Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.06% lower at 19,722, indicating that Dalal Street was headed for muted start on Wednesday.

Asian markets were mixed as investors remained cautious over prolonged higher interest rates and elevated oil prices. The Nikkei 225 index fell 0.47% and the Topix dropped 0.37%. The Hang Seng jumped 0.65% and the CSI 300 index rose 0.23%.

The Indian rupee weakened 9 paise to close at 83.24 against the US dollar on Tuesday.

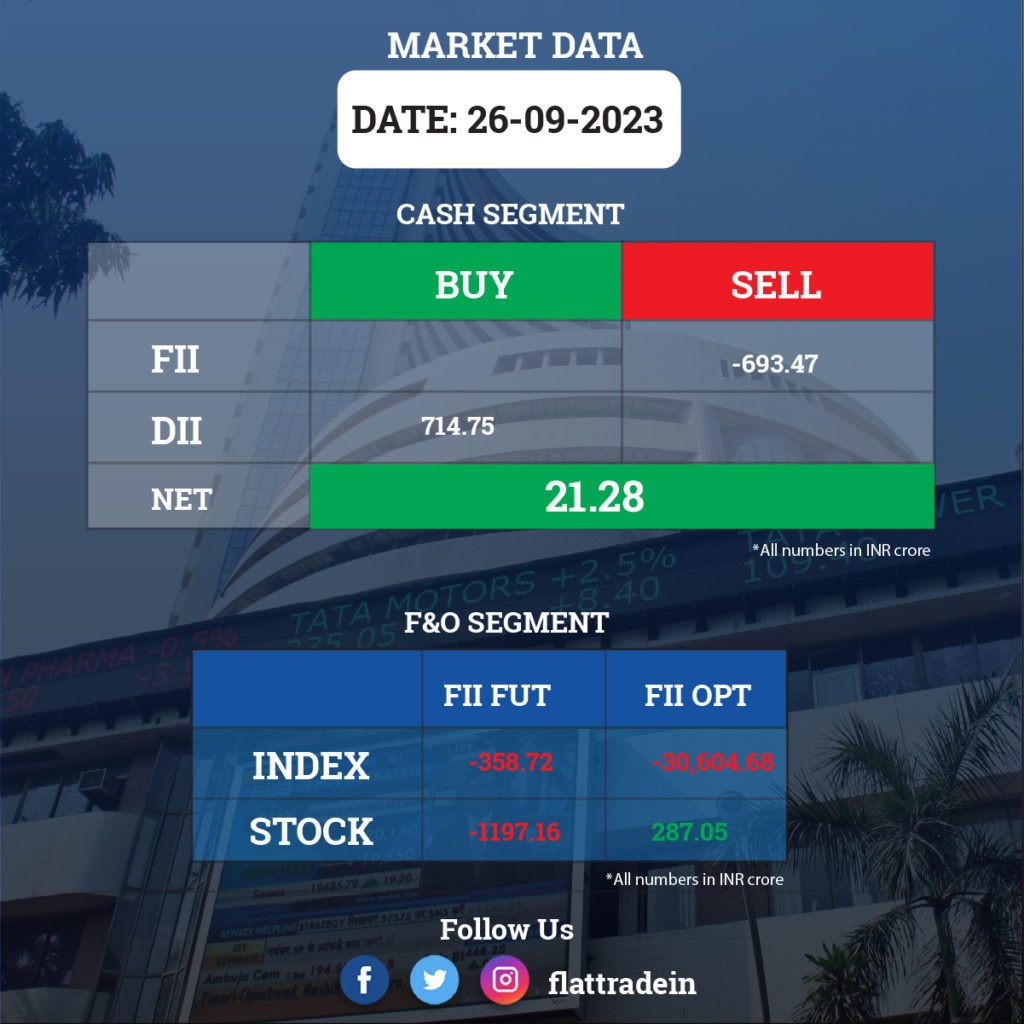

FII/DII Trading Data

Stocks in News Today

Infosys: The IT bellwether has announced a collaboration with Microsoft to jointly develop industry-leading solutions that leverage Infosys’ Topaz, and American tech giant’s Azure OpenAI Service and Azure Cognitive Services. Both organisations are bringing together their artificial intelligence (AI) capabilities to enhance enterprise functions with AI-enabled solutions across multiple industries.

