Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.01% higher at 19,142.5, signalling that Dalal Street was headed for muted start on Wednesday.

Most Asian shares were trading higher, tracking gains in Wall Street overnight. The Nikkei 225 index soared 2% and the Topix surged 2.15%. The CSI 300 index rose 0.15% and the Hang Seng fell 0.23%.

The Indian rupee weakened by 1 paise to 83.25 against the US dollar on Tuesday.

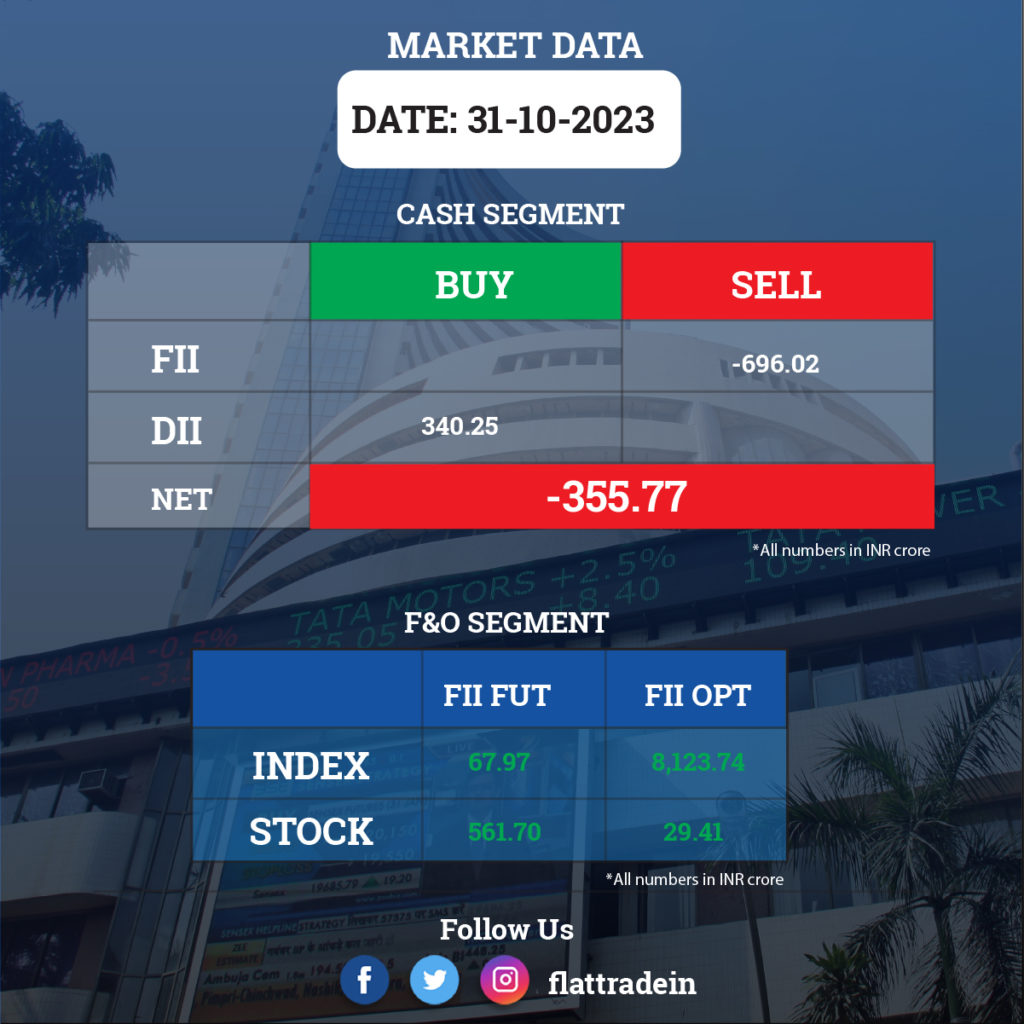

FII/DII Trading Data

Stocks in News Today

Larsen and Toubro (L&T): The infrastructure behemoth reported a consolidated net profit of Rs 3,223 crore in Q2FY24, up by 45% from Rs 2,229 crore reported in Q2FY23. Consolidated revenue rose 19% to Rs 51,024 crore in Q2FY24, helped by better execution of the large order book and accelerated progress in the projects. The company received orders worth Rs 89,153 crore at the group level during the quarter ended September 2023, a growth of 72% YoY. International orders stood at Rs 59,687 crore during the reporting quarter and it accounted for 67% of the total order inflows. The consolidated order book was at Rs 4.5 lakh crore in Q2FY24.

Bharti Airtel: The company’s consolidated net profit (after exceptional items) fell to Rs 1,340.7 crore in Q2FY24 from Rs 2,145.2 crore in the year-ago period. The decline was attributed to exceptional loss caused by tax and an interest provision due to a Supreme Court ruling over the variable licence fee (VLF) that was payable to the Department of Telecommunications. Its consolidated revenue was Rs 37,044 crore, 7.3% higher from Rs 34,527 crore in the year-ago period. Airtel’s average revenue per user (ARPU) for the quarter rose to Rs 203, up 1.5% from Rs 200 in Q1FY24. Its subscriber base grew to 342.3 million, with 3.7 million net user additions in the past quarter.

SBI: The country’s largest lender said that Deputy Managing Director and Chief Risk Officer Sureddi Srinivasa Rao has superannuated from his services at the close of business hours on October 31. Rama Mohan Rao Amara will be entrusted as Deputy Managing Director & Chief Risk Officer and will assume charge with effect from November 1.

