Market Opening - An Overview

Nifty futures on the Singapore Exchange traded 51.5 points, or 0.28 per cent, lower at 18,296, signaling that Dalal Street was headed for a negative start on Monday.

Asian shares fell on Monday as investors were concerned that China may tighten COVID-19 curbs which will lead to an economic slowdown. Japan’s Nikkei 225 index fell 0.10%, while Topix was flat. Hang Seng tanked 2.61% and the CSI 300 index was down 1.30%.

Indian rupee fell 3 paise to 81.68 against the US dollar on Friday.

Archean Chemical Industries: The specialty chemical company will make its debut on the BSE and NSE on November 21. The issue price has been fixed at Rs 407 per share.

Five Star Business Finance: The NBFC will list its equity shares on the exchanges on November 21. The issue price has been set at Rs 474 per share.

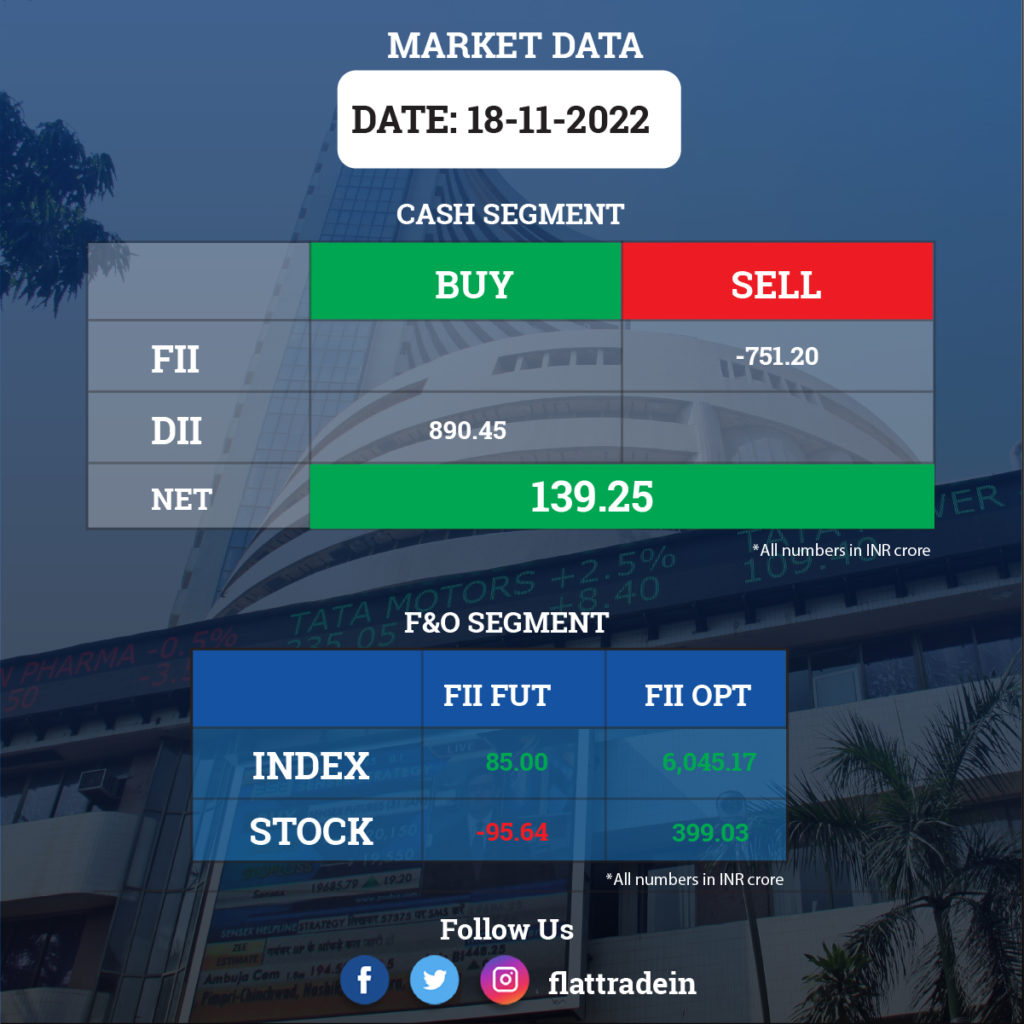

FII/DII Trading Data

Stocks in News Today

Tata Motors: The BSE will add Tata Motors in the S&P BSE Sensex index, instead of Dr Reddy’s Laboratories. Meanwhile, in the S&P BSE 100 and Sensex Next 50 indices, Adani Power and Indian Hotels Company will replace Adani Total Gas, and Hindustan Petroleum Corporation. The changes will be effective from December 19, 2022.