Suzlon Energy: The company announced that CRISIL has upgraded the ratings of Suzlon Energy Ltd. to ‘CRISIL BBB+/A2’ from ‘CRISIL BBB‐/A3‘ with a Positive Outlook for long‐term and short‐term facilities, reflecting the Company’s strengthened financial position, operational excellence and favourable sectoral tailwinds.

Separately, the company informed that Dilip Shanghvi and Associates (Investor Group)who had entered into an amended and restated shareholders’ agreement dated 28th February 2020 with the Promoters / Promoter Group of the company and the company, have informed the company and the other shareholders, who are party to the agreement, that the Investor Group has decided to terminate the agreement in accordance with the terms of the agreement. The company said there would not be any impact on the operations of the Company on account of the termination of the agreement. Further, the company said that with the termination of the agreement, Hiten Timbadia, the Investor Group’s nominee director on the board of the company, has also resigned as director of the company with effect from 26th September 2023.

IndusInd Bank: The lender announced a multi-year association with the International Cricket Council (ICC) as a Global Partner for the highly awaited ICC Men’s Cricket World Cup 2023 and future ICC Men’s events. As a Global Partner for ICC Men’s Cricket World Cup 2023, IndusInd Bank will access an array of exciting activities and promotions for its customers, employees and for cricket fans.

Vedanta: Global credit rating agency Moody’s Investors Service has downgraded Vedanta Resources’ Limited (VRL) corporate family rating (CFR) from Caa1 to Caa2 over elevated risks of debt restructuring over the next few months. With the current downgrade, the outlook remains negative for the parent company of Vedanta Ltd. and the outlook reflects VRL’s weak liquidity profile as well as the company’s ability to meet immediate cash requirements.

REC: The company in a press release said that REC has signed an MoU with Punjab National Bank (PNB) to jointly explore the possibility to fund the Power Sector and Infrastructure & Logistics Sector projects under the consortium arrangement. REC and PNB will associate with each other to co-finance loans totalling up to Rs. 55,000 crore over next three years.

Century Textiles: The company’s subsidiary, Birla Estates, has sold out phase 1 of Birla Trimaya in Bengaluru within 36 hours of its launch. With 556 units booked, accounting for Rs 500 crore in booking value, the company has solidified its position as a leader in the luxury residential real estate market of Bengaluru. The 52-acre land parcel situated in North Bangalore is in joint partnership with M. S. Ramaiah Realty LLP.

DCM Shriram: The company’s subsidiary, Fenesta, announced a significant capacity expansion of uPVC extrusion at Kota. As part of the expansion, Fenesta has successfully installed – 2 Extrusion Lines and 1 Blending Line to increase the capacity of uPVC extrusion. The planned expansion at the Kota plant will boost the annual production of upvc profiles from 8,600 metric tons to 12,284 metric tons.

Prataap Snacks: The company announced that GST Authority conducted search and seizure operations at the company’s manufacturing units in Bengaluru. The operations of the aforesaid manufacturing unit were not impacted and continued as usual, the company said in an exchange filing.

NDTV: The media company informed that it has received the permission from Ministry of Information & Broadcasting for three news and current affairs High Definition channels, namely, NDTV 24×7 HD, NDTV India HD, and NDTV Profit HD.

Rajnandini Metal: The company said in an exchange filing that it has received orders from 12 clients totalling Rs 206.91 crore. KEI Industries, Orient Cables India, Paramount Communications were the top three clients among the said 12 clients.

3i Infotech: The IT company has received a contract from Ujjivan Small Finance Bank, for end-user support service (workplace services). The total contract value is Rs 39.55 crore plus one-time transition charges of Rs 35 lakh. The contract is for a period of 5 years starting from October 1, 2023 to September 30, 2028, with the option to extend the contract with mutual agreement.

Container Corp: The company has appointed Sanjay Swarup as chairman and MD from October 1, 2023, to July 31, 2026. Sanjay Swarup is working as Director (International Marketing and Operations) in Container Corporation of India Limited.