Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.61% higher at 17,461, signalling that Dalal Street was headed for a positive start on Friday.

Most Asian shares were trading higher after dovish comments from Federal Reserve policy maker Raphael Bostic boosted risk appetite of investors. The Nikkei 225 index was up 1.45% and the Topix surged 1.26%. The Hang Seng gained 0.59%, while the CSI 300 index inched down 0.09%.

Indian rupee fell 9 paise to 82.59 against the US dollar on Thursday.

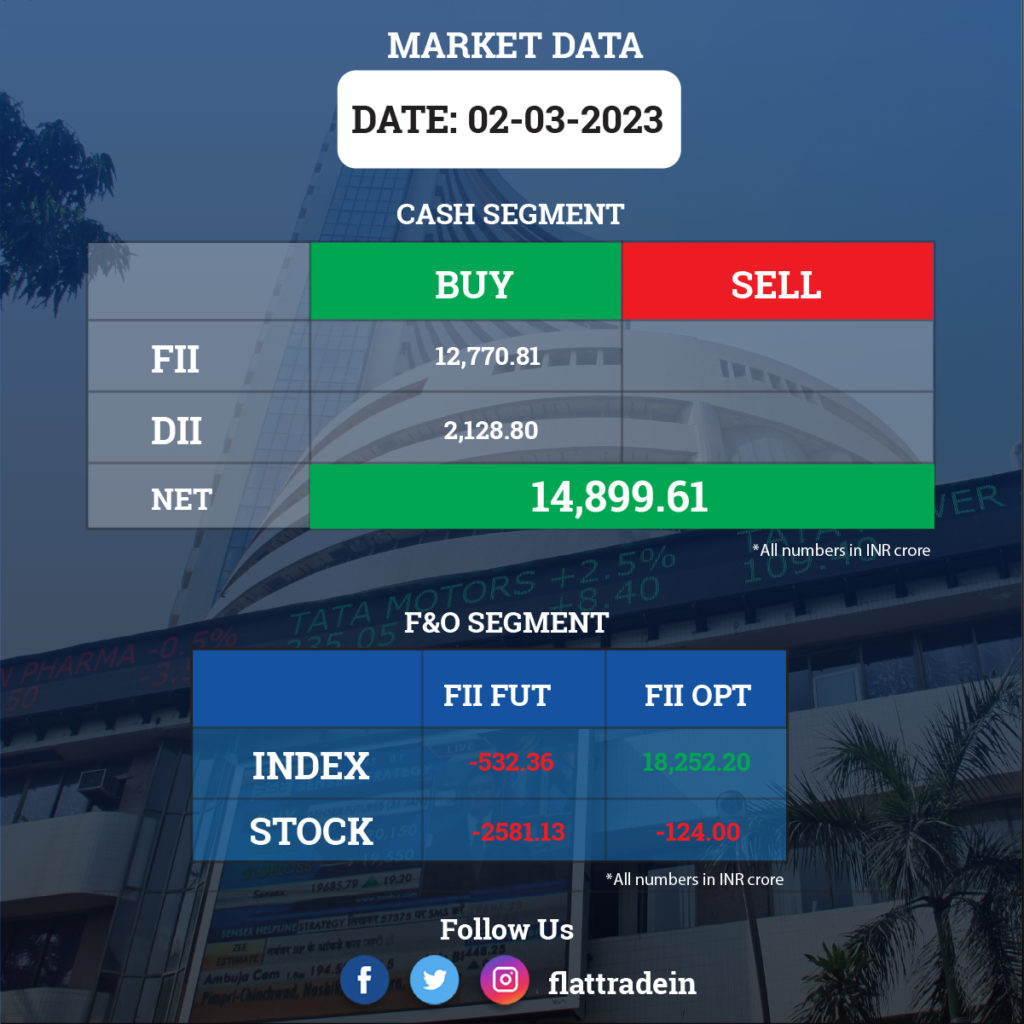

FII/DII Trading Data

Stocks in News Today

Tata Power: The company has collaborated with Enel Group to power digitalisation and automation of India’s distribution network. Under the agreement, Tata Power’s distribution arm Tata Power Delhi Distribution Ltd (TPDDL), serving 1.9 million customers in north Delhi, will work closely with Enel Group affiliated company Gridspertise, jointly controlled by Enel Grids and CVC Capital Partners, on project implementation. The first pilot project will focus on to accelerating digitalisation and automation of secondary substations and see Tata Power joining the international co-creation programme of Gridpertise’s proprietary QEd Quantum Edge Device. The other project is aimed at deploying Gridpertises’ metering technology on a pilot basis in the Delhi power distribution network.

