore in the corresponding quarter last fiscal. The fund house’s market share in total AUM fell marginally to 5.68% during the reported quarter from 5.98% in the year-ago period.

Trident: The Income Tax Department is conducting a search at premises and plants of the company, since October 17. The entire IT assets of all the senior officials including the undersigned are under the control of Income Tax Department, for scrutiny. The company further said that its officials are fully cooperating with the Income Tax Department.