In addition, Nxtdigital will be removed from S&P BSE AllCap, Consumer Discretionary, MidSmallCap and SmallCap with effect from November 22 as it is demerging into Hinduja Global Solutions as part of restructuring to separate their media and communication business.

Zomato: The online food delivery platform said that it will lay off nearly 3 per cent of its workforce across the organisation on account of cost-cutting efforts and to turn profitable. Zomato, which currently has nearly 3,800 employees, said that layoffs will be based on regular performance. Meanwhile, Mohit Gupta, co-founder at Zomato has resigned. He had joined the food delivery giant’s Deepinder Goyal and team, four-and-half-year ago. He decided to move on from Zomato to seek the other unknown adventures.

Jindal Stainless: Appellate tribunal NCLAT has upheld the NCLT order to allow the company to participate in the auction of debt-ridden Rathi Super Steel even after a bidder was selected. The National Company Law Appellate Tribunal (NCLAT) said the NCLT “did not commit any error” as sales were not completed and the object was to obtain the maximisation of the assets, hence it “sees no reason to take a different view”.

Earlier, in an e-auction, Rimjhim Ispat and Synergy Steel had emerged as the highest bidder with a Rs 177.50 crore offer for Rathi Super Steel as a going concern and a letter of intent was also issued on July 1, 2021. However, on October 3, 2021, JSL approached the NCLT and filed an application for consideration of its bid for acquiring Rathi Super Steel as a going concern. JSL had offered Rs 190 crore payable within 90 days from acceptance of the bid.

Reliance Capital: The sale of the company’s 51 per cent stake in Reliance Nippon Life Insurance Company (RNLIC), in the ongoing Corporate Insolvency Resolution Process, has pitched Nippon Life of Japan against RCAP Administrator and Aditya Birla Sun Life Insurance. The entry of Aditya Birla Sun Life seems to have likely upset the plans to Japanese Insurance major. Nippon Life is keen on acquiring RCAP’s 51 per cent stake in RNLIC, through a strategic partner.

Steel Companies: The central government has cut the export duty on steel products and iron ore with effect from November 19, 2022 — six months after the imposition of the levy on May 21. As per a finance ministry notification issued late at night on Friday, exports of specified pig iron, steel products and as iron ore pellets will attract ‘nil’ export duty. An industry member said that the government’s decision to remove export duty on steel items will boost demand for steel.

ONGC: India’s largest oil and gas producer ONGC has said that the company’s oil production will jump by 18% by FY2024-25. With the support of billions of dollars of investment, the oil major has hoped that the production will peak from the current fiscal year. In the previous fiscal year (2021-22), ONGC produced 21.707 million tonnes of crude oil, which is refined to produce petroleum products like petrol and diesel.

RHI Magnesita: The company is in the process of acquiring the refractory business of Dalmia Bharat Refractories Limited (DBRL) in India for about Rs 1,708 crore, Stefan Borgas, CEO of the Vienna-based company, has said. The share swap deal is being made through RHI Magnesita India, he added. “DBRL will transfer its business to Dalmia OCL (DOCL). Under the terms of a share swap agreement, RHI Magnesita will acquire all outstanding shares in DOCL in exchange for 27 million new shares in RHI Magnesita India Limited,” Borgas said.

Power Finance Corporation (PFC): The company has sanctioned a loan of Rs 3,940 crore for the construction of the Machilipatnam greenfield seaport, Lok Sabha MP V Balashowri said on Saturday. The estimated cost of the Machilipatnam port is Rs 5,253.89 crore and the loan sanction letter has been sent to Machilipatnam Port Development Corporation Ltd, the MP told reporters. The Machilipatnam port will be constructed on nearly 4,000 acres in two phases as per the master plan.

3i Infotech: The stock will be in focus as the IT company received a contract from Hindustan Petroleum Corporation, for managing and supporting IT infrastructure at HPCL offices, refinery including data centres across pan-India. Total contract value is approximately Rs 51 crore spread across three years.

REC: The state-run power projects finance company has received consideration and accordingly transferred its entire shareholding in Gadag II-A Transmission, presently held by its subsidiary RECPDCL, along with all assets and liabilities to ReNew Transmission Ventures, the successful bidder. Gadag II-A will establish transmission system for “transmission scheme for solar energy zone in Gadag with a capacity of 1,500 MW in Karnataka as a Part A Phase-II.

Indian Energy Exchange (IEX): The company said that the board of directors will meet on November 25 to consider share buyback proposal.

Engineers India: The company has received order from Chennai Petroleum Corporation for overall project management & EPCM services for OHCU revamp, CDWU and related off-site facilities for Group-II LOBS project at Manali refinery.