Adani Group: The promoters of the Adani group on Thursday sold shares worth Rs 15,446 crore in four of its listed entities to GQG Partners, a US-based global equity-investment boutique firm. They sold shares in Adani Enterprises worth Rs 5,460 crore, and those worth Rs 5,282 crore in Adani Ports & SEZ. They also sold shares worth Rs 2,806 crore in Adani Green Energy and Rs 1,898 crore in electricity distributor Adani Transmission. The promoters plan to use the proceeds to retire debt and for other purposes.

Adani Green Energy: The company said that its 700-MW hybrid green energy project has become operational, which took its total operating renewable portfolio to 8,024 MW, the largest in India. The project is its fourth wind-solar hybrid power plant fully operational at Jaisalmer in Rajasthan, a company statement said. The combined operational generation capacity of this newly added hybrid power plant is 700 MW and has a Power Purchase Agreement (PPA) at Rs 3.24 per kwh for 25 years.

NHPC: The state-owned hydro power giant has paid an interim dividend of Rs 997.75 crore to the government for FY2022-23. NHPC had already paid Rs 356.34 crore to the government during the current fiscal 2022-23 on account of final dividend for the financial year 2021-22. Thus, NHPC has paid a total dividend of Rs 1,354.09 crore to the government during the financial year 2022-23. NHPC today has more than eight lakh shareholders and total interim dividend pay-out for the financial year 2022-23 worked out to Rs 1,406.30 crore.

Hindustan Petroleum Corporation (HPCL): The oil retailer has raised Rs 1,650 crore via non-convertible taxable debentures on private placement basis. The company will utilise these funds for refinancing of existing borrowings and/or capital expenditure, including recoupment of expenditure already incurred and/or for any other purpose in the ordinary course of business.

Mahindra & Mahindra Financial Services: The NBFC said its total disbursement stood at about Rs 4,185 crore for February 2023, a 53% growth over February 2022. The loan book in February 2023 grew further by 1.5% over January 2023. The collection efficiency was at 97% for February 2023 compared to 98% achieved in February 2022. The

Bharat Forge: The company’s wholly-owned subsidiary, BF Infrastructure, has acquired 51% of equity shares of Ferrovia Transrail Solutions from PNC Infratech. Subsequently, Ferrovia has become wholly-owned subsidiary of BFIL and a step-down subsidiary of the company.

Happiest Minds Technologies: The board has approved the fund raising of Rs 125 crore via issue of 12,500 non-convertible debentures on private placement basis in domestic market in three tranches. The funds will be utilized for general corporate purposes. The issue of commercial papers in domestic market on private placement basis has been deferred for consideration at an appropriate time.

Natco Pharma: The board of directors of the pharma company will be meeting on March 8 to consider the proposal for buyback of fully paid up equity shares.

Titagarh Wagons: Consortium of Titagarh Wagons and BHEL emerges as 2nd lowest bidder for manufacturing cum maintenance of Vande Bharat Trainsets, including up-gradation of the government manufacturing units & trainset depots. The total quantity is 200 trainsets and L2 is eligible to get 80 trainsets. The quote of L1 bidder is Rs 120 crore per Trainset.

MOIL: The state-owned manganese ore producer announced production of 1.31 lakh tonnes of manganese ore in February 2023, a 10 percent growth over the same period last year. Manganese ore sales at 1.32 lakh tonnes during the month increased by 19 percent YoY.

India Grid Trust: The Indian power sector infrastructure investment trust has completed the acquisition and management control of Khargone Transmission, from Sterlite Power Transmission (one of the Sponsor of IndiGrid), for Rs 1,497.5 crore. The addition of Khargone Transmission to the portfolio will take IndiGrid’s assets under management to Rs 22,700 crore and company’s overall asset base to 8,416 ckms (circuit kilometer) of transmission lines and 17,550 MVA of transformation capacity.

Indiabulls Housing Finance: The company announced Rs 900-crore debt sale through a public issue of secured, redeemable, non-convertible debentures. The public issue will start on March 3 and end on March 17. The base size of the issue is Rs 100 crore, with a greenshoe option for an additional Rs 800 crore.

CG Power and Industrial Solutions: The company’s board declared an interim dividend for the FY2022-23. In a meeting with the Board of Directors, an interim dividend of Rs 1.5 per share of the face value of Rs 2 each for the FY2022-23 has been approved.