Tata Consumer Products: The company reported a 3% growth in its consolidated net profit at Rs 338 crore in Q2FY24 compared with Rs 328 crore in the year-ago period. Revenue from operations during Q2FY24 rose 11% YoY to Rs 3,734 crore as against Rs 3,363 crore in the corresponding quarter last fiscal. The revenue growth was on the back of 11% growth in the domestic market, 8% in the international market, and 3% in the non-branded business. Its consolidated Ebitda for the reported quarter stood at Rs 569 crore, up 30% YoY.

DCB Bank: The private sector lender has reported a 13% YoY growth in profit at Rs 127 crore for the quarter ended September FY24. Its operating profit rose 15.3% YoY to Rs 211 crore and other income was up 8% at Rs 107 crore. Net interest income increased by 15.8% YoY to Rs 476 crore, while deposits jumped 15.2% to Rs 45,496 crore and net advances grew 13% to Rs 37,276 crore in Q2FY24. Gross NPAs increased by 10 bps QoQ to 3.36% and net NPAs rose 9 bps to 1.28% for the quarter.

Mankind Pharma: The company reported a 21% YoY jump in net profit to Rs 511 crore in Q2FY24 as against a net profit of Rs 422 crore in the corresponding period of the previous fiscal. Revenue rose 11.6% YoY to Rs 2,708 in Q2FY24. Ebitda grew 15.4% YoY to Rs 686 crore, while Ebitda margin rose 80 basis points YoY to 25.3% in the quarter under review. Domestic branded formulation business rose 7.3% YoY to Rs 253 crore, while consumer healthcare grew only 1.6%. Exports business soared 159% YoY to Rs 179 crore in Q2FY24.

Adani Total Gas: The company posted a 8% YoY rise in consolidated net profit at Rs 173 crore in Q2FY24. Its consolidated revenue from operations fell by 0.92% YoY to Rs 1179 crore in the quarter under review. Ebitda increased 22% YoY to Rs 289 crore in Q2FY24. CNG volume increased by 20% YoY in Q2FY24 on account of reduction in CNG prices and network expansion of CNG stations, while PNG volume decreased by 3% YoY in the same period. Adani Total Gas added 37 new CNG stations during the quarter.

V-Guard Industries: The Consumer electrical and electronics company recorded a 35% growth in profit after tax (PAT) at Rs 58.95 crore during Q2FY24 as against Rs 43.66 crore recorded in the corresponding period last fiscal. Its consolidated net revenue from operations for the reported quarter was Rs 1,133.75 crore, a growth of 14% from Rs 986.55 crore in the year-ago period.

Lupin: The pharma major has received the Establishment Inspection Report (EIR) from the United States Food and Drug Administration for its Mandideep unit-2 manufacturing facility. The EIR was issued post the last inspection of the facility conducted during August 7 and August 11, 2023. The inspection closed with the facility receiving an inspection classification of ‘no action indicated’ (NAI).

NBCC: The company has received two orders worth Rs 100.79 crore. Out of the two order, one is for LED Flood Light in Dampa Tiger Reserve Forest in Mizoram for Rs 60.79 crore and and another order is for construction of phase A and B works for JNV Khagariya in Bihar for Rs 40 crore.

JSW Energy: The company said that Prashant Jain will step down as the joint managing director and CEO of the company to pursue his personal interests. He will continue to serve in his current position until January 31, 2024, to support an orderly transition.

Krishna Institute of Medical Sciences: The company has made additional investment by acquiring equity stake of 6.86% in SPANV Medisearch Lifesciences, a subsidiary of the company, and increasing its total shareholding in SPANV to 69.30%. The acquisition cost was Rs 221.99 per equity share totalling Rs 26.63 crore.

Newgen Software Technologies: The company said it has bagged orders for supply, implementation and maintenance of trade finance and supply chain finance solution. The aggregate value of the order is Rs 18 crore and the order is valid for five years.

Mangalore Refinery & Petrochemicals: The state-owned company recorded a 3.6% QoQ increase in consolidated profit at Rs 1,051.7 crore for quarter ended September FY24 supported by lower input cost. Revenue from operations (excluding excise duty) fell 9.2% QoQ to Rs 19,230 crore for the quarter under review.

KEI Industries: The company’s consolidated revenue was up 21% at Rs 1,947 crore in Q2FY24 as against Rs 1,608 crore in Q2FY23. Consolidated Ebitda rose 27% to Rs 204 crore in Q2FY24 from Rs 161 crore in Q2FY23. Its ner profit grew 31.2% YoY to Rs 140.2 crore in Q2FY24 from Rs 106.9 crore in Q2FY23.

Motherson Sumi Wiring: The company’s revenue gained 14.7% to Rs 2,105 crore in Q2FY24 from Rs 1,835 crore in Q2FY23. Its Ebitda jumped 37.2% to Rs 248.1 crore in the quarter under review from Rs 180.8 crore in the year-ago period. It reported a net profit of Rs 156 crore in Q2FY24, up 33.9% Rs 116 crore in the same period last fiscal.

Amara Raja Energy and Mobility: The company’s consolidated revenue rose 9.6% to Rs 2,959 crore in Q2FY24 from Rs 2,700 crore in Q2FY23. The company’s consolidated Ebitda was up 12.2% at Rs 402 crore in Q2FY24 as against Rs 359 crore in Q2FY23. Its consolidated net profit jumped 12.5% to Rs 226.3 crore in Q2FY24 from Rs 201.2 crore in Q2FY23.

Star Health Insurance: The company posted a 35% growth in PAT to Rs 125 crore in Q2FY24, compared to a profit of Rs 93 crore in the same period a year ago. Gross written premium grew by 17% to Rs 3,732 crore as against Rs 3,193 crore in Q2FY23. The company’s retail health premium grew 17% YoY to Rs 3,430 crore in the second quarter of the current fiscal.